Summary:

- Goldman Sachs exceeded revenue and net income estimates in Q1, with strong performance in investment banking and trading.

- Despite challenges, Goldman Sachs is refocusing on core strengths like investment banking, but also pushing into wealth management to drive a strong recovery and future growth.

- Initiating coverage with a cautious buy based on Goldman’s growth potential. However, near-term volatility is possible due to approaching high resistance levels.

Jacob Wackerhausen/iStock via Getty Images

Investment Thesis

The Goldman Sachs Group, Inc. (NYSE:GS), the Wall Street investment banking giant, has been on a roll. The company’s first-quarter earnings report handily beat analyst expectations, fueled by a surge in investment banking and trading revenue. This key area of expertise for Goldman Sachs translated to a strong financial performance.

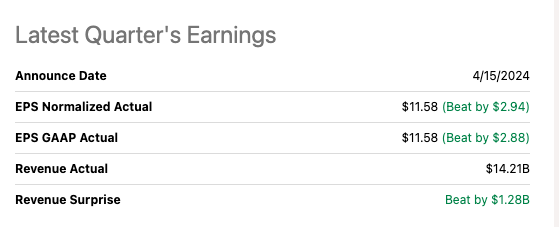

Goldman Sachs surpassed estimates for both total revenue and net income. Revenue hit $14.21 billion, exceeding projections of $12.92 billion. Net income for the quarter was $4.13 billion, resulting in earnings per share [EPS] of $11.58, well above the anticipated $8.49. These impressive figures were bolstered by a significant YoY increase in debt and equity underwriting along with investment banking fees. Further demonstrating confidence in its future, Goldman Sachs maintained a healthy dividend and share repurchase program.

Seeking Alpha

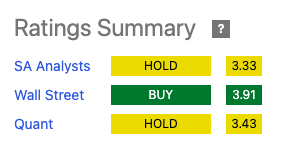

Growth and revision estimates are improving according to Seeking Alpha. The consensus rating also sits at a Buy with Wall Street with some analysts even projecting shares above $500, predicting a potential upside of more than 7%. The company is expected to report its second quarter in a couple of days on July 15, and the consensus is an EPS of $8.87, reflecting a substantial increase compared to the previous year.

Seeking Alpha

Goldman Sachs has faced challenges in the past, including economic uncertainty and a foray into consumer banking that resulted in losses. However, a strategic refocus on its core investment banking and trading business has led to a strong recovery. The recent success in underwriting, deals, and bond trading underscores Goldman Sachs’s renewed strength.

In this article, I aim to find if GS is a solid candidate for my value with a potential portfolio. To accomplish this, I will explore various factors like Management effectiveness, corporate strategy, and valuation to determine if GS still has the potential to grow and align with this investment style.

Management Evaluation

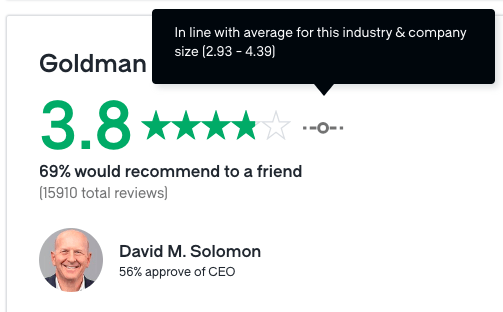

David Solomon is Chairman and CEO of Goldman Sachs. He has a long history with the company, having joined in 1999 and risen through the ranks. Despite his neutral Glassdoor approval rating, compared to the company’s average rating, his 25-year tenure suggests a strong alignment with the company’s long-term success. While his compensation includes a high percentage of stock options, which I consider acceptable due to the long-term focus they incentivize, his base salary and stock awards still make up a significant portion of around 30%. Considering all factors, I believe he has a ‘high alignment ratio” with the company’s long-term success.

Glassdoor

During the last earnings call, Solomon outlined Goldman Sach’s growth plans, emphasizing durability and client relationships.

Here are some of the takeaways from his strategy:

- Building a more durable business: the company aims to become less reliant on volatile markets by focusing on financing and asset & wealth management.

- Enhancing client relationships: GS plans to strengthen its relationships with its top 150 clients, who represent a significant portion of its business.

