Summary:

- American Airlines emerged from the pandemic with optimism, but continues to underperform in revenue generation compared to its competitors.

- Labor issues, including flight attendant contract negotiations, are impacting American Airlines’ service levels and financial performance.

- Despite efforts to reduce costs and improve service, American Airlines’ stock has declined significantly and faces challenges that make a turnaround unlikely.

American Airlines Boeing 777-323(ER) taking off from Kingsford Smith Airport Sydney Australia mccawleyphoto/iStock Editorial via Getty Images

American Airlines Group Inc. (NASDAQ:AAL) came out of the pandemic with optimism that the industry reset that impacted all airlines would give it a chance to change the trajectory of its financial underperformance to the industry that included much of the decade before the COVID crisis. Even though American Airlines (under AMR Corporation) was restructured under Chapter 11 of the U.S. bankruptcy code from 2011 to 2013, ending in its emergence as AAL and its merger with US Airways, AAL’s revenue generation remained below its peers and its costs were high, in part due to deals which were made with labor to secure their backing for the US Airways merger over AMR’s standalone restructuring plan. Although American and US Airways stated that one of the primary objectives of the merger was to be able to compete with Delta Air Lines, Inc. (DAL), which initiated the megamerger cycle via its merger with Northwest, United Airlines Holdings, Inc. (UAL), which merged with Continental, and Southwest Airlines Co. (LUV), which acquired AirTran Airways, American struggled to compete in the major competitive coastal markets including New York City as well as international markets in the late 2010s, resulting in its reduced attractiveness to high-value business travelers.

With the largest workforce and a goal of keeping airline employees on the job and able to serve the public when demand returned, American received the most federal grant money during the pandemic as its unions and executives were influential in the process of obtaining government help for the industry. American and Southwest both aggressively added capacity in the early stages of the pandemic whenever it appeared there might be the potential for demand recovery.

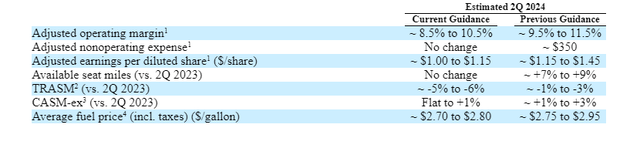

American revised its guidance on May 28 with a further deterioration of revenue and operating margin with slightly improved non-fuel and fuel costs.

AAL guidance 2Q2024 28May (aa.com)

Revenue Underperformance

American’s revenue performance relative to Delta and United can be seen from the following:

Total Revenue per Available Seat Mile (% change)

Full year 2023 4Q2023 1Q2024

American +1 -6.4 -4.9

Delta +3 -3 +1

United +1.7 – 4.2 +0.6

DAL has long been known to generate a revenue premium to the industry which is a large driver of its higher profits standing in contrast to AAL’s underperformance including to UAL. Deterioration of the revenue environment in the latter part of 2023 and into the winter of 2023-24 (second quarter 2023 and first quarter 2024) can be seen in the data above. Since international travel typically contributes profits in the middle two quarters but less so in at the beginning and end of the year, AAL’s underperformance can be somewhat understood but it still underperformed for 2023 as a whole. Other data shows that they are underperforming in revenue generation even in the domestic market.

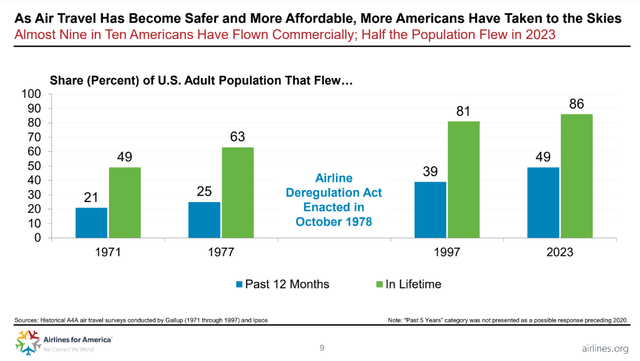

Travel Affordability (Airlines.org)

As post-pandemic demand returned first in the domestic sector, American showed promise of being able to overcome its financial woes of the previous decade. However, in the following year, as international demand began to return, American increasingly was left behind by Delta and United, both of which had larger international route systems pre-pandemic and were committed to restarting their international operations, although the two employed different strategies to meet the returning international demand. American, like Delta, retired older and less efficient international aircraft during the pandemic but DAL had to regrow its international fleet in order to rebuild its network. United, in contrast, did not retire international or domestic aircraft during the pandemic, stating that it would be ready to grow when demand returned. Indeed, in the third quarter of 2022, United generated significantly higher margins than American and Delta because it was able to meet international demand which most other global airlines were not prepared to serve but that advantage lasted only for one quarter.

