Summary:

- PENN Entertainment, Inc. has struggled with earnings and digital results, particularly with their Barstool Sports acquisition.

- The company’s foray into digital gaming has been costly, leading to potential interest from Boyd Gaming Corporation for an acquisition.

- A potential merger between PENN Entertainment and Boyd Gaming could create a powerhouse with significant cost-cutting and revenue potential.

Moussa81

Above: Sports betting has a low barrier of entry, slim margins but strong growth and takes the staying power of multi-millions of dollars to buy market share.

Premise:

My understanding of the long-term prospects of the PENN Entertainment, Inc. (NASDAQ:PENN) shares was enlightened just after the company founders (the Carlino Racino interests of Philadelphia) had decided to split the businesses into an operating company which became Penn National Gaming (Now, PENN Entertainment) in 2012. The realty went to a REIT, Gaming & Leisure Properties (GLPI), which would own all of its operating company’s real estate assets, including its 43 properties. I spoke to friends and ex-colleagues who had migrated to Penn and managed departments in some of their key properties.

Their overall take was positive. It emanated from the general feeling that the new entity would be run by ground-rooting casino people, not belt and suspenders operatives from Wall Street. Most were subsequently encouraged when Penn president Jay Snowden was appointed CEO in 2020.

Above: Penn has disappointed with earnings misses and mostly digital results.

Their enthusiasm sprang from Snowden’s background in gaming, which began at a front desk job at Harrah’s and eventually landed him as President of Caesars before he took the CEO seat at Penn. In all senses, Penn had become a mix of racinos owned from day one, and those acquired from acquiring Pinnacle in 2018.

The diversity of geography, customer preferences and service lines had to be hammered into a uniform set of expectations to keep members happy under the company’s growing loyalty members. Today it has 26m members and is one of the most reliable marketing programs in its tool chest. Moreover, it has been one of the key drivers of building the 18m members of its online sports and iGaming businesses.

The Penn geography, like most of those inside national regional casino operators, covers every part of the nation and must deal with extremes of climate, both expected and surprising. Mother nature rules the roost here. So when there is a weather backlash, it hits all competitors hard. That’s what and how it did to last winter’s Penn properties revenues, blitzed by inclement weather.

Having spoken with many Penn operatives through the winter, I was confident EBITDA at the end of it all would recover with an earnings meet. Barstool Sports was another question. From the get-go I saw flaws in the deal, but I still concluded that with its 26m member base added to Barstool’s 52m stoolies, Penn could build a shot at a nice single digit share of the soaring online gaming market.

My online misgivings noted then, I shared with SA readers but kept my outlook bullish re: retail. The one thing 30 years in the business had taught me was that sports fans were not all automatic gamblers on sports. Yes, they were passionate. Yes, they had their fandom. But no, these were not intense, weekly bettors on games. You saw them at the Superbowl, and the Final Four and other key events, but that was it.

The regular day in and day out sports bettor was a distinct species from a sports fan. FanDuel (FLUT, PDYPY) and DraftKings (DKNG) came into the fray with a strong wind at their backs comprised of their fantasy databases, which did have a great affinity to live money betting. The premise of the Barstool buy was on the surface smart. Why spend millions looking for sports bettors (besides the small number who populated your own live books) when with one fell swoop you could buy Barstool? Overnight you got 52m sports maniacs to market.

Worse case, you could say 5% out of that base and start live with 2.5m regular bettors? Right? Wrong. The flaw is in the “regular.” Barstool sports was one reason Penn stock ran to a crazy $86 in 2020. It was part of a tidal wave of betting fever in the online wagering sector. At best, during the most active quarters blowing the biggest marketing dollars at the sports betting player, Barstool culled a 5% market share. In 2021. Everyone was throwing tens of millions at sports betting customer deals, the entire sector’s revenue was $4.29b.

google

At 5% that delivered ~$224 in revenue to Barstool, sinking it very deep into red ink. But I was encouraged when I noticed that Penn had taken the cutlass to its sports betting spend and began to slash away. It turned out it was too little and too late. I took another hard look.

What changed then? What I expected but didn’t see forming in Penn’s avid pursuit of making digital a key vertical in the corporate future

Penn shares had been tooling along as one of the better US regional operators at around $25 a share, until late 2020 it took its first position in Barstool Sports. It had the huge TV sports online network of shows with anywhere from 52, to 60m regular viewers. The demo for sports betting appeared made in heaven. It was not. Nor was the Barstoolie nation. And now, no yet apparent ESPN.

Between 2020 and 2023, Penn shelled out a total of $551m for the site, ending in a total loss when it was sold back to Portnoy for a token $1.(The sale was prompted by owner Portnoy’s continuing upset with gaming regulations and scrutiny.)

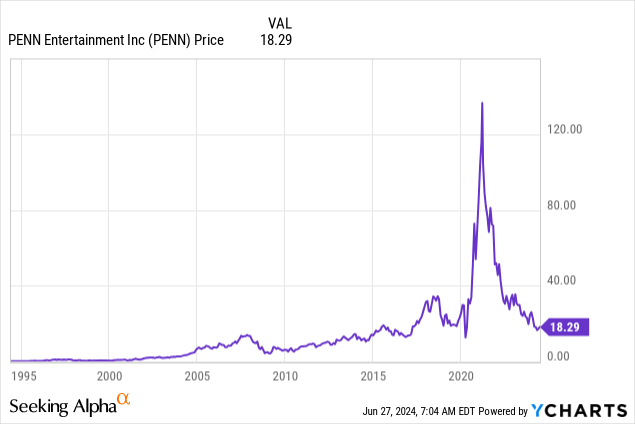

Penn may have lost over $1b on the entire exercise. It is to be noted that Mr. Market’s belief in the original Penn deal for Barstool had surged, putting the stock at $86 in chaotic 2020. But the trading before and after had been steady. In 2019 year’s end at $25: Watchers of the stock, including myself, had put far too much faith in digital.

