Summary:

- 82.5% of Amazon’s revenue still comes from retail sales, despite a focus on the high-growth AI cloud and advertising, which has experienced a mild acceleration in growth.

- Strong earnings growth and margin expansion were driven by layoffs and marketing spending cuts, not sustainable for long-term growth.

- AWS revenue growth shows rebound, and GAAP-EBIT margin reached all-time high in 1Q FY2024, driven by the GenAI boom.

- The management expects a significant increase in capex growth YoY in FY2024, driven primarily by higher infrastructure investments aimed at supporting AWS growth.

- The stock’s EV/Sales ratio is not expensive relative to its 5-year average, and its non-GAAP P/E for FY2024 is in-line with the Nasdaq 100 index.

Moment Makers Group/iStock via Getty Images

Investment Thesis

Amazon’s (NASDAQ:AMZN) stock reached its all-time high last week, buoyed by its AI growth optimism. In my previous analysis, I upgraded the stock from hold to buy in August 2023, driven by a cheap valuation and potential rebound in retail sales and cost management. Since then, the stock has surged 37%, beating S&P 500 index’s 21.5%. However, given the recent expansion in valuation multiples, I believe this AI hype is a bit premature. The company’s primary growth driver is still its retail business. While the recent increase in capital investments in AWS infrastructures will boost its long-term growth trajectory for its cloud segment, I do not believe AWS can significantly move the needle to improve its top-line growth in the near term.

The over 200% YoY improvement in earnings last year was not largely driven by revenue growth, but by operating efficiency due to massive layoffs and cuts in marketing spending. Therefore, I downgrade the stock to hold from buy as the current risk-reward is getting less attractive, especially given the potential cyclical weakness in consumer spending, which could create headwinds for its retail and advertising business.

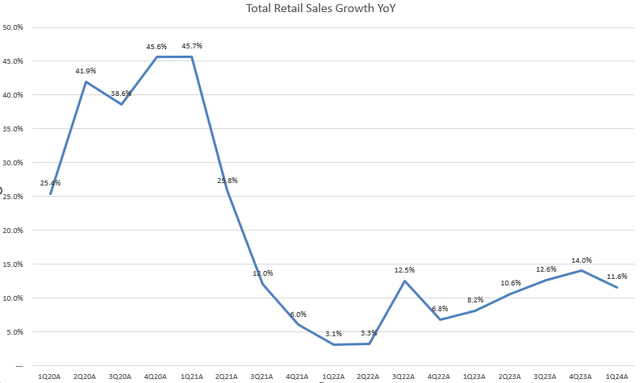

Still More Than 80% Revenue Comes from Retails

Many people are discussing how GenAI will improve the growth trajectory of AWS and its advertising business. According to Bloomberg article, AMZN reached a $2 trillion market cap last week, largely due to its AI optimism. However, we have yet to see a strong growth rebound in its total revenue yet. We know that AMZN’s net retail sales (82.5% of its total revenue) remain on a low teens growth trajectory. Particularly, its Online Stores sales maintain high single-digit growth. The company is strategically prioritizing high-growth cloud business related to AI technology, as the revenue mix from online stores decreased from 49% in Q1 FY2021 to 38.1% in Q1 FY2024. Meanwhile, AWS’s revenue mix has increased, reaching nearly 20% of its total revenue in the last quarter. Despite this shift, the company still largely relies on retail sales to maintain its growth trajectory. As shown in the chart above, total retail sales growth has reaccelerated since Q1 FY2023, supporting my previous bullish view on the stock over the past months.

Although 1Q FY2024 total revenue topped estimates, the growth rate experienced a mild QoQ slowdown. Additionally, the company is expected to see a continued QoQ slowdown in 2Q FY2024, based on its 7% to 11% growth outlook, which is below the market consensus. Management in the earnings call attributed this to a roughly 60 bps headwind from FX impact. Therefore, we may see retail sales growth slow in the next earnings result compared to Q2 FY2023, justifying my cautious view after the stock reached its all-time high.

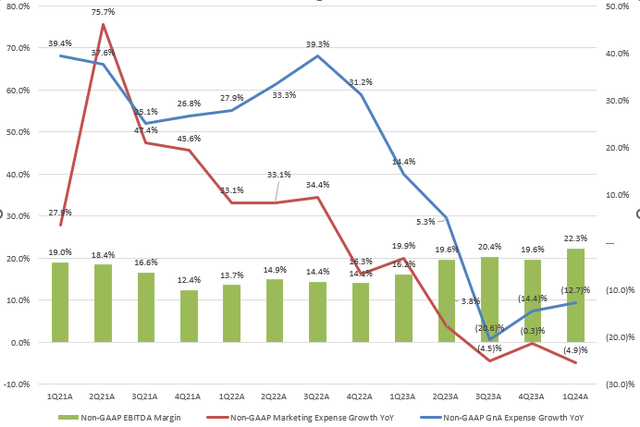

Earnings Growth Driven by Layoffs and Marketing Cuts

The company’s bottom line has significantly improved over the past quarters. Let’s focus on the green columns in the chart, we see that similar margin levels in Q1 FY2021 and Q1 FY2024. I believe that the key difference between these two periods is that the high EBITDA margin in Q1 FY2021 was driven by strong revenue growth, while the margin in Q1 FY2024 was due to reduced operating expenses.

