Summary:

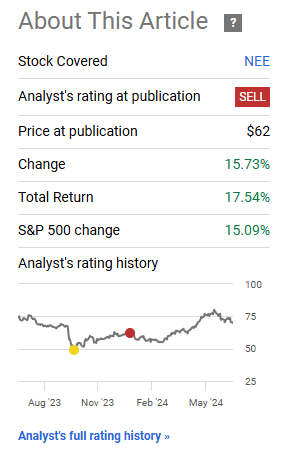

- We gave NextEra Energy a Sell rating the last time around.

- The stock has been strong, and our call has so far proven incorrect.

- We review why the risks remain high and why we think this goes far lower ultimately.

- We also examine the case for the 8.4% yielding units.

Florida Power and Light FPL Solar Powered trees in the park felixmizioznikov/iStock Editorial via Getty Images

We turned bearish on NextEra Energy, Inc. (NYSE:NEE) at the beginning of the year. A strong bounce off the lows was behind us, earnings estimates were optimistic and the valuation was aloft. The stock price had room to drop and the valuation would still remain in the unreasonable territory. Using historical data, metrics such as the EV to EBITDA and P/E ratio favored close to a 30% price decline from that point. The conclusion to that piece noted the crux of the matter.

NEE was the ultimate posterchild of the ZIRP (zero interest rate policy) bubble. That unwinding will take a lot more time, and downside risks abound. Of course here, one key facet is that we believe interest rates are headed higher at the long end. Those that use the Fed Cuts to justify their stance should know that long end rates being 2% over the short end is about as normal as things get when examining the long-term history. So even if you embrace the 6 rate cuts, know that the average situation would call for 10 Year yields at 5.5% in that case.

Source: NextEra Energy’s Next Leg Down

The price is higher by close to 16% and along with the dividends, the stock returned 17.5% to its investors since then.

Seeking Alpha

That of course feels awful. Nothing worse than missing out a bull run because you are bearish at the wrong time. We take the opportunity to tell you why we are sticking with our call and think that the stock will ultimately go much lower.

Q1-2024

Q1-2024 was a disappointment for the NEE bull community. The giant moved its earnings guidance lower after beating the adjusted earnings number. While the company stuck to its earnings range for 2025 and 2026, they were off a slightly lower base. The consensus numbers were also at the very high end of the range NEE presented. The good news there was the company affirming its rapid dividend growth. NEE promised 10% increases in both 2025 and 2026.

The Macro

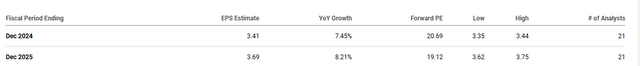

NEE trades at around 20X earnings.

The growth rate should be hitting around 6% a year. NEE’s range is for 6% to 8%, and we think the low end is more likely in the next 3 years. None of those numbers look bad in relation to where the stock traded as recently as 2021. In December 2021, the stock was near $95 per share and at a stunning 37.5X earnings (for 2021). It is fairly easy to declare that we are done now, and the stock can resume its long-term trajectory. We think there will be two hurdles here. The first being that capital markets tend to create excesses in one direction followed by excesses in the other. So that 37.5X multiple will likely be followed at some point by significant undervaluation. Some might argue that the 17X multiple we saw near its October 2023 level was good enough. We don’t think so, as utilities as an asset class generally trade near the 12X-14X mark. This is definitely true when interest rates are not anchored to zero. So a 17X multiple is far from even fair valuation and definitely not a sign of undervaluation.

The second aspect here is that the free flowing risk-on environment is very conducive to the overall multiple. We don’t believe that will last forever and in the next recession, NEE’s growth push and regulatory approvals will be challenged.

Verdict

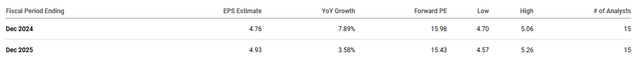

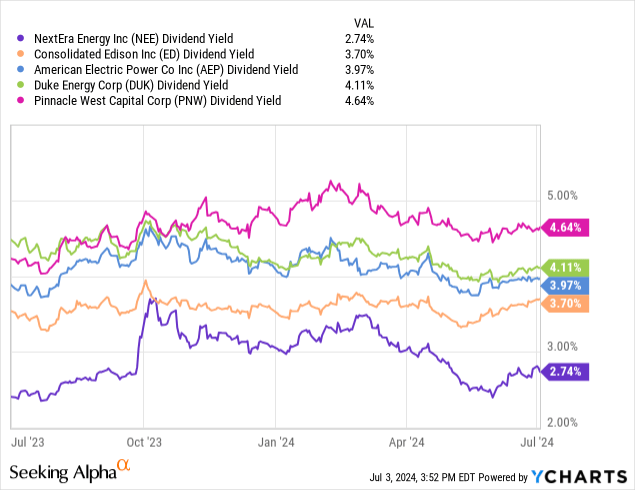

Price matters and valuation matters. We even suggested a long side play on NEE near the 2023 bottom. We are flexible in our approach and if NEE starts looking like it has at least partially corrected the excesses, we would move to a more constructive stance. As things stand, NEE remains fairly expensive. This is something even the income investors will acknowledge. You can see how NEE stands against comparable high-quality utilities like Consolidated Edison, Inc. (ED), American Electric Power Company, Inc. (AEP), Duke Energy Corp. (DUK) and Pinnacle West Capital Corp. (PNW).

