Summary:

- The market is “top-heavy” with concentration risk, the economy is uncertain, and a high risk-free rate is not reflected in the overall market. Investors can choose to mitigate risk in multiple ways.

- Nike, Inc.’s underperformance justified by stagnant revenue and negative net income growth presents an opportunity.

- Nike’s market share trends, its exposure to the economy, valuation, and its upcoming earnings support a bearish outlook, making put options an attractive risk mitigation strategy.

AleksandarGeorgiev/E+ via Getty Images

When reviewing the market performance of late, it is clear that it is “top-heavy” and many participants are puzzled about how long it can continue. For reasons economic, AI, liquidity, or otherwise, it is the reality we are living in. With the risk-free rate being the highest in near-term history and warning signs of an economic downturn, investors can choose to diversify the risks by betting on the laggards and reducing their exposure to the mega caps or trimming the market cap-weighted index if their exposure is primarily the SPY index.

Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

Does this mean that we should not manage risk at all? More than one way to skin a cat, and my preferred method is to find asymmetric bets with the losers. I believe there is an opportunity presented with Nike, Inc. (NYSE:NKE)

Factors that support my bearish view

The Business and its underperformance

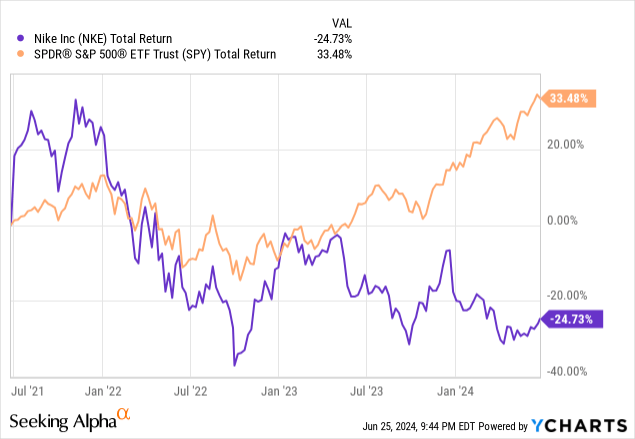

As a global leader in the design, development, manufacturing, and marketing of athletic footwear, apparel, equipment, and accessories, I believe Nike’s returns are closely tied to the economy and the overall market. But over the last three years, its returns have severely lagged the market (underperformed by more than 50%)

There are reasons for this –

1. The market is increasingly driven by certain mega caps (Nvidia (NVDA), Apple (AAPL), etc.) whereas much of the other components of the S&P 500 have suffered.

2. Concentration risk in the market is increasingly evident. The top 10 S&P500 companies now account for over 35% of the index’s market cap. I believe in many instances this could be justified.

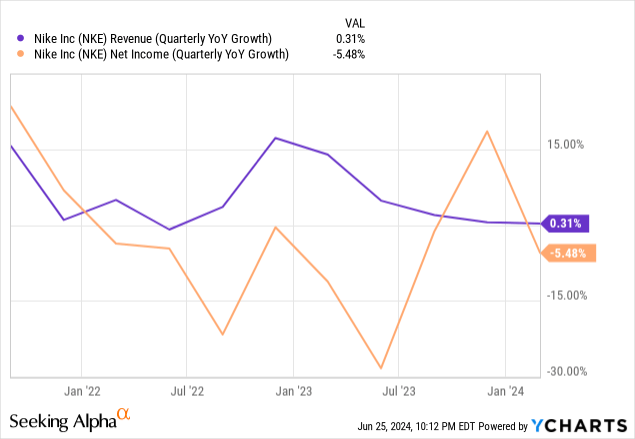

3. In Nike’s instance, the underperformance is completely justified when looking at its financial performance. Revenue has stayed flat over the past three quarters, and Net income growth has been negative for 8 of the last 9 quarters.

I understand past performance is not indicative of future returns, but the overall economy is not at its brightest point which may again play on Nike’s future.

