Summary:

- Accenture plc has returned -1.07% to shareholders since November 2023, falling more than 25% since February 2024.

- ACN benefits from technological transitions with minimal investment, has a global presence, and a large total addressable market.

- Recent events include increased bookings, acquisitions to boost organic growth, and progress in GenAI projects with high ROIs.

KanawatTH/iStock via Getty Images

I wrote an article about Accenture plc (NYSE:ACN) back in November 2023 with a Hold rating. During this time, the company has returned -1.07% to its shareholders, compared to the S&P 500’s 25.21% over the same period. Although it was up by 24% at one point, since February it has fallen by more than 25%. In today’s article, I will summarize the events that have occurred, as well as update various thoughts and reflections I have had about the company.

Underlying Thesis

As I explained in the first article, Accenture’s underlying thesis is that they are the picks and shovels of any technological transition. Accenture benefits from any technological transition and innovation with minimal investment. They did so with the cloud and are now doing so with AI. They will also benefit from the next revolution.

Their global scale allows them to have incredible know-how, as well as make them more resilient and durable. This knowledge accumulates and creates synergies within the company, driving a sort of virtuous circle where the more clients they help, the greater the number of future problems they will be able to solve. This is because their solutions are stored in the company’s internal data and can serve as a guide for future issues.

Accenture also has a global presence, both in terms of geographical location and client base. Their relationships with diamond clients (clients that spend more than $100 million annually with the company and have a relationship of over 5 years with them) protect them against any sector slowdowns. Many of these relationships are over 10 years old and include well-known companies such as Amazon, Salesforce, Adobe, etc. They have increased this number by 7 during the quarter.

Accenture’s Total Addressable Market (TAM) indeed encompasses the 2,000 largest companies globally, including public, private, and nonprofit organizations. As a company grows, fewer consulting firms can effectively support its needs, which enhances the resilience of Accenture’s clients and strengthens their long-term relationships. In fact, 75% of Fortune 500 companies do business with Accenture, and 95 out of its top 100 clients have been with the company for more than ten years.

Thanks to their scale, they are able to invest large sums of money that smaller competitors cannot, and these investments do not significantly impact their business figures. This is what I mean when I say they are able to ride any new technological wave without requiring significant investments. They are not the disruptors; they are the ones who help their clients implement new technologies.

Accenture Q3 2024 Earnings Call Transcript

On June 20th, Accenture reported its results for the third quarter of 2024. In this section, I will discuss the most important points mentioned in their conference call.

Accenture reaffirmed the thesis that they are the picks and shovels of technological transition during their presentation. However, they admitted that clients were becoming more hesitant to undertake more discretionary projects, which was also putting pressure on the prices they could charge. This is not a positive development and raises questions about how differentiated Accenture’s services are compared to its competitors. However, these doubts were dispelled by management’s comments regarding their market share compared to the competition:

“We continue to take market share on a rolling 4-quarter basis against our basket of our closest global publicly traded competitors, which is how we calculate market share” Julie Sweet, Accenture’s CEO.

“As a reminder, we assess market growth against our investable basket, which is roughly 2 dozen of our closest global public competitors, which represents about 1/3 of our addressable market.” KC McClure, Accenture’s CFO.

However, if we look at their growth profile, we see that it has mostly come through acquisitions, with 35 so far this year. They say they do this to ultimately boost organic growth. The advantage of their scale and financial muscle is that they can make countercyclical investments, meaning they can buy interesting companies at the low points of the cycle when they tend to be cheaper. Acquisitions are also a way to acquire talent without having to develop it internally from scratch.

As we can see in the chart above, Accenture is currently in the trough of the current cycle. The consulting and outsourcing services they provide are cyclical, although they exhibit a clear underlying macro trend, distinguishing them from purely cyclical industries without such a trend. Below is a photo illustrating what I mean. Accenture’s services may be postponed but not canceled, as this would risk their clients falling behind technologically compared to their competition.

Source: Author’s Representation

However, if we look at their bookings, a clear leading indicator of their future sales, these increased by 22% in dollars and 26% in constant currency, with a book-to-bill ratio of 1.3, which explains the rise in their share price last Thursday. This could indicate the beginning of a new bullish cycle in the sector, following the challenging comparisons of the last two years after the surge in sales and profits experienced during the COVID-19 pandemic and the subsequent year.

They also discussed their capital allocation, mentioning that during the quarter they bought $1.4 billion worth of shares at an average price of $320.41. However, a significant portion of these buybacks will offset the dilutive effect of stock-based compensation (SBCs).

They made a comment about why their debt has increased: “Yes. No, that’s a great question. So, in terms of our cash, you said that we started the year at $9 billion, and now we’re little bit – we are about $5.5 billion. And we do have some debt. It’s very small, as you mentioned, for a company of our size. We do have a credit facility that we put in right during the pandemic, and we continue to have a credit facility. It’s about $5.5 billion. It’s a five-year credit facility and what you just see, Dave, is that we’re just exercising some of that credit facility, kind of normal treasury operation.” KC McClure, Accenture’s CFO.

They also discussed how their GenAI projects were progressing, for which they had a $3 billion investment plan.

