Summary:

- Temporary growth slowdown is due to labor shortages and tough y/y comps.

- AYI’s healthy backlog and macro data suggest demand remains healthy.

- Despite negative growth, AYI continues to show solid margin improvements.

Edwin Tan /E+ via Getty Images

Investment summary

My recommendation for Acuity Brands, Inc. (NYSE:AYI) is a buy rating. I don’t believe the recent negative growth is due to any structural reasons. Based on what I am seeing, the underlying non-residential construction demand remains robust, and the key constraint to growth is the tight labor market, which should go away as the macro environment eventually recovers. Importantly, AYI continues to see a healthy backlog, which I take as a leading growth indicator. Also, AYI has managed to lower its cost structure, providing more room for margin expansion when growth recovers.

Business Overview

AYI sells indoor and outdoor lighting and control systems. Of the two, lighting is its main business under Acuity Brands Lighting [ABL], which represents 94% of LTM revenue, and AYI focuses mostly on non-residential construction. The other segment is the Intelligent Spaces Group [ISG], which sells building management systems-related solutions. Geography-wise, the majority of revenue is from the US (86% as of FY23).

3Q24 results update

Released last week, AYI reported 3Q24 net sales of $968 million, below consensus estimates of $997 million. Breaking down sales by channel: (1) retail channel saw 4.8% decline to $46 million; independent sales network saw 7.1% decline to $637 million; (3) direct sales network saw decline of 6.6% to $97 million; (4) corporate accounts went up 36.3% to $61 million; and (5) OEM and other saw flattish growth, coming in at $58.2 million. Consolidated gross continues to expand (up 200bps in 3Q24), coming in at 46.7%. This drove the increase in adj. EBIT margin as well, coming in at 17.3% (up 100 vs 3Q23). As a result, adj. EPS grew by ~11% to $4.15.

Growth slowdown is a short-term issue

The market continues to be negative on AYI’s core business growth performance, which has continued to stay (1Q24: -7%; 2Q24: -5%; 3Q24: -4%), as seen from the pressure that AYI’s share price is seeing. While the headline numbers don’t look good, I think the market is overlooking the fact that this growth slowdown is a temporary one. There were two main reasons: (1) the tough y/y comp saw in 1H23; (2) a tight labor situation. For the former, AYI is going to see easier comps in 4Q24 and the next few quarters, so this headwind will turn into a tailwind. The latter is the problem of pressuring growth. The tight labor market has been a persistent problem in the US construction industry, and this has negatively impacted AYI’s ability to ramp production quickly enough to meet demand.

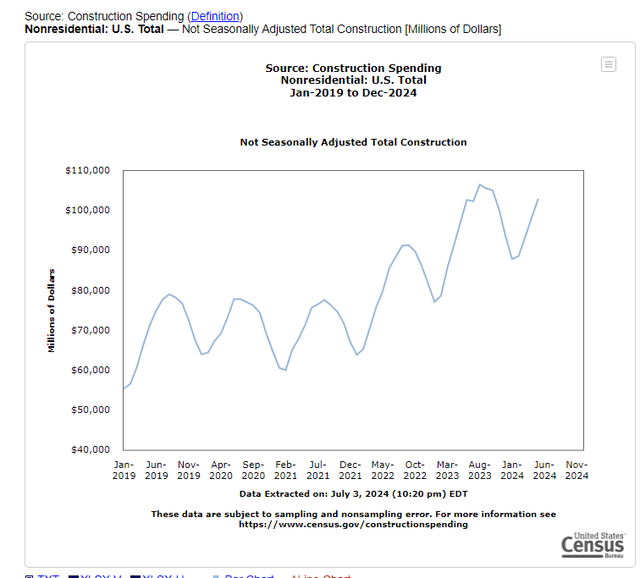

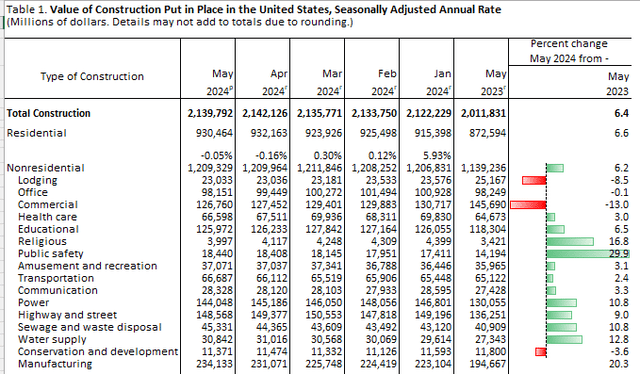

US Census

US census

As such, the reasons for growth slowing down are idiosyncratic and not structural. In reality, the non-residential construction market in the US has been robust. According to the US Census Bureau, non-residential construction spending has continued to show positive growth this year, and the strength is across the board except for office and commercial (which I believe is due to the work-from-home culture dampening demand for these buildings).