Uncertain Future (Economic and Company-specific) May Affect Nike

Nike being in the consumer discretionary sector means the future of the economy will have a role to play in Nike’s future as well. The U.S. economic landscape appears increasingly uncertain, with several indicators pointing towards potential challenges ahead. Recent data and expert analyses suggest that the world’s largest economy may be facing headwinds that could lead to a slowdown or even a downturn.

1. According to the Bureau of Economic Analysis, GDP growth slowed to an annual rate of 1.3% in the first quarter of 2024, down from 3.4% in the previous quarter. This deceleration has raised fears about the possibility of a recession in the near term.

2. Retail Sales rose just 0.1% for the month, excluding autos it declined 0.1% against the estimate for a 0.2% increase. This follows April sales, which were worse at -0.2%. Retail sales indicate that consumer sentiment may be cooling and could be the canary.

3. Sales for American brands have been declining in China in favor of homegrown brands. Tesla’s China market share shrank to 4% in April, almost halving from 7.7% in March (China’s BYD reported a 29% growth), Apple’s revenue fell 8% for the latest quarter (Huawei’s sales have been soaring), Starbucks sales per customer has declined 9% on average (competing with local brands).

So why does this matter?

Nike has a significant global footprint, with operations in over 100 countries, but close to 15% of its sales come from China alone. But sales have been slowing in the region, and there are indications that this may continue in 2024 as well. Additionally, market share has been gained by many of the local participants. A recent survey conducted by Citigroup also found that Adidas was the most favored brand. The survey asked 1,000 Chinese consumers various questions to gauge what brands they recommended to family and friends, what brands they considered purchasing next, and what brands were the most innovative (big gap in the scores between Adidas and Nike)

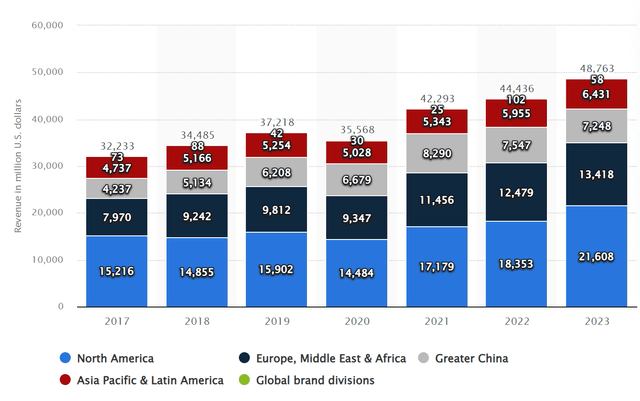

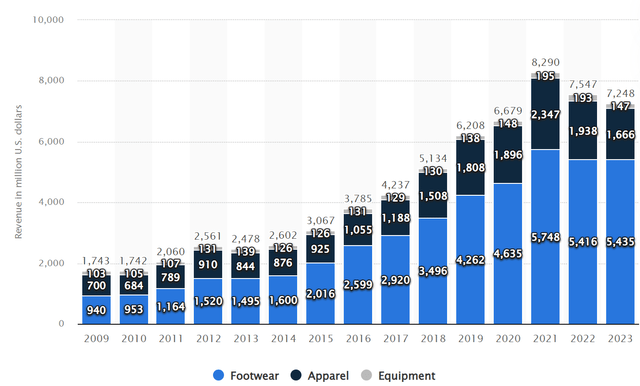

Nike’s Revenue mix by geography (Statista)

Nike’s declining revenues in China (Statista)

