Summary:

- Intel continues to underperform against competitors like NVIDIA and AMD in the GPU and CPU markets, respectively.

- Intel is refocusing its efforts into chip manufacturing, but also specializing within the AI segment to gain an edge.

- By 2030, Intel’s revenues could be more than double, reaching $123 billion, with growth catalysts and a reasonable margin of safety supporting a buy rating.

Gary Landry Jr/iStock via Getty Images

Thesis Summary

Intel (NASDAQ:INTC) continues to disappoint and underperform, while stubborn analysts (myself included) keep waiting for the Intel turnaround.

Intel has had the misfortune of being outplayed by two different competitors in two distinct segments. I’m talking of course of NVIDIA (NVDA) in the GPU market, and Advanced Micro Devices (AMD) in the CPU market.

Trapped between a rock and a hard place, Intel has chosen to change the paradigm, by refocusing its efforts into chip manufacturing.

In my last Intel article, I delved into its Foundry aspirations and compared it to TSMC. I concluded that given the growing geopolitical uncertainty, Intel could become a “national champion”, which supported buying the stock.

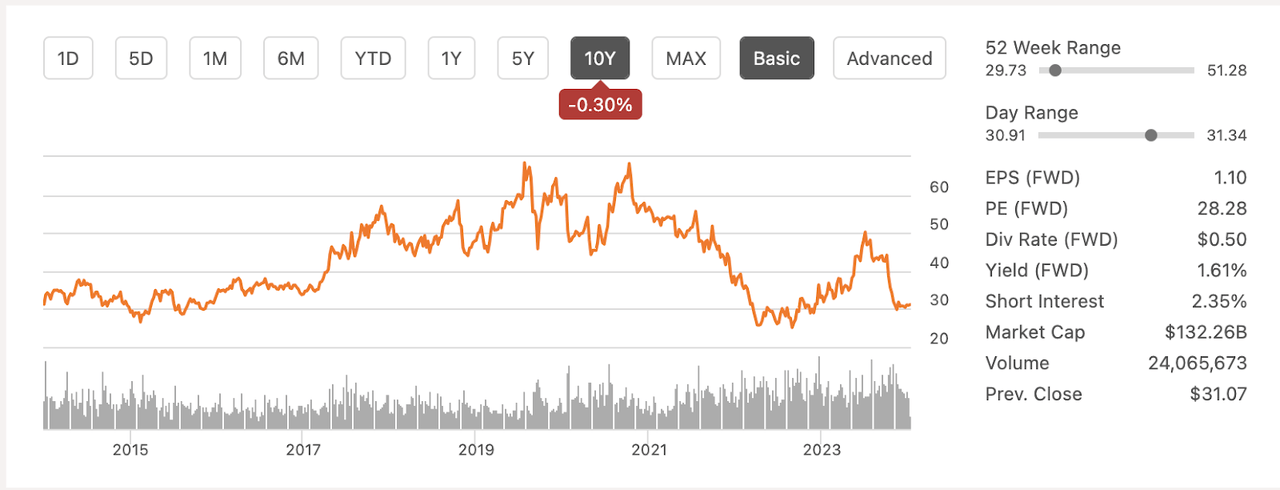

In today’s article, I will discuss why Intel’s price has not appreciated over the last 10 years, and what we can expect over the next 10, by quantifying and qualifying Intel’s latest efforts in the fab and AI segments. We will estimate Intel’s revenues as far out as 2030.

I maintain a buy rating given the growth catalysts ahead and the reasonable margin of safety.

The Lost Decade

Intel is a huge company and a household name, but more than that is needed to actually deliver returns to investors.

Over the last 10 years, the stock has essentially not moved, although to be fair, Intel has paid out a pretty steady dividend over the last 10 years.

