Summary:

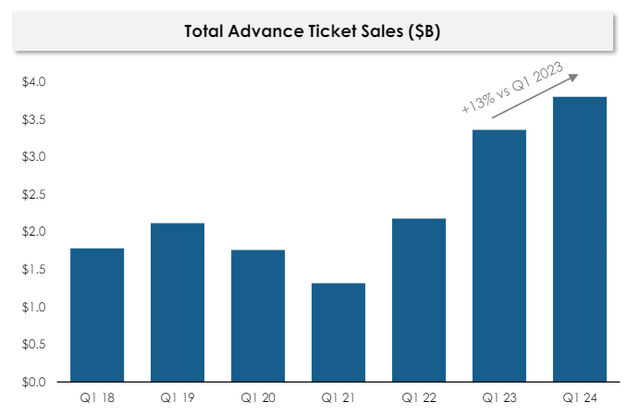

- Norwegian Cruise Line Holdings benefits from pricing strength. Q1’24 advance ticket sales reached a new post-pandemic record of $3.8B.

- The company’s low P/E ratio underprices cyclical profit potential in a rising economy.

- Debt reduction efforts and strong booking trends position Norwegian Cruise Line Holdings for an upside revaluation.

Elena_Sistaliuk

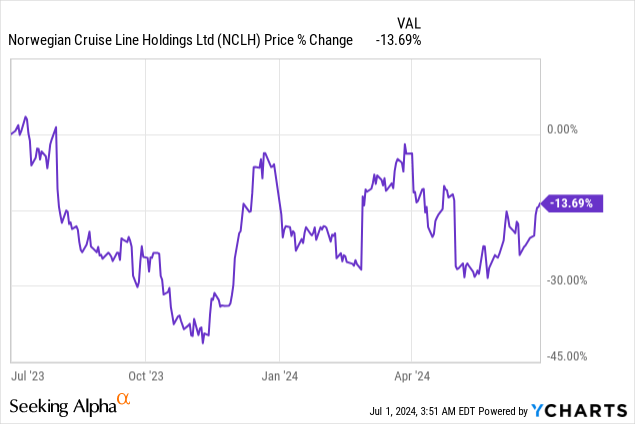

Norwegian Cruise Line Holdings (NYSE:NCLH) continued to benefit from record pricing for its ticket sales in the first-quarter, a trend that likely continued in the second-quarter as well. As a result, the cruise line company has attractive EBITDA upside in the upcoming quarters, in part because the company is applying strict cost controls. With industry projections also calling for a continual rebound in passenger numbers for ocean-going cruises in FY 2024 and the company’s share being unreasonably cheap, I believe Norwegian Cruise Line Holdings has significant upside revaluation potential in FY 2024!

Previous rating

Norwegian Cruise Line Holdings was a buy for me in April as the cruise line company benefited from solid demand for future cruises. With ticket sales seeing continuing pricing strength in the second-quarter and the macro picture holding up well, Norwegian Cruise Line Holdings could be on track to see a new post-pandemic record in cruise bookings in Q2’24. Importantly, shares of Norwegian Cruise Line Holdings continue to trade at a low price-to-earnings ratio that underprices the company’s cyclical profit upside in a rising, spending-driven economy.

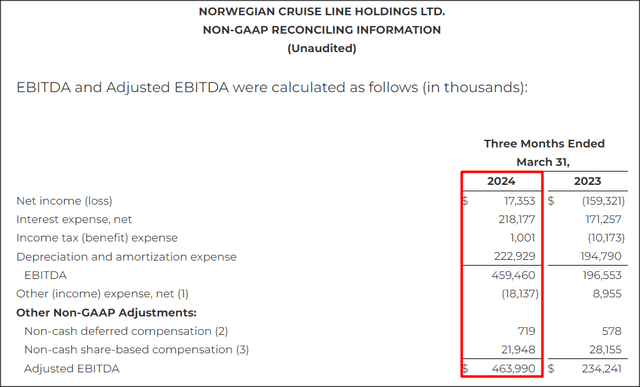

Pricing strength translates to revenue and EBITDA upside

On the back of continual booking strength, in terms of both pricing and volume, Norwegian Cruise Line Holdings has a lever to grow its EBITDA — a key metric for cruise line companies that neglects the impact of capital expenditures and depreciation — at double-digits this year. Norwegian Cruise Line Holdings’ adjusted EBITDA in Q1’24 was reported at $464.0M, showing a year-over-year improvement of 98%… chiefly because of growing passenger numbers and higher average ticket prices. The cruise line company beat its own outlook for Q1’24 adjusted EBITDA (~$450M) by $14.0M as well.