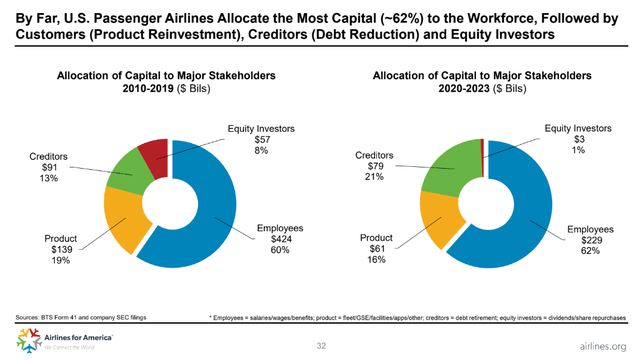

Allocation of capital by category (Airlines.org)

Delta had an extensive order book with Airbus SE (OTCPK:EADSY) for widebody long-haul aircraft while American had a relatively small The Boeing Company (BA) 787 order book; United added to its 787 order book and now is the largest customer for that aircraft type, expecting to be able to aggressively grow. American recognized during the pandemic that it could not successfully compete in most of the transpacific markets it previously flew and did not attempt to replace the transpacific capacity it had pre-COVID. Demand across the Atlantic post-COVID has been strong but American’s European profitability has long been centered in London where it operates a joint venture hub with International Consolidated Airlines Group S.A. (OTCPK:ICAGY). Many of AAL’s continental European destinations have long underperformed DAL and UAL in terms of revenue and the company similarly has chosen not to grow its fleet to chase transatlantic demand. U.S. DOT data shows that American lost money flying both the Atlantic and Pacific in 2023 with its small international profits coming entirely from its Latin America route system centered around Miami where it has a near monopoly position among U.S. carriers to Latin America. While AAL recognized it was going to be much smaller to Europe and across the Pacific, it missed out on the international revenue growth that has buoyed the results of Delta and United.

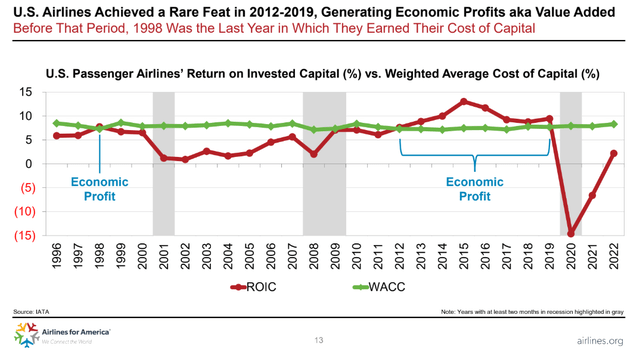

U.S. Airline ROIC (Airlines.org)

American’s revenue issues have also involved domestic markets. AAL’s domestic passenger revenue per seat mile was down 2.8% in the first quarter of 2024, in line with its transatlantic system; in contrast, DAL’s domestic RASM for the quarter was up 3%. Multiple U.S. airlines saw unit revenue declines in Latin America due to large increases in capacity while the Pacific was particularly troubling for American due to heavy competitive capacity increases even though AAL’s Pacific capacity was down.

As I have highlighted in previous articles including most recently in March 2024, American has been focused on reducing its sales costs. Growing evidence indicates those efforts were not successful and alienated some of American’s top customers including corporate and other high-value customers. American’s Chief Commercial Officer left the airline in June after a 20-year career at the company. He was an architect of AAL’s strategies to reduce the airline’s distribution costs which included incentivizing booking travel through the most efficient technologies but also withholding benefits to travelers that are booked through more traditional mechanisms. In addition, the company reversed several of the distribution policies that were implemented under Mr. Raja.

AAL’s strategies appear to have raised concerns with some of American’s closest business partners as well. British Airways made airline news by deciding to implement a codeshare agreement with Alaska Air Group, Inc. (ALK) and JetBlue Airways Corporation (JBLU) even though the U.K. airline has a revenue sharing joint venture with American. Alaska, with its largest hub in Seattle, is part of the same oneworld alliance as American and British Airways but is not part of the transatlantic joint venture. New York City-based JetBlue is not in the oneworld alliance or the joint venture. British Airways’ actions are likely because it is either seeing or fears seeing an impact on its corporate sales efforts in the U.S.