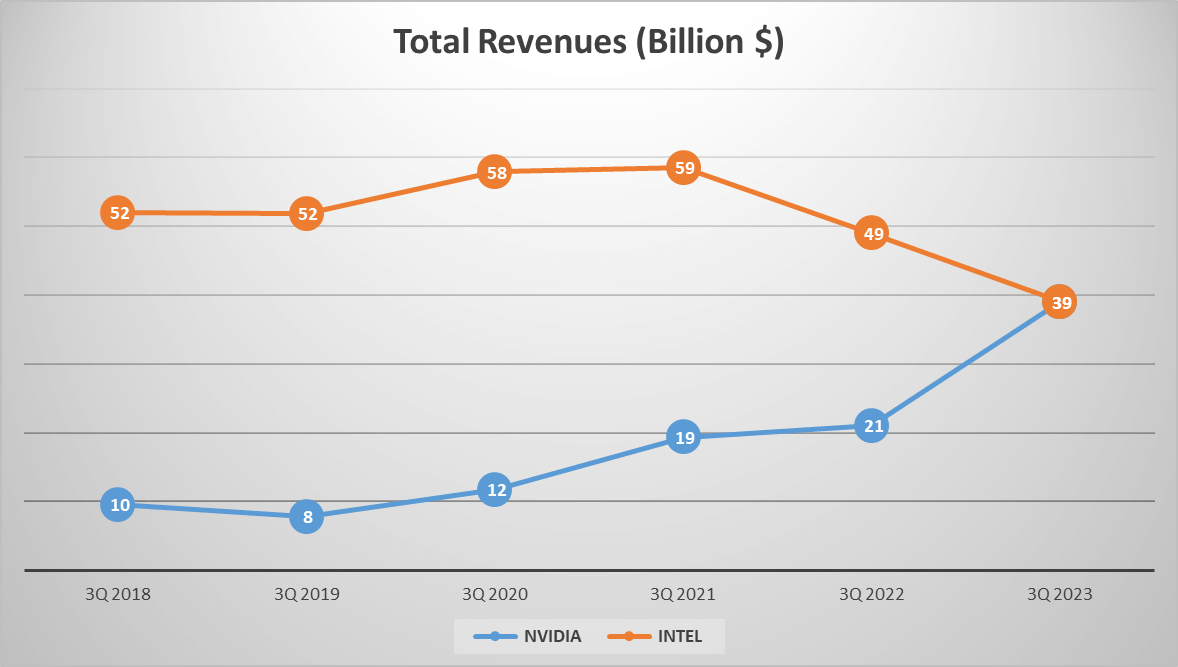

The dethroning of Intel was made official last year, when NVIDIA actually surpassed the company in yearly revenues.

Intel vs NVDA Revenues (X)

NVIDIA finished its fiscal 2024 year (January 30th, 2023 to January 28th, 2024) with $60.9 billion in revenues. Meanwhile, Intel procured $54.2 billion in 2023.

Intel’s revenues actually fell 14% YoY, while NVIDIA’s revenues more than doubled. How can this be when both companies are part of the semiconductor industry?

Intel Gets Squeezed

Intel has been in the chip business for quite some time and has a wide array of products. But, perhaps, it was this “diversification” that sealed its fate.

While Intel does make GPUs and has accelerated their development in the last two years, the company has always had a stronger foothold on CPUs.

However, the AI revolution has made GPUs, rather than CPUs a much more valuable component of the process. This allowed NVIDIA to step in with its A100, and then its H100 and take the market by storm.

New data centers are much more GPU-heavy than their predecessors, and these chips are much more expensive than the CPUs, which means that most expenditure has gone towards GPUs in the last few years.

In a world of GPUs Intel was still relying on its CPUs to obtain most of its data center revenue, and on this front, Intel was also losing the battle.

2023 was also the year when AMD’s CPU market share reached a new high compared to Intel.

The chip designer’s CPU share grew a half point to 31.1 percent in 2023 while Intel’s decreased as much to 68.9 percent when counting total CPU shipments between both companies last year, according to CPU-tracking firm Mercury Research.

Source: CRN.com

Intel has no doubt fallen behind, squeezed out of the market by two companies that were hungrier and just doing things better.

So what’s the road up ahead for Intel? Here are the main options:

-

Compete head-to-head with NVIDIA

-

Specialize itself within the AI market

-

Grow the Foundry business

Let’s dive deeper into each of these, and try to quantify what Intel can do over the next 10 years.

Fab Transition and AI Redemption

Intel can try to compete with NVIDIA. Perhaps it won’t be able to develop superior tech, but it could develop similarly efficient technology that is better priced.

In this regard, Intel is planning to begin selling the Gaudi 3 as soon as they possibly can. These have been developed in great part thanks to the acquisition of Habana Labs in 2019.

Intel has reported a $2 billion sales pipeline, but this is still a measly figure compared to what NVIDIA is pulling from data centers. However, it’s a start, and it will be a first step in showing that NVIDIA is not the only option out there.

In my opinion, Intel stands to challenge NVIDIA if it makes the right moves (acquisitions) and differentiates itself from NVIDIA, perhaps by offering lower-priced chips.

Intel is also making a big bet on AI PCs, an area in which it does have some past experience. Intel’s latest Core Ultra Processors will reportedly have a Neural Processing Unit, NPU, to complement the CPU and GPU part of the PC.

But the company will again face stiff competition here from AMD, mainly, but also the likes of Qualcomm (QCOM), Apple (AAPL) and NVIDIA itself.

