Summary:

- Snap has experienced a surprising turnaround in revenue growth, recovering from previous losses and stabilizing its stock price.

- Despite stronger revenue growth, Snap’s core problem of sluggish user growth in the U.S. and Europe remains.

- Over the long run, Snap’s ability to continue its revenue growth pace will be predicated on its ability to attract and retain its users.

- Elevated adjusted EBITDA and revenue multiples, amid a period of heavy investments in infrastructure, also keep me on the sidelines with a Sell rating.

Wachiwit

Under pressure for most of the year, Snap (NYSE:SNAP) has made a surprising and recent turnaround. The social media company, once best known for its disappearing chat messages, has achieved substantial re-acceleration in revenue growth after investors had long thought Snap’s best days were behind it.

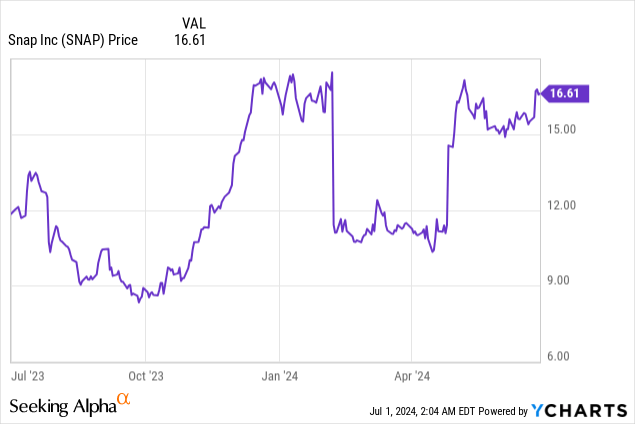

Snap’s stock has been remarkably volatile this year: the company fell sharply after Q4 results and a weakened growth profile, and rallied back to recover all of those losses in its Q1 earnings print. The stock has stabilized in the high teens and is roughly ~flat year to date. Now assessing Snap amid the volatility, however, I continue to see few reasons to remain invested in this stock for the long term.

Acceleration in revenue growth may be short-lived if user growth doesn’t pick up pace

I last wrote a bearish opinion on Snap in March, when the stock was trading in the low teens. While I acknowledge that my bearish call was premature, and I certainly didn’t foresee the revenue acceleration in Q1, in my view, the core issues of this company still remain ever-present.

While Snap continues to grow DAUs, it’s not growing in the U.S. nor in Europe, which are its highest-revenue generating regions. Add that to the fact that revenue growth is also outstripping both DAU growth and impressions growth, and we have a formula for an unsustainable growth pattern. Yes, Snap may benefit in the short-term from driving up prices on ads and driving better engagement with its advertisers, but its long-run growth will be ultimately predicated on how many users it can attract and retain. With this in mind, I’m reiterating my sell rating on Snap.

Outside of sluggish growth in the high-ARPU North American region, here are all of the other key reasons to be wary of Snap:

- Social media is fad-driven. More to the point above, Snap is always at risk of a newer and more in-the-moment platform (like TikTok) taking over eyeball share and stealing users away, perhaps permanently. Snap doesn’t have the same messaging/connecting-with-old-friends appeal that Facebook and Instagram do, putting it at risk of obsolescence.

- Enormous infrastructure costs. Snap’s investments in machine learning have dramatically increased its server costs, which have taken a hit to gross margins and overall profitability. It has introduced a new metric, infrastructure cost per DAU, which is just under $1 – almost the ARPU itself of a user in the “Rest of World” region.

- Net debt. Unlike many mid-large cap tech peers, Snap is actually in a net debt position. Snap is investing in a number of initiatives, including augmented reality, virtual reality, new app features, and an upgraded advertiser platform: it may be spreading its resources too thin.

While improved revenue growth is certainly a positive that I won’t ignore, it’s difficult for me to see Snap rallying beyond this point as it works an uphill battle to sustain high-teens revenue growth amid sluggish user growth.

Valuation checkup

Moreover, amid Snap’s latest rally, we can no longer make the argument that Snap is cheap – which was one thing the stock had going for it after it crashed in February.

At current share prices near $17, Snap trades at a market cap of $27.59 billion. After we net off the $2.91 billion of cash and $3.30 billion of convertible debt on Snap’s most recent balance sheet, the company’s resulting enterprise value is $27.98 billion.

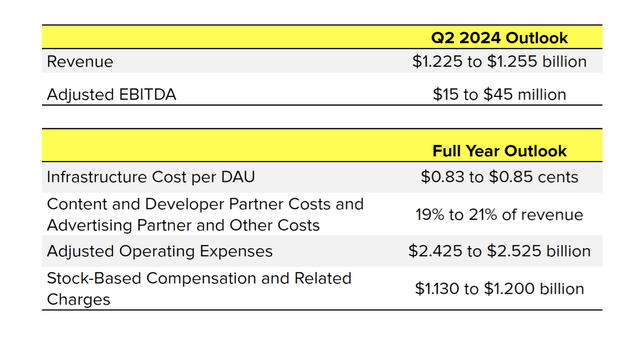

The big catalyst that moved Snap’s stock skyward was its latest outlook, which called for 18% revenue growth in Q2 (sustaining the re-accelerated growth pace it set in Q1). For the full year, the company has not guided to revenue or adjusted EBITDA, but consensus is calling for $5.37 billion in revenue: or 25% growth, which is higher than growth rates in either Q1 or the company’s guidance in Q2.

Snap outlook (Snap Q1 shareholder letter)

Nevertheless, if we take consensus at face value, Snap trades at 5.2x EV/FY25 revenue.