- Technological efficiency: focus on empowering employees to serve clients better rather than solely on cost reduction. Which I believe at some point should increase their Net income margin.

However, he acknowledged that the leveraged finance and sponsor activity sectors are currently operating below potential. He anticipates an eventual pick-up, which would provide a major tailwind for the company.

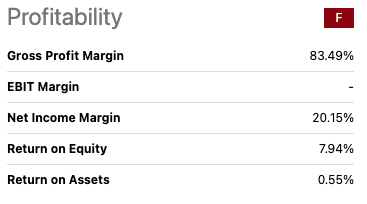

Denis Coleman took the CFO role in 2018; however, he has experienced profitability below the sector median. The company’s average ROE sits at around 8.13%- vs 10.55%, revenue growth (FWD) 3.68%- vs 5.08%, and Net income margin is at around 20%- vs 23%. This can likely be attributed to the wind-down of their consumer banking operations and strategic shift towards wealth management.

Seeking Alpha

During the earnings call, he offered mixed news. Despite a favorable market environment and strong client engagement, some areas underperformed.

Here’s a breakdown:

- Positive: strong showing in the Global Banking and markets segment due to tight credit spreads and rising equity valuations. Additionally, a revival in the syndicated loan market.

- Negative: fees from alternative investments declined compared to the previous quarter, and the public investment portfolio experienced markdowns.

He also talked about selling off its “historical principal investment” portfolio at a pace of $1.5 billion per quarter which I believe is a good strategic move to free up its balance sheet. He also mentioned prioritizing a sustainable dividend before considering share buybacks.

Overall, I find that Goldman Sachs leadership delivered a positive message on client engagement, but the numbers tell a different story, ROE, Net interest margin, and revenue growth lags peers. While CFO Coleman plans to free up capital by selling the HPI portfolio, how it will be deployed for better returns remains unclear. Uncertainties including translating client activity into profit add to the concern. Despite confidence in the management’s abilities to turn the current situation around and considering all factors, I am giving them a “Below expectations” rating for now.

Corporate Strategy

Goldman Sachs is refocusing its strategy for stability. They’re stepping back from volatile trading activities and diving deeper into financing, providing loans and debt issuance for corporations and governments. Wealth Management is another key focus, aiming to capture a larger share of high-net-worth clients. Building strong, long-term relationships is paramount, making Goldman Sachs a one-stop shop for all their clients’ financial needs. With the growth in their wealth management unit, I expect they will become more like their chief competitor Morgan Stanley offering a more diversified source of revenues from trading and investment banking.

Here is a table I created with key differentiators between GS and some companies in the industry offering similar services:

|

Goldman Sachs |

Morgan Stanley (MS) |

JPMorgan Chase & Co. (JPM) |

UBS Group AG (UBS) |

|

|

Investment Banking Market Share |

7.3% |

6% |

9.2% |

2.3% |

|

Corporate Growth Strategy |

Focus on wealth management and financing. Reduce Reliance on volatile markets and diversify from investment banking. |

Focus on wealth management and investment banking. Expand international presence. |

Diversified across consumer, corporate & investment banking. Grow market share in all segments. |

Focus on wealth management and investment banking in core markets, strengthen European presence. |

|

Advantages |

Strong client relationships. Leading market share in FICC (Fixed Income, Currencies & Commodities trading) |

Strong wealth management platform. Expertise in M&A |

Largest and most diversified bank in the US; strong global presence. |

Strong wealth management platform in Switzerland. Leading investment banking presence in Europe. |

|

Disadvantages |

Lower profitability compared to peers. Reliant on trading revenue. |

Smaller scale compared to GS and JPM. Weaker corporate banking presence. |

Lower profitability in investment banking compared to GS. More exposed to economic downturns. |

Lower profitability compared to US Banks. Regulatory challenges in key markets. |

Source: From companies’ websites, presentations, Seeking Alpha, Statista

Valuation

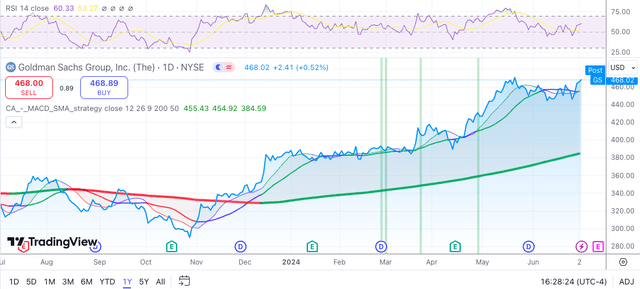

GS currently trades at around $467.92. The stock is up around 20% since its last reported earnings in mid-April at an all-time high level. The stock is also up around 22% TR YTD.