Norwegian Cruise Line Holdings

Up-trending ticket prices and a strict focus on keeping costs in line are the main drivers of EBITDA growth at Norwegian Cruise Line Holdings. Demand for ocean-going cruises is so strong that the company’s ticket sales surged 13% year over year in Q1’24. Bookings are currently at record levels $3.8B and well-exceed the pre-pandemic booking record of FY 2019.

Norwegian Cruise Line Holdings

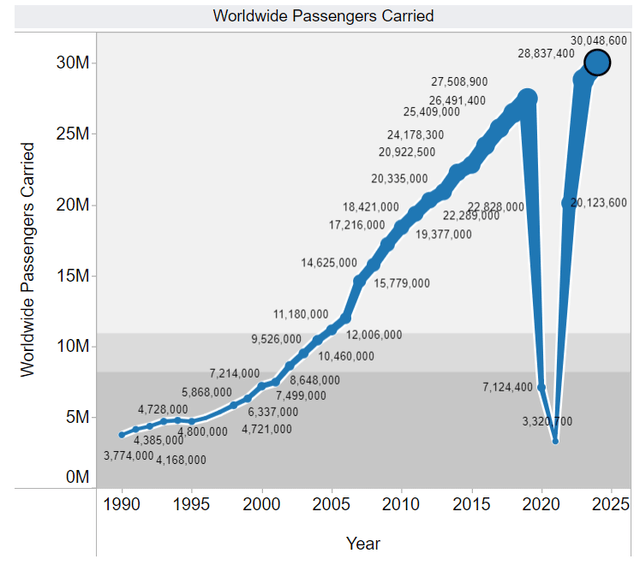

Continual EBITDA growth is the main reason why I believe that Norwegian Cruise Line Holdings can realize upside revaluation gains in the next twelve months, under the condition that cruise line passenger trends continue to point upward. The sector is in a full-swing recovery and appears set to reach a new passenger record in FY 2024: the industry as a whole is expected to accommodate more than 30M passengers this year.

Cruise Market Watch

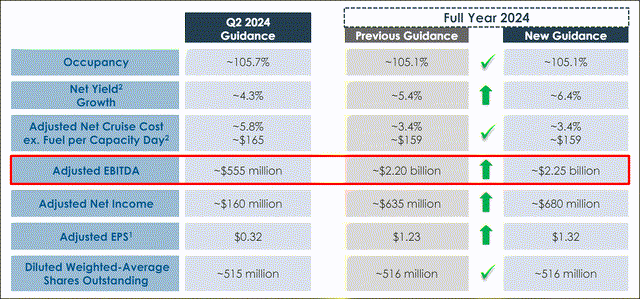

This growth in passenger volume culminates in strong pricing for cruises which in turn has created a bullish outlook for NCLH’s EBITDA prospects: in the last quarter, the cruise line company raised its guidance for adjusted EBITDA from $2.20B to $2.25B which implies a year-over-year EBITDA increase of 21%.

