Summary:

- Devon Energy is a large player in the oil and gas market with a market capitalization of $28.88 billion.

- Despite recent share price declines, company fundamentals remain strong with increased production guidance and cost reductions.

- Valuation metrics show Devon Energy is attractively priced compared to similar firms, with low leverage and a stable oil price outlook.

zhengzaishuru

With a market capitalization of $28.88 billion as of this writing, Devon Energy (NYSE:DVN) is quite a large player in the oil and gas exploration and production market. With this size comes a degree of stability that is uncommon with much smaller players in the industry. But fundamental stability should not be conflated with share price stability. The fact of the matter is that, over the past few months, things have not been particularly pleasant for this company.

As an example, we need only look at share price performance from late March of this year through today. Back then, I wrote a bullish article about the company, even calling it a cash cow and saying that investors would be wise to take it into consideration as a real prospect. Even though I rated the company a ‘buy’ because of these factors, shares have seen nothing but downside since. The stock is actually down 6.2% since that article was published. That’s far worse than the 5.2% increase seen by the S&P 500 over the same window of time.

Given this significant return disparity, you might think that there was something fundamentally wrong with the company. But that does not appear to be the case. In fact, when management announced financial results for the first quarter of 2024, they increased guidance for the year as a whole. Admittedly, there is some concern about oil prices as OPEC+ nations begin curtailing their production cuts later this year. But the oil production data provided by OPEC suggests that the market can absorb that extra output without fearing over supply. At the end of the day, this makes me believe that the market is being irrational. And with how much I liked the company in my last article, I like it even more now.

Some revisions

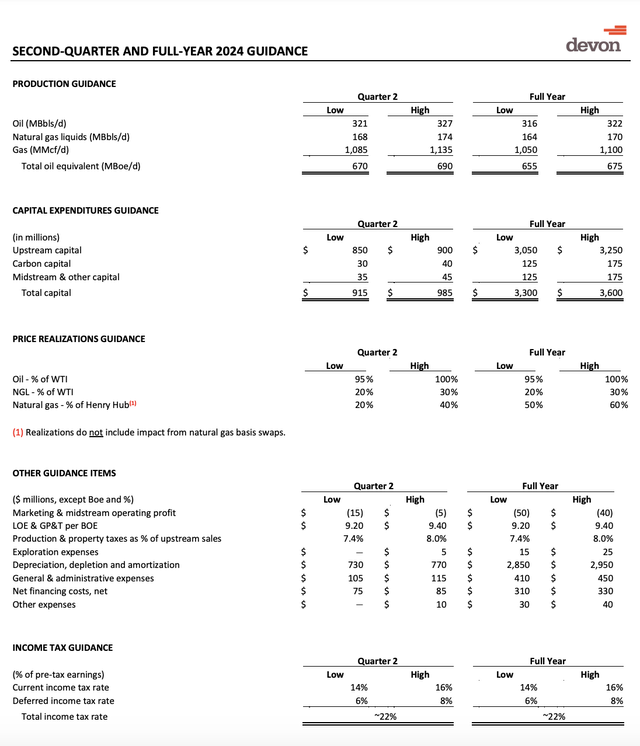

In looking over the guidance data provided by management, I did notice some differences from initial guidance provided for this year that was released at the end of the 2023 fiscal year and guidance that came out in the first quarter of this year that management provided to investors in April. Previously, management had forecasted between 640,000 and 660,000 boe (barrels of oil equivalent) per day for this year. Guidance now calls for this to be between 655,000 and 675,000 boe per day. At the midpoint, this would be 242.725 million boe of oil, natural gas, and NGLs. That’s 2.3% higher than the 237.25 million boe previously forecasted.

There have been some other guidance changes as well. Although not a cash-based item, depreciation, depletion, and amortization is still a very real expense for a company. This number has now dropped from $12.22 per boe to $11.95 per boe. Meanwhile, general and administrative costs have been revised lower from $1.81 per boe to $1.77 per boe. While this may not seem like much, when applied to the total expected production for the company for this year, it should translate to an extra $75.2 million in pre-tax profits accruing to shareholders throughout the year. This has been offset to some extent by the expectation that other miscellaneous expenses should now come in at around $35 million, compared to $20 million that management had previously forecasted.

