Summary:

- Investing in dividend growers historically outperforms the market, while cutters underperform.

- 3M Company shows promising signs of recovery and growth despite its recent dividend cut.

- Strategic moves like the Solventum spin-off position 3M for a strong comeback and potential substantial returns.

chairboy

Introduction

Dividend cuts aren’t great. There’s no doubt about it.

Investing in companies with consistent dividend growth isn’t just great for income generation, but also a proven way of outperforming the market.

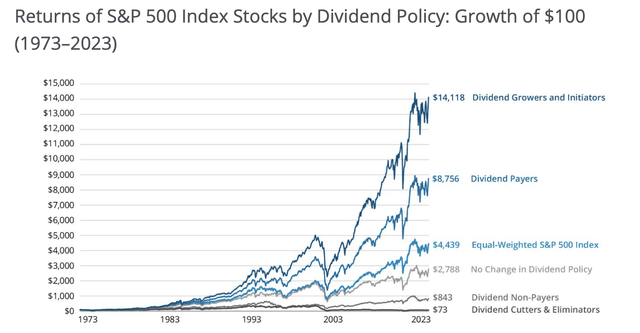

Since 1973, dividend growers and initiators have turned a $100 investment into $14,118. This implies a 10.4% CAGR. Dividend payers turned $100 into $8,756.

Then, there are dividend cutters and eliminators. These companies turned $100 into $73.

In other words, if you had bought that basket of stocks, you would have wasted more than half of a theoretical human lifetime losing money.

The big difference between dividend growers and cutters makes sense.

- Dividend growers continue to prove their ability to stay relevant. These companies aren’t just profitable, but so profitable that they can grow their dividends (cash outflows) on a consistent basis. I always say that running a business is tough. Running a business with increasing dividend liabilities is even tougher. The market tends to reward that.

- Dividend cutters are the opposite. While some companies cut their dividends for a reason (like major M&A), most cuts are because of bad news. Companies with declining earnings and inefficient dividend coverage ratios aren’t in high demand on the market. I think that speaks for itself.

While I will not use this article to defend dividend cutters (it’s difficult to love dividend growers more than I do), there are exceptions.

I believe it is important to refrain from generalizing dividend cutters for two reasons.

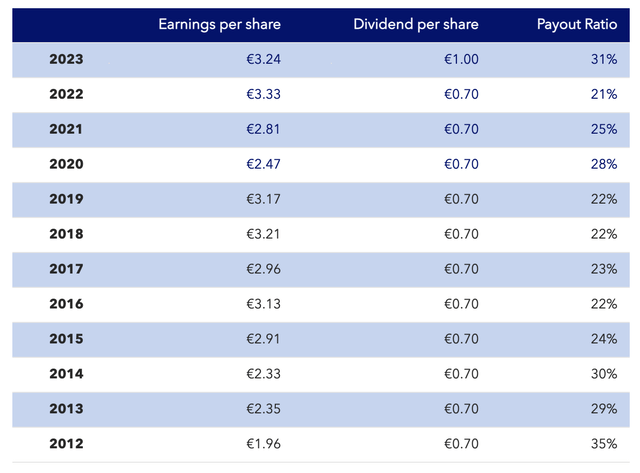

Reason 1: Consistent dividend growth is rare. Most European companies, for example, stick to their payout ratios. They usually pay a dividend 1-2x per year, which is entirely dependent on net income.

The table below shows the dividend of Beiersdorf (OTCPK:BDRFF), one of the most respected and consistent growers in the European consumer staples industry. While its dividend has gone up over time, it has often “cut” its dividend, although most Europeans don’t view it as a cut.

I tend to apply the same to my portfolio. I own companies like Deere & Company (DE) and Union Pacific (UNP). While both have impressive long-term dividend growth, they often come with a prolonged period of unchanged dividends.

In other words, I care about the long-term trend. I don’t necessarily care to own Dividend Aristocrats or Dividend Kings.

