Summary:

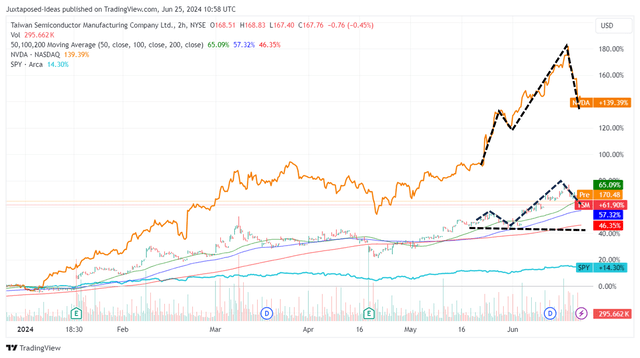

- NVDA’s recent beat and raise performance has further buoyed multiple generative AI stocks, TSM included, with the latter running away from its 50/ 100/ 200 day averages.

- This is further aided by the foundry’s projected price hikes from 2025 onwards, with the fully booked 3nm capacity underscoring its robust intermediate term prospects.

- Even so, with a capacity glut potentially occurring from 2025/ 2026 onwards as multiple foundries ramp up productions, we urge readers to temper their intermediate-term expectations.

- TSM has already charted a potential head and shoulder pattern, with more uncertainty likely over the next few weeks.

- While we are reiterating our Buy rating, investors may want to wait the correction out. Patience is more prudent here.

takasuu/iStock via Getty Images

We previously covered Taiwan Semiconductor Manufacturing Company Limited (NYSE:NYSE:TSM) in April 2024 with a Buy, reviewing how Intel’s (INTC) foundry segment has performed against the former’s market dominance in FY2023.

Our deep dive then had further bolstered our confidence in TSM’s forward execution and profitability, significantly aided by the healthy balance sheet.

While the global foundry market remained big enough to accommodate multiple players, we believed that TSM might very well retain its title as the market leader for many years to come, attributed to the trifecta of node advancement, volume manufacturing, and profitability.

Since then, TSM has further rallied by +17.7% compared to the wider market at +6.3%, with much of the tailwinds attributed to Nvidia’s (NVDA) recent beat and raise FQ1’25 performance and promising market trends surrounding generative AI.

This is on top of the improved market sentiments from the foundry’s recent price hikes, fully booked position through 2026, and expanded manufacturing capacity through the end of the decade.

Even so, while we are reiterating our Buy rating, it comes with the caveat the investors wait for a moderate retracement for an improved margin of safety, especially given the market-wide correction observed since the recent peak.

TSM’s Price Hikes Imply Its Highly Sticky Offerings, With Minimal Market Competition

TSM has previously hinted at the possibility of hiking prices for NVDA to better represent the former’s contribution during the ongoing generative AI boom, with the higher ASPs likely to be further passed on to customers.

It appears that the price hike is finally here, with TrendForce reporting that the foundry aims to increase the prices for 3nm chips by over +5% and advanced packaging/ CoWoS by up to +20% in 2025, with it also occurring across the board to other clients, including Apple (AAPL) and Advanced Micro Devices (AMD).

This is unsurprising indeed, due to the deterioration in TSM’s gross margins to 53.1% by FQ1’24 (+0.1 points QoQ/ -3.2 YoY/ -9.1 from the peak of 62.2% reported in FQ4’22/ +7.1 from FY2019 levels of 46%), as NVDA’s rose inversely to 78.9% (+2.2 points QoQ/ +12.1 YoY/ +16.4 from FY2020 levels of 62.5%).

Most notably, prices are expected to be hiked across the 3nm and 5nm family, with these two segments comprising 9% (-6 points QoQ/ NA YoY) and 37% (+2 points QoQ/ +6 YoY) of its FQ1’24 revenues, respectively.

Combined with the supposedly fully booked 3nm capacity through 2026, it is unsurprising that TSM has felt comfortable to moderately raise prices, with the aim of “delivering a long-term gross margin of 53%.”

This is particularly attributed to the “rising electricity, material, chemical, gases, and other variable costs” in Taiwan from April 2024 onwards, with these expected to impact its gross margin by up to -70 basis points from FQ2’24 onwards.

This also builds upon the -200 basis point impact from the “conversion of its 5-nanometer tools to support 3-nanometer demand,” with H2’24 likely to see a further deterioration in the foundry’s gross margins to 50%, if not worse.

At the same time, readers must also not forget that TSM is already constructing/ ramping up multiple new foundries in Japan, the US, and Europe, with the prices likely to be further hiked given the “higher cost of overseas fab” with customers incurring “a premium for chip production in specific regions” (ie: the US and Germany).

As a result, we believe that TSM’s price hikes are inherently good for the business, naturally flowing into its bottom-lines, to be discussed below.

Raised Consensus Estimates Appear Warranted, Less So The Premium FWD P/E Valuations

The Consensus Forward Estimates

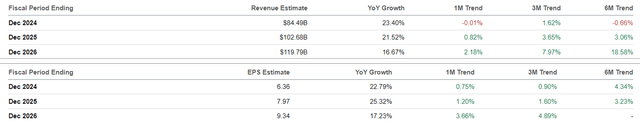

As a direct result of the raised prices and renewed super cycle of cloud computing, it is unsurprising that the consensus have raised their forward estimates, with TSM expected to generate an improved top/ bottom-line growth at a CAGR of +21.5%/ +21.7% through FY2026.

