Summary:

- Energy Transfer demonstrates improving profitability, which aids in deleveraging the balance sheet. Both factors are crucial for dividend safety.

- Accelerated investments in data centers provide a significant tailwind for large midstream companies like ET.

- Valuation analysis suggests ET’s fair value is $19.85, 22% higher than the last close.

ake1150sb

Introduction

I gave a ‘Strong buy’ recommendation for Energy Transfer (NYSE:ET) in April. I am quite happy because ET delivered almost 5% return to investors after my recommendation.

My updates to fundamental and valuation analyses suggest that there are no reasons to become less bullish about ET. Accelerated investments in data centers is a huge tailwind for all midstream companies, especially the large ones like ET. Profitability keeps expanding, which helps to deleverage the balance sheet as well. Recent acquisitions suggest that the management wants to fortify ET’s position as one of the most important companies for the U.S. energy sector. The valuation is still compelling and a high 7.8% forward dividend yield is safe.

Fundamental analysis

The latest news about ET suggests that the stock is among Mizuho’s top energy picks for July. I agree with Mizuho’s opinion because ET’s fundamentals are improving and the stock still offers a compelling 7.8% forward distribution (dividend) yield.

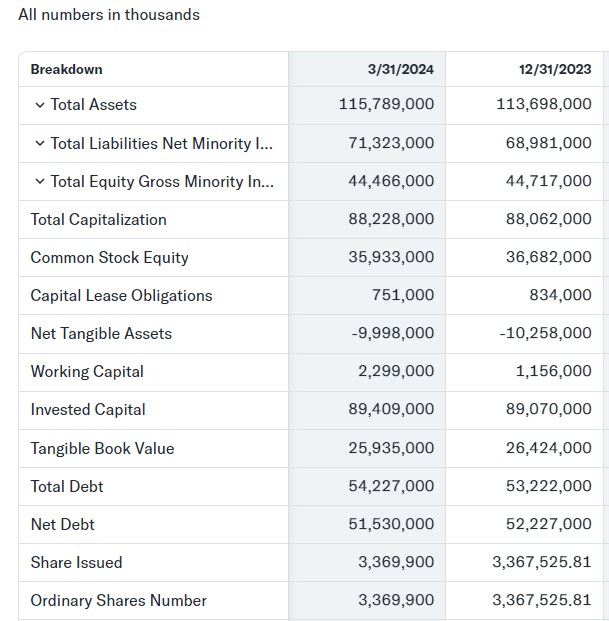

I will first assess the safety of the stock’s dividend yield. The latest available quarterly report is the one ended March 31, 2024. ET’s revenue grew by 13.9% YoY in Q1, a strong topline performance. From the profitability metrics point of view, investors should be happy as well. The gross margin grew YoY from 17.7% to 18%, and the operating margin widened from 10.86% to 11%. As a result, ET’s cash flow from operations (‘CFO’) grew YoY from $3.35 billion to $3.78 billion. Strong CFO allowed to spend more on investments and also allocate funds to deleveraging. The net debt position decreased from $52.3 billion to $51.5 billion. Expanding CFO together with the balance sheet deleverage are good for ET’s dividend safety.

Yahoo Finance

From the longer-term perspective, I have to emphasize ET’s endeavors to consolidate its positioning in the Permian basis. On May 28, ET announced that it is acquiring WTG Midstream in a $3.25 billion transaction. WTG Midstream owns and operates the largest private Permian gas gathering and processing business with assets located in the core of the Midland basin. To finance the deal, ET prices a $3.5 billion offering via issuance of senior notes. According to the company’s co-CEO Tom Long, consolidation “makes sense in the midstream space”. This means that the company might be considering more acquisitions.

This move will likely help to fortify ET’s positions as one of the vital midstream companies for the U.S. As data center spending is soaring, the demand for natural gas will likely be high. According to TC Energy’s executive vice president and chief operating officer of natural gas pipelines, gas demand for electricity to run data centers will increase by as much as 8 billion cubic feet a day by 2030. This is a huge secular tailwind for midstream companies, especially the largest ones like Energy Transfer.

Lastly, ET’s assets are quite diversified and it has a solid LNG exports exposure. Therefore, the recent information that the Federal judge blocked Biden administration’s LNG export ban is positive for ET. The U.S. LNG exports are expected to show steady growth in 2024 and 2025.

Valuation analysis

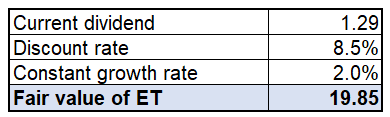

For a dividend machine like Energy Transfer, the most suitable valuation approach is a dividend discount model (‘DDM’). The current dividend is $1.29. Cost of equity is the discount rate for the DDM approach, which is 8.5% for ET. Constant growth rate and equals long-term inflation average of the U.S., i.e., 2%.

Calculated by the author

Fair value of ET is $19.85, almost 22% higher than the last close. I find such an upside potential compelling, especially if we add up ET’s high dividend yield.

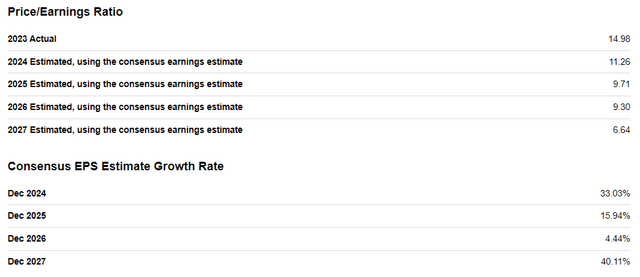

ET’s undervaluation is also underscored by its P/E ratio, which is expected to decrease to 6.6 by FY 2027. Wall Street analysts expect solid EPS growth over the next four fiscal years, which will lead to a substantial EPS contraction.

With ET’s accelerating acquisitions which are expected to contribute to revenue growth, and the management’s commitment to keep costs under control, it is reliable to expect EPS expansion. Therefore, ET is very attractively valued based on forward P/E ratio analysis as well.

Mitigating factors

ET’s performance from the share price appreciation point of view has been impressive since the pandemic crisis. The stock delivered a massive 53% total return over the last three years, which is much better compared to the S&P 500. However, ET lost 43% of its value over the last decade. While the last three years’ performance has been solid compared to the S&P 500, I think investors have to know that over the past decade, it has been declining.

The environmental controversy around one of ET’s largest assets, Dakota Access Pipeline (‘DAPL’) started escalating in 2016 when first construction permits were received. ET suffers from intense pressure from environmental stakeholders who want the pipeline to be shut down. It is difficult to quantify the financial effect of a potential stoppage of DAPL; however, it will certainly be a disruption to ET’s operations and will adversely affect profits. The DAPL environmental review is delayed to 2025.

Geopolitical uncertainty of recent years makes it difficult to forecast trends in the global energy market. While midstream companies are less exposed to changes in hydrocarbon prices, they are affected by the global energy supply and demand equilibrium. Such an uncertainty adds a layer of uncertainty on ET’s short-term profitability prospects.

Conclusion

ET’s stellar 7.8% dividend yield remains safe as fundamentals are rock-solid and the management’s recent move will help in fortifying ET’s position as one of the most vital companies for the U.S. energy. Accelerated investments in data centers from technological giants is a strong secular tailwind for ET. The valuation remains attractive, meaning that ET is a ‘Strong Buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.