Summary:

- ROKU continues to underperform the wider market as the FTC investigates the WMT-VZIO deal.

- Even so, we believe that opportunistic investors may continue to buy the dip, with ROKU still reporting improving profitability metrics while growing streaming market share.

- Combined with the management’s strategic efforts in advertising and the sports live streaming, we believe that the upcoming FQ2’24 earnings call is likely to be a potential beat and raise.

- ROKU is also attractively valued compared to its peers, thanks to the recent pullback and the projected accelerated bottom-line growth through FY2026.

- Combined with the robust support at the $52 support levels, we believe that it remains a compelling Buy for growth oriented investors.

SvetaZi

We previously covered Roku (NASDAQ:ROKU) in March 2024, discussing why we had rated the stock as a Buy, with the recent pullback offering interested investors with an improved margin of safety as the management continued to execute improved margins in FY2023 and reiterate positive profit margins in FY2024.

At the same time, we believed that the recent sell-off arising from the Walmart (WMT) – Vizio (VZIO) deal had been overly done, since ROKU continued to benefit from the secular transition from TV Media to streaming as more platforms offered ad-supported tiers and reported improved monetization.

Since then, ROKU has further retraced by -6.1%, well underperforming the wider market at +4.1%. Even so, we are reiterating our Buy rating, with the recent Nielsen report highlighting the platform’s growing streaming market share.

Combined with the strategic sports/ advertiser partnerships thus far, we believe that it remains well positioned to grow profitably moving forward, with it likely to translate into the stock’s potential capital appreciation ahead.

We shall further discuss the few metrics readers may want to look at as we near ROKU’s FQ2’24 earnings call.

Roku’s Turnaround Is Already Here

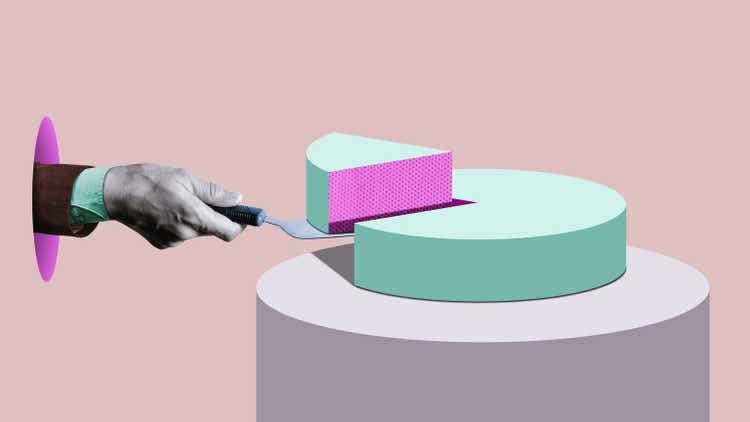

ROKU 6Y Stock Price

TradingView

ROKU has had an amazing run during the pandemic, which then evaporated after sentiments normalize from 2022 onwards. Even now, the stock struggles to make headways as it remains GAAP unprofitable while currently being challenged by the potential WMT-VZIO acquisition.

With the company set to announce their upcoming FQ2’24 earnings call on July 25, 2024, we shall highlight a few metrics readers may want to look out for.

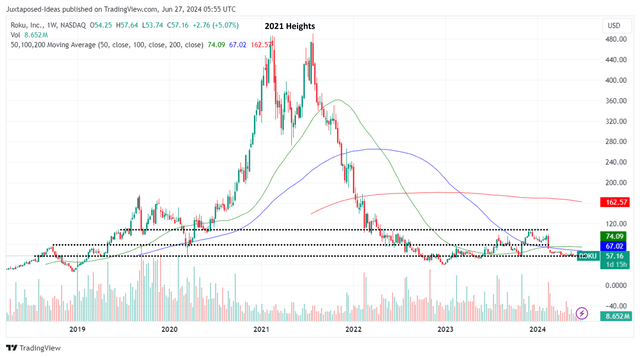

1. ROKU’s Streaming Viewing Share & Advertising Opportunities

Shift In TV Viewing

Nielsen

As of May 2024, ROKU continues to gain in streaming share to 1.5% (+0.1 points MoM/ +0.4 YoY), up from the 1.2% reported in the last article (February 2024).

