Summary:

- Dell’s financial history shows steady and somewhat cyclical growth.

- While better known for its brand of PCs and other devices, it also provides server and storage solutions.

- With that, Dell has an opportunity to meet server needs for AI computing and could ride some growth.

- In both segments, they may be pressured by competition and a better price is warranted as their capital allocation strategy remains unclear too.

Georgii Boronin/iStock via Getty Images

A friend of mine recently asked me, “What’s wrong with Dell (NYSE:DELL)?” following a steep drop from its peak upon the release of Q1 earnings. Yet, someone taking the long view might think that things are just fine.

DELL 5Y Price History (Seeking Alpha)

Whether May’s drop or the long-term gains have gotten your attention, it’s definitely worth taking a closer look and seeing what role Dell has. I personally think they will play an important role, but there is more to them than just that, so I think they’re a Hold until a better margin of safety shows itself.

Financial History

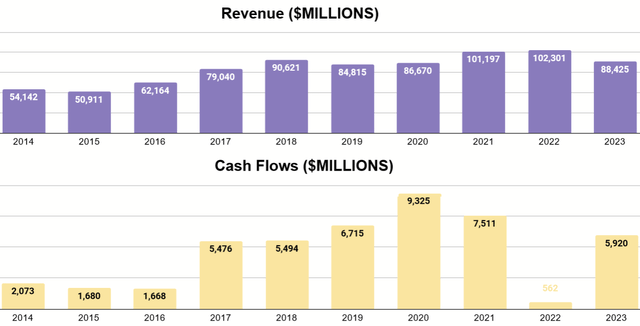

Over the past decade, Dell has had a record of growth, but there are some interesting subtleties to it. Note that my graphs show data as they correspond most closely to a calendar year, but the company reports in fiscal years typically ending January or early February. Thus, 2023 here would be fiscal 2024.

Author’s display of 10K data

Revenues and free cash flow definitely increased between the start of the past decade and the end. 2022 showed a precipitous drop in FCF, despite having the highest revenue of the period.

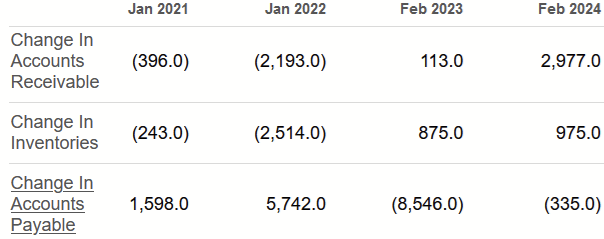

Cash Flow History (Seeking Alpha)

The biggest influences here don’t seem to be any major impacts to net income or capex. Rather, 2022 just featured unusual timing in its working capital, namely among how much fluctuation there was in accounts receivable and payable, as well as inventories.

Regarding the decline in 2023’s revenue, management explained (Fiscal 2024 Form 10K, pg. 51):

During Fiscal 2024, net revenue decreased by 14%, driven by declines in CSG net revenue and, to a lesser extent, ISG net revenue, which reflected the prolonged impact of global macroeconomic conditions on demand.

This indicates that, while growing, the company is still large enough that its results are influenced by macro-cycles, and this largely explains why its growth trend hasn’t been a straight line. Additionally, the company notes that its result tend to be very seasonal, with sales in the Americas strongest in the second and fourth quarters, while other regions are strongest in the fourth.

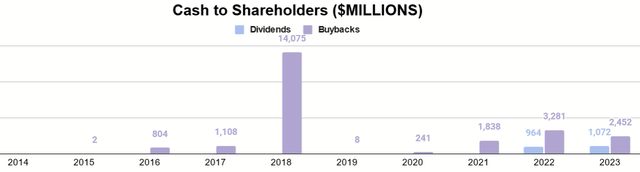

Author’s display of 10K data

Cash returned to shareholders has largely been seen through buybacks, but common dividends started to be paid in 2022. The unusually large buybacks in 2018 were a technicality related to the repurchase of Class V shares, a form of common stock tied to Dell’s economic interest in VMWare at the time and done as a mechanism to take the company public again that year. VMWare was later spun off from Dell in 2021. As such, I don’t believe 2018 represents a repeatable pattern for Dell’s buybacks (but it may say something about M&A).