Labor and Service Issues

In addition to its revenue and strategic challenges, American is facing a deteriorating labor situation with its flight attendants which are the only workgroup at the Ft. Worth-based airline that has not seen a new contract after COVID. Airline labor contracts are governed by the Railway Labor Act and those contracts do not expire but become amendable. Most airline labor contracts became amendable during the COVID era but airlines and unions postponed settlement until stability was reached in the industry. American’s flight attendant union contract became amendable in 2019 which means the company has not given any pay raises in five years. American and its flight attendant union have been in federal mediated negotiations for months including a rare session in Washington, D.C. on Saturday after “last ditch” negotiations last week failed to result in a settlement. The union has set up a strike center. The union does not have the resources to pay strike pay. The union released a statement Sunday saying that the company and union remain in negotiations which means the National Mediation Board cannot declare an impasse which would be necessary for the union to strike.

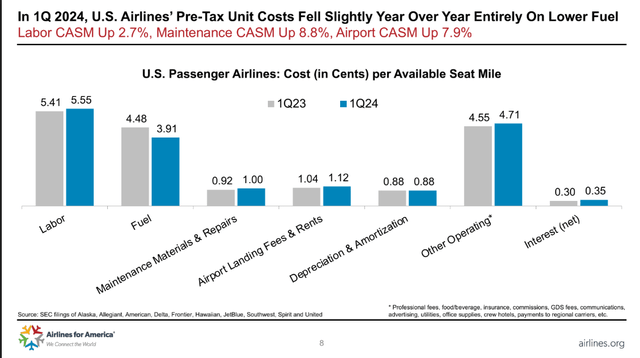

Airline Industry Unit Costs by Category (Airlines.org)

Delta kicked off the post-covid pay raises among the big 4 airlines with a new contract with its pilots in December 2022 followed by raises in 2023 for its largely non-union workforce, including its flight attendants. Among the big 4, Southwest settled with its flight attendants earlier this year, adding to its costs but helping to unify the workforce at the embattled carrier. Southwest’s contract with its flight attendants provides retroactive pay, something Delta did not offer its non-union employees since they received pay raises early in the post-COVID recovery. American’s flight attendant union asked for pay raises in line with what pilots received. After Southwest’s contract approval with retroactive pay was announced, American’s flight attendant union added retroactive pay to its list of demands although it is not certain if American or United, which also has an outstanding flight attendant contract, would offer retroactive pay to flight attendants. Each of the big 3 airlines spent the better part of $1 billion in retroactive pay for their unionized pilots. American, with the weakest earnings and balance sheet of the big 4, would likely struggle to pay retroactive pay as well as significant pay raises to its 25,000 flight attendants, its largest workgroup.

