Summary:

- Amazon has crossed the $2 trillion mark for the first time, but I see more upside ahead.

- AWS continues to see positive momentum in both accelerating top-line growth and expanding profit margins.

- The stock is reasonably valued at around 41x this year’s earnings, with potential for at least 15% annual return upside over the next 5 years.

- I reiterate my strong buy rating for the best business in the world.

Chip Somodevilla/Getty Images News

Amazon (NASDAQ:AMZN) has finally crossed the $2 trillion mark for the first time, which may be surprising to many investors given the dominant positioning of its various businesses. Like many tech peers, AMZN has emerged from the 2022 tech crash with pronounced margin expansion, dispelling any fears regarding the profitability of its web service or e-commerce units. Some investors might still be disappointed that AWS has not seen revenue growth accelerate more meaningfully upon the growth of generative AI, but they might be missing the point, as both AWS and the e-commerce divisions do not appear to be getting the valuation multiple that they deserve. I continue to view AMZN as a collection of very high quality businesses that, in addition to generating substantial cash flows, should earn a further re-rating upwards. I rate the stock a strong buy.

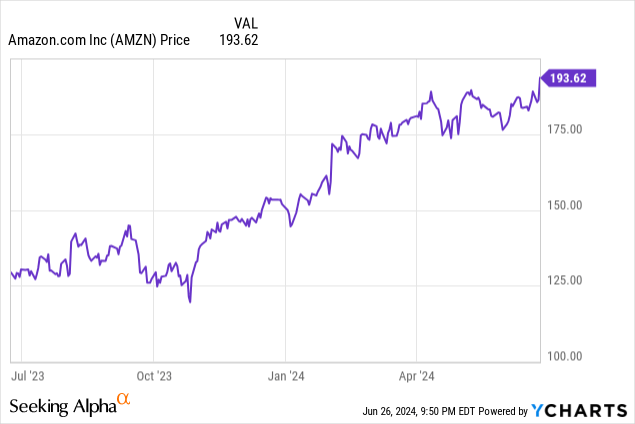

AMZN Stock Price

I last covered AMZN in April where I rated the stock a strong buy and called it “the best business in the world.” The stock has slightly outperformed the broader market since then.

While it is admittedly difficult to call AMZN stock cheap today, I believe that this is a case where the cream will rise to the top.

