Summary:

- Alphabet Inc./Google is projected to reach a $3T market cap in ~3 years based on market’s EPS growth.

- I think the timeframe could be even sooner.

- The double-compounding mechanism – profit growth plus a shrinking share base due to aggressive buybacks – could push Google stock to $3T market cap much sooner.

tostphoto/iStock via Getty Images

Google stock: EPS projection points to $3T market cap in ~3 years

I last covered Alphabet Inc. aka Google (NASDAQ:GOOG) (NASDAQ:GOOGL) with a buy rating 3 months ago under a title of Let your profit run. The article argued that Google’s stock price has a large potential for further growth due to the company’s unique business model, which combines mature segments and new frontiers such as AI and cloud computing. The stock did demonstrate a robust run from ~$156 at that writing (a then-record price) to the current record level of about $185, translating into a total return of 18.5%, far outperforming the broader market’s ~5% return over this period.

Since then, the company has released its 2024 Q1 earnings. Thus, I think an updated assessment of my thesis is in order. Considering the profit catalysts and outlook provided in the earnings report, this article upgrades my rating from the previous buy to a strong buy. The Q1 results (which are terrific in my view) have been detailed by many other SA articles already since then. Therefore, in this article, I will focus on an angle that has been less discussed: its share buyback programs and how it can accelerate GOOG market capitalization growth.

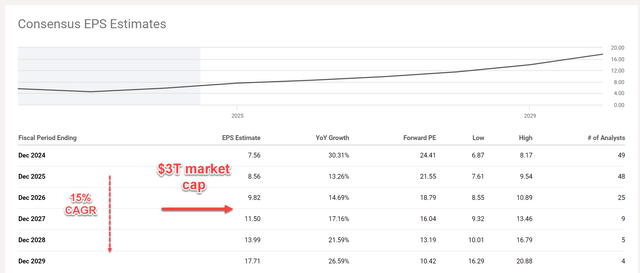

The chart below shows the consensus new EPS estimates for GOOG stock in the next 6 years. Based on the chart, analysts expect Google’s EPS to grow steadily at a robust pace over the next six years. They estimate EPS to reach $7.56 by the end of FY 2024, and then increase at a compound annual growth rate (CAGR) of 15%. At this rate, the company would reach a $3 trillion market cap somewhere between FY 2026 and 2027 assuming today’s valuation multiple.

Next, I will explain why its path to $3T market cap could be accelerated by the share repurchase program and also an expansion of its valuation ratio.

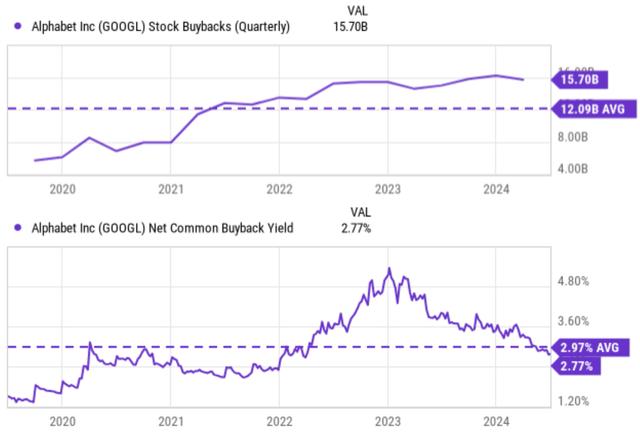

GOOG stock: acceleration from buybacks

GOOG has been a consistent and aggressive buyer of its own shares in the past, as illustrated by the chart below. The company has been spending on average over $12B per quarter on share buybacks. The financial position is in terrific shape according to its Q1 earnings, paving the way for accelerated buybacks (plus an initiation of dividends). The company currently sits on over $110 billion in cash assets, with only about $12 billion of long-term debt. Moreover, organic operating cash flow is forecasted to surpass $100 billion in FY 2024 (more on this later). I certainly anticipate a good portion of the cash to be used toward capital expenditures as the company continues its focus on AI computing activity. At the same time, there will be plenty of cash left to be returned to shareholders. Against this background, the company announced a new $70B share repurchase plan together with the initiation of its first quarterly dividend.

The dividend is a minor part of the capital return plan in dollar amount compared to the share repurchases. And as I will show immediately below, the repurchase will be far more potent considering the stock’s fair valuation and its growth potential ahead.

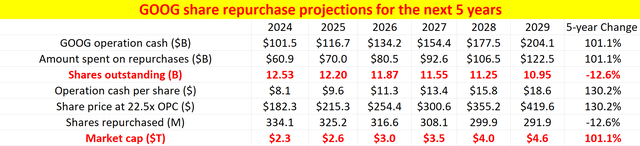

As an illustration of the potency of the repurchases, the table projects the impact in a few years. The potency is rooted in what I call double-compounding, when growing earnings meet a decreasing share count. My following projection was based on a few simple assumptions:

- I assumed GOOG to allocate about 60% of its operating cash flow (“OPC”) toward share repurchases, based on the $70B plan and forecast of its OPC.