2021: $51.85

2022: $29. 70

2023: $26.02

So what we saw in this history is Mr. Market going wild over online gaming in general, blind to the flaws many in the business saw. The same over valuing of where the interactive business was going was clearly still in Snowden’s mind. Just after exiting the Barstool association at a huge loss, he turned to Disney (DIS). The result of those talks was a $1.5b deal to convert Barstool Sportsbook into ESPNBet.

The price: Penn contracted to plunge another $150b over ten years to rebrand the service to ESPNBet. Once more, I shared my view of the flaws of that deal to SA readers. And therein my overall bullish take on the management decisions at Penn disappeared.

I thought that Penn could continue to produce gains in their baseline retail business and wave goodbye to their overblown interactive pretensions. This was not to be the case, as performance of their retail business as late as 1Q24 indicated that old man winter had taken its toll on Penn revenues in some of its regions. But retail was still a stalwart.

Early results of ESPNBet were bullish based on the same misreading of the space that had infected Barstool. Since its launch and ESPN’s barrage of mega forecasts thus far in 2024, it has given PENN spokespeople not much more than much hamada hamada hamada in response to investors and analysts’ response to the poor showing.

espn

Above: The keys to the ESPN deal hid many of the flaws.

Example, in the first four months of 2024, total (all states) Sports Betting win has reached $4.79b. ESPNBET share of the sports betting market has averaged for the year around 3% including high and low hold months. Back last august when launched simultaneously in 13 states it racked up a reasonable 8% share including all those first time triers. Since then, the handle has dropped. 645,000 active users are gone. At best to date, ESPNbet has a 3.5% share of the market. There’s lots of work ahead. A new Disney executive takes over next month.

The core retail business of Penn, ups and downs, weather-related or not, remains strong. Its 43 properties do well. The company is in the process of testing a Cashless/ Contactless system of attending to all customer interactions by use of online systems throughout the stay. The bottom line here tells us that Penn is committed to transforming its business to an entirely digital system.

After losing probably close to $1b or more on its thus-far failed efforts to build a digital presence as a major player in sports and iGaming, Penn continues to pursue that business. My friends and associates inside the company tell me they believe the chase of digital has become a top corporate priority, One executive told me, “It is part of the future of gaming okay. But not its entire future. We have a great retail business and it needs constant attention. I think we’ve gone off track here a bit. Our ESPN deal will never overtake the big guys.”

A Boyd Gaming (BYD) deal is a powerhouse despite many obstacles – if the parties are serious

It appears to me that PENN Entertainment, Inc.’s plunge into interactive operations and marketing clearly has its flaws. As a result of those moves, it is ripe for a deal. That is why I believe in the minds of relatable possible acquirers, the news has trickled out this week that Boyd Gaming has peaked an interest in buying Penn. What seems to me an automatic win for both companies has thus far been greeted by “not so fast” analysts with a different narrative.

I agree with some analysts who see the series of real obstacles ahead that may stand guard against the conclusion of a deal. They are all clear, from the realty owners GLPI, to Penn’s deal with ESPN. Add the usual gauntlet on both sides of the transaction pontificating over every issue: premium, assignment of assets, debt to be paid or included in the total deal and lastly the always convoluted mess buying a family type entity that is public can make. (Your attention is drawn to Paramount (PARA) and Ms. Shari Redstone’s mountain of no-no’s after months.)

I may respectfully take the opposite view. Not only do I agree a long list of potholes stands on the road before such a deal can be done, but I also think it makes wonderful sense for both companies. And my experience tells me that when a deal crosses the barriers of common sense, that reaches the level“as any fool kin plainly see” (Note the old Li’l Abner comic). And this is just that kind of deal.

Here’s an endgame scenario for investors:

1, The newco could have 71 casinos–more than anyone. Management can either keep all or sell off any that does not meet its criteria for profitability but could make sense to another buyer.

2. BYD management are proven among the smartest asset allocators in the industry. Under their supervision, it is unlikely that anyone is throwing more dollars into a money pit that is still the basis of digital gaming.

3. BYD’s interactive footprint is relatively small. Adding an edited version of ESPNBet to its own verticals builds scale immediately. Or conversely, remain as simply an ESPNBet advertiser, or sell it all to Disney.

4. When merging two companies essentially in the same business, the potential of cost-cutting is huge.

5. Consolidate the costs and maturities of debt to bring annual interest costs down.

There is much more. Yes, agreed, there are many roadblocks to consummating such a deal, but in the end, can anyone deny you begin with combined inherited long-term debt at $8.1b and probably hammer out a refi deal that saves a ton?

Combined revenue, 2023: $11.7b

By comparison, 2023: $10.3b

Anywhere between $27 and $30 a share can take it if the negotiators really want the deal and are willing to trudge past the obstacles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We call hold only as long as BYD possible deal lingers. If it dies, we call sell.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.