AMZN Stock Key Metrics

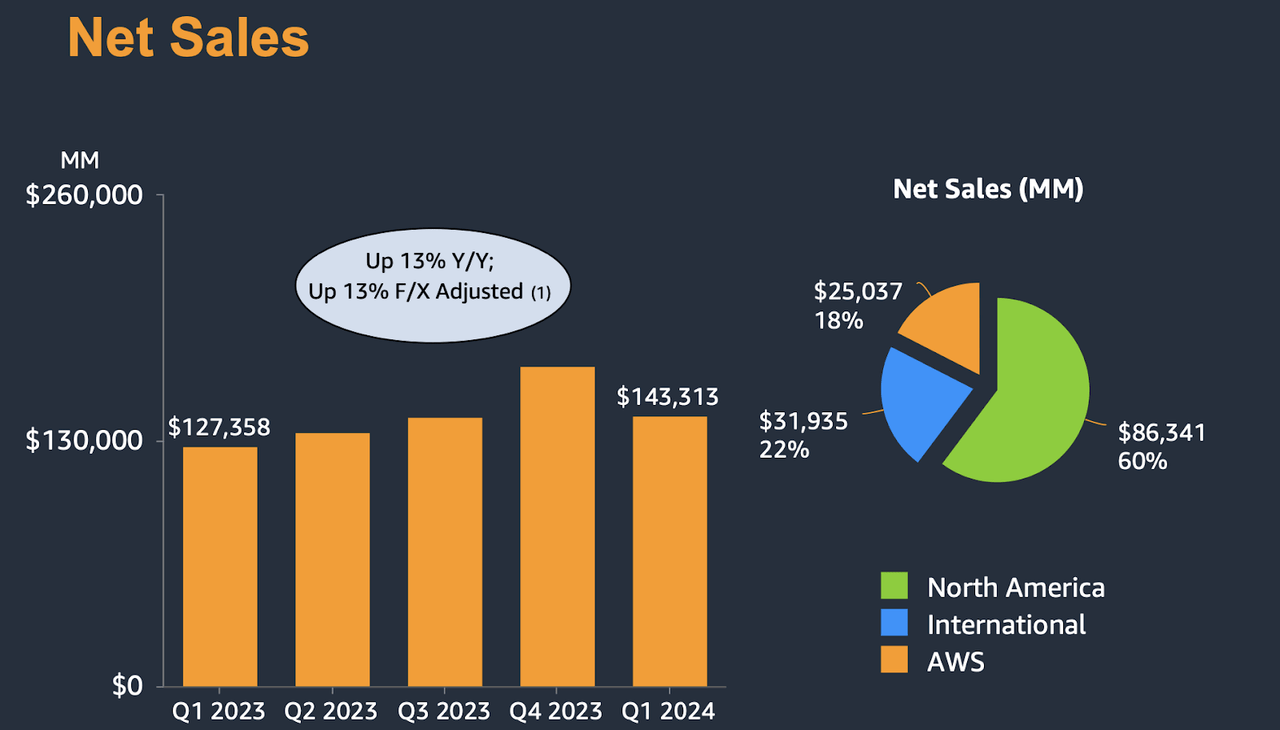

In the most recent quarter, AMZN generated 13% YoY revenue growth to $143.3 billion, showing minimal deceleration from the 14% shown in the fourth quarter and coming at the high end of guidance for 8% to 13% growth.