Combined with the growing streaming share of 38.8% (+0.4 points MoM/ +2.4 YoY), it is apparent that the secular transition from TV Media to streaming is still ongoing.

As a result, we believe that ROKU’s FQ2’24 revenue guidance of $935M (+6% QoQ/ +10.3% YoY), gross profit guidance of $410M (+5.5% QoQ/ +8.3% YoY), and adj EBITDA guidance of $30M (-26.6% QoQ/ +268.5% YoY) are not overly aggressive indeed.

This is especially since the advertising market trend remains robust, with the management already hinting that they expect Q2 advertising revenue growth to continue improving on a QoQ and YoY basis.

The same has been highlighted by multiple streaming giants, with Alphabet (GOOG) highlighting that “YouTube ads revenues were up 21% year-on-year” in Q1’24, with Disney (DIS) also reporting increased opportunities through sports live streaming.

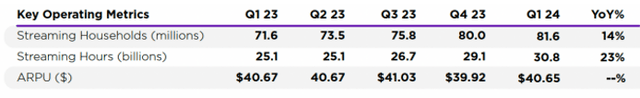

ROKU’s Operating Metrics

ROKU

With ROKU similarly tapping into the sports content categories and sports-oriented advertisers, we believe that the company remains well positioned during the secular transition, attributed to the highly successful Sports Zone and partnerships with multiple brands, such as NFL, Super Bowl, and NBA, amongst others.

For example, the management has highlighted that the recent Super Bowl LVIII in February 2024 has attracted the largest US TV audience on record, with over a fifth of viewers streaming through the ROKU TV platform while contributing to the FQ1’24’s robust performance metrics.

Impressive indeed, since ROKU has also recently launched the NBA Zone in April 2024, right on time for the 2024 NBA Draft occurring in June and Summer Leagues in July, further underscoring its ability to opportunistically drive viewership ahead.

2. WMT – Vizio Deal May Not Go Through After All

For reference, ROKU had lost -32% of its value as WMT announced its intentions to acquire VZIO in February 2024, with it triggering concerns of intensifying streaming hardware competition, along with the potential end of the Onn Roku TV partnership.

Since then, our hypothesis has come true, with the FTC launching an in-depth antitrust review against the deal by April 2024, with it potentially triggering a prolonged regulatory process lasting for months, if not years.

With an uncertain resolution and more and more mega deals terminated thus far, we believe that it is too early to discount ROKU’s near-term prospects, especially since VZIO’s 18.6M users pale in comparison to the former’s 81.6M.

Moving forward, we maintain our belief that the Connected TV market remains big enough to accommodate multiple players, with Statista highlighting that up to 88% of the US households own at least one internet connected TV device in 2023, with eMarketer projecting up to $40.9B in the US CTV ad spending by 2027, expanding at a CAGR of +12.9%.

It goes without saying that the sell-off has been unjustified, especially due to ROKU’s robust performance metrics discussed above.

3. ROKU Is Still Attractively Valued Compared To Its Peers – Thanks To The Robust Profitability Prospects

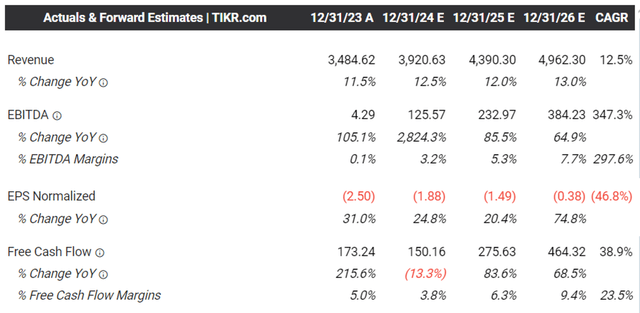

The Consensus Forward Estimates

Seeking Alpha

For now, ROKU’s top/ bottom-line projections remain largely stable, with the company still expected to chart low double digit top line growths while generating robust adj EBITDA and Free Cash Flows through FY2026, implying its ability to grow on a sustainable and profitable basis.

These numbers do not appear to be overly ambitious as well, based on the robust performance observed over the past year, with the management’s strategic efforts continuing to drive incremental growth in streaming share, allowing the platform to consistently grow its advertiser base and eventually, top/ bottom-lines.