- I assumed its OPC to grow at a CAGR of 15%, simply taken from the consensus EPS estimate discussed above.

- I assumed the shares were bought at 22.5x of its cash flow, which is the current ratio as of this writing. Later, I will argue why such a ratio is too low and thus represents a conservative estimate of the return potential.

With these parameters, the results point to a $3T market cap somewhere between FY 2025 and 2026 as shown. Of course, all these parameters are open for debate. But the essence of double-compounding would remain the same and be a strong fundamental force working in the shareholder’s favor.

Google stock: valuation and profit catalysts

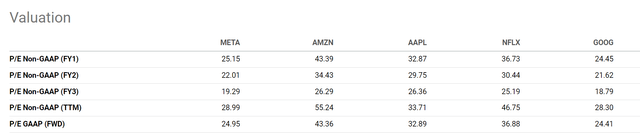

As aforementioned, GOOG currently trades at a forward P/E ratio of 24.4x, or about 22.5x of its cash flow. This multiple is too low in my view, both in absolute and relative terms. As a simple illustration, as illustrated by the chart below, GOOG has the lowest P/E ratio among its FAANG peers. In terms of FY1 P/E on a non-GAAP basis, its 24.4x P/E is substantially lower than Apple’s (AAPL) 33x, Netflix’s (NFLX) 36x, and Amazon’s (AMZN) 43x.

Yet, I see GOOG as one of the best-position powerhouses for our digital future. After reading Q1’s earnings report, I fully agree with the CEO’s comments that “GOOG is well underway with its Gemini era.” There is indeed unparalleled resonance among its various operating segments ranging from search, YouTube, cloud computing, and AI. Among all the synergies among its segments, two key factors stand out in my mind that differentiate GOOG from other tech companies. First, the synergy among its dominant advertising platform, its search engine, and the Android mobile operating system. This combination generates massive recurring revenue, which then provides a strong financial foundation to sustainably fund the company’s moonshot ventures in areas like self-driving cars and artificial intelligence.

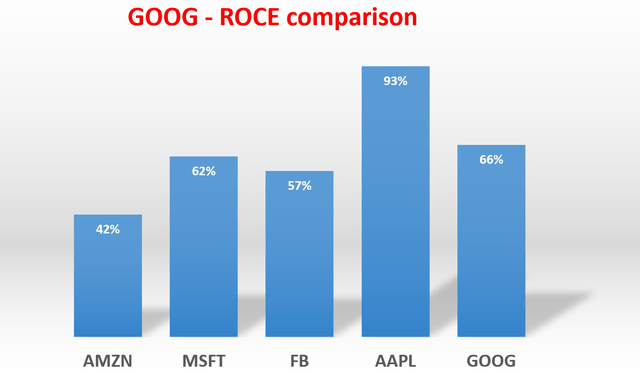

Second, the synergies between its vast user data and its advertising segment. The data provides an unmatched resource, in my view, for GOOG to develop new products across its ecosystem. It further unlocks a feedback loop that strengthens GOOG’s market position and increases user engagement. This data advantage makes it difficult for competitors to replicate Google’s advertising dominance, product offerings, and profitability (as evidenced by its enviable ROCE, return on capital employed even among the FAAMG group as seen in the chart below).

Risks and final thoughts

In terms of downside risks, GOOG faces largely the same set of risks common to other high-tech companies, such as competition intensification, rising operating expenses, and also a potential economic slowdown. This could lead to slashed advertising budgets, and ad-related sales are a crucial income stream for many tech companies. In addition to these common risks, I think a more unique risk for GOOG is regulatory scrutiny. Yes, it is true that other high-tech companies face similar scrutiny. But my view is that the risk will be more intense for GOOG given its dominant search engine position and vast user data collection, and the company has faced lawsuits and investigations constantly in the past.

As a recent example, GOOG was in the spotlight again (together with a few other leading social media platforms) as “the U.S. Supreme Court dismissed challenges to laws from Florida and Texas on how these companies moderate content.” Antitrust regulations aimed at limiting data collection or search manipulation could hinder GOOG’s ability to personalize advertising and maintain its market share, posing a unique challenge compared to other tech companies in my mind.

All told, my conclusion is that the upside potential far outweighs these downside risks at this point. Thus, I consider GOOG as a compelling investment opportunity and upgraded my rating to a strong buy. The combination of a 15%+ growth rate, a relatively low P/E, and an aggressive buyback program is simply too powerful. The double-compounding mechanism could push GOOG’s market cap above $3T in as soon as ~2 years, and even sooner if its P/E ratio expands – a very likely scenario in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat the S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.