PNW is the best comparative here by far. It yields almost 2% more than NEE. It trades at a 16X multiple. We can expect similar growth rates for both.

So why would you want to pay extra for NEE? We continue to rate this a Sell.

NextEra Energy, Inc. UNIT 09/01/25 (NEE.PR.R)

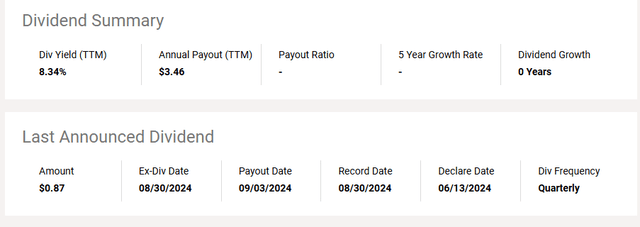

While no one will be chasing NEE for its dividend yield, they might run after NEE.PR.R. We can hear their thinking process.

“8.5% dividend yield from NEE, sign me up!”

If that seemed to lack any due diligence, then well, that is how the standard income investor functions. We saw this in the case of Algonquin Power & Utilities Corp., (AQN) and its mandatory convertible units, which had the ticker AQNU. Both prices tracked each other fairly closely, and legions of analysts were surprised as they actually missed the first two words in our description.

Mandatory convertible.

While NEE does not use the term, it is obvious that you are going to have to do this exchange within 14 months:

The stock purchase contract requires the holder to purchase for $50 a variable number of shares of NextEra Energy, Inc. common stock no later than 9/1/2025 and pays a contract adjustment rate of 2.326% per annum. The stock purchase settlement rate will be 0.4500 shares per unit if the then current market price is equal to or greater than $111.10 and 0.5626 shares per unit if the market price is equal to or less than $88.88. For market prices between those values the settlement rate will be $50 divided by the market value. Prior to the IPO of this security, the last reported sale price of the common stock on 9/14/2022 was $88.88 per share. The stock purchase contract may be settled any time at the holder’s option and the company will deliver 0.4500 shares of common stock for each purchase contract.

Source: Quantum Online

So, in essence, you are getting common shares, but you have to adjust for the higher dividend in the interim. Using the 0.5626 shares of NEE, we get a fair value of around $40 for NEE. Of course, this disregards the higher payments until then. At the current price of $42.50, NEE.PR.R is slightly overvalued, even taking into account the hefty yield differential. Since we rate NEE a Sell, we will rate NEE.PR.R a Sell as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

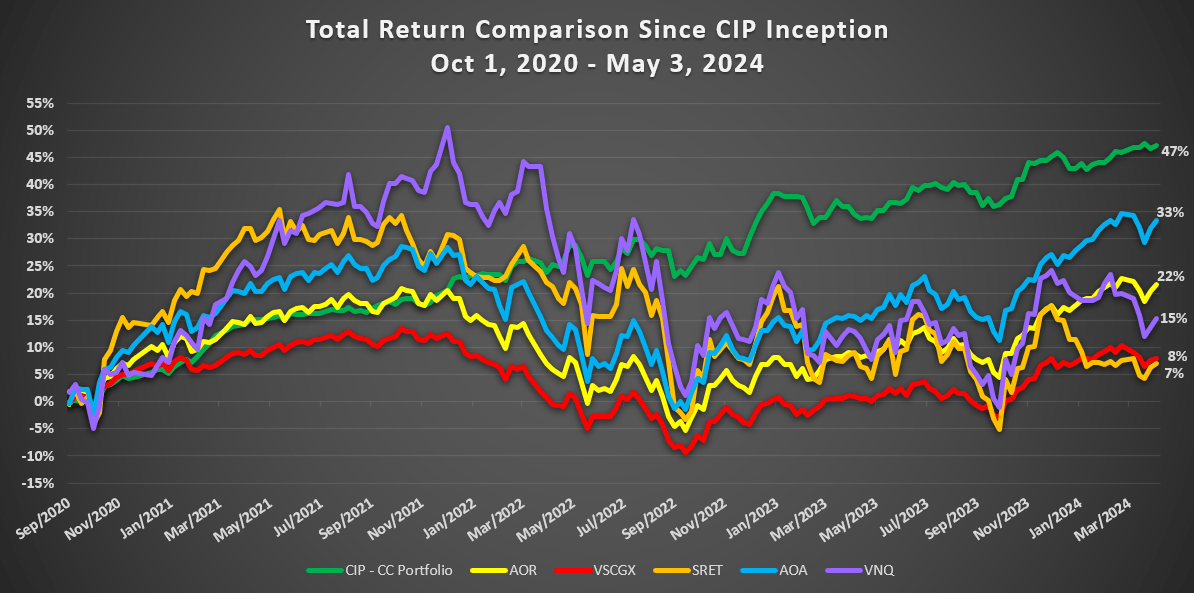

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.