That’s what brings me to reason 2.

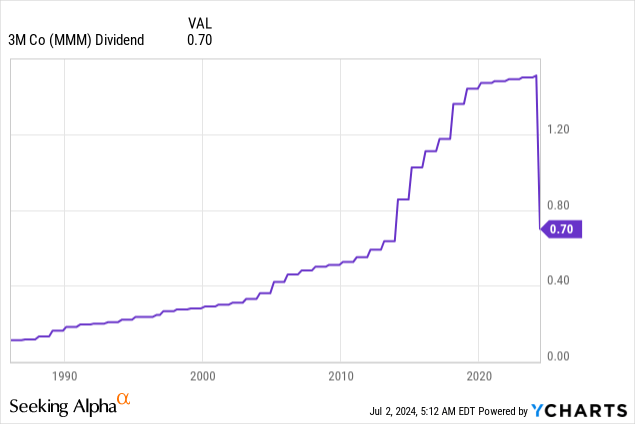

Reason 2: A dividend cut can be the start of a recovery. Speaking of Dividend Kings, the 3M Company (NYSE:MMM) was a Dividend King with more than 60 consecutive annual dividend hikes.

Unfortunately, it turned into a great example of why these titles rarely mean something.

As much as I respect companies with consistent dividend track records, some of them focus too much on their dividends, which can lead to unsustainable payouts and cuts down the road.

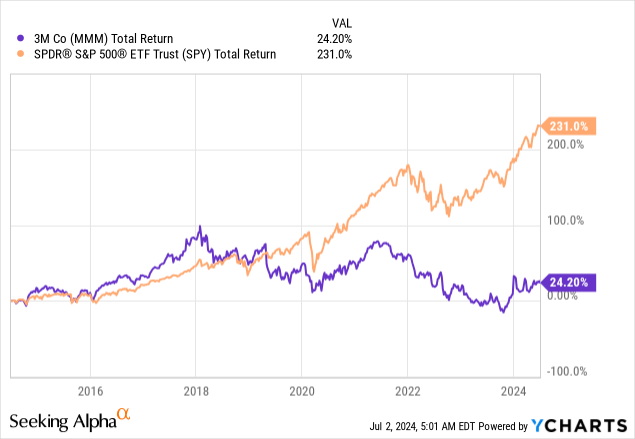

Over the past ten years, 3M stock has returned just 24%, lagging the S&P 500 by more than 200 points.

Moreover, it cuts its quarterly dividend from $1.51 to $0.70 on May 14. It now yields 2.8%.

While this is – undoubtedly – a reason for long-term investors to be very disappointed, it comes with opportunities.

Although statistics are not in our favor, some dividend cuts and reorganizations bear fruit. The latest example is General Electric, which is now GE Aerospace (GE) and one of the hottest stocks on the market.

As I discussed in a recent article:

- GE is streamlined after two major spin-offs.

- It has a much healthier balance sheet.

- It has a fantastic growth profile.

- It sees a path to elevated dividend growth and aggressive buybacks.

Although 3M is different from GE, I am very upbeat about 3M and believe it is a great stock.

Hence, on January 2, 2024, I wrote an article titled “A Bold Prediction: I Believe 3M Could Double.”

Since then, shares have returned 13%, slightly lagging the S&P 500’s (SP500) 16% return.

In this article, I’ll explain why I remain very upbeat about 3M, expecting it to potentially deliver substantial returns, making it a standout in the “dividend cutters” category.

Confidence Is Back – And Right Fully So

On July 1, Yahoo Finance reported that 3M is a “Favorite amongst institutional investors who own 66%.“

Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. Therefore, a good portion of institutional money invested in the company is usually a huge vote of confidence on its future. – Yahoo Finance

One big reason is the Solventum (SOLV) spin-off, which I discussed on April 2.

From a 3M point of view, the spin-off was genius, as Solventum is a business that – despite operations in high-demand areas – faces significant competition risks.