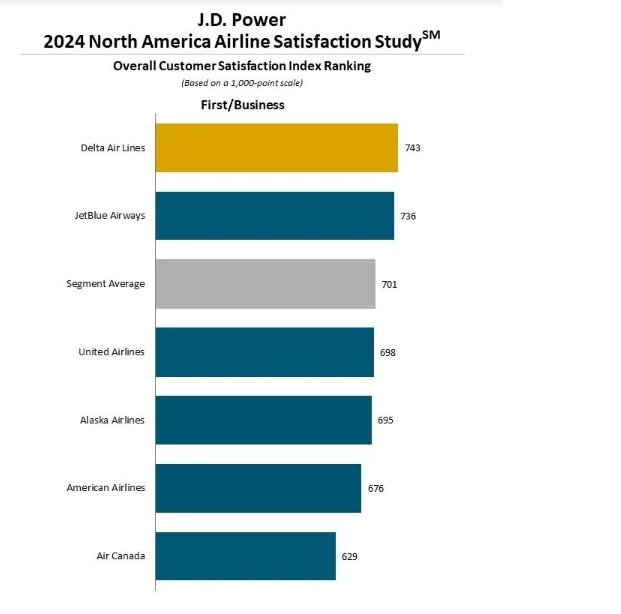

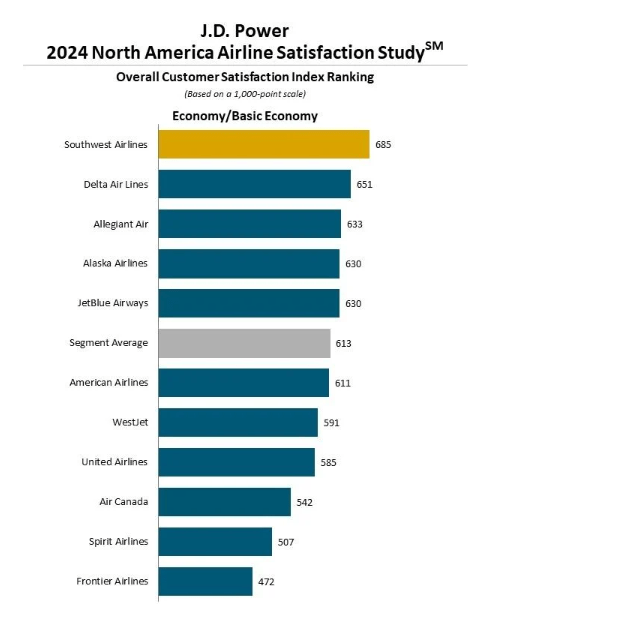

Since flight attendants spend more time with airline passengers than any other workgroup, the prolonged negotiations have had an impact on American’s service levels. Many customers have perceived that American’s cost-cutting efforts have tarnished its customer service while others believe the carrier offers comparable service to Delta and United. While individuals have different perceptions of quality, J.D. Power ranks American lower than both Delta and United for premium cabin service and lower than Southwest and Delta for economy passengers but above United.

JD Power 2024 First/Business Ratings (JD Power) JD Power 2024 economy ratings (JD Power)

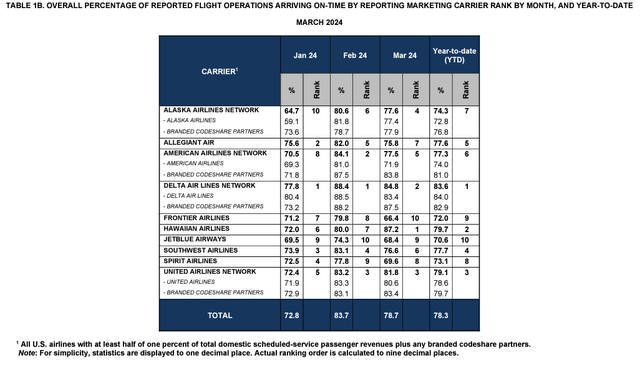

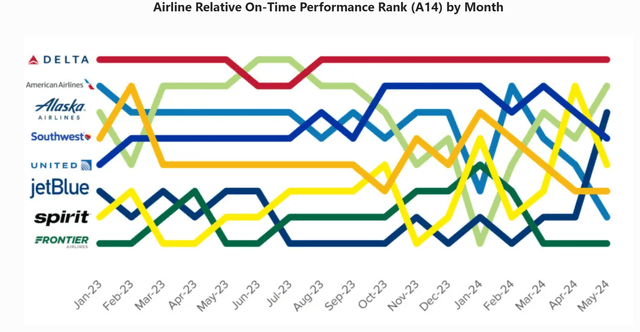

American focused on operational reliability in 2023 and made significant progress. Performance this year has not been as good, compounded by bad weather esp. in May at American’s hub at Dallas/Ft. Worth airport, the nation’s second-largest. There is a lag of at least two months for DOT data to be released but, through March, American ranks as the #6 airline YTD even though AAL’s on-time is just 1% below average and similar to Southwest. Private sector data provides more updated information showing AAL’s decline in on-time relative to other carriers.

US Airline Domestic On-Time YTD March 2024 (U.S. Dept. of Transportation) US Airline On-Time Trends (CrankyFlier.com)

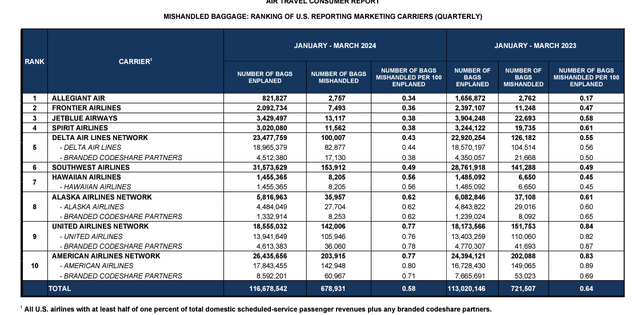

American’s baggage handling has consistently been near the bottom of the industry and DOT data shows that AAL and UAL share the bottom spot. American also holds the lowest spot of the large airlines for involuntary denied boarding. American’s low customer service performance is certain to negatively impact its ability to acquire high-value passengers, esp. when combined with the company’s sales strategies.