“We also have leaned into the new area of growth, GenAI, which is comprised of smaller projects as our clients primarily are in experimentation mode, and this quarter we hit two important milestones. With over $900 million in new GenAI bookings this quarter, we now have $2 billion in GenAI sales year-to-date, and we have also achieved $500 million in revenue year-to-date. This compares to approximately $300 million in sales and roughly $100 million in revenue from GenAI in FY 2023. Leading in GenAI positions us to help our clients take the actions needed to reinvent and to benefit from GenAI, which frequently means large-scale transformations.” Julie Sweet, Accenture’s CEO.

From here, we can calculate the ROIs they are achieving (over 50%), but only in terms of revenue since we don’t know the margins they are generating. However, the company’s operating margin has increased by 10 basis points compared to last year.

Finally, the management also provided the guidance for the fiscal year 2024:

“For the full fiscal 2024, we now expect our revenues to be in the range of 1.5% to 2.5% of growth in local currency over fiscal 2023, which assumes an inorganic contribution approaching 3%. We now expect our full year adjusted earnings per share for fiscal 2024 to be in the range of $11.85 to $12, or 2% to 3% growth over fiscal 2023 results. For the full fiscal 2024, we continue to expect operating cash flow to be in the range of $9.3 billion to $9.9 billion, property and equipment additions to be approximately $600 million, and free cash flow to be in the range of $8.7 billion to $9.3 billion,” said KC McClure, Accenture’s CFO.

Valuation

Once we know more about the company, it’s time to start valuing it. Following the guidance on the company’s free cash flow, we will adjust it for dilution in SBC to calculate Accenture’s FCF yield for 2024. From there, I will try to determine what growth rate we can expect for this figure in the coming years.

For the Free Cash Flow of 2024, I have chosen the midpoint of the management’s guidance (9B$). The stock options for 2023 were 1.9B$, and I believe they will increase by 12% in the future, which would give 2.1B$ in 2024. In recent years, this figure has grown at 15.75%, but I think that thanks to AI, they will be more efficient with the workforce, and it might even decrease in some segments of the company. I believe this will relieve pressure on them. Once we have the FCF Yield adjusted for SBCs and Accenture’s current Enterprise Value, we can calculate its Yield (3.56%).

Source: Author’s Representation

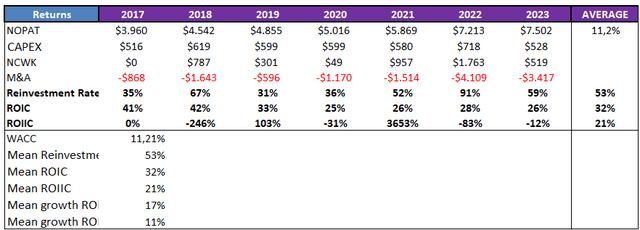

Now we need to calculate what we believe the company’s FCF growth rate will be for the next 5 years. In recent years, this figure has grown at a CAGR of 11.62%. To do this, we will multiply the reinvestment rate (50%) by the ROIIC obtained over the last 6 years (20%). This gives us a growth rate of 10% for the FCF in the coming years. This is below past growth rates, but I believe it is a realistic scenario for the company.

Source: Author’s Representation

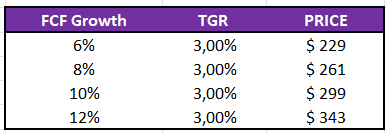

Once we have this, we can think in two different ways. The first is that if the company is giving us an adjusted Yield of 3.56% and expects FCF growth of 10%, in the long term, it should give us mid to low double-digit returns. We can also perform a reverse DCF to see what growth rates the market is discounting at the current price and create other scenarios with different FCF growth rates. As I write this, Accenture is trading at $307. With a discount rate of 10% (the minimum I require for this type of investment) and a terminal growth rate of 3%, since I believe Accenture will always benefit from implementing future technological transitions, with the expected FCF growth of 10% projected over 10 years, we obtain a Fair Value of $299. With the same assumptions and changing the FCF growth rates, we can obtain other purchase prices, as shown in the image.

Source: Author’s Representation

Taking into account everything discussed in this section, I believe Accenture is trading at Fair Value. To buy it and achieve somewhat higher IRRs, I would need some margin of safety. Therefore, I rate the stock as a hold and will watch it to buy at $240-250.

Risks

In my opinion, although some are a bit remote, Accenture’s risks haven’t changed much.

Its business model is very labor-intensive, making it less scalable and requiring high compensation in SBC. Additionally, it is a market with considerable competition for talent, so monitoring the attrition rate is essential.

It remains to be seen if artificial intelligence will benefit Accenture by making it more productive and less dependent on labor. On the other hand, it could also lead clients to use this technology to undertake projects they would have previously outsourced. However, given the complexity of these projects, I find this unlikely and think it might impact smaller consulting firms more.

A possible spin-off of the consulting division of the Big 4 auditing firms could flood the market with new competitors capable of working with clients they couldn’t previously reach. This, in a market that already has few entry barriers, could suppose some risk for the firm. Although Accenture’s scale and current clients can protect it from this.

Conclusion

In conclusion, Accenture remains a quality company trading at Fair Value. According to the bookings from the latest results, we might currently be in the trough of the cycle, which would imply a positive future evolution of the figures that the market has started to discount in the stock price. I will be waiting to add to the company in case it reaches my target prices. If it were trading around $250, I would have rated the stock as a buy. But we are not there yet. If any of the readers have worked for the company or its competitors, I would love to hear some insights about the company that are less known to the general public.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.