Summary:

- Dell Technologies Inc. stock fell 26% from 52-week high, now trading above the 50-day moving average.

- Dell reported strong earnings, with revenue up 6% year over year and $1.1 billion returned to shareholders.

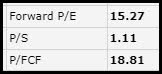

- Dell is undervalued with 15 forward P/E ratio and 1 times sales, poised for EPS growth and linked to Nvidia’s new Blackwell chip and Musk xAI data center.

Thinglass

Dell Technologies Inc. Buy Thesis

My top buying opportunity in the AI Realm is currently Dell Technologies Inc. (NYSE:DELL). I just bought a position in Dell. Dell’s stock recently fell 26% from the 52-week high of $180 after last quarter earnings were announced.

Dell Chart After Earnings Drop

Dell Current Chart

I saw the DELL stock pullback as much worse than it should’ve been. After some recent volatility, the stock is now trading, once again, right above the 50-day moving average. This should provide strong support technically.

This could very well be your “Last Chance” to buy Dell at these levels

I watched one of my “old school” favorite movies this weekend, “Thank God It’s Friday.” At the end of the movie, Donna Summer sings her signature song, “Last Dance.” The lyrics got stuck in my head, and today I couldn’t stop applying them to the current situation with Dell’s stock, with some minor editorial changes, please indulge my poetic license. The song lyrics are:

“So let’s dance the last dance Let’s dance the last dance Let’s dance the last dance Let’s dance the last dance tonight.”

I changed them to:

“This is your last chance

Yes, it’s your last chance

to buy Dell… at this level

oh oh yeah!”

Ha! Please excuse me! I couldn’t help sharing that gem!

Back to business! The stock has been finding its footing right at the 50-day SMA and the bottom of the uptrend channel after the recent pullback.

In the following sections, I will lay out my bull case. Let’s start with a review of the recent earnings. Below is a short overview of the recent earnings highlights.

Dell Earnings Highlights

“Dell announces financial results for its fiscal 2025 first quarter. Revenue was $22.2 billion, up 6% year over year. Operating income was $920 million and non-GAAP operating income was $1.5 billion, down 14% and 8% year over year, respectively. Cash flow from operations was $1.0 billion. Diluted earnings per share was $1.32, and non-GAAP diluted earnings per share was $1.27, up 67% and down 3% year over year, respectively.”

- First quarter revenue of $22.2 billion, up 6% year over year

- Infrastructure Solutions Group (ISG) revenue of $9.2 billion, up 22% year over year, with record servers and networking revenue of $5.5 billion, up 42%

- Client Solutions Group (CSG) revenue of $12.0 billion, flat year over year, with commercial client revenue at $10.2 billion, up 3%

- Diluted earnings per share of $1.32, up 67% year over year, and non-GAAP diluted earnings per share of $1.27, down 3%

- Dell returned $1.1 billion to shareholders through share repurchases and dividends, and ended the quarter with $7.3 billion in cash and investments.

Vice Chairman and COO Jeff Clarke stated on the Conference call regarding their AI initiatives:

“In ISG, our AI-optimized servers orders increased to $2.6 billion, with shipments up more than 100% sequentially to $1.7 billion. We have now shipped more than $3 billion of AI servers over the last three quarters. Our AI server backlog is $3.8 billion, growing sequentially by approximately $900 million. Our AI optimized server pipeline grew quarter-over-quarter again and remains a multiple of our backlog.

We’ve seen an expansion in the number of enterprise customers buying AI solutions, which remains a significant opportunity for us given we are in the early stages of AI adoption. Traditional server demand remained strong in Q1. It grew for the second consecutive quarter year-over-year and the fourth consecutive quarter sequentially. Storage demand has stabilized with revenue flat year-over-year.

We highlighted our AI strategy to accelerate adoption of AI, which is built on five core beliefs. The first data is the differentiator. 83% of all data is on-prem and 50% of data is generated at the edge; second, AI is moving to the data because it’s more efficient, effective and secure. And AI inferencing on-prem can be 75% more cost effective than the cloud; third, AI will be implemented in a wider range of ways, from locally on devices to massive data centers depending on the use case; fourth, you need an open, modular architecture to support rapid and sustainable innovation; and finally, AI requires a broad and open ecosystem to take advantage of the latest advancements.