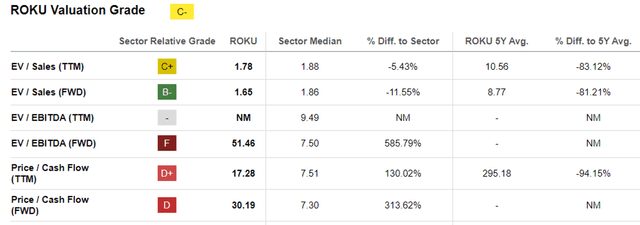

ROKU Valuations

Seeking Alpha

Even so, it is undeniable that the market remains uncertain about ROKU’s prospects, as observed in its consistently discounted FWD EV/ EBITDA valuations of 51.46x and FWD Price/ Cash Flow valuations of 30.19x, compared to the previous article at 82.13x and 35.54x, respectively.

However, when compared to its:

- direct hardware peers, such as VZIO at 30.72x/ NA (adj EBITDA growth at a CAGR of +40.2% through FY2026),

- direct streaming peers, such as Netflix (NFLX) at 28.72x/ 43.72x (+24.1%),

- well diversified tech/ streaming peers, such as GOOG’s YouTube at 15.16x/ 18.14x (+16.3%), Amazon’s Prime Video (AMZN) at 14.66x/ 15.52x (+20.1%), DIS’ Disney+ at 12.99x/ 16.72x (+8.1%),

- media giants, such as Max (WBD) at 6.02x/ 2.47x (-0.4%), Paramount (PARA) at 7.21x/ 11.10x (+10.5%), and Peacock (CMCSA) at 6.30x/ 5.19x (+2.4%), respectively,

it is apparent that ROKU is trading at a relatively reasonable valuation here, when comparing its projected bottom-line expansion (adj EBITDA) at an accelerated CAGR of +347.3% to its peers.

This is especially since the management continues to reiterate their confidence in accelerating “the growth of Platform revenue and continue to grow Adjusted EBITDA, and Free Cash Flow in 2025 and beyond,” building upon the profitability trend observed over the past three consecutive quarters thus far.

So, Is ROKU Stock A Buy, Sell, Or Hold?

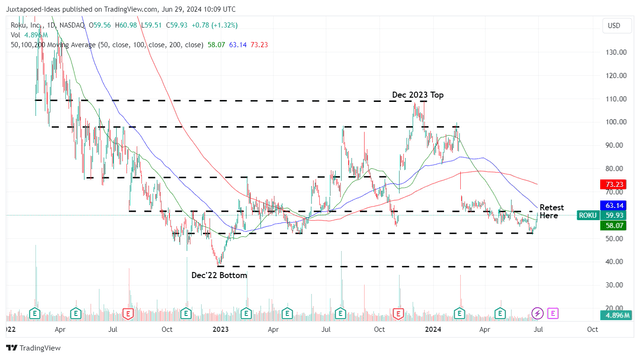

ROKU 2Y Stock Price

TradingView

For now, ROKU continues to retrace since the December 2023 top and the WMT – VZIO induced pullback, with the stock recently retesting its previous support levels of $52 while successfully bouncing off those levels.

Based on the LTM adj EBITDA of $114.2M (+154.1% sequentially) and the FQ1’24 shares outstanding of 143.75M, we are looking at a LTM adj EBITDA generation of $0.79 (+152.6% sequentially).

Combined with the FWD EV/ EBITDA valuation of 51.46x, it appears that ROKU is trading at a notable premium of +47.6% to our fair value estimates of $40.60.

However, based on a similar calculation method using the consensus FY2025 adj EBITDA estimates of $232.97M, we are looking at an estimated adj EBITDA per share of $1.62 (expanding at a 2Y CAGR of +43.2%) and a resultant intermediate-term price target of $83.30.

With the latter implying an excellent +38.9% upside potential from current levels, thanks to the recent pullback, we believe that ROKU continues to offer a compelling investment thesis here, significantly aided by the recent bounce observed in the $52 support levels as the bulls buy the dip.

As a result of the robust support at these levels and the highly attractive risk/ reward ratio, we are reiterating our Buy rating for the ROKU stock here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.