Summary:

- Salesforce is the world’s #1 CRM company with a wide moat, sticky business model, and undervaluation.

- Recent quarterly results showed disappointing guidance, but strong revenue growth and high operating margins.

- My valuation models suggest Salesforce stock is undervalued, with potential upside based on dividend discount and discounted cash flow models.

bymuratdeniz/iStock via Getty Images

Salesforce (NYSE:CRM) is the world’s #1 CRM company, having pioneered the software-as-a-service business model back in the late 90s and has carved out an estimated 21.7% market share in CRM software. I recently bought shares in Salesforce due to the company’s wide moat, sticky business model and undervaluation based on conservative discounted cash flow and dividend models. This analysis will highlight the company’s recent earnings results, revenue and earnings guidance, briefly touch on how Salesforce’s business model works and do a deep dive into the valuation of Salesforce stock.

Recap of Salesforce’s Recent Quarterly Results

Salesforce shares declined nearly 20% following its most recent earnings report in late May after the company lowered guidance and reported weak results that disappointed investors. First quarter revenues of $9.13 billion were up 11% year-over-year. GAAP and non-GAAP operating margins were 18.7% and 32.1% respectively. Current remaining performance obligations of $26.4 billion were up 10% year-over-year, while free cash flow of $6.08 billion was up 43%.

Fiscal Year 2025 Guidance

Salesforce initiated 2nd quarter FY25 revenue guidance of $9.2 – $9.25 billion, which would imply growth of 7 – 8%. The company maintained full-year revenue guidance of $37.7 billion to $38 billion (up 8 – 9% yoy) but lowered full year FY25 GAAP operating margin to 19.9% while maintaining non-GAAP operating margin of 32.5%. In the quarter, Salesforce bought back $2.2 billion in stock and initiated its first-ever quarterly dividend of $0.40. The mid-point guidance for non-GAAP EPS for fiscal year 2025 is $9.90 and $6.08 for GAAP EPS. For reference, any firm that publicly releases financial statements is required to report GAAP figures (however, GAAP requires companies to report non-cash items and non-recurring expenses). Companies tend to report non-GAAP figures as well to give analysts and investors another view of business performance, since non-cash charges such as stock-based compensation and amortization of intangible assets are deducted when calculating GAAP EPS.

Salesforce has a Wide Moat Due to High Switching Costs and Sticky Business Model

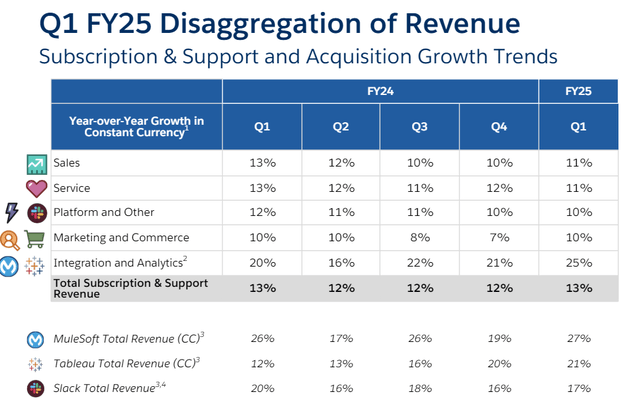

Salesforce’s customer 360 CRM platform features many types of cloud offerings including sales, service, marketing, commerce, integration/analytics and a data cloud. As illustrated in the chart below, Salesforce has seen solid growth in its integration and analytics offerings, with nearly twice the growth rates of its other products over the last 5 quarters.

