Summary:

- McDonald’s had a solid Q1 earnings report with high single-digit YoY operating income growth and 5% YoY revenue growth.

- A resurgence in popularity among Gen-Z consumers along with real operational efficiency improvements have allowed McDonald’s to expand margins even amidst a tough macro environment.

- The recent selloff in reaction to slowing comparable sales growth has left shares trading around $250 suggesting a 24% undervaluation in my base-case scenario.

- McDonald’s faces market cyclicality risk which could reduce the rate of growth over the coming year as consumers have less disposable income to spend on eating out.

- The long-term outlook remains positive; rating upgraded to Strong Buy.

thad

Investment Thesis

McDonald’s Corporation (NYSE:MCD) continues to be one of my favorite stocks at present time despite the surprisingly abundant negative sentiment that appears to be placing downward pressure on shares.

The recent Q1 report saw McDonald’s generate solid topline revenue growth along with great operational improvements resulting in a wonderful 8% YoY increase in operating income. While total comparable sales growth did slow to 2% YoY, I believe the softening consumer environment is primarily to blame for this weakness rather than any inherent flaws at the company.

The recent selloff starting in early 2024 has sent shares down almost 25% from highs of almost $300. With little material change to the earnings outlook for FY24, I maintain my IV estimate of $325 and believe shares may be up to 24% undervalued as a result.

I upgraded my rating from a Buy to a Strong Buy based on a positive long-term outlook and see a real GARP opportunity in shares at the present time.

Business Overview

Since the inception of the first McDonald’s restaurant back in 1940, the chain has grown to become a true figurehead of the entire fast-food industry.

While their iconic Big Mac, chicken nuggets, fries, and hamburgers can be found universally across the globe, McDonald’s has a truly massive selection of regionally specialized products sold by the firm in specific target markets.

Such an innovative combination of iconic menu items alongside regionally specialized products has proven to be the key that allows McDonald’s to capture the food share of worldwide customers.

The firm currently serves 70 million customers daily across over 100 countries thanks to the work of over 1.7 million employees. McDonald’s currently operates just under 45,000 restaurant outlets across the globe.

While the company is known by consumers for being an iconic burger joint, McDonald’s primarily extracts their revenues from franchisee rent payments made to the firm for operating their franchises on the land owned by the McDonald’s Corporation.

Of course, the firm also receives royalties from the sale of their trademarked food items along with some franchise fees which further bolster McDonald’s overall revenue profile.

I conducted an extensive in-depth analysis of McDonald’s economic moat and business operating back in September 2023 titled, “McDonald’s: Why I’m Lovin’ This Modern-Day Buffett Style Pick” which I suggest you read to gain a more holistic understanding of the burger-chains enterprise.

Earnings Analysis – Q1 FY2024

The most recent Q1 earnings report presented a mixed set of fiscal results which appears to have generated uncertainty among investors.

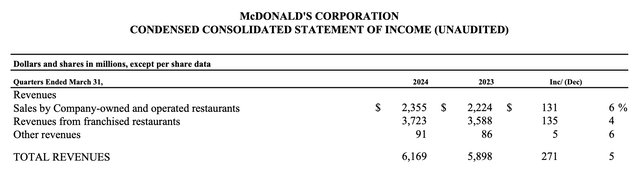

Headline figures of 2% YoY comparable sales growth and a 5% YoY increase in total revenues are positive in my opinion and ultimately indicate the continued ability of McDonald’s to resonate with consumers.

Such solid results come despite continuously decreasing disposable income among U.S. and European clientele.

McDonald’s also managed to limit the increase in operating expenses to just 6% YoY thanks to the continued actions of their “Accelerating the Arches” operational excellence initiative.

During the webcast of Q1 results and the recent 2024 investor day event, I appreciated the continued commitment from the management team to refine their operations structure by eliminating duplicated functions across their global network.

The fundamental “four Ds” structure of the Accelerating the Arches initiative (consisting of Digital, Drive-thru, Delivery and Development) remains relevant in my opinion and sets out what I see as a realistic and comprehensive plan for continued brand growth and expansion.

