Summary:

- INTC is extremely attractively valued for a company with such solid AI and data center exposure and the potential to become the biggest beneficiary of the AI transition in PCs.

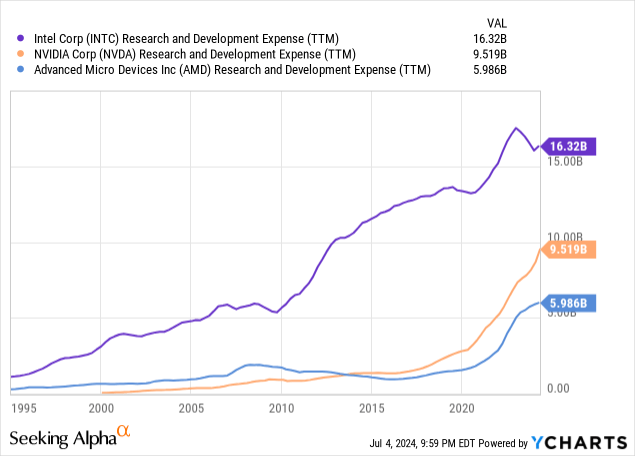

- The company spends on R&D approximately the same amount as Nvidia and AMD combined.

- My intrinsic value calculations suggest that INTC’s target price is $37.

JHVEPhoto/iStock Editorial via Getty Images

My thesis

Intel Corporation’s (NASDAQ:INTC) stock is very attractively valued for a stock with such solid exposure to AI and data centers. The intrinsic value of the stock is 18% higher than Intel’s market capitalization, which means that the target price is $37.

Intel generates notably more Data Center revenue compared to wildly overvalued Advanced Micro Devices, Inc. (AMD). The company spends much more on R&D than NVIDIA Corporation (NVDA) and AMD and released its Gaudi 3 accelerator, which is more powerful than Nvidia’s H100, according to the company. Nvidia and AMD are fierce competitors, but Intel is well-positioned to get solid gains from the accelerating spending on data centers and AI.

Considering Intel’s strong exposure to AI and data centers and its very attractive valuation, I think that INTC is a Strong Buy.

INTC stock analysis

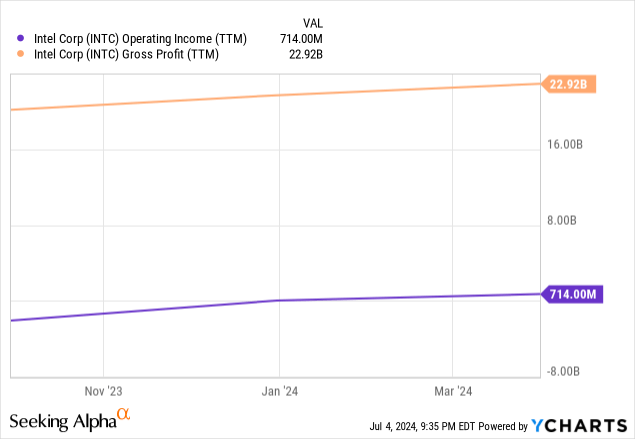

Sentiment around INTC is weak in 2024 since the stock lost 38% of its value YTD. However, financial performance in Q1 tells me that the market’s reaction should be the opposite. Revenue grew by 8.6% compared to the same quarter last year. Profitability is also steadily improving.

The reason for the latest INTC sell-off was softer-than-expected guidance from the management for the remainder of 2024. However, it appears to be a shortsighted reaction because as investors we should pay more attention to longer-term horizons.

AI is a big elephant in the room because INTC’s AI exposure is solid. Intel’s Gaudi 3 AI accelerator is a direct competitor to Nvidia’s H100 series. During the Vision 2024 event, Intel’s management stated that Gaudi 3 delivers a 50% on average better inference and 40% on average better power efficiency than Nvidia H100. With a more attractive price compared to H100, Gaudi is positioned well to become a popular alternative to H100 series. Moreover, the previous generation, Gaudi 2 proved itself appealing as it powers Meta Platforms, Inc.’s (META) Llama large-language model (LLM).