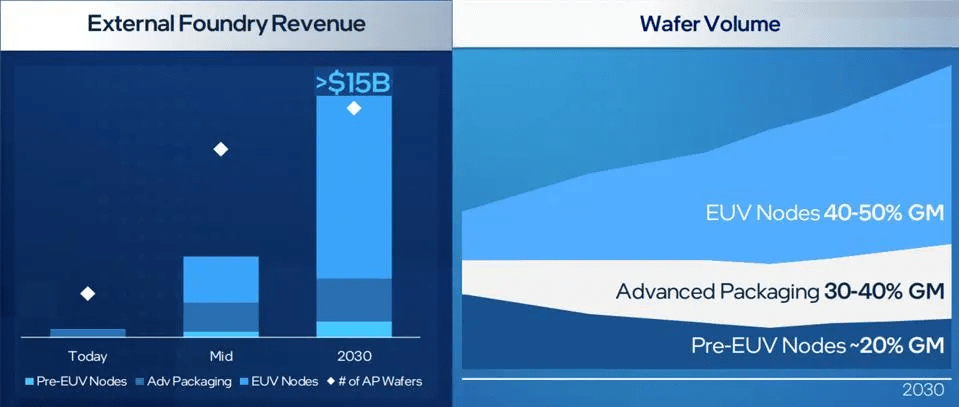

Lastly, and perhaps most notably, Intel has decided to change the paradigm completely by making a big investment in its new Foundry business. By 2030, Intel expects it could become the second largest Foundry in the world

While this move has been criticized by some, it makes a lot of sense in my opinion. The move allows Intel to:

-

Benefit from AI demand through a less crowded market.

-

Achieve vertical integration.

-

Set itself up as a “national champion”, which I discuss in-depth in my last article.

So, with that said, let’s put the theory into practice and crunch some numbers:

Forecast and Valuation

Let’s begin by crunching some numbers.

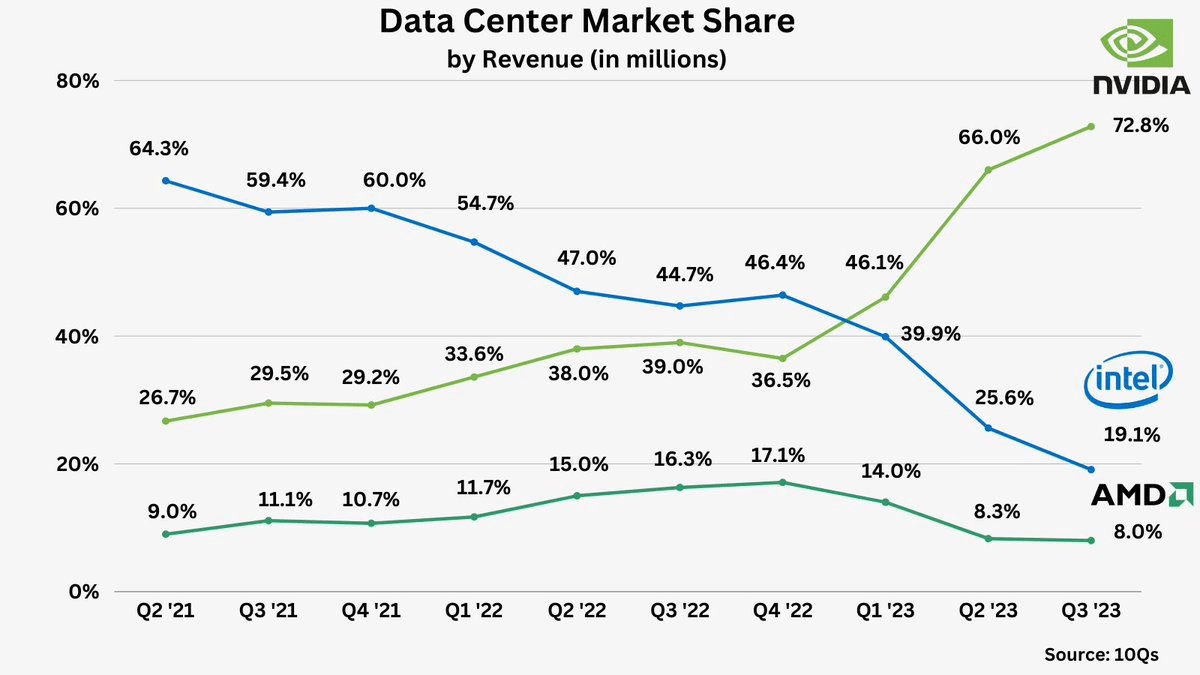

Data Center Market Share (10Qs)

As of Q3 2023, Intel had around 19.1% market share in the Data Center Market, after losing significant ground to NVIDIA and also AMD.