Revenue Growth for Salesforce Clouds (Salesforce Q1 2025 Earnings Presentation)

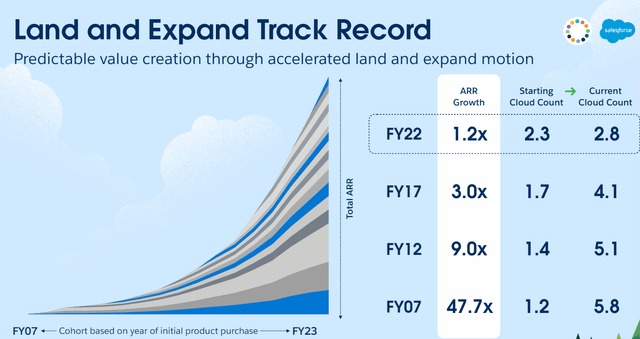

To understand how Salesforce’s business model works, imagine a small business signs up for the CRM product (“sales cloud”) then decides they need a messaging platform for their teams to communicate, so they add and integrate Slack, which would be part of the “platform cloud.” Customer retention is high once a customer has signed up for multiple clouds, as evidenced by the ARR expansion highlighted in the investor day deck back in 2022. The customer cohort from 2007 has increased it’s spend nearly 48x, having expanded from just over one cloud to nearly six clouds.

Salesforce ARR Growth by Cohort (Salesforce Investor Day 2022 Deck)

These numbers make sense since the switching costs are high for an enterprise once they integrate all their data onto the Salesforce platform. Moreover, Salesforce’s Einstein co-pilot should be a boon for growth because it will help enterprises automate most of their workflows and will increase the stickiness of their software products. Per Salesforce’s most recent annual report, CEO Marc Benioff stated, “Einstein Copilot can answer questions, create content, interpret complex conversations and dynamically automate tasks on behalf of a user, all from a single, consistent user experience embedded directly within Salesforce’s industry-leading CRM applications.”

Salesforce Stock is Undervalued Based on Discounted Cash Flow (“DCF”) and Dividend Discount Models (“DDM”)

For valuation purposes, I modeled a discounted cash flow and dividend discount model, since Salesforce recently initiated a dividend.

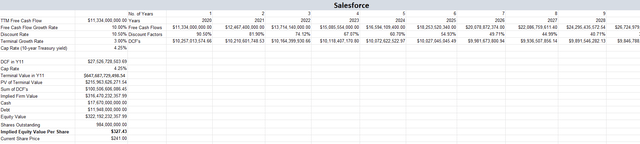

Discounted Cash Flow Model

Salesforce’s trailing twelve months free cash flow is ~$11.33 billion. For both the DCF and DDM models, I assumed Salesforce would grow cash flows and dividends by 10% (which seems conservative given Salesforce has grown free cash flows by over 30% annually for the last 10 years). The discount rate used in both the DCF and dividend discount models was 10.5%. The capitalization rate used in the DCF model was the current 10-year treasury rate of ~4.25%, which is the risk-free rate.

Salesforce DCF Model (Microsoft Excel)

The implied equity value after adding back excess cash and subtracting the debt is ~$327 per share, which would imply roughly 35% upside based on the closing price of $241.76 as of market close on June 25th.

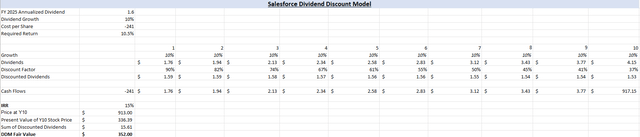

Dividend Discount Model

Since Salesforce recently initiated their first-ever quarterly dividend of $0.40, I included a dividend discount model as a supplement to the discounted cash flow model. The annualized dividend for FY 2025 is assumed to be $1.60 ($0.40 x 4) and the dividend growth is assumed to be 10%. As previously mentioned, Salesforce’s management team projected GAAP and non-GAAP EPS of $6.08 and $9.90, respectively. Based on these estimates, that would assume a payout ratio of about 16% for non-GAAP EPS and 26% for GAAP EPS, which are conservative and sustainable dividend payout ratios. Dividend growth was assumed to be 10%, which is not unsustainable for a market leader like Salesforce over the long term. For context, the 10-year dividend CAGR for Microsoft (MSFT) and Oracle (ORCL) were 10.6% and 13.5%, respectively.