Nvidia and AMD are unlikely to be the ones standing by as Intel’s Gaudi 3 potentially captures their market share. For example, Nvidia’s new generation of accelerators called Blackwell is expected to be much more powerful than H100. The AI battle will be fierce, but what I want to underline is that Intel’s R&D budget is $7 billion larger than Nvidia’s and about $10 billion higher compared to AMD’s. Therefore, I believe there is a high probability that Intel can reply to Nvidia’s Blackwell with “Gaudi 4” soon.

Intel also has a solid presence in data centers, with a $3 billion Q1 revenue from its “Data Center and AI” business. For example, AMD’s “Data Center” segment’s revenue was $2.3 billion in Q1 2024. Intel’s XEON processors are also quite popular in the data center field. Their processors are deployed by Amazon Web Services, a subsidiary of Amazon.com, Inc. (AMZN), the world’s leading cloud company. Intel also partners with Microsoft Corporation’s (MSFT) Azure and Alphabet Inc. (GOOG), (GOOGL) Cloud. Having partnerships with all the largest cloud players means that Intel is extremely well-positioned to benefit from accelerating the data center spending of these giants. Amazon plans to invest $150 billion in data centers over the next 15 years. Such a horizon of 15 years means that the trend is not temporary but secular. The main competitors of AWS have similar ambitions and plans.

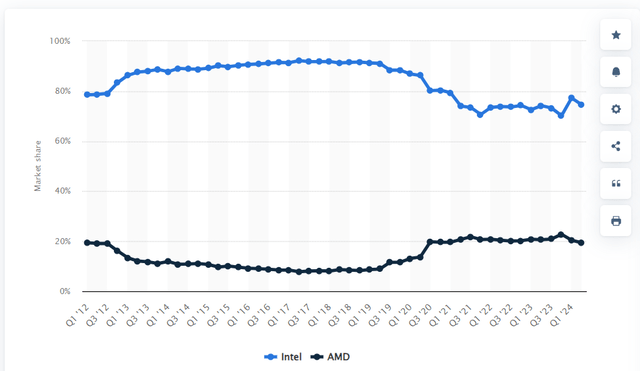

Firm AI and data center potential are not the only strengths of INTC. The company dominates the x86 laptop CPUs market with a 75% market share, according to statista.com. AMD’s market share is more than three times lower and Nvidia is not even in the discussion. Such dominance makes INTC well-positioned to create a new industry of AI laptops, which could also unlock new growth drivers for the company.

Intrinsic value calculation

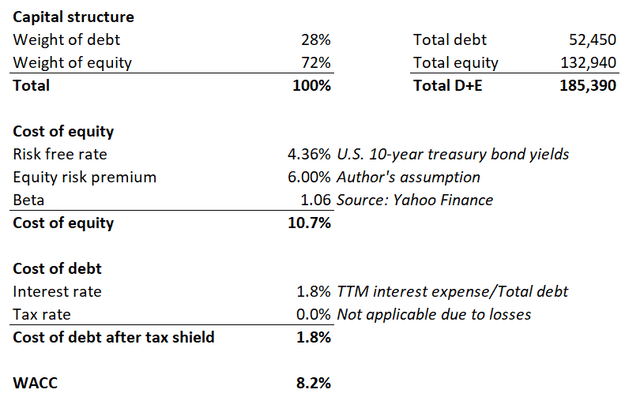

Calculating the discount rate for a discounted cash flow (DCF) model is crucial because it affects the present value of future cash flows. Intel’s weighted average cost of capital (WACC) is 8.2%, which was estimated using the capital asset pricing model (CAPM). My calculations are outlined in the below model, and all assumptions are shown.