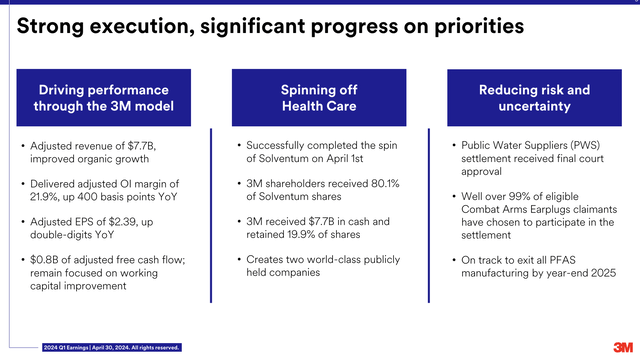

As 3M made clear in its 1Q24 earnings call, this separation translates to a leaner, more focused operation that can drive higher shareholder returns.

The spin-off also included 3M retaining a 19.9% equity stake in Solventum and receiving $7.7 billion in cash.

Moreover, the company successfully settled with U.S.-based Public Water Suppliers, agreeing to make total payments with a pretax present value of up to $10.3 billion over the next 13 years.

While this is a big financial hit, this settlement mitigates long-term legal risks related to PFAS detection in drinking water and provides a lot of long-term visibility.

Moreover, the company settled the Combat Arms multidistrict litigation, with over 99% of claimants participating, resulting in a total payment commitment of up to $5.3 billion through 2029.

It also has a much healthier balance sheet.

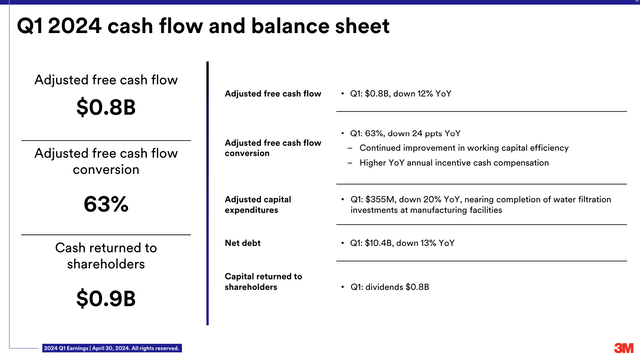

At the end of the first quarter, the company had a net debt load of $10.4 billion, which is a 13% year-over-year decline, supported by strong free cash flow.

The company generated $800 million in free cash flow, which translates to a conversion rate of 63%, expected to benefit from future improvements in working capital efficiencies (short-term cash requirements for the business).

Speaking of free cash flow and balance sheet health, the company aims to maintain a 40% dividend payout ratio, which would align it with industrial peers and position it “well above” the S&P 500 median.

As annoying as its dividend cut may have been, I think it’s one of the steps that will allow 3M to shine for many years to come, as I already discussed in the lengthy introduction.

Rating agency giant S&P Global agreed with me when it affirmed the company’s BBB+ credit rating on May 8:

The affirmation reflects our view that a reduced dividend will enable 3M to deploy excess cash flow to lower its debt leverage. We believe this robust cash flow cushion will help buffer credit ratios from large calls on cash, including maturities or other potential obligations in the next few years.

[…] Based on the company’s public disclosures, it appears 3M’s dividend could be half its previous level, after spinning out about one-quarter of its EBITDA. 3M Co. received almost $8 billion of proceeds, which we net against our adjusted debt and which helps lower leverage into the 2x-3x range, pro forma the spinoff of Solventum. Furthermore, 3M retains a 19.9% stake in Solventum, which we believe is worth about $2 billion that could be liquidated over a five-year period to generate more cash. – S&P Global

The agency will likely lower its rating for 3M if the net leverage ratio remains above 3x in 2024 or 2025.

The risks of that happening are extremely low, as analysts expect 3M to lower net debt to less than $4 billion by 2026, which would imply a 0.5x leverage ratio.