We launched the Dell AI Factory to help accelerate AI innovation in an option. It combines our Dell solutions and services optimized for AI workloads with an open ecosystem for partners, including NVIDIA, Meta, Microsoft and Hugging Face. The Dell AI Factory is the industry’s broadest AI-optimized portfolio of solutions and services that can be designed and sized to meet the specific requirements of our customers.

We also extended our engineering leadership with new features and capabilities across our portfolio, including the new PowerEdge XE9680L, an 8-way GPU server with 12 Gen5 PCIe slots and direct-to-chip liquid cooling that improves overall power efficiency by 2.5x. With its 4U form factor, customers can buy the densest rackable architecture in the industry with up to 9 XE9680Ls and 72 high-wattage GPUs in one rack that can support performance up to 130 kilowatts straight from our factory.”

Chief Financial Officer Yvonne McGill Stated:

“We again demonstrated our ability to execute and deliver strong cash flow, with AI continuing to drive new growth,” said Yvonne McGill, chief financial officer, Dell Technologies. “Revenue was up 6% at $22.2 billion, servers and networking revenue was up 42%, and we generated $7.9 billion of cash flow from operations over the last 12 months.”

So why the sell-off?

The issue was the same as it’s been with plenty of companies as of late: market participants were expecting higher margins on the AI front to show up in the numbers already. As I have stated previously, many market enthusiasts have gotten overly excited about the prospects for AI profits to come rolling in right away.

The fact of the matter is, it takes time for these opportunities to evolve and be realized. First comes the capital expense phase, coupled with initial pilot programs to sort out where costs can be cut and services added. Once this phase is complete, profit margins should improve dramatically as processes are streamlined, expenses are eliminated, and services are added. Not to mention the increased margins based on volume of sales. Now let me turn our attention to the plethora of recent news events that bolster and underpin my thesis.

Why Dell is my top AI derivative play

NVIDIA Corporation (NVDA) recently announced:

“The new Blackwell platform has arrived – enabling organizations everywhere to build and run real-time generative AI on trillion-parameter large language models at up to 25x less cost and energy consumption than its predecessor.”

Regarding their new Blackwell chips, Dell will be a huge beneficiary of this development, according to the release. Michael Dell stated:

“Generative AI is critical to creating smarter, more reliable and efficient systems. Dell Technologies and NVIDIA are working together to shape the future of technology. With the launch of Blackwell, we will continue to deliver the next-generation of accelerated products and services to our customers, providing them with the tools they need to drive innovation across industries.”

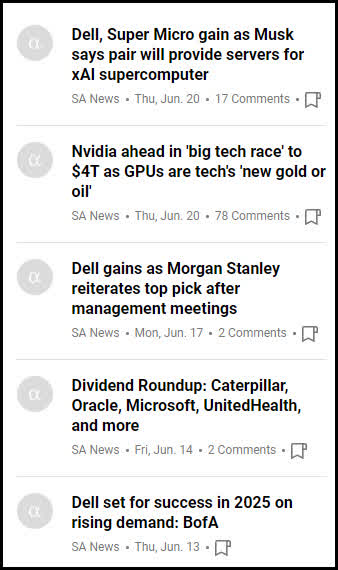

This is only the tip of the iceberg when it comes to Dell’s recent wins. Per Seeking Alpha News, Elon Musk recently announced Dell would “provide servers for the supercomputer that his artificial intelligence startup xAI is building in Austin.”

Below is a screenshot of the various positive Seeking Alpha news stories regarding Dell.

Seeking Alpha

So Dell has definitely got plenty of tailwinds that should push up revenues and profits in the coming years. The next positive I see presently is the fact Dell is currently trading for an exceptional valuation.

Dell is vastly undervalued

Finviz

I’ve been a big fan of Dell for over 30 years. Michael Dell, who started the company out of Austin, is an OG (original gangsta), a tech leader who knows what he is doing. I’ve been following Dell over the decades, since I live close by in San Antonio and had many friends go to work for Dell and become proverbial “Dellionaires.“

The company has had its ups and downs, yet, always seems to come out on top. I see the recent pullback as an excellent opportunity to start a new position. Even though the stock is up substantially, (176%), over the past year, it still trades for a song basically.