2024 Q1 Presentation

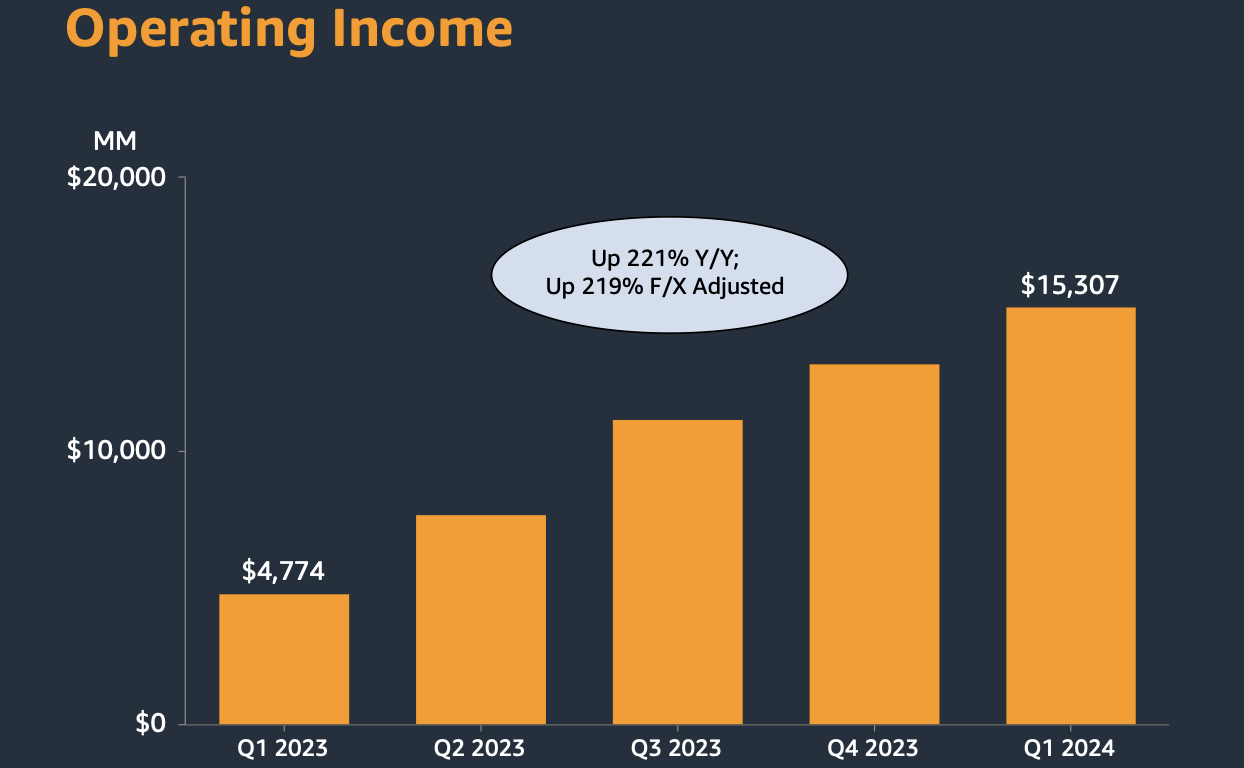

AMZN paired that strong top-line growth with a stunning 221% YoY growth rate in operating income to $15.3 billion, crushing guidance for operating income of between $8 billion to $12 billion.

2024 Q1 Presentation

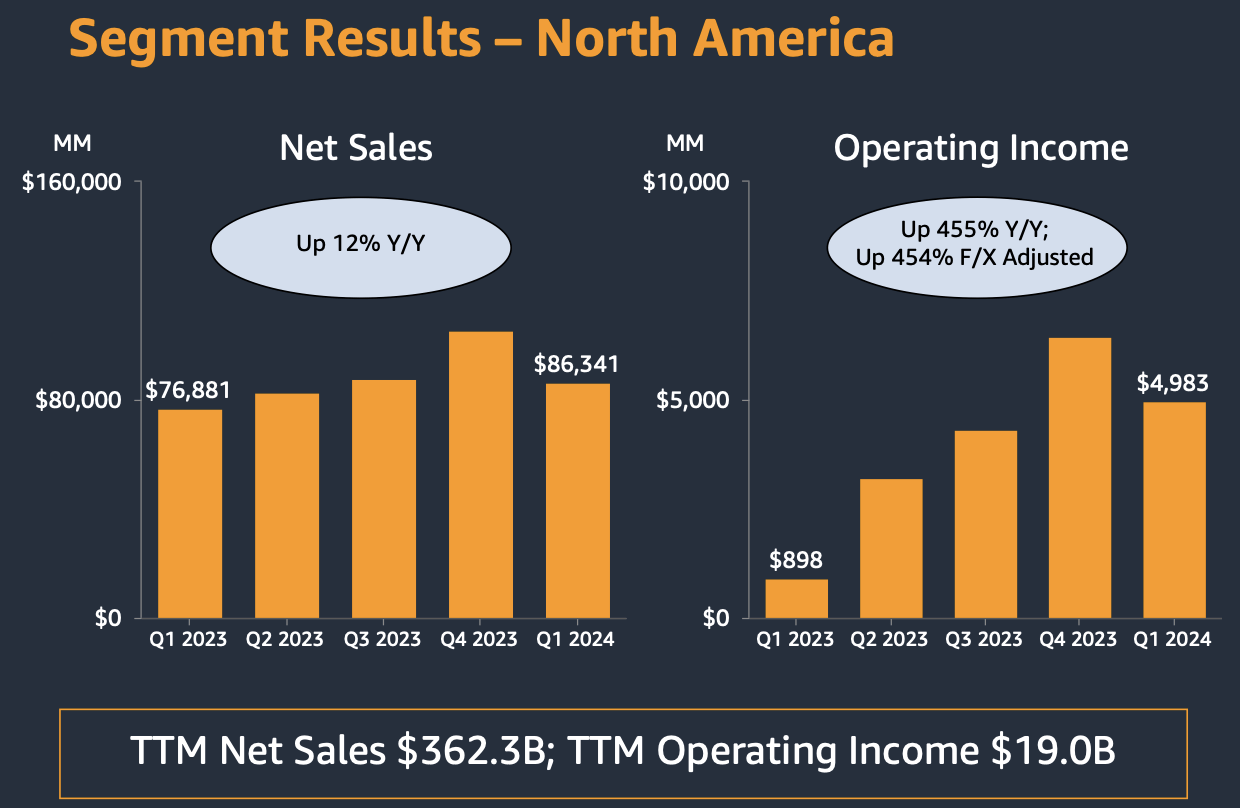

The company saw its North America business post 12% YoY revenue growth, a solid result given the scale. As has been typical in the recent quarters, AMZN generated substantial margin expansion, with operating income jumping from $898 million to $4.98 billion.