And if we assume an 9% adjusted EBITDA margin on this revenue profile (which represents 5 points of y/y margin expansion, in line with Q1 actuals and what Q2 guidance implies in y/y margin expansion), we get adjusted EBITDA of $483.3 million (roughly ~tripling y/y) and a multiple of 58x EV/FY25 adjusted EBITDA.

It’s clear that Snap’s valuations are relying on a lot of future wins, including a realization of benefits and moderation from the company’s current infrastructure investments. In my view, I’m not confident that the company can sustain its growth trajectory, especially since recent COVID-era trends have shown us that advertiser demand can be incredibly fickle.

Q1 download

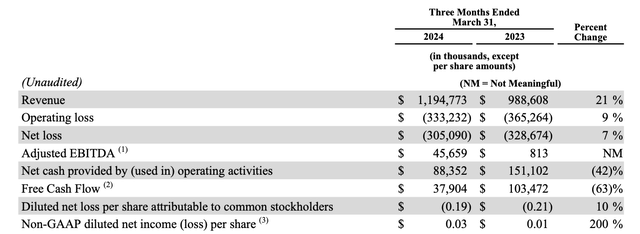

This being said, we certainly must acknowledge the strengths that Snap has exhibited in its Q1 results. The Q1 earnings summary is shown below:

Snap Q1 summary (Snap Q1 shareholder letter)

Revenue soared 21% y/y to $1.19 billion, well ahead of Wall Street’s expectations of $1.12 billion (+13% y/y) and accelerating sharply over 5% y/y growth in Q4.

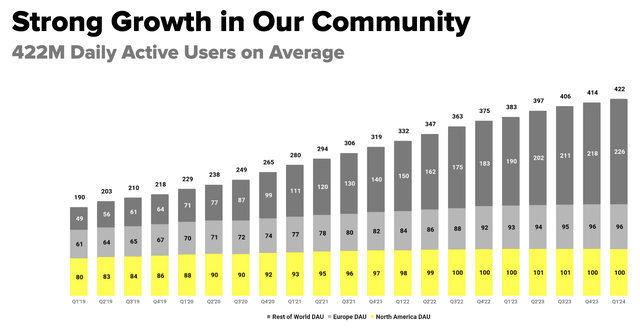

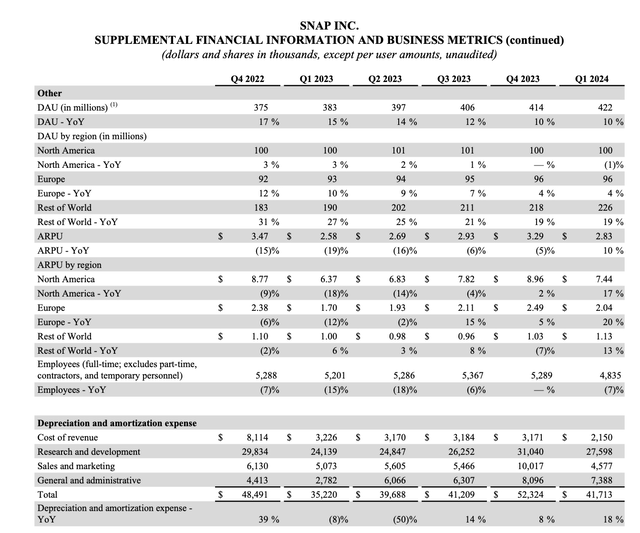

That being said, however, I still don’t see Snap as having solved its core problem. The chart below shows that while Snap added 8 million DAUs in the quarter to end at 422 million (+10% y/y), users in North America and Europe remained stable at 100 million and 96 million, respectively. North American users also remain below the peak of 101 million achieved in mid-2023.

Snap DAU trends (Snap Q1 shareholder letter)

Why this is incredibly important is the fact that a North American DAU generates $7.44 in ARPU as of Q1 – which is more than 6x the $1.13 that a “Rest of World” user generates. Oversaturation in the North American market, as well as Europe (~2x the ARPU of a “Rest of World” user) will stifle Snap’s ability to grow.

Snap trended metrics (Snap Q1 shareholder letter)

We also point out that Snap reported only 7% y/y growth in impressions delivered, which is also below 10% y/y growth in DAUs and 21% y/y growth in revenue: which indicates to me that engagement per DAU is falling. Snap’s impressive revenue results are being driven by improved advertising performance and pricing, which are not long-term factors we can bank on.

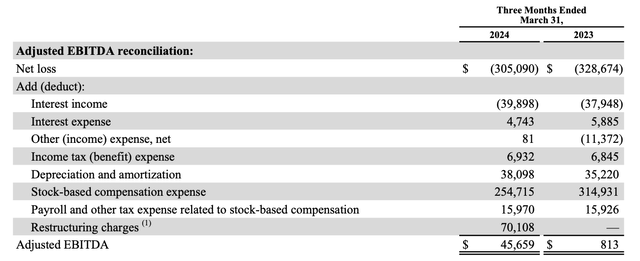

We are impressed, however, with Snap’s surge of profitability despite its heavier infrastructure investments. Adjusted EBITDA in the quarter leaped to $45.7 million, or a 4% adjusted EBITDA margin, versus breakeven in the year-ago quarter.

Snap adjusted EBITDA (Snap Q1 shareholder letter)

Its outlook also calls for $15-$45 million in adjusted EBITDA in Q2, or a ~2% midpoint margin versus -4% in the year-ago quarter.

Key takeaways

In my view, Snap very much remains a “show me” stock with a lot to prove. Without user growth in the U.S. or Europe, the company will have a tough time maintaining revenue performance, and elevated adjusted EBITDA multiples also keep me on the sidelines. Continue to watch this stock, but in my view this rally will fade sharply.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.