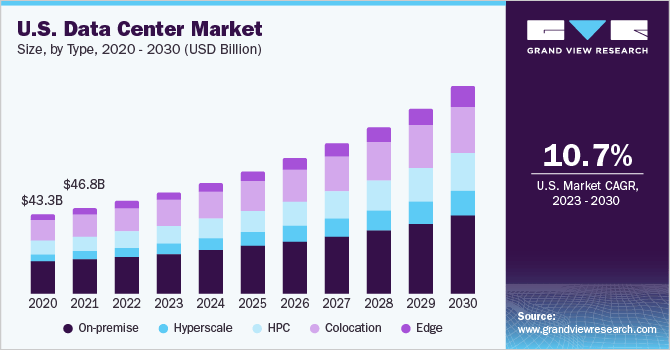

UD Data Center forecast (Grand View Research)

The Data Center market is projected to grow at a 10.7% CAGR in the next 8 years, reaching close to a $440 billion market cap.

Intel made $15.2 billion from Data Centers last year. Assuming it can grow these revenues at 10% over the next 7 years, until 2030, that would put Intel’s Data Center revenues at just over $30 billion.

This seems realistic, given the fact that Intel has already made big efforts to recover market share. Intel was caught off guard, but now it has a clear direction.

Canalys is projecting AI PC shipments to rise at a 44% CAGR from 2024 to 2028, from an estimated 48 million PCs this year, before doubling to more than 100 million in 2025 and rising to over 205 million by 2028.

Source: Forbes

According to the research above, AI PCs shipments could grow at a 44% CAGR until 2028. To be safe, let’s assume a 40% CAGR until 2030. Meanwhile, the overall PC market is projected to grow at around 9.10%.

Intel’s Client Computing, which is where PC revenues are included, generated $29.26 billion in 2023.

Let’s say Intel can actually become a strong presence in PCs, and achieve a growth of 15%. That would put revenues at $78 billion by 2030.

And lastly, let’s take Intel at face value, and say they can fulfill their $15 billion foundry revenue estimates.

Intel Foundry revenue forecast (Investor slides)

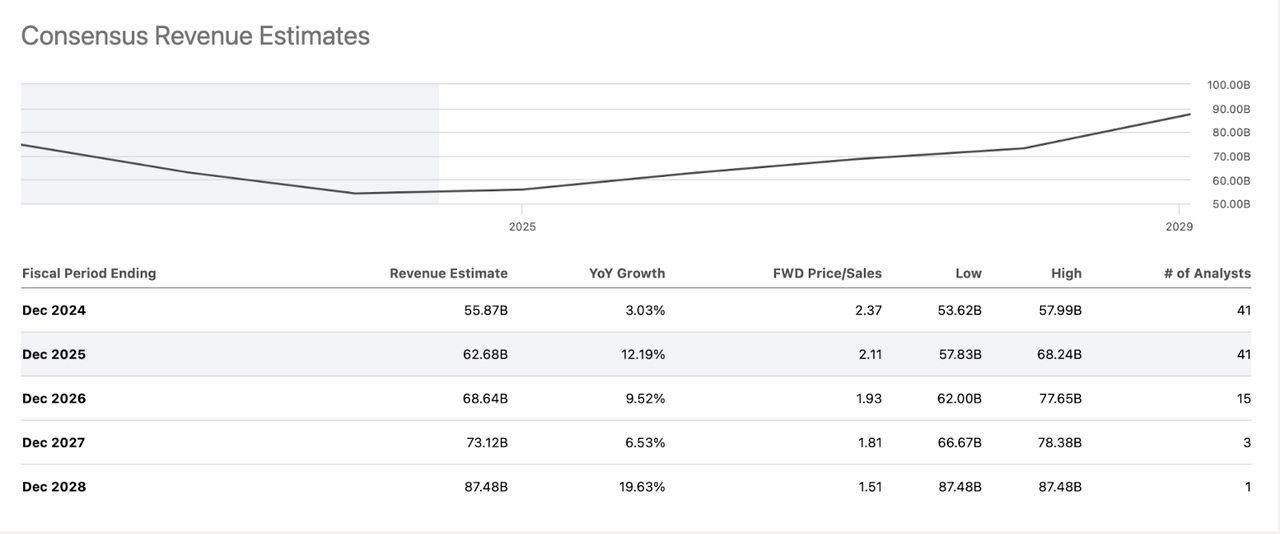

This adds up to $123 billion in revenues by 2030, implying that the company’s revenues could be more than double, growing at a CAGR of 12%.

It’s definitely on the optimistic side. Analysts would put Intel at around $90 billion by 2029. Maybe closer to $100 billion by 2030.

Still, this is not very far off from estimates, and I don’t think we have made outlandish claims given the forecasts for the different segments Intel’s involved in.

At today’s PS of 2.3, that would mean Intel’s market cap could be close to $260 billion, and the price would be at least double what it is today, not even accounting for multiple expansion.

Final Thoughts

All in all, Intel has plenty of potential ahead, while most of the downside seems to have been realized. This may not deliver crazy returns, but it is a very solid value investment, pays a decent dividend and has numerous growth catalysts ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video