2024 Q1 Presentation

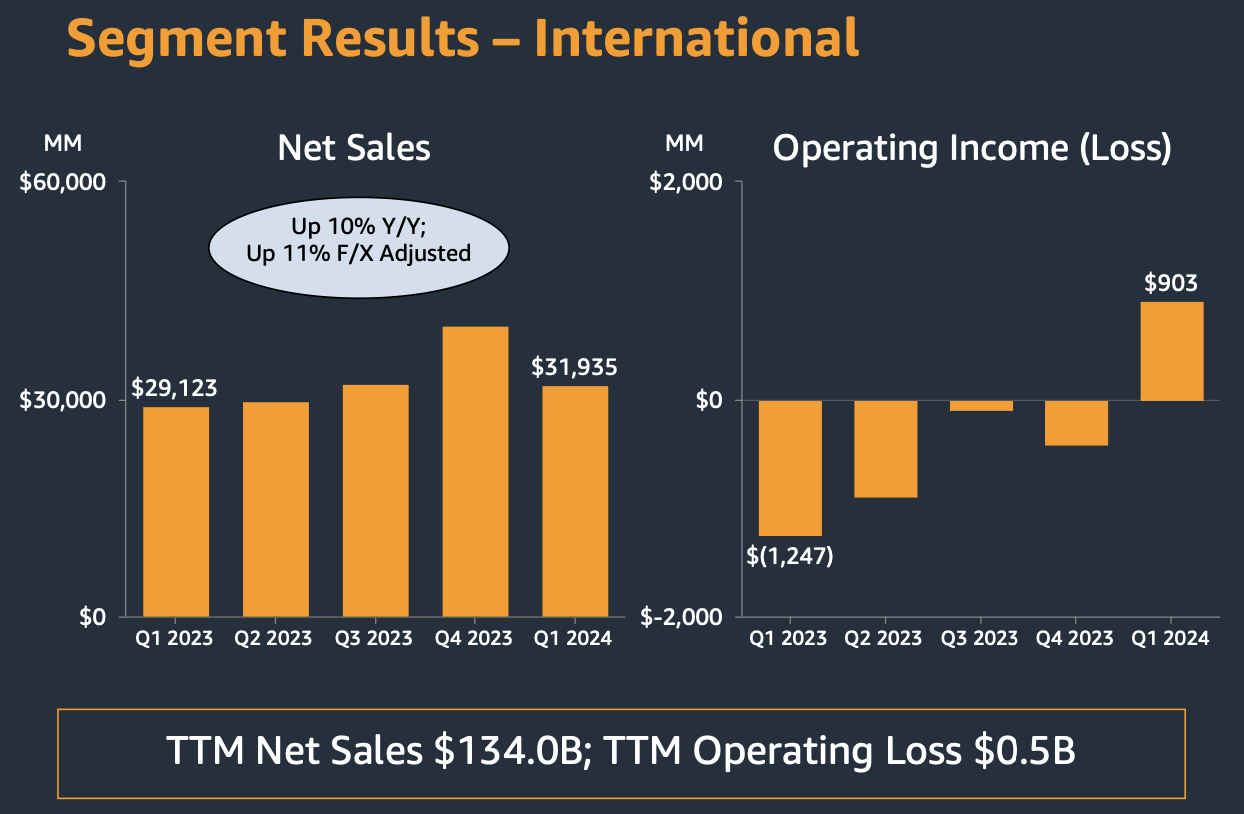

AMZN saw its international segment grow slower at just 10% YoY, but deliver similarly strong profitability improvement, with operating income swinging from a $1.2 billion loss to a $903 million profit. Does anybody still remember when Wall Street seemed skeptical of the e-commerce segment’s long term profitability during the 2022 tech crash?