US Airline Baggage Mishandling (U.S. Dept. of Transportation)

Slower Growth

Even though American placed an order for over 225 aircraft in March 2024, split between Airbus, Boeing, and Embraer S.A. (ERJ), the company announced in late June that it was suspending pilot hiring for the remainder of 2024, blaming delivery delays from Airbus and Boeing. Other airlines including Southwest have also suspended pilot hiring for 2024. Suspending pilot hiring is particularly significant for American since it has one of the oldest pilot workforces among U.S. airlines and expects approximately 800 pilots/year to reach mandatory retirement age in the next few years.

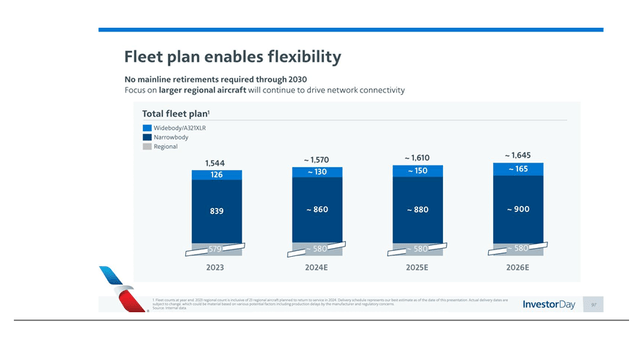

AAL Fleet Plan March 2024 (AA.com)

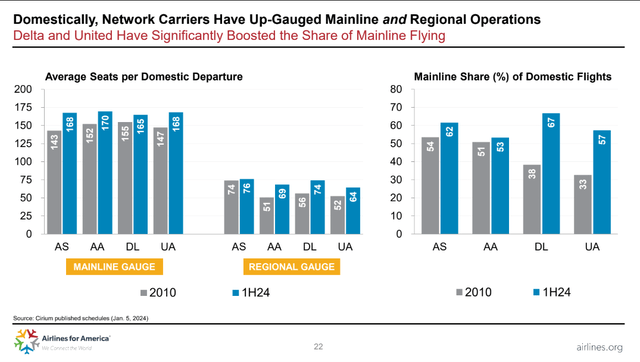

AAL’s fleet plan calls for pushing beyond 1000 mainline aircraft, something United has also released as part of its fleet plan but which Delta may achieve first. American’s fleet plan does see growth in its widebody fleet which, in terms of the number of aircraft, is almost as high as its domestic narrowbody fleet. American is not backing down on its commitment to regional jets, maintaining a fleet of 580 regional jets including those flown by its wholly owned subsidiaries. Part of the recent order includes E175 jets which will replace older and smaller regional jets and ensure American’s regional jet operation remains large well beyond 2030. American currently operates the highest percentage of its network on regional jets which brings its average aircraft size to the lowest size among the big 3 airlines plus ALK that use regional jets.

Average seats per departure (Airlines.org)

While American will likely slow mainline capacity growth, even though it has not been announced, it has not retreated from its commitment to serve small cities with regional jets, esp. from its southern U.S. hubs of Charlotte and DFW. While AAL says that its strategy of connecting small cities to its global network provides a unique advantage, it is not clear that the advantage has translated into increased revenues. As pilot hiring at the large jet airlines slows, the result is increased numbers of pilots at regional airlines so other airlines are also increasing their service to small cities.

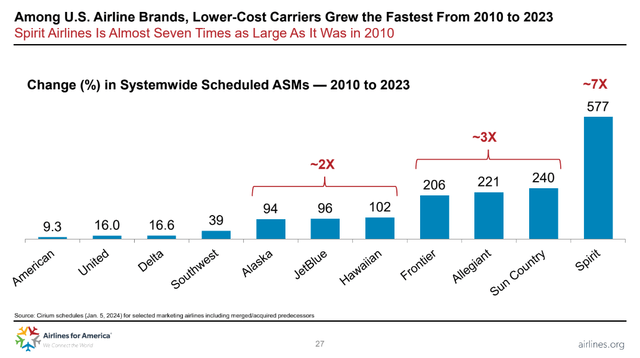

Growth rates by carrier (Airlines.org)

AAL stock has disappointed

American Airlines is one of the big 3 global carriers that have enjoyed a surge in global demand. While economists have frequently suggested that a weakening of demand would come to the airline industry, peers Delta and United have seen strong demand that has defied those macroeconomic expectations; American should be more closely aligned with the performance of global carriers DAL and UAL rather than low cost and ultra-low-cost carriers that have seen a significant deterioration in their finances. Further, AAL’s smaller order book means that it could be spared some of the challenges that other airlines are experiencing due to Boeing’s delivery delays and problems with the Pratt and Whitney, a subsidiary of RTX Corporation (RTX), Geared Turbofan engine which American does not operate. Finally, it is possible that American will reach an agreement with its flight attendant union which will be within what the company can afford without degrading AAL’s financial performance. It is possible, therefore, that AAL could overcome the challenges that I have suggested and continue its upward trend which I suggested earlier this year the company should be able to do.