Salesforce DDM Model (Microsoft Excel)

Assuming a dividend yield upon exit of 0.5% (which equals the discount rate of 10.5% less the growth rate of 10%), the fair value of Salesforce stock based on the 10-year dividend discount model is $352 (~46% upside from the closing price of $241.76 as of June 25th). For comparison, two large cap tech stocks which also recently initiated their first dividends were Meta (META) and Alphabet (GOOGL). Both Meta and Google’s current implied annual dividend yields are about 0.4% and Salesforce’s current annualized dividend yield is about 0.67%.

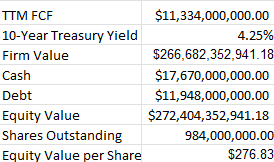

Valuation Assuming Zero Growth

For an even more conservative valuation, dividing Salesforce’s TTM free cash flow of $11.33 billion by the current 10-year US Treasury yield of 4.25% yields an implied firm value of ~266.68 billion. Adding back excess cash after paying off all the debt yields an implied equity value of $272.4 billion, or roughly $277 per share (14.5% upside).

Salesforce Zero Growth Valuation Model (Microsoft Excel)

Salesforce’s current free cash flow yield based on the TTM free cash flow is 4.84%. This means current Salesforce shareholders are getting a higher free cash flow yield than a risk-free government bond! Moreover, Salesforce investors will get the upside in Salesforce’s future growth, which you obviously would not get investing in risk-free government bonds.

Risks

Two primary risks of investing in Salesforce are succession and integration risk. CEO Marc Benioff founded the company in 1999 and has been an instrumental force in leading and growing the company to becoming the leading CRM platform that it is today. If he were to step down, there is the possibility that another CEO would not be able to run the company as efficiently and effectively as Benioff has. Integration risk is also something for investors to keep an eye on, since Salesforce has made some big acquisitions over the last few years. Time will tell if these acquisitions ultimately pay off for investors. Salesforce acquired Slack for $27.7 billion in July 2021 and Tableau in August 2019 for $15.7 billion. Salesforce also acquired Mulesoft in May 2018 for $6.5 billion and Demandware in July 2016 for $2.8 billion. While not recently disclosed in its annual filings, Salesforce did disclose the performance of the companies they had acquired during their investor day conference back in September 2022. At that time, Slack and Tableau had grown revenues 1.4x and 1.5x, respectively, since acquisition. Mulesoft and Demandware had revenue growth of 6x and 4.4x. It seems as if these acquisitions have been effectively integrated into Salesforce’s software platform, but the performance of these recent acquisitions is something for investors to keep an eye on.

Conclusion

Salesforce is currently the leading CRM platform and has created tremendous value for shareholders over the years. For instance, for every dollar retained, Salesforce has created more than $6 in market value. Salesforce has increased its market cap by ~$200 billion while retaining roughly $32.5 billion in earnings over the last 10 years. Salesforce currently trades at historically low P/E multiples, with its leading P/E valuation of 39.64x based on projected GAAP EPS of $6.08 for FY 2025. This is near the 5-year low, according to yCharts. As previously mentioned, Salesforce’s current free cash flow yield is 4.84% which equates to a reasonable 20.65x price to free cash flow. Based on non-GAAP EPS projections of $9.90 for FY 2025, that would imply a leading price to earnings ratio of 24.42, which seems like a reasonable valuation for a wide-moat market leader such as Salesforce. Salesforce recently initiated its first dividend and is focusing on returning cash to shareholders via dividends and stock buybacks. I believe Salesforce can become a solid blue-chip dividend growth stock for years to come due to its leading market position, investments in AI and stickiness of its product offerings. Salesforce stock is undervalued based on historical P/E metrics, discounted cash flow/dividend models, and long-term investors should be rewarded by investing in Salesforce stock at current prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.