2024 Q1 Presentation

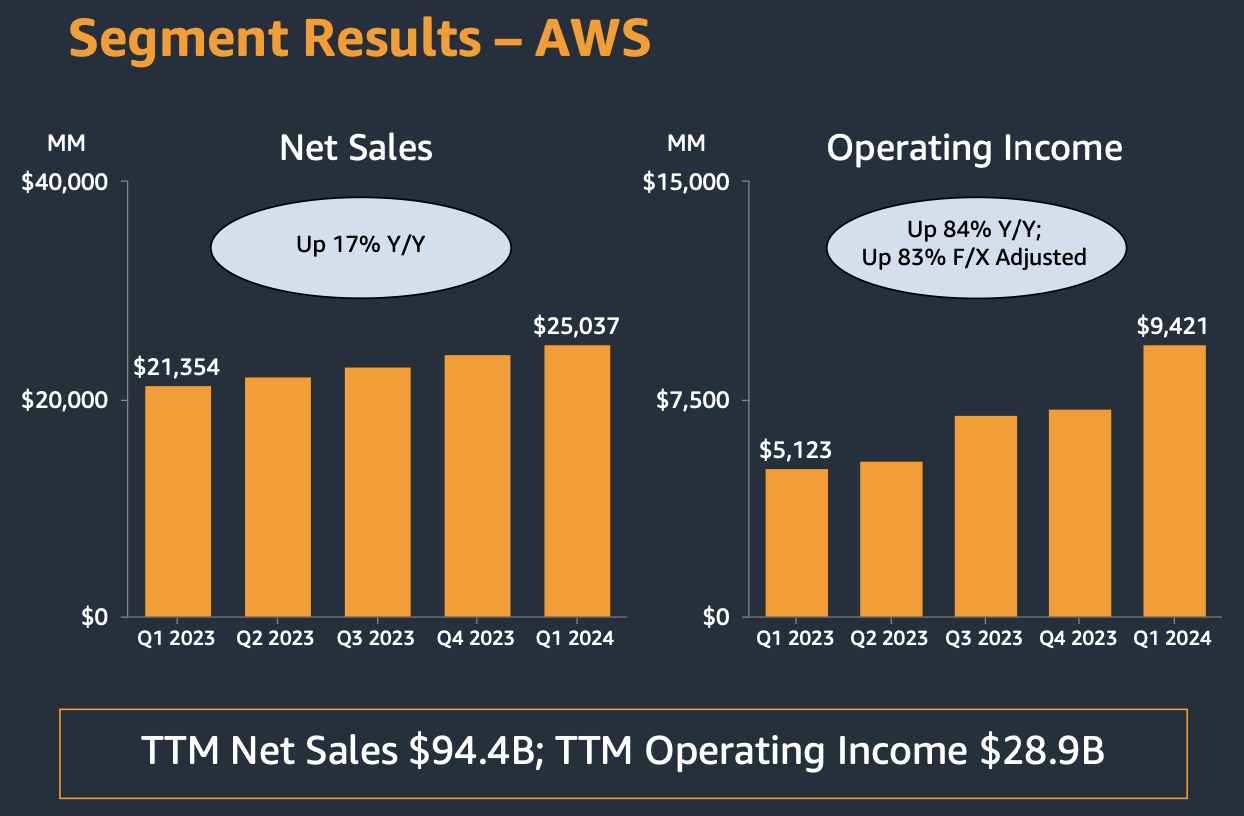

It is interesting that whereas Wall Street seemed bearish on the e-commerce segment and exclusively focused on the cloud computing segment AWS during the 2022 tech crash, the opposite is more true today. Wall Street has seemed concerned that AWS (and Google for that matter) may be falling behind Microsoft Azure (MSFT) amidst the rise of generative AI. Yet AWS continues to see positive momentum, with revenue growth accelerating from 13.2% in the fourth quarter to 17% YoY (16% excluding the leap year benefit). AMZN also saw operating margins rise nearly 1,400 bps to 37.6%.

2024 Q1 Presentation

AMZN ended the quarter with $85 billion of cash versus $57.6 billion of debt, representing a bulletproof net cash balance sheet.