We saw that AMZN’s total revenue growth in 1Q FY2021 was 45.7% YoY, whereas in 1Q FY2024, it was only 11.6% YoY. I think that achieving strong earnings growth by cutting General and Administrative and Marketing expenses is unsustainable in the long term. The negative YoY growth trend in these expenses since Q3 FY2023, as shown by the blue and red lines above, further supports this.

According to another Bloomberg article, AMZN is cutting hundreds of jobs including 27,000 corporate roles, as part of a cost management plan following a pandemic-era hiring boom. Therefore, I’m skeptical that a further stock rally from here will be largely driven by cost cuttings. The management also implied an 8.2% GAAP EBIT margin in Q2 FY2024, below the 10.7% seen in Q1 FY2024. However, could AI boom structurally shape the company’s overall growth outlook? Let’s check out its AI cloud business.

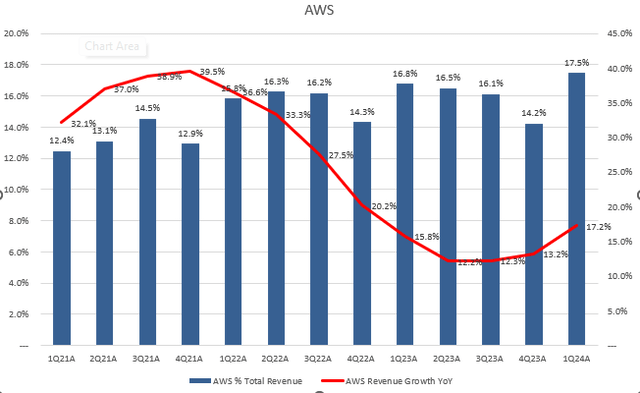

Growth Drivers: AWS and Advertising Business

AWS’s revenue mix has steadily expanded over the past years, from 12.4% of total revenue in Q1 FY2021 to 17.5% in Q1 FY2024. However, significant growth rebound due to the current AI frenzy has yet to be seen. Nonetheless, it’s encouraging to see AWS’s GAAP EBIT margin reach an all-time high of 37.6%. While job cuts in the Cloud computing division may have contributed to this improvement, management explained that it was primarily due to managing infrastructure and fixed costs.

Meanwhile, advertising revenue continues to maintain over 20% YoY growth in the last quarter. The management attributed this strength to sponsored products and ongoing improvements in relevancy and measurement capabilities for advertisers. However, the advertising business segment currently accounts for only 7.5% of total revenue, which is not very significant.

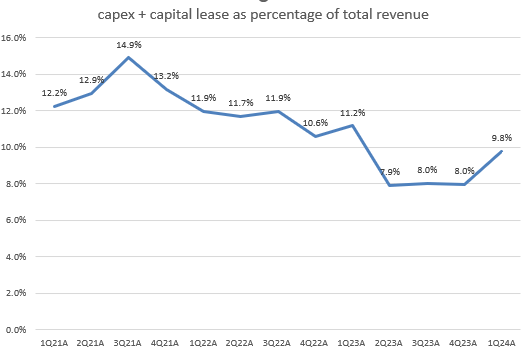

Significant Capital Investments in FY2024

The company model

During the earnings call, management indicated a meaningful increase in capital expenditures on a year-over-year basis in FY2024, primarily driven by higher infrastructure capex to support growth in AWS, including generative AI. They define capital investments as the combination of capex plus equipment finance leases. Looking at the chart above, we notice that this ratio is below the past three-year average but has started to tick up in 1Q FY2024. I believe AMZN is making the right move by increasing capital investments to support AWS infrastructure, particularly in generative AI efforts. Unlike other software companies like Microsoft (MSFT), AWS takes time to become a key driver of boosting its top-line revenue growth.

Valuation

I upgraded the stock to buy in August 2023 as AMZN’s valuation multiple was cheap amidst a potential growth rebound in its core retail business. The stock is currently trading at 3.5x EV/Sales TTM, which is nearly in-line with its 5-year average of 3.46x. Meanwhile, according to Seeking Alpha consensus, AMZN is expected to generate non-GAAP EPS of $5.74, which implies 33.6x non-GAAP P/E FY2024. This multiple is also in-line with Nasdaq 100 index. Therefore, I think the stock is not trading at a lofty valuation and currently fairly valued.

Conclusion

In conclusion, while AMZN’s stock soared to an all-time high fueled by market optimism around its AI cloud business, the company’s primary growth driver remains its retail sales. Despite the strong growth potential of AWS, the segment has yet to contribute significantly to its top-line growth. Moreover, the recent earnings improvement has been largely due to cost-cutting measures rather than revenue growth, raising concerns about sustainability. With potential cyclical weaknesses in consumer spending and a moderate growth outlook, the current valuation appears in-line with my expectation. Consequently, I am downgrading the stock from buy to hold, given the less attractive risk-reward profile at this moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.