Summary:

- JPMorgan Chase faces mixed signals with concerns about profitability uncertainty and overvaluation.

- There are certainly positive factors here, including its strong net interest income growth and optimistic outlook.

- However, I see limited upside potential in the next year due to uncertainties related to rates, operating expenses, and capital return programs.

yanik88

JPM stock faces mixed signal

I last covered JPMorgan Chase (NYSE:JPM) about three months ago, urging investors to take advantage of the recent price rally and take some profit (see the next chart below). The stock price has indeed moved largely sideways since then, rising about 1.6% (compared to a 4.8% advancement from the broader market). The specific factors that went into my thesis are recapped below:

The article argues that many of the catalysts that drove JPMorgan Chase’s earnings growth in 2023 are unlikely to continue into 2024, leading to concerns of over-earning and a potential decline in profitability. At the same time, the stock may be fully valued or even overvalued, leaving no margin of safety.

Seeking Alpha

Against this backdrop, the thesis of this article is to reiterate the Hold rating on the stock given the developments in the past three months. I consider all of my earlier concerns to be still valid. Moreover, I see a few additional uncertainties developed since my last writing to be elaborated on in the remainder of this article. With these uncertainties, I expected stock prices to keep looking for a definitive direction in the near future (say the next year or so).

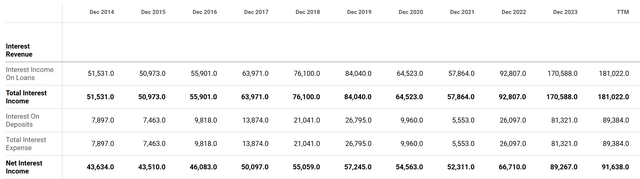

JPM stock: The positives

Let me start with the positives. The bank has demonstrated another quarter of net interest income (“NII”) since my last writing. Particularly, 2024 first quarter earnings per share of $4.63 were 13% above the $4.10 figure generated for the same period last year. One key contributor to the robust results was a rise in NII as you can see from its income statement below. JPM’s net interest income has increased significantly in recent years. After a sharp decline in 2020 and 2021 amid the COVID-19 pandemic, its net interest income has almost doubled from a bottom of $52.3 billion in FY 2021 to the current $91.6 billion (on a TTM basis). Looking ahead, JPM sees even better NII and have recently upped its NII guidance from its prior outlook of ~$89 billion, excluding markets, of $91 billion. The optimism is largely rooted in a combination of factors favorable interest rate environment and stable loan balance.

However, looking ahead, I see reasons why these favorable factors in the past 1~2 years may have run their course, as elaborated on next.

Seeking Alpha

JPM stock: The negatives

With the ongoing high borrowing rates and elevated inflation, I expect at least one of the two things to happen next – possibly both: A) a higher delinquency rate on debt (because people could not make ends meet), and/or B) a lower balance (because of write-offs and/or paydown’s as people do not want to pay the high interest rates). I see signs for A already. As an example, the chart below shows the Delinquency Rate on Credit Card Loans (All Commercial Banks) over the past decade. The delinquency rate reached its lowest point at ~1.5% in 2021 amid the epic QE. It has since climbed to the current 3.16%, the highest level in at least 10 years. JPM also reported diminished deposit balances in the most recent earnings call, and I think the root causes are one (or both) of these factors.

FRED

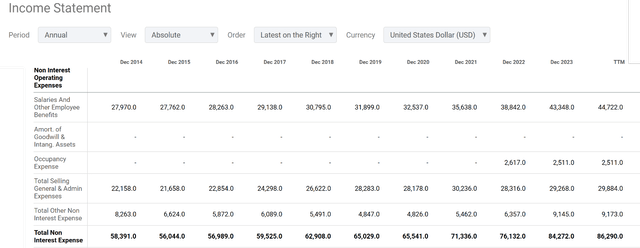

Another concern – operating expenses. As you can see from the chart below (taken from its income statement), JPM’s total operating expenses have been increasing significantly in recent years. From 2020, total operating expenses increased by nearly one-third, going from $65.5 billion to the current level of around $86.3 billion. I see a range of factors that have been causing such an increase, including inflation, growth in salaries and employee benefits, and investments in new technologies. Looking ahead, I see all factors to be persisting the generating pressure on the bank’s profitability.