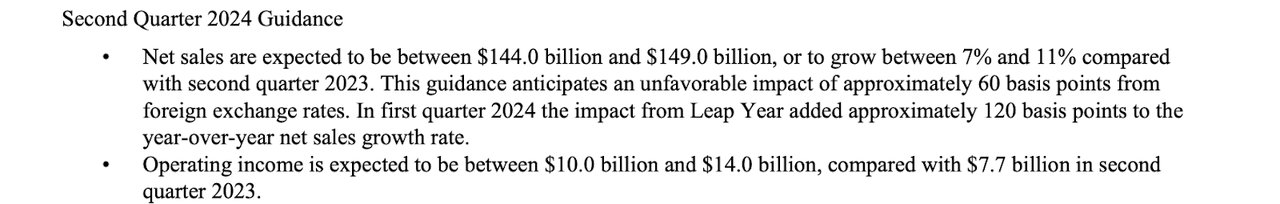

Looking ahead, management has guided for the second quarter to see up to 11% revenue growth to $149 billion (versus consensus of $148.61 billion) and up to $14 billion in operating income. As has been the case in recent quarters, I expect the company to mainly post a significant beat on the profitability front.

2024 Q1 Press Release

On the conference call, management appeared upbeat about an acceleration in their AWS growth prospects. Management noted that customers have “largely completed the lion’s share of their cost optimization and turned their attention to newer initiatives.” Management described the current environment as returning to the pre-pandemic trends of companies seeking to modernize their infrastructure by moving to the public cloud. Management again noted that “85% or more of the global IT spend remains on-premises,” indicative of the long growth runway of the business.

I should not omit management’s interesting commentary that whereas in the past there was sometimes a “pendulum shift between profitability and investment,” they believe that they are “at the stage now where we’re doing both at the same time continually.” As a long term investor in AMZN stock, it seems like there have been periods in which Wall Street was either critical of the lack of profitability (coupled by fast top-line growth), or the lack of top-line growth (coupled by expanding profit margins). Will Wall Street be ready as AMZN is set to offer the best of both worlds?

Regarding capital allocation, AMZN did not follow in the footsteps of Alphabet (GOOGL) and Meta Platforms (META) in authorizing a dividend, and management noted that they “don’t have anything to share” with regards to either dividends or buybacks. I liked management’s commentary that their priority for cash is to pay down debt taken on during their prior periods of negative free cash flow generation. Amidst a period in which many mega-cap tech titans are trading at rich valuations, it is refreshing to see a management team focused on reducing leverage instead of mindlessly buying back stock.

Is AMZN Stock A Buy, Sell, or Hold?

Is AMZN a generative AI play? I’m inclined to say it is given that AWS can be argued to be a picks and shovels enabler of the growth story, but it isn’t clear if investor consensus agrees with me. Perhaps that might soon change, with headlines that AMZN is considering upgrading Alexa to have generative AI for a monthly fee. I’d never recommend purchasing a stock solely due to generative AI hype, but perhaps investor interest in a generative AI boosted Alexa might get them to better appreciate the wonderful business in AWS.

It is well known that Chinese e-commerce merchants have been aggressively growing in the United States, especially from the likes of Pinduoduo (PDD). AMZN appears to be taking steps to address this rising competition, with plans to offer discounted shopping from Chinese merchants on their platform. AMZN’s e-commerce business has the enviable moat of logistics infrastructure, which is difficult to replicate due to the sheer amount of capital needed to replicate it. This advantage allows AMZN to deliver fast shipping at a far lower cost than competitors, as well as bringing on new merchants seamlessly as discussed above.

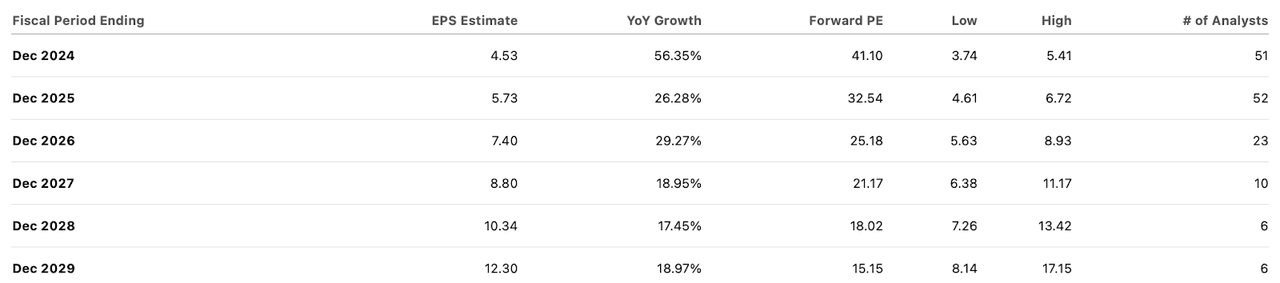

It is notable that even as AMZN crosses the $2 trillion milestone, the stock still looks at least reasonably valued at around 41x this year’s earnings.