In general, analysts are upbeat about free cash flow generation, expecting consistent free cash flow in the mid-$3.5 billion range, roughly 6.3% of its market cap.

This supports a 44% dividend payout ratio (in line with the company’s target) and further debt reduction.

With all of this in mind, future growth is expected to massively benefit from a more streamlined portfolio and increasingly efficient supply chains.

During the most recent Wells Fargo Industrial Conference, the company noted it has undertaken one of its largest restructuring efforts, focusing on using data analytics to streamline operations, reduce costs, and enhance efficiency.

This includes reducing overhead costs, improving supply chain management, and aligning resources better with customer needs. So far, the company is pleased with the streamlining efforts.

Regarding its streamlined business model, the company is still a cyclical player. However, it has tailwinds, including its automotive franchise, which has historically outperformed market build rates by 300 to 500 basis points.

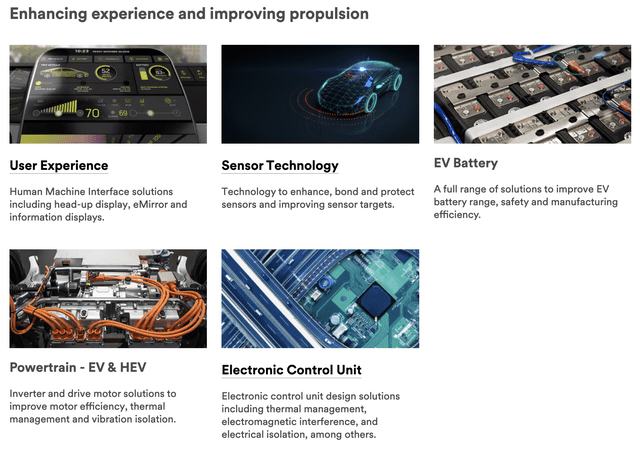

Moreover, 3M is investing in emerging technologies such as auto electrification and climate tech, which are expected to drive future growth.

To add some color, in the first quarter, the company’s auto electrification business grew by 31%. In this business segment, the company works with the Chinese giant BYD Company (OTCPK:BYDDF), one of the most aggressively growing e-mobility giants in the world.

Even in light of mixed industrial demand trends, the company noted that specific areas like roofing granules grew by mid-single digits.

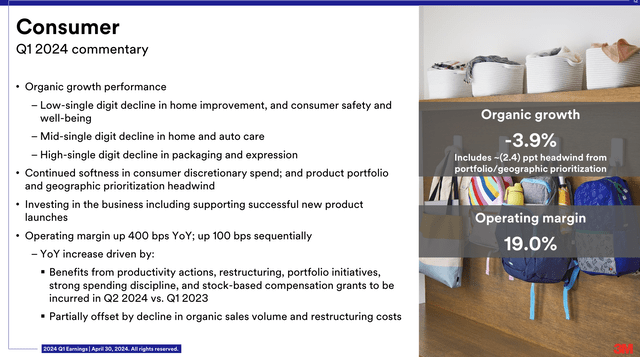

Meanwhile, in its consumer business, the company is focusing on high-performing brands like Filtrete and Command while exiting less profitable product lines.

This way, it can allocate capital more effectively and drive margins.

Essentially, the company is moving from a volume-focused strategy to a quality-focused strategy where profitability and long-term growth are more important than squeezing the most out of every product it had after the Solventum spin-off.

The aforementioned consumer space is a great example of this, as the company grew operating margins by 400 basis points – despite 3.9% lower organic growth.

What does all of this mean for 3M’s outlook?