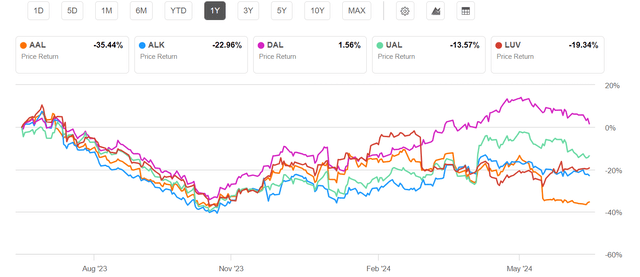

However, many of us, myself included, had hope that American Airlines could regain its position as a leader in the U.S. airline industry, the sheer number of challenges AAL faces on top of the stock price declines make it unlikely that AAL will deliver even industry-comparable stock performance. The best large jet U.S. airline stock has been DAL and it is nearly back to its year-ago level. AAL is 35% lower over the past year, the worst of the big 6 airlines. On a year-to-date basis, DAL and UAL are up 18% while AAL is down the same amount. AAL has been one of the worst performers on Wall Street and has recently been the most shorted S&P 500 industrial stocks; AAL cannot shake investor pessimism and the large-scale issues it continues to face make it unlikely that it will convince investors that it can be turned around.

Big 6 US Airline 1 year Chart (Seeking Alpha)

A review of airline stocks over the last 3 years shows that airline stocks post-COVID have declined in the summer and into the fall, regaining strength in the winter, only to repeat the cycle in the following year. Airline industry stocks for 2024 appear to be following a similar trajectory, likely as investors receive guidance about the best revenue periods of the year only to see doubts about long-term performance shape investor mindsets into the fall.

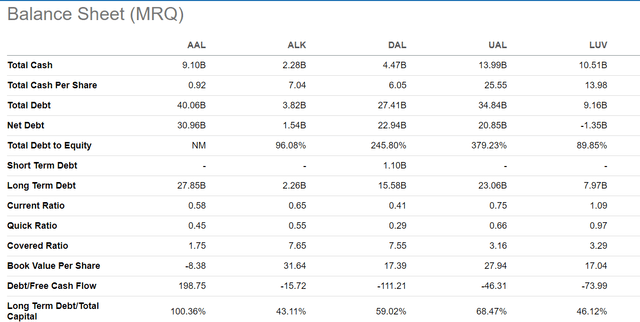

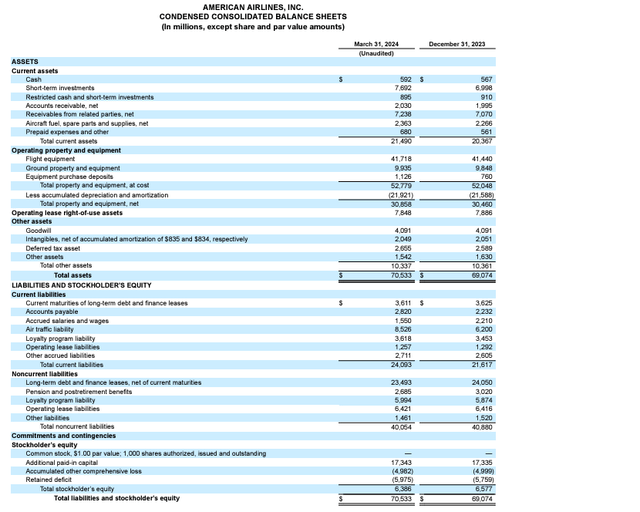

AAL’s biggest negative remains its debt even though the company has tried to pay down debt. AAL had a retained deficit of $5.9 billion on March 31, 2024.

AAL vs industry balance sheet (Seeking Alpha) AAL balance sheet 1Q2024 (AA.com)

Considering the trajectory of U.S. airline stocks, AAL’s eroded position in the industry, and its challenges including below-average revenue generation and likely intensifying labor and customer service issues, a SELL rating is appropriate for AAL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.