Summary:

- Recent developments, including a joint venture with Volkswagen, have prompted me to upgrade Rivian stock to “Buy”.

- Financial figures for Rivian show improvement in margins and cost-effectiveness, with expectations for reduced cash burn and increased efficiencies.

- The joint venture with Volkswagen provides a significant financial backing for Rivian, potentially delaying cash burn issues and improving solvency.

- The current cash-to-market cap ratio looks good, and since that ratio will only go up after the JV launch, I think RIVN has a good incentive to grow.

- I’m upgrading the stock from “Hold” to “Buy”, as the “game changer” VW gave it seems to be a real one.

RoschetzkyIstockPhoto

Introduction

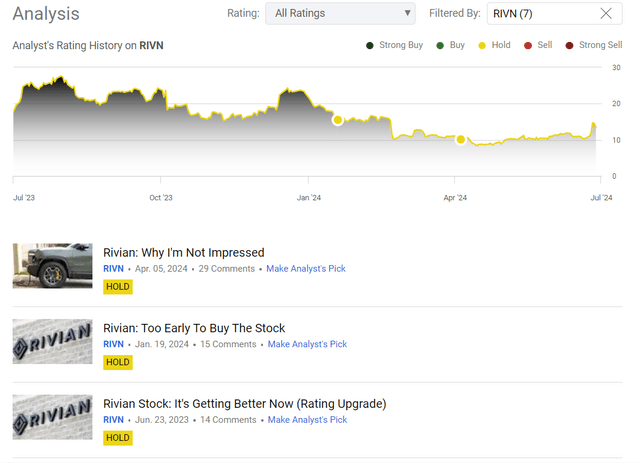

The first time I wrote about Rivian Automotive, Inc. (NASDAQ:RIVN) stock here on Seeking Alpha was in November 2021 – that was an IPO analysis where I concluded that the stock had been overvalued to a great extent at the very beginning of its public journey. It immediately surged after the IPO, and it moved away from logically explainable levels of growth – during that rise, I updated my “Sell” recommendation a few times. The stock started to crater, and I held my “Sell” rating until June 2023 when I upgraded RIVN to “Hold”, thinking that the company’s situation was improving then: Margins were showing clear signs of growth at the time; nevertheless, I couldn’t assign a “Buy” rating due to its high valuation and strong competition risk.

The last time I wrote about RIVN was at the beginning of April. At that time, I wrote that I was not impressed with the company’s results for the fourth quarter of fiscal 2024 as they showed a widening gross loss, raising concerns about the whole business model’s viability.

Seeking Alpha, my coverage of RIVN

However, the latest news surrounding the company now tells me that it might be time to finally upgrade RIVN to “Buy”.

Why Do I Think So?

Before we turn to the news – the main catalyst for my upgrade today – I suggest taking a look at the company’s latest financial figures before that news.

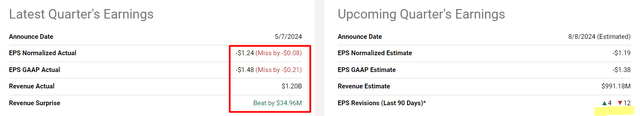

As we know from the press release commentary, a few thousand vehicles that Rivian built during Q1 FY2024 were not counted towards production since they were awaiting parts, impacting Q1 inventory and delaying their inclusion in delivery counts. So the revenue suffered, declining by 2% YoY, but beating the consensus expectation by almost $35 million. Unfortunately, we can’t say the same thing about EPS, which amounted to negative $1.24 per diluted share on an adjusted basis – that was $0.08 less than expected. The drop in the bottom line occurred amid an adjusted EBITDA loss of $798 million – while the EBITDA margin improved by 400 basis points to 8.0%, the firm faced elevated cash usage due to increased accounts receivable and inventory balances. The negative surprise in terms of EPS expectations has prompted Wall Street analysts to lower their estimates for the next few quarters, delaying the prospect of Rivian finally breaking even on the bottom line.

However, management said during the earnings call that it expects a slight cash benefit from working capital for the year, so the expectation that the company will take more time to break even than was expected a few months ago may turn out to be wrong. Rivian has also shared through the same call that they have completed a tooling upgrade for improved cost-effectiveness and are now anticipating “significant cost improvements from R1 engineering design changes and new supplier components.” The company also looks to reduce gross inventory by >25% over the next 1.5 years and expects lower variable costs to drive gross profit improvement throughout FY2024. So on the back of it all, Rivian reiterated its FY2024 production guidance of 57,000 vehicles and adjusted EBITDA guidance of negative $2.7 billion. This makes me more confident that the revised estimates for the next few years were probably an overreaction – in any case, the management’s expectations did not directly indicate that analysts had to do it.

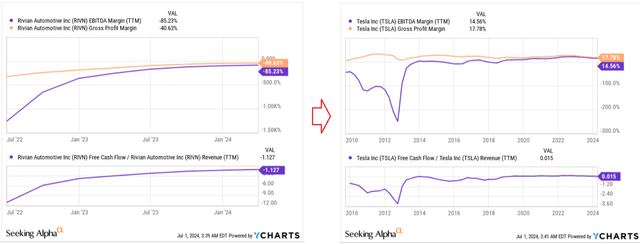

Speaking about guidance, Rivian’s management reduced the FY2024 CAPEX forecast by $550 million to just $1.2 billion, with further reductions expected in FY2025. The long-term targets still speak of a 25% gross margin, high-teens adjusted EBITDA margin, and a 10% FCF margin. These numbers are similar to what we saw at the peak of Tesla (TSLA), which means they could be feasible if the company’s product remains competitive over time.

And now we come to news that revives the RIVN bulls and might actually give Rivian a chance in this ongoing EV race.