This is compared to the original estimates of +16.3%/ +18% and historical growth at +12.5%/ +14.6% between FY2016 and FY2023, respectively.

TSM Valuations

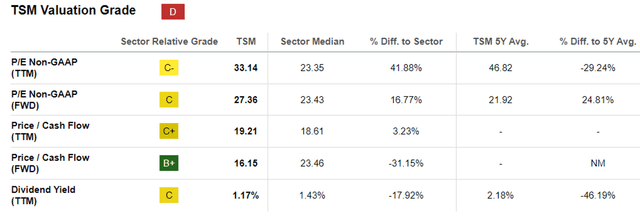

Perhaps this is why the market has also awarded TSM with the premium FWD P/E valuations of 27.36x, compared to the previous article at 22.11x, its 5Y average of 21.92x, and the sector median of 23.43x.

While the raised estimates do warrant the higher P/E valuations, we are not certain how sustainable these numbers may be, since we have observed increased AI chip redundancy as lead times moderate, potentially triggering a near-term pullback.

At the same time, readers must remember that TSM is slated to report a drastically expanded manufacturing capacity moving forward, with the first Japan plant expected to hit volume production from Q4’24 onwards and the second plant by the end 2027.

This is on top of the three plants in Arizona, with staggered volume production by H1’25, 2028, and the end of the decade, and Europe, with production from 2027 onwards.

Readers must also note that the same capacity expansions have been reported by INTC and Samsung (OTCPK:SSNLF), with it likely to bring forth capacity glut with (potential) under utilization if demand does not grow as expected.

This is not surprising as well, since we may see consumers placing orders as needed instead of doing so in advance, triggering reduced visibility into TSM’s intermediate term top/ bottom lines.

This is given the shorter lead time – or, as highlighted by Barbara Jorgensen here, a relatively painful bullwhip effect – “with orders likely pulling back as new capacity comes online.”

While there is no doubt about TSM’s expertise in advanced foundry technologies, the capacity glut may bring forth decelerating demand and subsequently, impacted prices and top/ bottom-lines.

As a result, investors may want to temper their intermediate-term expectations, especially since it is uncertain if the high double-digit growth projections are sustainable due to the inherent cyclical nature of the semiconductor industry.

So, Is TSM Stock A Buy, Sell, or Hold?

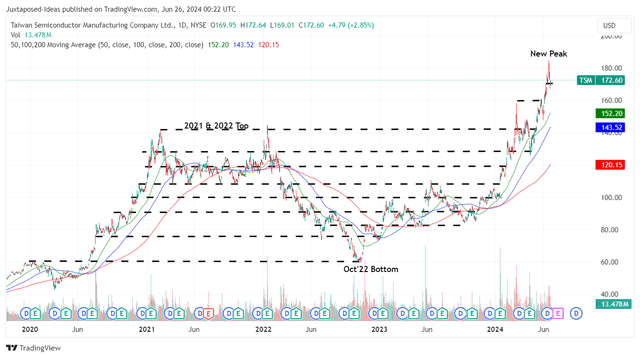

TSM 4Y Stock Price

For now, TSM has rallied to a new peak while running away from its 50/ 100/ 200 day moving averages, and seemingly charting the $142s as its next support level, if not $159s.

For context, we had offered a fair value estimate of $114 in our last article, based on the FY2023 adj EPS of $5.18 and the FWD P/E valuations of 22.11x. This is on top of our long-term price target of $199, based on the consensus FY2026 adj EPS estimates of $9.02.

As discussed above, with the generative AI sentiments hitting fever pitch, we prefer to maintain our previous calculation using the same P/E valuation of ~22x, since it is also nearly inline to the 5Y P/E mean of 21.92x while offering an improved margin of safety.

Even then, it is apparent that the same optimism has also been embedded in TSM’s stock prices, with it trading at a notable premium of +45.2% to our estimated fair value of $115.50, based on the LTM adj EPS of $5.25 and the P/E valuations of 22x.

On the other hand, based on the raised consensus FY2026 adj EPS estimates of $9.34 (+3.5% from previous estimates), there remains an excellent upside potential of +22.4% to our long-term price target of $205.40.

While minimal, the foundry also offers a decent forward dividend yield of 1.47%, with it offering interested investors with the chance to regularly add more shares on a quarterly basis.

As a result of the attractive risk/ reward ratio, we are iterating our Buy rating for the TSM stock, though with an important caveat.

TSM & NVDA YTD Stock Price

Investors are encouraged to wait for a moderate pullback, since TSM is currently trading at a premium to our fair value estimates while appearing to chart a new head and shoulder pattern, a trend similarly observed for NVDA as market analysts expect further near-term pullback.

Based on TSM’s recent pattern, interested investors may consider observing a little longer and adding after a moderate pullback to its previous trading ranges of between $145s and $160s, depending on their dollar cost averages and portfolio allocation.

Patience may be more prudent here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, INTC, AAPL, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.