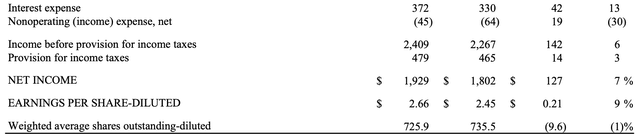

Combined topline growth successes thanks to continued brand resonance with consumers along with a strict approach to cost control allowed Q1 operating income to grow 8% YoY to over $2.7 billion.

Indeed, McDonald’s noted higher sales-driven franchise margins as a key figure behind their operating margin expansion, which only further solidifies the hypothesis that consumers continue to spend their hard-earned dollars, euros, and yuan in McDonald’s establishments.

Net income expanded accordingly by 7% YoY with McDonald’s generating EPS of $2.66 per diluted share – a 9% increase compared to Q1 FY23.

Overall, I considered the Q1 results to have been a solid set of earnings data for the firm and believe the overall ability of McDonald’s to continue growing their earnings in the high-single-digits is impressive given the prevailing macro conditions.

Seeking Alpha | MCD | Profitability

Seeking Alpha’s Quant Profitability grade for McDonald’s continues to be “A+” with sector-leading metrics underpinning their business operations.

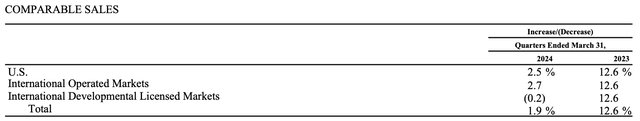

Nevertheless, it must be noted that the rate of comparable sales has decreased significantly and has actually fallen below those levels last seen during the 2022 slump.

On a YoY basis, comparable sales growth has stalled from 12.6% in Q1 FY23 to just 2% in Q1 this year.

Such a fall in the rate of sales growth illustrates the challenges all companies are facing both in the U.S. and global markets due to the increasingly realized impacts of contractionary monetary policy.

Given that eating out even at fast-food establishments is generally much more expensive than grocery-store shopping, it comes as no surprise that the cyclical restaurant industry is feeling the impacts of the economic slowdown before many other sectors.

While I do consider McDonald’s to be a resilient and very well-managed business, they are still not immune to the impact falling real disposable income has on consumer spending habits.

The reality of a potentially flatline year of revenue growth appears to have spooked some investors as evidenced by the post-Q1 selloff in MCD shares. However, for a long-term investor like myself, I view the potential for weaker earnings much more positively given the predominantly external reasons for the aforementioned slump.

Taking into account these factors, I maintain my earlier assessment of McDonald’s as possessing a robust financial position characterized by excellent business economics, a solid balance sheet, and an astute management team.

I therefore believe the firm is well positioned to not only withstand a challenging consumer landscape, but to generate sustained profitability from their operations despite the tough macro environment.

Valuation – Q1 FY2024

Seeking Alpha | MCD | Valuation

Seeking Alpha’s Quant Valuation Grade has been upgraded from an “F” back in February 2024 to a “D-” grade at the present time.

The selloff post-Q1 results have decreased the firm’s P/E GAAP TTM ratio by around 4 points to 21.64x along with a similar decrease in P/CF TTM from 24x to just 19.17x today.

The current P/E GAAP TTM is also 25% below a 5Y historic average which illustrates just how relatively cheap the company is at present time.

While the firm’s P/S TTM continues to be quite elevated at 7.04x, I believe that McDonald’s ultimately still has significant growth opportunities both domestically and in new markets which warrants this ratio at the present time.

The current P/S TTM is also 12% lower than a 5Y historic average once again suggesting shares are on sale compared to previous valuations.

Seeking Alpha | MCD | 1Y Advanced Chart

A look at Seeking Alpha’s 1Y Advanced chart for MCD stock versus the ever-popular S&P 500 tracking SPY index fund (SPY) illustrates the relatively sour investor sentiment towards the burger giant’s shares.

On a one-year basis, MCD stock has been massively outperformed by the S&P 500 as technology stocks have propelled the index to new heights while consumer cyclical companies’ valuations have suffered.