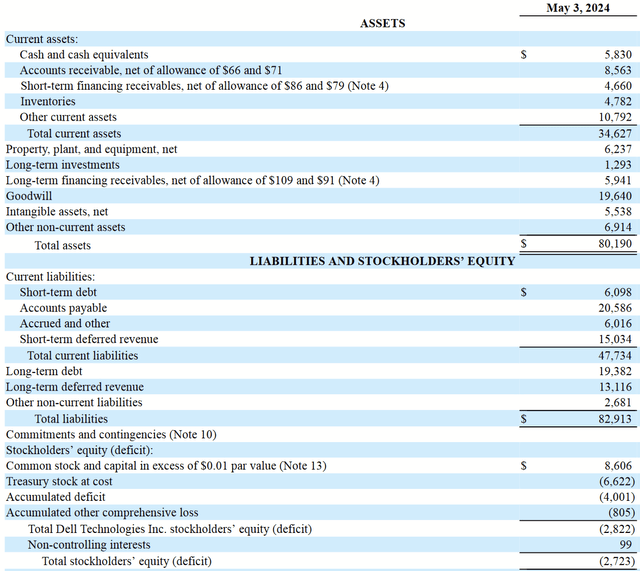

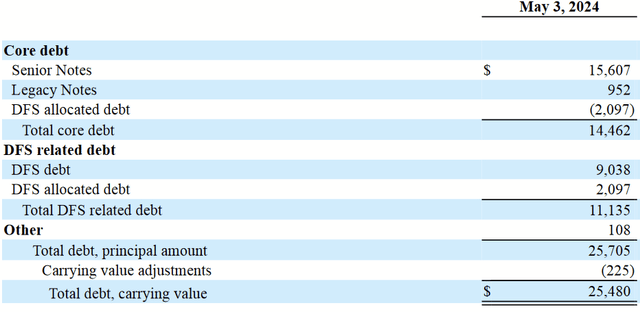

Latest Form 10Q

As the balance sheet is concerned, some may note both that, despite the consistently positive cash flows, the equity on the balance sheet is negative. This is, in part, a consequence of the buybacks and the $6.6 billion number against equity they create. It isn’t necessarily a cause for concern.

Debt Breakdown (Latest Form 10Q)

Moreover, if we look above, a substantial portion of their debt comes from Dell Financial Services and as such doesn’t come with the same apparent risks that a dry reading the balance sheet might suggest. As management elaborated in their latest 10K (pg. 61):

DFS related debt primarily represents debt from our securitization and structured financing programs. Our risk of loss under these programs is limited to transferred lease and loan payments and associated equipment, as the credit holders have no recourse to Dell Technologies.

This debt functions like that of a typical, financial company, and the core debt just over $14B is the more telling figure, in my view.

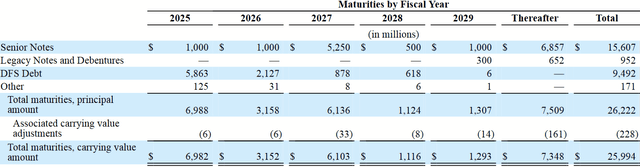

Latest Form 10K

Considering how the core debt is staggered over many years and only totals a few years’ worth of free cash flow, I don’t find the balance sheet to show any worrying signs and believe that Dell has actually managed it well enough.

