Summary:

- PayPal stock has dropped 10.1% since March 2024, but financial data shows revenue growth, active account stabilization, and increased payment transactions.

- Profits and cash flows have increased, with adjusted earnings per share expected to rise in the mid to high single digits for 2024.

- PayPal is undervalued compared to similar companies, with a strong net cash position, active share buybacks, and growth potential, making it a “strong buy.”

JasonDoiy

In my opinion, one of the most attractive opportunities on the market right now is none other than payment processing behemoth PayPal Holdings (NASDAQ:PYPL). Unfortunately, many investors don’t seem to agree with me at this point in time. Since I last wrote about the company in late March of 2024, ultimately upgrading it to a “strong buy,” shares of the business have pulled back. In fact, they’re down a rather painful 10.1% since then, which is far removed from the 4.3% increase seen by the S&P 500 over the same window of time.

To be clear, I don’t think that all of the pessimism surrounding the company is unwarranted. The business has faced some problems in recent quarters. But to be quite frank with you, it has gotten ridiculous just how cheap the stock is, especially after seeing some more recent financial data provided by the company. Although I don’t own the stock at this point in time, it’s on my short list for leading candidates as I move out of other holdings and into new ones. I do believe that the firm will offer investors strong upside potential from here. So, even in spite of some of the company’s deficiencies, I think that keeping it rated a “strong buy” is only logical.

The picture is still great

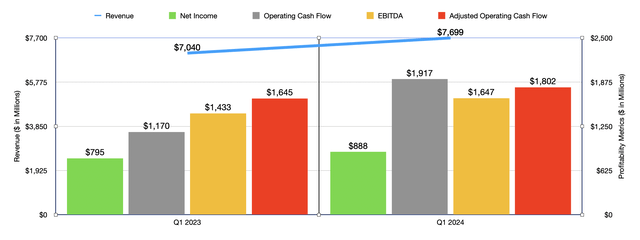

Back when I wrote about PayPal earlier this year, we had data covering through the end of the 2023 fiscal year. That data now extends through the end of the first quarter of 2024. During that quarter, revenue for the company came in at $7.70 billion. That’s 9.4% higher than the $7.04 billion the company generated one year earlier. The big driver behind this move higher was transaction revenue. It managed to pop 10.5% from $6.36 billion to $7.03 billion. Naturally, domestic revenue for the company was weaker than international revenue, growing by only 7.7% at a time when international sales shot up 11.7%. But that’s to be expected for a company that already has a large chunk of a mature market.

Author – SEC EDGAR Data

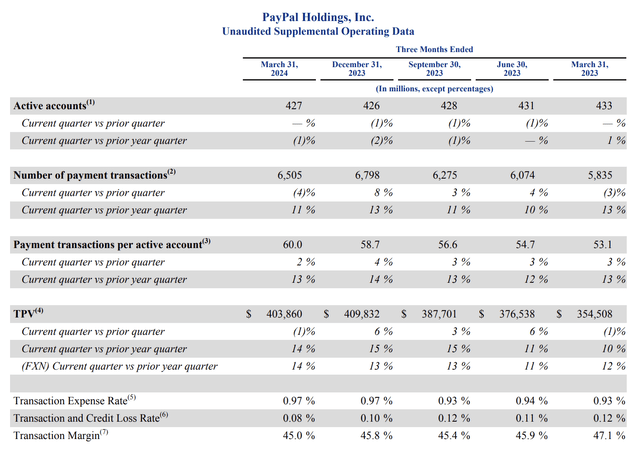

What I found particularly interesting was that PayPal finally saw an uptick in the number of active accounts using its services. You see, in the first quarter of 2023, the firm had 433 million active accounts. This metric fell in each of the subsequent quarters, bottoming out at 426 million active accounts at the end of last year. But finally, in the first quarter of this year, the company saw a modest improvement, with the number of active accounts inching up to 427 million. The consecutive quarterly declines in active account numbers is the one thing that gave me pause about the business. So to see some stabilization here is most certainly encouraging.

In addition to seeing an increase when it came to active accounts, the company also reported a rise in the number of payment transactions processed using its network. Even though it was still down from the 6.8 billion transactions reported in the final quarter of last year, the 6.51 billion reported in the first quarter of this year was still 11.5% above the 5.84 billion the company reported in the first quarter of 2023. What really helped with this was that the firm continues to see an increase in the number of payment transactions per active account. Even though the number of active accounts had fallen in prior quarters, the firm continued to see this number march higher. In the most recent quarter, it stood at 60. That’s up from the 53.1 reported the same time last year. In addition to this, total payment volume on the company’s network expanded from $354.51 billion in the first quarter of 2023 to $403.86 billion in the most recent quarter.