Norwegian Cruise Line Holdings

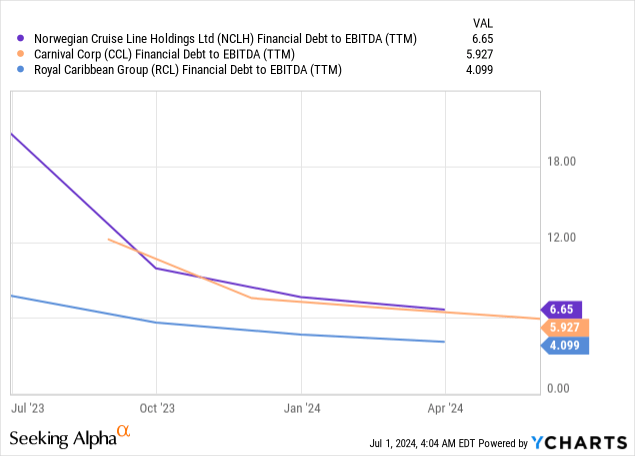

Debt weighing on valuation

As I will discuss in the next section, Norwegian Cruise Line Holdings is a cheap investment in the cruise line sector, and the reason for this is likely the company’s large debt burden it carries on its balance sheet. Norwegian Cruise Line Holdings has the most unfavorable financial-debt-to-EBITDA ratio in the cruise line sector, although the company has made progress in the last year reducing its leverage. Norwegian Cruise Line Holdings currently has a financial-debt-to-EBITDA ratio, on a TTM basis, of 6.65X, which is even higher than Carnival (CCL)’s ratio of 5.9X. Since Carnival is the largest company in the sector, it also had the largest amount of net financial debt on its balance sheet: $27.7B.

Norwegian Cruise Line Holdings’ valuation

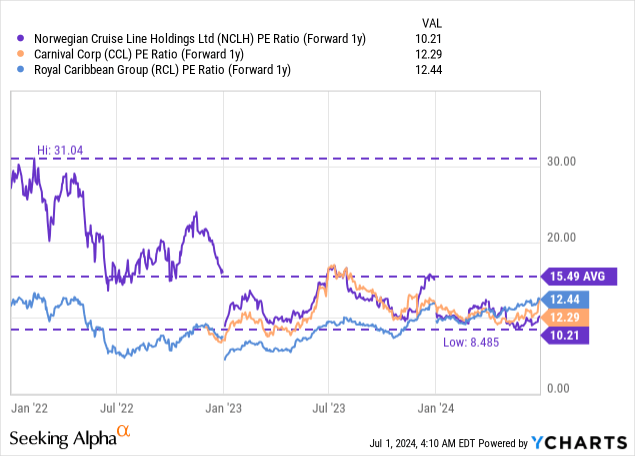

The sector broadly seems cheap and this is especially true for Norwegian Cruise Line Holdings. The cruise line sector currently has a forward P/E ratio, based off of FY 2025 projected earnings, of 11.6X. Norwegian Cruise Line Holdings, Royal Caribbean Group (RCL) and Carnival are trading at P/E ratios of 10.2X, 12.4X and 12.3X with Norwegian Cruise Line Holdings still being the cheapest cruise line play for investors.

Norwegian Cruise Line Holdings was priced at an average 3-year price-to-earnings ratio of 15.50X so investors can buy shares at a decent-sized discount of 34% to the longer-term valuation average. In my last work on the cruise line company, I stated that NCLH could have a fair value of $25, based off of a fair value P/E ratio of 15.0X, which now also corresponds to the firm’s longer term P/E average. I believe the industry passenger outlook, sequential EBITDA gains and booking records could be catalysts for a revaluation to occur in the next twelve months, under the condition that the U.S. economy doesn’t drift into a recession and that NCLH continues to reduce its leverage. A 15.0X P/E ratio implies a fair value of $27.60. The increase in my fair value is due to a rise in FY 2025 consensus EPS estimates (which rose from $1.69 per-share in April to $1.84 per-share).

Risk factors for Norwegian Cruise Line Holdings

NCLH has cyclical profit upside as long as passengers feel they have enough disposable income to go on cruises. However, cruise line companies are dependent on positive consumer spending trends, and re-accelerating inflation or a down-turn in the economy could weigh on spending attitudes and are therefore key risk factors that investors must consider. From an operational perspective, weakening booking trends and lower cruise prices would send a clear warning signal to investors that demand for ocean-going cruises is moderating.

Closing thoughts

Norwegian Cruise Line Holdings has cyclical profit upside in a rising economy that is defined by growing consumer spending. The cruise line company saw continual pricing strength in the first-quarter and I would argue that Norwegian Cruise Line Holdings is headed for a record second-quarter as well due to strong demand for ocean-going cruises.

The biggest advantage for investors, in my opinion, is Norwegian Cruise Line Holdings’ low P/E ratio, which translates to a high safety margin. With a P/E ratio of only 10.2X, shares not only are priced below the longer-term valuation average, but also below the industry group. The company’s debt provides a bit of negative sentiment overhang, but Norwegian Cruise Line Holdings has taken steps to reduce its leverage. More needs to be done, but the trend points in the right direction. Given that NCLH has made progress in terms of reducing its leverage, I believe NCLH remains a highly promising investment in the cruise line industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.