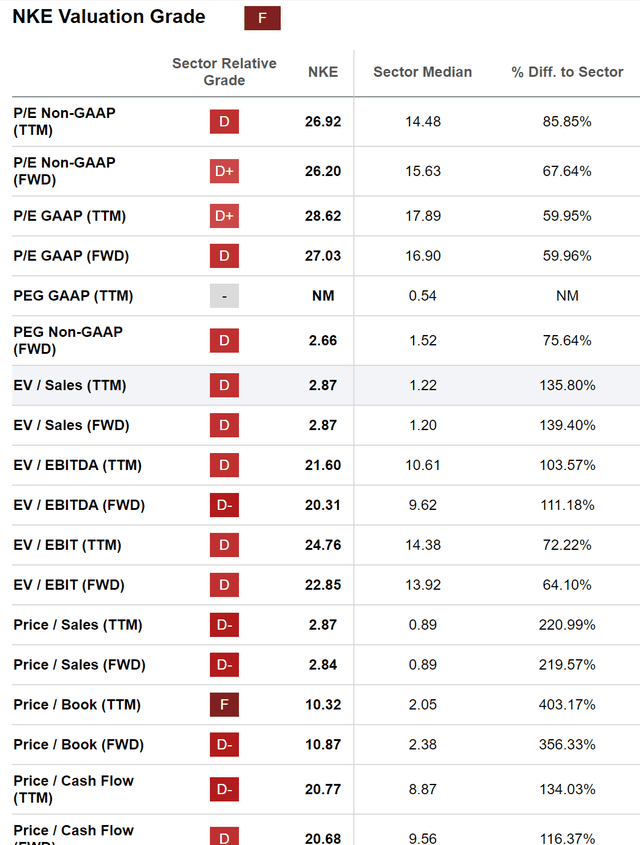

Valuation that does not reflect the risks

The stock has been down more than 10% for the year and more than 45% from its all-time highs, but this still does make it cheap with its P/E ratio at 28.6x. Nike stock’s valuation grade is currently an F, with its valuation far from the sector median.

I put together a list of its closest comparables and their earnings multiples, and it does not look good within this group either.

Nike’s closest comparables for valuation (Seeking Alpha and Author Compiled)

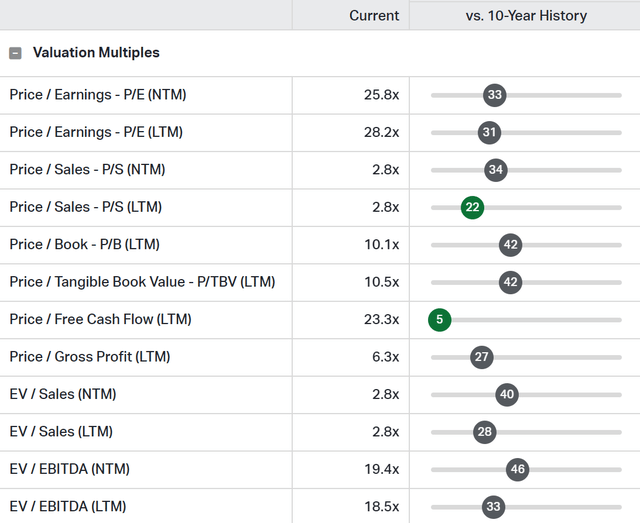

An argument can be made that relative to its own history, its valuation is fair. But in the last ten years, this valuation was justified by citing its potential and forward growth. The pandemic and certain other factors also contributed to inflated P/Es in the last decade. So looking back does not provide an accurate assessment.

Nike’s valuation Percentile Rank against its historical multiples (Koyfin)

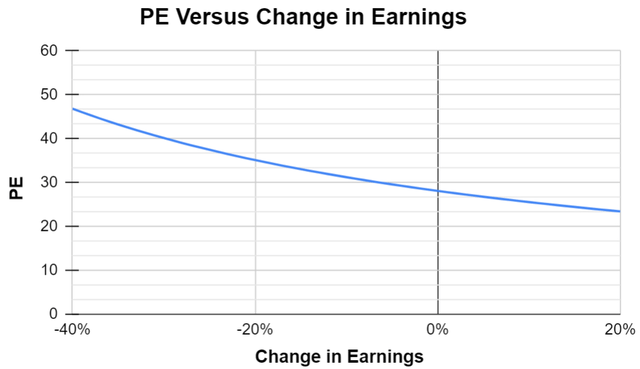

How about forward valuation? This is where I believe the uncertainty is not baked into the stock fully. Economic slowdowns or recessions have a big impact on the consumer discretionary sector, and Nike would not be immune. It is difficult to quantify the exact impact itself, so a range of scenarios could be more useful.

Author Designed from Company data

On the upside, even in the most optimistic scenario where we see earnings improve by 20%, the valuation would only get more aligned with the market average (SPY is trading approximately at 25x). But on the downside, if earnings were to decline by 40% in a worst-case scenario, we could see earnings multiple inflate beyond 45x. If the price of the stock resets to accommodate a lower valuation or a valuation that is more aligned with the market, a downside of 10 – 50% would not be surprising.