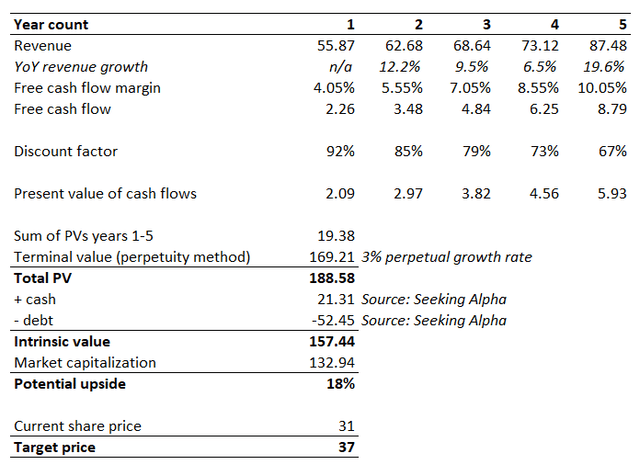

A DCF model also needs revenue and free cash flow assumptions. Consensus estimates are the ones that are usually priced in by the market, so I use consensus for my years 1-5 horizon. Taking a TTM levered FCF margin will not work for INTC because it is negative. At the same time, consensus expects Intel’s EPS to demonstrate strong growth over the next five years.

Therefore, my FCF margin assumption for year one will be INTC’s historical average of 4.05%. Due to the expected aggressive EPS growth, I incorporate a 1.5 percentage points yearly FCF improvement. A 3% perpetual growth rate is in line with current inflation levels. Cash is added and total debt is subtracted when I finalize my intrinsic value calculation. My target price is $37 because INTC’s intrinsic value is 18% higher than its market capitalization.

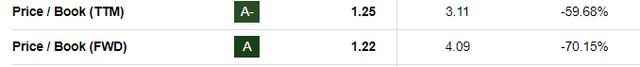

In addition, Intel’s current market value is only 25% higher than the book value. It is considered very low when we compare it to an average of 3 from industry averages.

What can go wrong with my thesis?

The competition is intense across all products offered by the company. INTC competes with Nvidia and AMD in the CPU/GPU field, both of them are known for their aggressive growth profiles and their fabless business model makes these players more flexible. New technologies in the industry emerge, which creates new opportunities for previously less-known companies. For example, Arm Holdings plc (ARM) looks like an under-the-radar player compared to Intel’s well-known brand, or even NVDA and AMD. However, this business is thriving, and its market cap is higher compared to Intel. Fierce competition is the most significant factor that can make my thesis look bad over time.

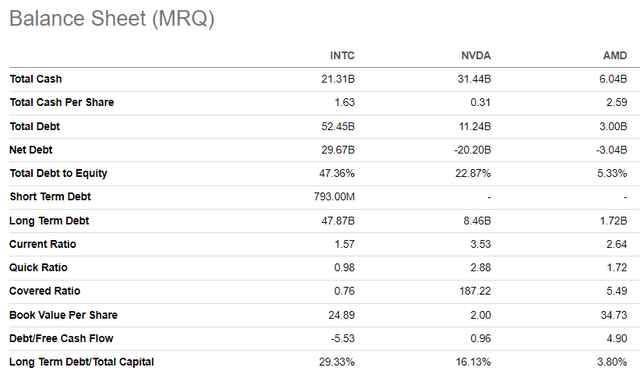

Intel’s highly leveraged balance sheet, especially compared to NVDA and AMD, might be an obstacle to the company’s success. High debt levels weigh on profitability and limit any company’s flexibility in allocating its financial resources. From the perspective of the balance sheet, NVDA and AMD have a competitive advantage over INTC.

The semiconductor industry is cyclical and heavily depends on the broader economic environment. Since interest rates remain high in the U.S., some analysts believe that the U.S. will enter a recession either this year or in 2025. The recession will highly likely lead to overall spending softening, which will also affect semiconductors. Moreover, the potential recession might also lead to investors selling off risky assets like stocks and reallocating capital to fixed-income instruments. This will also not be beneficial for my thesis.

Summary

Intel’s firm exposure to thriving AI and data center domains together with its compelling 18% upside potential makes it a Strong Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.