Summary:

- I believe GoDaddy Inc.’s valuation at approximately 15x forward free cash flow offers a positive risk-reward opportunity.

- Despite carrying over $3 billion in net debt, GoDaddy’s strategic initiatives and product innovations position it well for future growth.

- The company’s focus on enhancing customer experiences and simplifying tasks for entrepreneurs drives strong performance, particularly in the Applications and Commerce segment.

ipuwadol/iStock via Getty Images

Investment Thesis

GoDaddy Inc. (NYSE:GDDY) has a lot going for it. And yet, to say that this is a blemish-free investment would be to misconstrue reality. Ultimately, GoDaddy carries more than $3 billion of net debt, which hinders its ability to in the near-term significantly return capital to shareholders.

And yet, the business is undeniably reasonably priced. In a market where few stocks are priced at anything less than 20x forward free cash flows, GDDY is priced at approximately 15x next year’s free cash flows.

Briefly, there’s a lot to like about this investment thesis, and I believe it offers investors a very positive risk-reward. More specifically, I declare that investors will in time look back to $143 per share as a low entry point for this stock.

Why GoDaddy? Why Now?

GoDaddy’s platform provides entrepreneurs with tools and services for building websites. Their goal is to create inclusive opportunities for small and medium-sized businesses. They focus on simplifying tasks for their customers, such as website creation and ecommerce store management, through technology to streamline processes and improve user experiences.

In the near term, GoDaddy is seeing strong growth, particularly in its Applications and Commerce segment, where bookings have accelerated significantly. They have implemented strategic initiatives like enhancing pricing and bundling capabilities and launching new products like GoDaddy Airo and GoDaddy Smart Terminal Flex. These efforts are expected to increase their free cash flow, positioning them well for 2024 and into 2025.

However, GoDaddy faces challenges in this space, including intense competition in the web services market. For example, one top competitor is Wix.com (WIX), but numerous other competitors offering similar website-building and e-commerce tools are available, which puts pressure on GoDaddy to continually provide superior value to attract more customers. In short, there’s a rather shallow moat.

Given this balanced background, let’s now discuss its fundamentals.

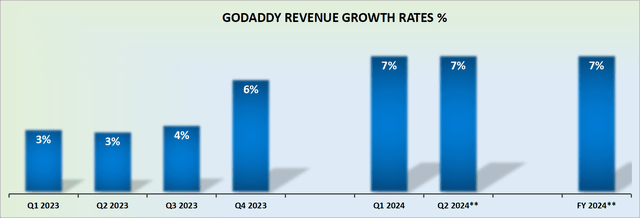

GoDaddy Expected to Deliver High Single-Digit Growth Rates

GoDaddy was once a business that one could depend on for double-digit revenue growth rates. Today, its growth rates have all but evaporated. But not quite. And therein lies its bull case.

What investors want is some growth. But beyond that, investors crave and demand certainty. Once investors vaguely know what they are getting, they can start to price it in.

And after that, if the business suddenly starts to deliver some topline acceleration beyond expectations, then, the stock becomes suddenly compelling and investment-worthy. That’s the premise of GoDaddy.

This is a business that is on a path for high-single digit growth rates. However, since its valuation isn’t too demanding, investors are being offered a good risk-reward, a topic we explore next.

GDDY Stock Valuation — 15x Forward Free Cash Flow

I’ll discuss the negative and positive aspects of its valuation. Firstly, the negative aspect.

GoDaddy carries approximately $3.2 billion of net debt. This debt is cumbersome. Yes, GoDaddy is eager to repurchase its shares, given its valuation is low enough for these repurchases to be accretive, but its ability to meaningfully return capital to shareholders is hampered by the fact that more than 15% of its market cap is made up of debt.

That being said, GoDaddy will probably make around $1.3 billion of free cash flow next year, which leaves its market cap priced at around 15x forward free cash flow. This is undoubtedly a fair valuation, even if GoDaddy’s underlying business prospects operate in a highly competitive environment.

All in all, there’s a lot to like here.

The Bottom Line

Paying 15x next year’s free cash flow for GoDaddy presents a positive risk-reward opportunity for investors due to the company’s robust growth strategy and strong financial performance. With an approximate 10 to 15% growth in free cash flow this year, plus given its significant acceleration in its Applications and Commerce segment, makes GoDaddy well-positioned for sustained profitability.

Their focus on innovative customer experiences, enhanced pricing and bundling, and strategic product rollouts like GoDaddy Airo and Smart Terminal Flex indicates potential for continued value creation.

Notwithstanding its competitive challenges, these initiatives underscore a solid trajectory, making the valuation an attractive entry point for investors seeking long-term gains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.