Now, to assess its value, I employed an 11% discount rate, this rate reflects the minimum return an investor expects to receive for their investments. Here, I am using a 5% risk-free rate, combined with the additional market risk premium for holding stocks versus risk-free investments, I’m using 6% for this risk premium. While this could be further refined, lower or higher, I’m using it as a starting point only to get a gauge using unbiased market expectations.

Then, using a simple 10-year two staged DCF model, I reversed the formula to solve for the high-growth rate, that is the growth in the first stage.

To achieve this, I assumed a terminal growth rate of 4% in the second stage. Predicting growth beyond a 10-year horizon is challenging, but in my experience, a 4% rate reflects a more sustainable long-term trajectory for mature companies that should be close to historical GDP growth. Again, these assumptions can be higher or lower, but from my experience, I will use a 4% rate as a base case scenario due to the nature of their business. The formula used is:

$467.92 = (sum^10 EPS (1 + “X”) / 1+r)) + TV (sum^10 EPS (1+g) / (1+r)).

Solving for x = 10.5%.

This suggest that the market currently prices GS EPS to grow at 10.5%. According to Seeking Alpha analyst consensus EPS over the next 3-5 years CAGR at 14.02%. Therefore, it seems that GS is undervalued on a fundamental basis.

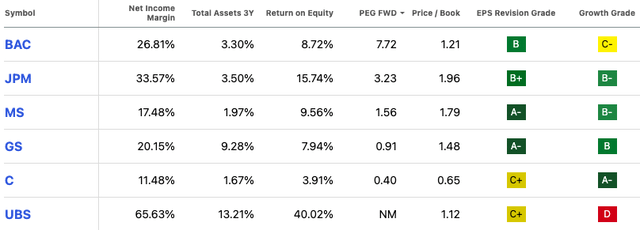

Further, I’ll also look at their forward price-earnings to growth (PEG) ratio which sits at 0.91x -versus a sector median of 1.13x- implying the stock price is below the industry. However, their forward price to sales (P/B) ratio seems undervalued at 1.40x -vs 1.07x. However, when compared to a select group of companies, highlighted below, that are considered leaders in the industry, these mixed signals make more sense and the company just looks undervalued:

However, I believe this undervaluation is justified as GS ROE is still low compared to other competitors like Morgan Stanley or JPM. However, I do believe the bank is turning a page on profitability with its push into wealth management with earnings revisions and growth turning positive as highlighted above.

Technical Analysis

GS has been on a positive momentum since they last reported earnings in mid-April. Despite the company constantly hitting all-time highs since May, the stock looks appropriately valued, on a technical basis, with its 1-year average RSI in neutral territory at 60 and above its 14-day moving average of 53 indicating the stock price might be changing trends.

GS has formed a strong support level at around $444 and a resistance level at just under $470, the stock should move around this band awaiting more news and breaching its all-time high. The next earnings report is July 15.

Takeaway

Goldman Sachs’s strategic shift towards wealth management and financing offers promise for long-term stability and potential growth. While the recent quarter impressed and the stock is up YTD, high expectations may already be priced in. Lower profitability compared to peers and uncertainties about capital deployment raise caution. Considering all the factors, I’m starting my coverage of GS with a cautious Buy as I believe their push into Wealth management is working, and strengthening their balance sheet is a step in the right direction to profitability as it will free up more capital for reinvestment into growth projects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My analysis specializes in identifying companies that are experiencing growth at a reasonable price or value companies with potential. Rating systems don't consider time horizons, risk profiles, or investment strategies. My articles aim to inform, not to make decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.