Seeking Alpha

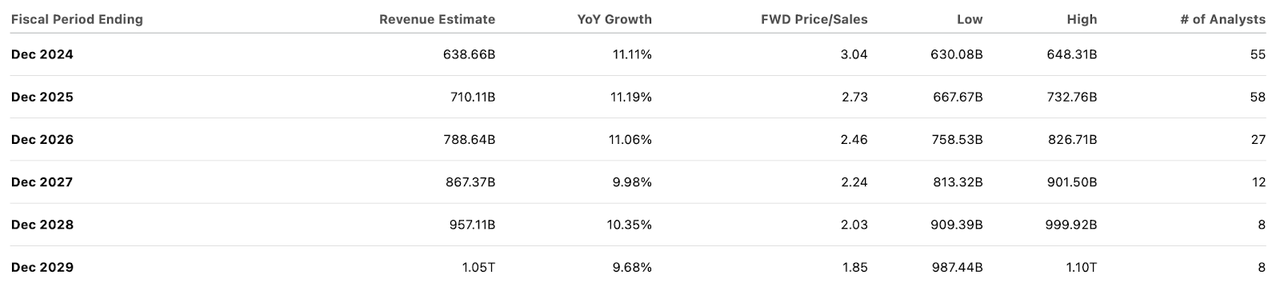

Consensus estimates call for the company to sustain double-digit top-line growth for many years to come.

Seeking Alpha

At a cursory level, it is already easy to make a case for undervaluation. The stock trades for 15x 2029 estimates. I note that profitability estimates look reasonable, especially given that the company is already operating at a consolidated double-digit operating margin. Both the company’s e-commerce and AWS businesses represent deeply entrenched platforms with recurring revenues and long term secular growth. It is difficult to see competition emerging in e-commerce and AWS customers tend to grow in usage year-to-year. Based on double-digit top-line growth over the near term, and high single digit growth over the long term, these businesses deserve 30x earnings multiples. This implies at least 15% annual return upside over the next five years.

On a sum of the parts basis, the opportunity is even more apparent. AWS is operating at a $100 billion annual revenue run rate. I can see this segment generating at least 45% net margins over the long term, but will use 40% for modeling purposes. Given the net cash balance sheet and aggressive top-line growth rate, I see this business being worth at least 40x earnings today, representing 16x sales or a $1.6 trillion valuation. I can see the e-commerce operations sustaining a 10% net margin long term, but will use 7% for modeling purposes. Based on $550 billion in forward revenues and a 30x earnings multiple, I see this segment being worth $1.2 trillion. Adding these together, we arrive at a $2.8 trillion valuation, or $264 per share stock price.

AMZN Stock Risks

It is possible that AWS will be disrupted by Azure or other cloud operators, perhaps due to generative AI capabilities. In this scenario, AWS might see elevated churn and pressure on growth rates, similar to what is seen at smaller operator DigitalOcean (DOCN). It is possible that the e-commerce infrastructure is unable to prevent competition from emerging – perhaps fragmented logistics infrastructure is eventually able to compete effectively. In these scenarios, I would expect AMZN to both face pressured growth rates as well as pressure to its valuation multiples. In particular, we have not yet seen evidence of pressure from PDD in the e-commerce segment – perhaps we might see some pressures to growth in the coming quarters.

AMZN Stock Conclusion

AMZN has been a great winner over the long term, but its businesses are of such high quality that I still see material upside ahead driven by both ongoing growth as well as multiple expansion. The company is shaping up to be a long term beneficiary of generative AI, even if it tends to be ignored in such discussions. I like the company’s net cash balance sheet and commitment to driving profitable growth, allowing investors to benefit from both secular growth and cash generation. I reiterate my strong buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!