Business Model

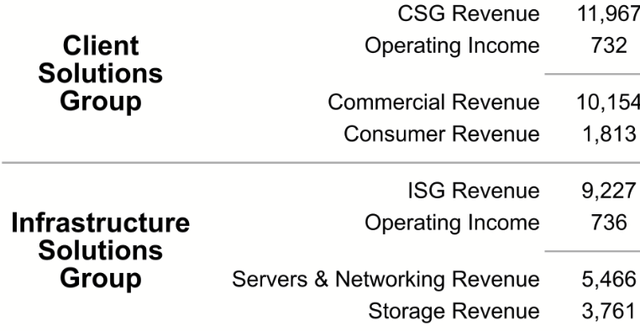

With that review of the past done, let’s discuss what the current make-up of the business is. First to consider is that Dell reports its results in two operating segments: Infrastructure Solutions Group (“ISG”) and Client Solutions Group (“CSG”).

ISG primarily offers server, storage, and cloud services to business customers. These include general-purpose and AI-optimized servers.

CSG concerns what the reader may find more familiar: Dell’s branded PCs and other devices.

Between the two segments, Dell reports a slight majority of revenues from the Americas, with the rest coming from other regions.

Q1 Fiscal 2025 Company Presentation

CSG is the slightly larger segment, and most of their products as sold to commercial customers, as opposed to individual consumers. ISG primarily earns revenue from its server product.

Additionally, Dell Financial Services provides financing options to customers in the form of leases.

Future Outlook

The main question on folks’ mind and what drove its price gains over the past year seems to be AI, so we’ll consider that first and then review other matters that will be important to long-term returns.

Riding the AI Wave

In Q1 earnings, management described Dell as “perfectly designed” for this moment that is the emergence of generative AI. COO Jeff Clarke described the opportunity in five points:

We highlighted our AI strategy to accelerate adoption of AI, which is built on five core beliefs. The first, data is the differentiator. 83% of all data is on PRAM and 50% of data is generated at the edge; second, AI is moving to the data because it’s more efficient, effective and secure. And AI inferencing on PRAM can be 75% more cost effective than the cloud; third, AI will be implemented in a wider range of ways, from locally on devices to massive data centers depending on the use case; fourth, you need an open, modular architecture to support rapid and sustainable innovation; and finally, AI requires a broad and open ecosystem to take advantage of the latest advancements.

He went on to say:

And then the long-term opportunity in the enterprise for us is inference, where you might recall from the remarks I made last week at DPW long term inference will be the largest use case or what I like to call “AI in production” and use over the course of the decade.

So what I like here is that management has a very clear understanding of the nature of the technology and the role Dell has to play. Inferencing was also mentioned as offering long-term value for AMD (AMD), which I recently covered before this. What I think is also important is that Dell demonstrates the product variety to meet multiple forms of AI demand, depending on the performance needs of customer.

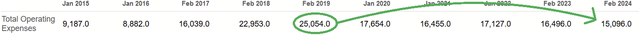

They also mentioned that this area of ISG shows all the signs of rapid growth, and so I believe this will be visible in the long term. A few analysts did highlight that Q1 results suggested they weren’t making much money on AI, but they reiterated the seasonality of their business and that they enjoy advantages of scale that become clearer later in the year.

Seeking Alpha

Do we have reason not to trust them that fiscal 2025’s costs will work at scale? Dell has shown good ability to reduce its OpEx over time, despite growing revenue. With the heavy demand behind AI, unlike prior opportunities, I think Dell will continue to scale well and keep costs contained.

CSG Revenues

As this is still the larger segment and serves more traditional needs in technology, I expect some of Dell’s cash flows to continue to be cyclical. Yes, I think there is a trend of growth as more of the world develops and needs devices to function, but I don’t think this will have quite the same growth and tailwind that the demand for AI has. It is also here that I suspect competitors are more likely to chip away at their sales.