As part of my analysis of the company, I have also decided to revise higher my own expectations regarding the price at which oil, natural gas, and NGLs should ultimately trade for. In my prior analysis, because of where energy prices were, I assumed that WTI crude would average around $75 per barrel this year. I am now increasing that to $80 per barrel. Even though WTI crude prices were higher than this when I wrote my last article, the fact that we have remained pretty consistently above the $80 handle since then has given me some confidence. I also increased my price point for natural gas from $2 per Mcf to $2.50 per Mcf. At the time that I wrote about Devon Energy earlier this year, prices were at $1.46 per Mcf. Today, they are just shy of $3.

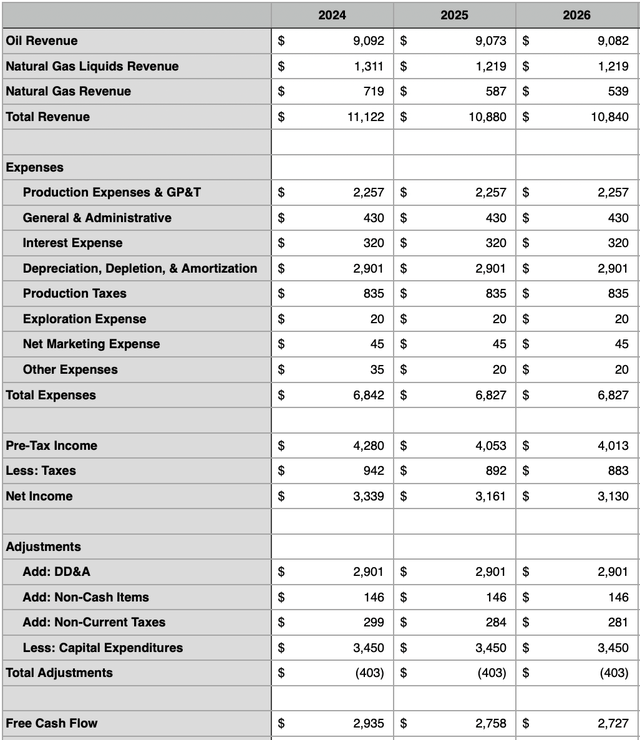

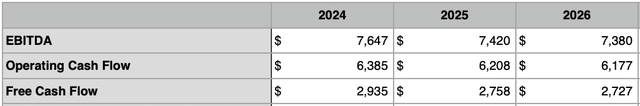

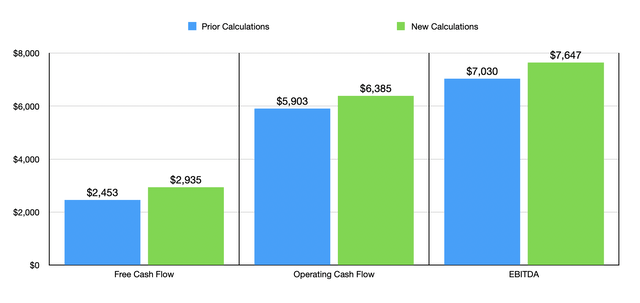

Taking all of these changes, I was able to create the table above. This table assumes that production for the company will remain flat over the three-year window covered. As you can see, free cash flow should come in at around $2.94 billion this year. This is actually up quite a bit from the $2.45 billion that I calculated in my prior article. In the table below, you can also see operating cash flow and EBITDA for the company set beside the free cash flow figures for it. Operating cash flow should be around $6.39 billion. That’s up significantly from the $5.90 billion my previous forecast called for. And finally, EBITDA should be around $7.65 billion. That compares favorably to the $7.03 billion previously forecasted.

The data in these tables shows a natural decline in cash flow figures for the company from 2024 to 2025, and again from 2025 to 2026. Even though output is expected to remain unchanged, this drop is due to differences in the firm’s hedging portfolio. In some cases, hedging can hurt a company. But in this case, the hedging that is occurring this year and next is expected to temporarily boost the company’s cash flows compared to what things would look like if the firm was not hedged.