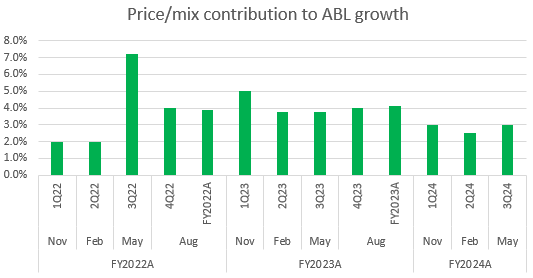

What investors should also note is that growth is delayed and not a loss for AYI. While they failed to meet production targets, it doesn’t mean that AYI is not growing. The AYI order rate and backlog continue to be healthy. Management noted that order rates continue to grow, outpacing shipments, which bodes well for the backlog heading into 4Q24. In addition, lighting tends to be one of the last few parts that go into a building, so there is a lag between the robust demand we see today and actual orders flowing into AYI. Lastly, AYI continues to demonstrate a positive price/mix growth contribution, which shows the industry and AYI itself are not really seeing any pressure in terms of oversupply, weak demand, or anything like that.

Redfox Capital Ideas

Margins continue to improve

Despite the negative growth performance, AYI continues to show solid margin improvements. The ABL segment expanded adj EBIT margin by 100bps vs 3Q23, driven largely by 180bps gross margin expansion. This shows that AYI execution on its initiatives (improve productivity, service quality, and technology) is working well, and it also means that AYI has a structurally lower cost base today. Which means, when growth recovers, AYI should be able to drive margins to new heights. To put things into perspective, the ABL segment generated $898.5 million in revenue in 3Q24, and the 18% adj EBIT margin vs. 3Q22 generated $1 billion in revenue (12% higher), but only saw a 15.8% adj EBIT margin.

Valuation

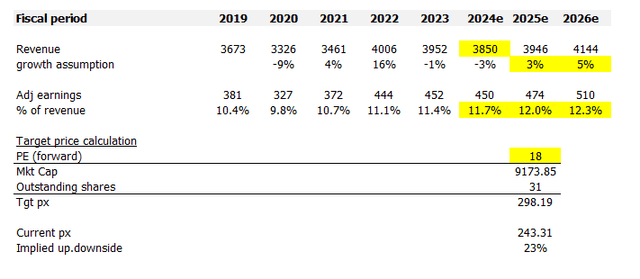

Redfox Capital Ideas

I model AYI using a forward PE approach, and using my assumptions, I believe AYI is worth ~$298. I believe a growth recovery back to industry level (mid-single-digits), at the minimum, is possible over the next few years as the macro environment gets better (labor situation gets better and rates come down, which will ease the cost of funding burden for developers). For FY24, I assumed sales to come in as guided (guided for $3.85 billion, which, I think, is a credible guide given 3 quarters of the year results are already out and management has 1 month of 4Q24 data). As for FY25 and FY26, I modeled a gradual recovery at 5%. However, I do expect margins to grow higher than 11.4%, as 3Q24 is already at 13.5%. Using the recent trend of ~30 bps of expansion per year, I extrapolated it over the next 3 years. When things get normalized, I expect AYI to trade back to its historical multiple of 18x.

Risk

AYI could see a further slowdown in growth if the labor situation gets worse, forcing them to miss more production targets. Given that this appears to be the focus of the market, share prices should see further pressure. Margin expansion could be a lot more muted in the near term than I expected if management decided to step up growth reinvestments (i.e., invest more in technology and other productivity initiatives). While this is likely good for the long term, muted margin expansion coupled with further negative growth will put more pressure on the stock.

Conclusion

My view for AYI is a buy rating. The underlying demand in the non-residential construction market remains healthy, and the weak growth performance so far is temporary (due to labor shortages and tough y/y comps). Importantly, AYI’s backlog remains healthy, and it has managed to lower its cost structure, leaving more room for margin expansion when growth recovers. Once AYI starts to show normalized growth, multiples should re-rate upwards to 18x.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.