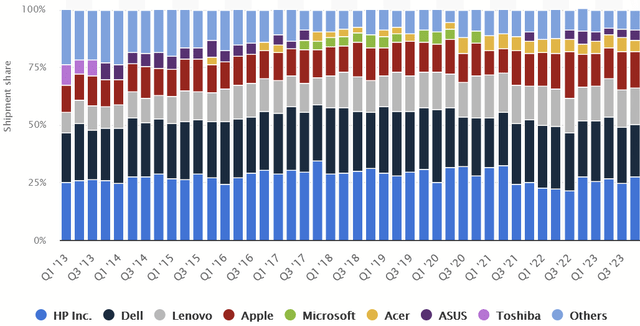

PC Shipment Market Share (Statista.com)

For example, Statista shows that Dell has typically accounted for 20% – 25% of PC shipments in the U.S. Lenovo (OTCPK:LNVGY) and Apple (AAPL) were the ones who managed to gain share, while HP (HPE) has been their most consistent rival.

For more traditional use of devices, I think consumers and businesses alike are more likely to spend on these products on a budget and that they will try to get as much use out of a device as they can before upgrading. Having said that, Dell mentioned in their latest 10K that they expect a PC refresh cycle to begin later this year, and so we may begin to see growth in the short term from this. With that said, they also disclosed in their Risk Factors:

CSG faces risk and uncertainties from fundamental changes in the personal computer market, including a decline in worldwide revenues for desktops, workstations, and notebooks, and lower shipment forecasts for these products due to a general lengthening of the replacement cycle.

So we should also expect that the later part of the decade may not feature as much growth.

Capital Allocation

I find that the strategy with capital allocation is a bit hard to place, given the last decade was rife Dell going private and becoming public again. The buybacks so far have been good and occurred with lower share prices, but we’ll want to see how much that appetite keeps up if the share price shoots up faster than the fundamentals (which is a recurring problem among tech stocks).

It is interesting that they are willing to pay dividends and that the amount continues to increase. This may actually prove that Dell has a keener sense of return on capital, as it is actually willing to distribute dividends.

The one blight on the record is M&A, namely that acquisition and later disposal of VMWare not long after. It was not disastrous for Dell, but it does seem to me that they can be a bit fickle with their planning, and we should observe carefully if do any ambitious M&A going forward.

Overall, I think their record on capital allocation is mixed but showing signs of changing, and we should keep a keen eye in upcoming quarters.

Valuation

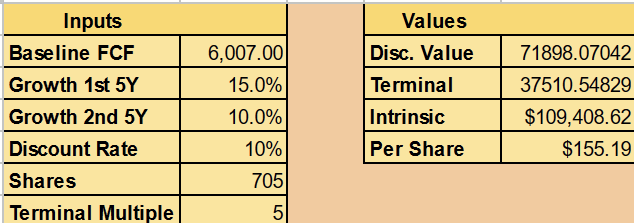

Now we come to the valuation, which I will do using a Discounted Cash Flow model. I will make the following assumptions:

- $6,007M as baseline free cash flow

- 15% growth the first 5 years

- 10% growth the next 5

- Terminal multiple of 5

$6,007M is the average FCF of the last five years. Given current revenue growth guidance, their ability to keep costs down, and tailwinds of AI, I expect this can probably have a CAGR of 15% over the next decade. It seems possible that they could have more competition that challenges margins in the future. They even mentioned in the earnings call that they sell a premium product and are not priced as low as their competition, so it remains unclear how long they can keep that up. As such, I’ve projected for a decline in growth to 10%. Additionally, Dell has shown that it can trade at quite a low multiple when the market loses confidence, and so I have projected for that to keep it conservative.

Author’s calculation

Priced for a 10% discount rate (typical return of a broad market index), that suggest a fair value per share is $155. The current price is a modest discount to that but not a compelling one to suggest a margin of safety.

Conclusion

Dell is a well-known brand and probably not going anywhere on the traditional PC side, but it will be challenged here. AI server and storage solutions provide an ideal business opportunity for them, even if it’s not as lucrative as what AMD or Nvidia (NVDA) is getting on their financial reports. Even so, for the right price at the right time, understanding Dell could make it possible to profit from an investment in their shares.

At the moment, I don’t think that time is right. The discount is a modest one, and given my lingering curiosity about capital allocation and how it will respond to competitive pressures, I want more of that priced in first. Until then, while Dell isn’t in trouble, it’s just a Hold for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.