Seeking Alpha reported on June 25, 2024, that Volkswagen (OTCPK:VWAGY) and Rivian have announced an agreement for VW to invest in Rivian and the creation of a joint venture to develop electrical/electronic architecture technology on a 50-50 basis. Based on currently available information, Volkswagen will make an initial $1 billion investment in Rivian as a convertible note with the possibility for further investments which may cumulatively amount to ~$5 billion. This includes $1 billion at the inception of the joint venture in 2024, with additional spending of $1 billion each year in 2025 and 2026 coupled with a loan worth $1 billion which is expected by the 5th year. The deal is set to be signed off towards Q4 2024 pending further reviews and regulatory approvals so that it can avail cost savings therefrom, thus financing Rivian’s R2 model launch together with its medium-sized skateboard platform. Management would consist of two Co-CEOs appointed by Rivian for technical direction and Volkswagen for the COO post.

Why it’s important?

I believe this move by VW-Rivian is a game changer for Rivian for various reasons. To start with, the structure of the JV enables $2 billion in investments to go straight into Rivian’s balance sheet. Many skeptics, myself included, have long worried about what would happen to Rivian’s cash cushion if the company continues to burn as much cash as it has. Now it’s obvious that the joint venture is giving RIVN a big financial backing, which should automatically delay the emergence of these currently irrelevant issues for a couple of years.

Rivian will also name the technical director of the joint venture after it licenses its current electrical architecture IP to the venture. The main goal of this partnership is to reduce vehicle costs, particularly in electronic control units (ECUs), previously estimated at ~$2000 per vehicle (based on Goldman Sachs data, proprietary source). Rivian anticipates that it will be able to fund the operation of the R2 ramp at Normal and the mid-size platform at Georgia beyond previous projections thanks to the financial support of the JV. The initial investment of $1 billion will be converted into equity, resulting in an immediate reduction in cash burn.

In addition, this alliance aims to reduce capital expenditures and increase efficiencies so that Rivian can achieve a positive gross margin by Q4 2024, improving its solvency or marketability position financially speaking.

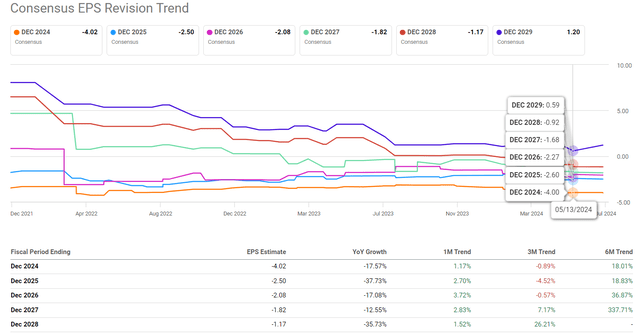

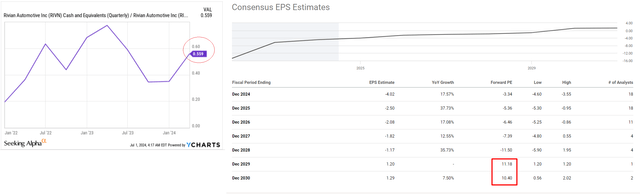

With all this in mind, you might think that the market would quickly adapt to the new information, and Wall Street analysts would quickly revise their estimates for the 2024-2027 financial year upwards. But in reality, that hasn’t happened – the only projection that changed meaningfully was FY2027 EPS:

I think the market is still slow because it is quite difficult to quantify the new JV in the forecasts. But I definitely expect positive changes in terms of projected EPS, which hasn’t happened yet – once it does, I think it will be a new catalyst for RIVN stock growth.

It’s challenging for me to say that the company is undervalued. The first positive EPS is expected to emerge only in FY2029, but considering my forecast that EPS estimates will likely increase, Wall Street may soon start anticipating a break-even point around FY2027 instead of FY2029. This scenario would significantly reduce uncertainty, which is a positive sign for the stock. Additionally, the company is currently trading at ~56% of its cash balance to market cap – as Rivian’s liquidity improves with the new deal with Volkswagen, this ratio should increase, providing a fresh incentive for stock growth, in my view.

Seeking Alpha, YCharts data, the author’s notes

That’s why I decided to finally upgrade the stock to “Buy” today.

Where Can I Be Wrong?

The biggest risk in my forecasts today is that the company is still deeply unprofitable. In addition, the general uncertainty in the industry suggests that this unprofitability could last much longer than I have estimated.

The U.S. government’s tariffs are intended to protect American car manufacturers from Chinese competition, so these tariffs should benefit Rivian by helping to boost domestic sales. However, outside the US, such as in China – one of the key markets for their competitor Tesla – I think Rivian will face major challenges to gain market share. Therefore, there is a risk that Rivian will have little chance to expand outside America.

And of course: the lack of positive earnings (forecasted) until 2029 makes my statements that RIVN stock could grow higher very risky: even if the expectation of the breakeven event is shifted from 2029 to 2027, this still means that there’s uncertainty about the sustainability of Rivian’s business model.

The Bottom Line

Despite the many risks surrounding the company and the uncertainty about its future earnings, I believe that RIVN deserves an upgrade today, as the effects of the joint venture with Volkswagen point to improved liquidity as well as an increased chance of achieving its goals regarding the development and sales launch of new models.

Yes, the company’s valuation is under fire because even on next year’s basis the firm isn’t expected to be EPS positive, but still, the current cash-to-market cap ratio looks good, and since that ratio will only go up after the JV launch, I think RIVN has a good incentive to grow.

I’m upgrading the stock from “Hold” to “Buy”, as the “game changer” VW gave it seems to be a real one.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!