Nike’s Upcoming Quarter Earnings do not inspire confidence

There could be some warning signs that earnings are headed down that lends credence to pessimistic scenarios. When you look at Nike’s earnings revisions for the upcoming quarter, the number of up revisions is only one for EPS and two for revenues, whereas the number of down revisions is 12 for EPS and 14 for revenues!

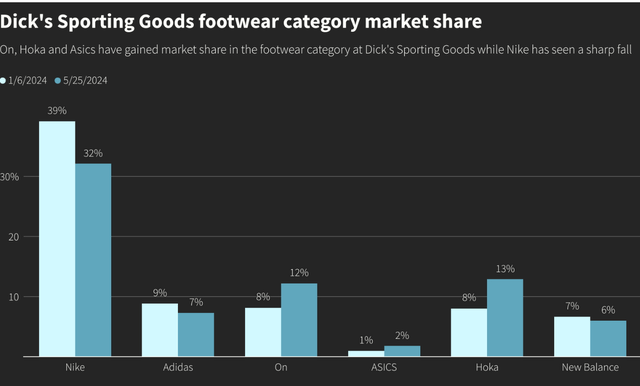

Multiple brokerages have cut their price targets and expect the company to give up market share to newer brands. According to YipitData, which collates market share using email receipt and transaction data, On’s market share in the footwear category at Dick’s Sporting Goods increased to 12% as of May 25, up from 8% at the beginning of January. During the same period, Hoka’s market share rose to 13% from 8%. Conversely, Nike’s market share at the retailer declined to 32% in May, down from 39% in January.

Risks to this Thesis

This is an option play. So, by nature, it comes with all the risks of holding and buying an option (You can lose your entire investment if it does not pan out within the time duration of the option). This thesis specifically focuses on going long on puts and with the earnings coming out this week, improving business prospects combined with the stock reacting positively (or even not reacting much at all) can severely bring down the value of your investment. Even with a bad earnings report, we could see the stock move higher for several reasons –

- Management commits to a big buyback (FedEx earnings is the most recent example)

- Cost reductions may impress the market

- Positive outlook and future strategy using the Olympics as the ramp may impress the market.

However, since we will be buying long-duration, there could still be a slim chance of this working out as this stock has a Beta of 1.1, and significant market volatility could benefit us (I plan to hold or roll the puts depending on market reaction)

Nike Put Option Play

This is one of my many other risk mitigation strategies. While this does not provide all the protection I need for my portfolio, it definitely forms a part of my overall tail risk or drawdown protection strategy. Also to note, this takes a minute percentage of my book. The best part of this play is being wrong has a negligible effect, but being right has a noticeable effect on my portfolio!

While buying this, a few things of note –

1. Deep OTM put options with at least 3 months to expiry have asymmetry but rely on high volatility or significant price correction to provide any real benefit (Payoff is significant in case my thesis works out and the price moves in my favor or implied volatility resets to a significantly higher value). I have exposure to contracts expiring on September 20 at various strike prices ($75, $70, $65). Payoffs vary depending on the premiums paid and the move of the stock. Far OTM puts can potentially generate 10x – 50x the investment.

2. Sufficient Liquidity and volume to ensure the spread between bid and ask is reasonable

3. This strategy or modifications of this strategy (Ex: Shorter-dated puts such as July 19 expiry and closer strike price such as $85) could also work for individuals with significant long exposure to Nike or consumer discretionary in general and who want to protect themselves from any short-term downside.

It has to be stressed, that the implied volatility is relatively high as earnings are imminent (Jun 27 AH) and market participants are expecting a move in the Nike stock (5-10% moves are typically priced-in for earnings). So if the stock moves up due to a favorable reaction to earnings, does not react, or even moves down, the premiums paid to the options could lose their entire value. This is a bet on the stock gapping down significantly post the earnings announcement, OR the stock moving down below the strike price before expiry as a reaction to the market also moving lower.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.