Finviz

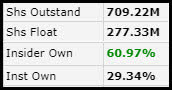

Dell’s stock trading for one times sales and a 15 handle forward P/E ratio. Dell beat on the top and bottom lines and reaffirmed guidance. The stock is also trading for approximately 19 times free cash flow as well. This is close to the significantly undervalued threshold of 15 times free cash flow. It is almost trading as a value stock, yet, has massive growth potential.

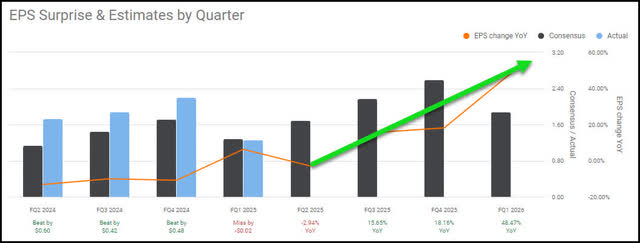

I believe the fact the stock has run up so much over the past year has blinded many to the fact it is actually still trading for an attractive valuation. In fact, if it stays at the current level, it should get even cheaper based on the present EPS forecast for the next several quarters. See below chart.

Seeking Alpha Dell EPS surprise forecast

Before I wrap this piece up, I’d like to point out another very positive attribute of Dell’s stock. Michael Dell currently owns over 50% of the stock. Another 10% is owned by other insiders. This has led to the float being tiny. Only about 39% of the shares are available for trading. 61% owned by insiders and 29% by Institutions. So when the stock begins to take off, it is going to have a substantial upward trajectory, I surmise.

The Wrap Up

Dell has a solid roadmap ahead for improved EPS growth and expanding profit margins on their new AI initiatives. What’s more, it is inexorably linked to Nvidia’s new Blackwell chip, due out at the end of this year. Not to mention being selected by Elon Musk to provide the infrastructure for his new xAI data center in Austin. It’s the perfect set up for the stock to regain its upward momentum and breach the latest highs.

The remarkable piece of the puzzle is the fact the stock is still trading with a 15 forward P/E ratio and 1 times sales. Add to this the fact Dell has returned $1.1 billion to shareholders through share repurchases and dividends, ending the quarter with $7.3 billion in cash and investments, what more can you ask for?

When markets currently trading at all-times highs, overbought, and overvalued, buying opportunities have become much fewer and farther between. I see Dell Technologies Inc. stock as truly finding the proverbial “needle in the haystack.” Let’s just hope it transforms into the “Goose that lays the golden egg!” Ha! Those are my thoughts on the matter. I look forward to reading yours!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

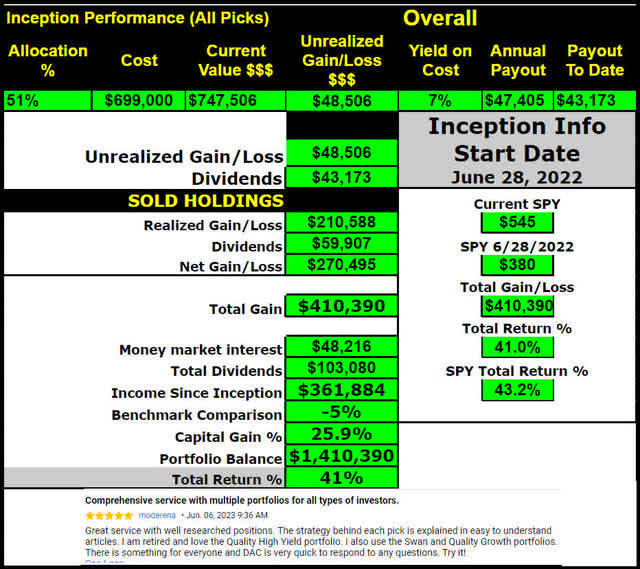

All picks since inception have just reached a new all-time high! We are up 41% since inception two years ago!

Join now for top income and growth buys, timely macro insights, and a lively chat room!

Send me a Private Message for a special discount link! Only a few spots left.

See portfolios below.

~ Super SWAN Quality Income – Yield – 5.8%

~ SWAN Quality Income – Yield – 9.4%

~ Quality High Yield Income – Current Yield – 11.5%

We also have Quality and Speculative growth portfolios focused on capital appreciation with $259,094 in total gains representing a 26% in capital appreciation to date.