A Fantastic Valuation

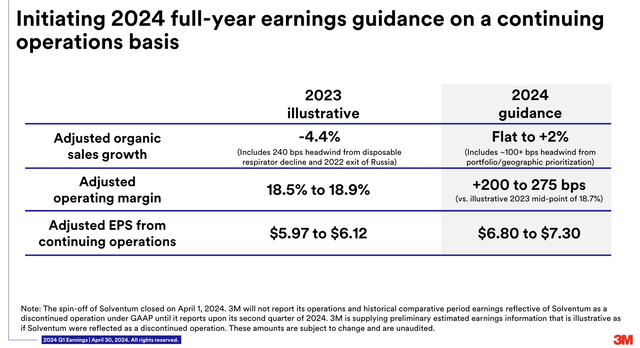

Even in this environment of subdued economic growth (it’s really tough for cyclical industrials), the company has an expected adjusted EPS guidance range of $6.80 to $7.30.

Using the midpoint of that range, we’re looking at 15% growth, supported by operational improvements, strategic cost reduction, and favorable market conditions in certain high-growth areas.

In light of its focus on margins, 2024 guidance calls for at least 200 basis points higher adjusted operating margins, which is impressive.

Looking at the FactSet numbers below, analysts are a bit more upbeat than the company, as 3M has a consensus EPS target of $7.17, slightly about the guidance midpoint of $7.05.

In 2025 and 2026, EPS growth is expected to be 8% and 6%, respectively.

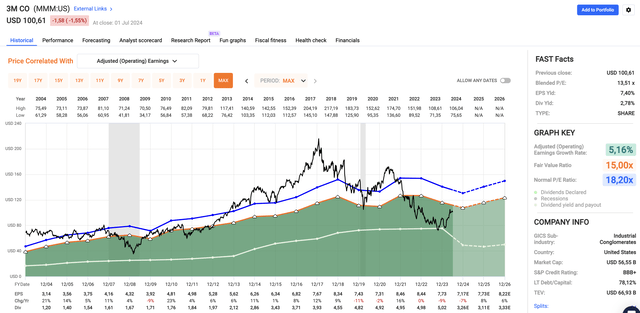

Achieving these growth rates under current conditions would be fantastic, especially because 3M trades at a blended P/E ratio of just 13.5x.

While it will take winning back a lot of confidence to return to its normalized P/E ratio of 18.2x, I’m positive the company will get it done.

This implies a fair stock price target of $149, roughly 50% above the current price.

Especially if we get a bottom in cyclical growth in the next 1–2 years (it could happen much sooner), I expect EPS growth expectations to see meaningful hikes.

Although I completely understand that investors who have been with 3M for a while are disappointed – and this is by no means an attempt to push people into 3M – I consider 3M to be a promising industrial stock.

In fact, I expect 3M to turn into a dividend growth stock again in the years ahead, potentially outperforming the industrial sector (XLI) on a prolonged basis.

Takeaway

Dividend cuts are undeniably tough, but they can sometimes signal the start of something positive.

Investing in dividend growers has historically outperformed the market, while cutters have often done the opposite.

However, exceptions exist.

3M, despite its recent dividend cut, shows promising signs of recovery and growth.

With strategic moves like the Solventum spin-off, debt reduction, and a renewed focus on efficiency and profitability, I believe 3M is positioned for a strong comeback.

While the road ahead may be challenging, I remain optimistic about 3M’s potential to deliver substantial returns and regain its status as a dividend growth stock.

Pros & Cons

Pros:

- Historical Resilience: Despite recent challenges, 3M has a track record of resilience and innovation, resulting in a strong business model.

- Strategic Adjustments: Initiatives like the Solventum spin-off and the sale of lower-margin product lines put 3M in a better spot for elevated EPS growth and debt reduction.

- Strong Market Position: Dominance in critical sectors like automotive and consumer products provides stability and growth potential.

Cons:

- Recent Dividend Cut: The recent dividend cut significantly hurt investor confidence.

- Cyclical Sensitivity: As a cyclical stock, 3M is subject to economic volatility, which impacts shorter-term growth rates.

- Execution Risk: Successfully growing margins and repositioning the company for growth is tough. 3M needs to execute well to maintain its BBB+ credit rating and convince investors it’s capable of rebuilding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.