PayPal Holdings

It should come as no surprise, after seeing these numbers, that PayPal would also report a rise in profits and cash flows in response to this. Net income grew from $795 million in the first quarter of last year to $888 million the same time this year. That’s a rise of 11.7% year over year. Other profitability metrics followed a similar trajectory. The most aggressive was operating cash flow, which shot up by 63.8% from $1.17 billion to $1.92 billion. But if we adjust for changes in working capital, we get a more modest increase of 9.5% from $1.65 billion to $1.80 billion. Lastly, EBITDA for the company expanded by 14.9% from $1.43 billion to $1.65 billion.

When it comes to the 2024 fiscal year in its entirety, management did say that adjusted earnings per share will rise somewhere between the mid to high single-digit range. Unfortunately, this doesn’t tell us much about total profitability because of two factors. First, the company did change how it calculates adjusted earnings per share recently. But more importantly, management is very active in buying back stock. During the first quarter alone, the firm bought back $1.5 billion worth of shares, leaving a hefty $9.4 billion remaining under the firm’s current share authorization plan.

Author – SEC EDGAR Data

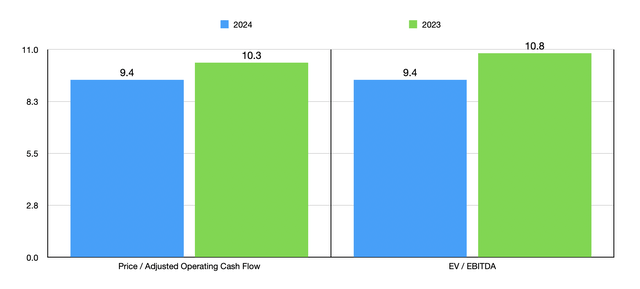

Perhaps a better way of estimating financial performance for 2024 would be to annualize the results experienced so far for the year. This would mean adjusted operating cash flow of about $6.75 billion and EBITDA of $6.26 billion. Using these metrics, as well as historical results from 2023, I was able to value the company as shown in the chart above. As you can see, on a forward basis, the stock is now trading in the single-digit range relative to cash flows and EBITDA. For a firm that’s growing, that has seen some stabilization on its one weak spot, that continues to buy back a great deal of stock, and that is an industry leader, I find this kind of trading multiple to be absurd. Shares are also cheap relative to similar companies, as shown in the table below.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 10.3 | 10.8 |

| Automatic Data Processing (ADP) | 25.0 | 17.3 |

| Fiserv (FI) | 18.7 | 13.4 |

| Fidelity National Information Services (FIS) | 10.5 | 11.8 |

| Global Payments (GPN) | 11.9 | 10.0 |

| Paychex (PAYX) | 21.7 | 17.9 |

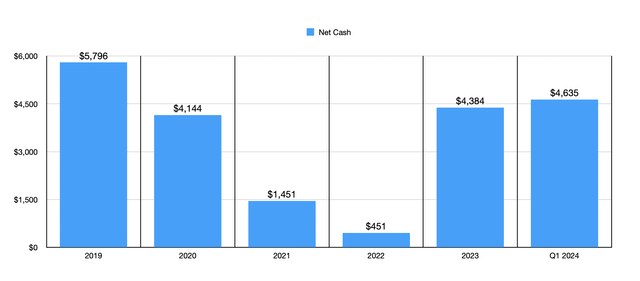

On a price to operating cash flow basis, PayPal ended up being the cheapest between it and five companies similar to it that I compared it to. And when we use the EV to EBITDA approach, only one of the five companies ended up being cheaper than it. It’s also worth noting that, in addition to being a cheap firm that generates significant cash flow and that’s buying back stock, the firm continues to grow its net cash position. At the end of 2021, the firm had net cash of $1.45 billion. This number did fall to $451 million by the end of 2022. But by the end of last year, net cash had skyrocketed to $4.38 billion. Despite the major buybacks, the firm still managed to grow its net cash position to $4.64 billion by the end of the most recent quarter.

Author – SEC EDGAR Data

Takeaway

To be perfectly honest with you, there is not really anything that I’m terribly concerned about when it comes to PayPal at this point in time. The company looks healthy and management has been active in buying back shares. Including the most recent quarter, from 2019 through today, the company has allocated about $16.4 billion to share buybacks. Even so, net cash is larger than any time dating back to 2019. Active account numbers have finally stabilized, at least for now, and those who continue to use the firm’s services are using it at an increasing rate. Add on top of this how cheap the stock is, both on an absolute basis and relative to similar firms, and I cannot help but to keep it rated a “strong buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!