However, I believe that the long-term prospects at McDonald’s look solid and suggest that great investor returns could be on the horizon once systematic economic challenges soften.

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from an objective perspective.

For the base-case valuation, I used McDonald’s current share price of $249.99, a realistic 2024 EPS analyst consensus estimate of $12.45, a realistic “r” value of 0.11 (11%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13%, I derive a base-case IV of $325.70.

This represents a noteworthy 24% undervaluation in shares relative to current prices.

A more conservative bear-case CAGR value for r of 0.07 (7%) can be utilized to model a scenario whereby McDonald’s EPS growth slowing due to a severe recessionary environment. Even with such a low CAGR value, shares are valued at around $240.00, suggesting essentially a fair valuation at present.

While the difference between my base and bear-case scenarios illustrates just how reliant the current share valuation is on continued future growth, it is also important to note how much more margin of safety is currently present in the stock price as a result of the recent selloff.

Projecting a short-term outlook is an activity which I am often reluctant to do, especially given the relative instability and opaqueness of the prevailing macroeconomic conditions. As a result, I suspect that in the next 1-12 months, the direction of MCD stock may be quite erratic and susceptible to the impacts of short-term catalysts and news.

The long-term outlook for McDonald’s appears much more positive to me. The company has managed to develop a newfound hipness with more youthful customer demographics all the while continuing to eliminate bloat from the operations structure.

McDonald’s Risk Profile

The restaurant business continues to be an incredibly competitive industry. Constantly evolving consumer tastes and consumption preferences create a challenging task for businesses: how to remain iconic while also not becoming irrelevant.

It is precisely this challenge that results in the large turnover rate seen within the industry when it comes to business openings and closures.

McDonald’s is arguably one of the most successful restaurateur stories in history, with the chain having served customers for just over 80 years.

Furthermore, the recent ability of McDonald’s to connect with younger demographics of consumers such as Gen-Z illustrates the know-how present at the firm when it comes to the management of their iconic brand.

However, it would be foolish to dismiss the considerable competitive forces that McDonald’s must manage within the industry. Notable fast-food behemoths like Restaurant Brands International Inc.’s (QSR) Burger King, Yum! Brands, Inc.’s KFC, and even Five Guys are constantly trying to attract customers away from McDonald’s and into their establishments.

The popularity of local, small-scale fast-food offerings has also increased drastically in recent years as a trend of healthier, or at least more localized eating has become popular across the U.S. and Europe.

McDonald’s also faces some cyclicality with respect to their revenues, as the overall demand of customers is tied to the amount of disposable income they have available to spend on eating out. While all restaurants face this challenge, it is worth noting and can often result in periods of about two years where revenue growth stalls in comparison to previous years.

When it comes to the topic of ESG, I do not see any material threats impacting McDonald’s operations. The firm is committed to achieving net-zero carbon emissions by 2050 and has been hard at work reducing the volume of plastics and waste present in each product’s packaging.

Overall, I believe McDonald’s has a low-risk profile with a majority of the threats facing the firm being latent rather than active. Furthermore, I consider the current management team to be evidencing an excellent approach to tackling these latent threats through proactive and cogent business practices.

I implore you to conduct your own research into any potential risk or ESG material that may concern McDonald’s before making any investing decision. This is critically important as the topic of risk analysis is inherently subjective and open to interpretation.

Summary

I continue to really like the McDonald’s Corporation as an enterprise. Their business economics continue to be first-class all the while the firm continues to expand their reach across the globe.

While the recent slowdown in total comparable sales is regrettable, I am not overly concerned about the long-term trajectory of the firm. Quite simply, McDonald’s continues to run the company using cogent operational objectives and activities even despite the soft macroeconomic demand environment.

Cyclicality is simply part of investing in consumer-oriented service businesses. In the case of McDonald’s, I believe the majority of the current headwinds are simply down to external factors.

Given the current decrease in valuations, I feel comfortable upgrading my rating for MCD stock from a Buy to a Strong Buy given the increased margin of safety and the long-term prospects at the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. The opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.