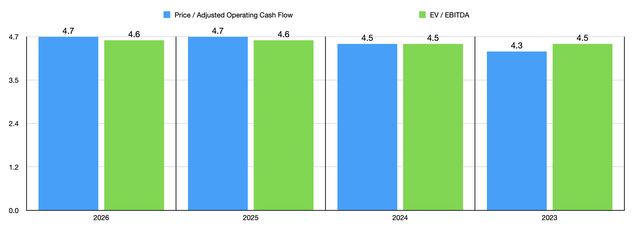

In the chart below, you can see what these cash flows mean for the company from a valuation perspective. This particular table covers data for the 2024 fiscal year, as well as for 2025 and 2026. It also covers the valuation of the company using historical data from 2023. If we stick to the 2024 figures, the firm is trading at a price to adjusted operating cash flow multiple of 4.5 and at an EV to EBITDA multiple of 4.5. These are nearly identical to the 4.3 and 4.5, respectively, that we get when using data from 2023. Many of the oil and gas companies that I have seen over the past year typically trade at EV to EBITDA multiples of between 4 and 6. So at this point in time, Devon Energy is near the lower end of that scale.

As part of my analysis, in the table below, I decided to compare Devon Energy to five similar enterprises. What I found was that, on a price to operating cash flow basis, only one of the five companies was cheaper than Devon Energy. And when it came to the EV to EBITDA approach, our candidate ended up being the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Devon Energy | 4.5 | 4.5 |

| Diamondback Energy (FANG) | 5.8 | 6.4 |

| Coterra Energy (CTRA) | 6.7 | 6.0 |

| Texas Pacific Land Corporation (TPL) | 39.2 | 31.6 |

| EQT Corporation (EQT) | 6.0 | 8.0 |

| Marathon Oil Corporation (MRO) | 4.1 | 4.7 |

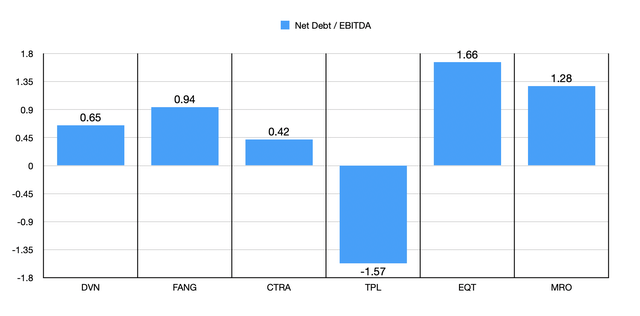

Of course, valuation is only one piece of the equation. We also need to look at the overall risk profile of the business in question. Perhaps the easiest way to do this is to look at leverage. The net leverage ratio for Devon Energy is quite low at 0.65. Typically, the market wants to see this number come in at 2 or lower. This means that our candidate has quite a bit of wiggle room. In the chart below, you can see that two of the five companies I compared it to have leverage that is lower than it. The other three are higher. This places Devon Energy on solid footing, not only on an absolute basis, but also relative to comparable firms.

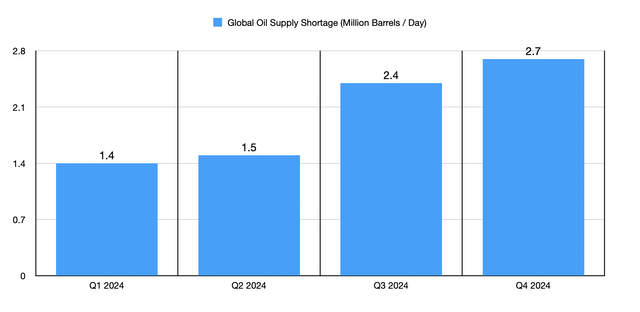

Even though it’s not the primary focus of this article, I don’t think it would hurt to discuss, briefly, concerns about oil prices moving forward. Earlier this year, OPEC+ announced that it would be scaling back on its 2.2 million barrels-per-day production cuts come October of this year. That is a tremendous amount of oil that will come onto the market. However, the countries involved in this agreement stated that they will phase out the cuts over the span of a year. In the chart below, you can see, based on the assumption that no cuts take place, how much of a daily oil shortfall OPEC has forecasted for each of the quarters this year. By the final quarter of this year, we are looking at a shortfall of 2.7 million barrels per day. So even if they were to let all of this oil flood onto the market at once, I don’t see energy prices falling materially from here. That should most certainly bode well for Devon Energy and its peers.

Takeaway

Based on the data provided, I must say that I remain impressed by Devon Energy. Management decided to increase guidance when it comes to production while decreasing certain cost items. The company as a whole is healthy and the changes reflected in my model suggests that significant cash flows should be the end result. On an absolute basis and relative to similar firms, Devon Energy looks attractively priced as well. Meanwhile, leverage is well under control and there is no strong evidence that we should see oil prices plummet for the foreseeable future. When you put all of this together, it’s difficult not to rate the company a rather solid ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!