Seeking Alpha

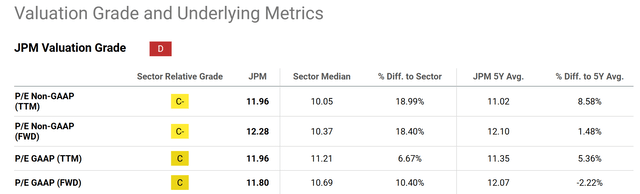

JPM stock: valuation

To add to the investment uncertainties, the stock’s valuation is also quite elevated, in my view. As a reflection, the chart below summarizes JPM stock’s valuation grade. As seen, JPM’s P/E ratios are slightly higher than its five-year average and substantially higher than the sector median. For example, its TTM P/E ratio is 11.96x, compared to the sector median of only 10x. This represents a 19% difference.

Seeking Alpha

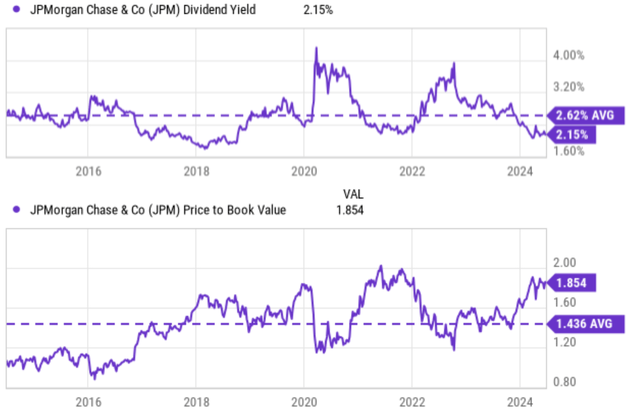

For banking stocks that pay regular dividends, I like to rely more on their dividend yield and price/book ratio for valuation assessment. The next chart below shows JPM’s dividend yield compared to its historical average (top panel) and its P/B ratio compared to its historical average (bottom panel). And as you can see, both metrics point to a substantial overvaluation too. To wit, the chart shows that JPM’s dividend yield is currently at 2.15%, which is noticeably below its historical average of 2.62%. JPM’s P/B ratio is currently at 1.85x, which is above its historical average of 1.43 by almost 30%.

Seeking Alpha

JPM stock: Other risks and final thoughts

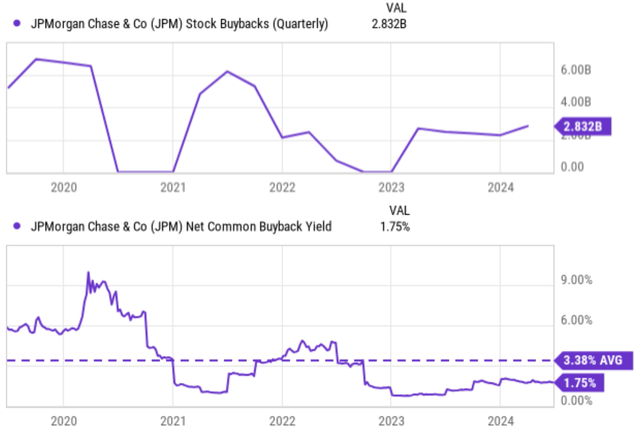

As a large bank, JPM faces all the risks common to its peers and also the general economy. Most other articles have mentioned these risks already and I won’t reiterate them here. Here, I will just point out an uncertainty that’s more specific to JPM’s investment thesis, which involves share repurchases. JPM has been actively (and quite aggressively) buying back its own shares in recent years. This was brought about, no doubt, by the company’s solid earnings and capital position. In dollar amounts (shown in the top panel below), the buyback peaked at over $6 billion on a quarterly basis in mid-2021.

In terms of net common buyback yield (shown in the top panel below), the five-year average is about 3.38%, representing a sizable contribution to the total return. However, the most recent buybacks were significantly milder. The last quarter’s buyback was about $2.83 billion, translating into a net common buyback yield of only 1.75%, far below the historical average. Such a decrease reflects both profitability pressure and also regulation uncertainty in my mind. Looking ahead, my view is that JPM’s next stock buyback program will largely depend on the Federal Reserve’s bank stress tests under a revised Basel III endgame rule.

All told, I anticipate JPM shares to remain range-bound in the near future due to the mixed factors analyzed above, and thus maintain my rate at Hold. On the positive side, there’s nothing wrong with holding shares in a well-run bank, even at a premium valuation. However, I see limited return potential under current conditions due to uncertainties related to its NII, operating expenses, and future capital return programs.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.