Summary:

- TSMC’s share price has surged over the past year, reflecting its value as a key player in technology.

- Capacity expansion to meet AI chip demand is a priority, with plans for new facilities and technological advancements.

- Geopolitical diversification, pricing leverage, and strong financials contribute to TSMC’s potential for future growth.

BING-JHEN HONG

Introduction

Taiwan Semiconductor (NYSE:TSM) has had an amazing run in the last year, up around 77%, and well over 110% since it hit the bottom sometime in October of last year. The company’s value has finally been seen by the masses, and the share price is starting to reflect a company that is at the forefront of innovation and a key player in basically every technology. The company’s share price has continued to perform well since the last time I covered it back in April, when I said the company was just getting started. The company is up over 30% since then, compared to S&P500’s (SPY) 7.5%.

I am still in it for the long run, and I don’t think we have really seen what the company has to offer in terms of growth. Below are the reasons that I believe will help the company continue to perform very well over the next 5 years, if not more, and that not everything has been priced in just yet. I believe such a dominant player in the industry should be worth a lot more than what investors are giving it credit for.

Reason 1: Capacity Expansion to Meet the AI hype demand

This is an obvious one. The explosive demand surge for AI chips is going to play a large role in the company’s top-line potential. I can see the company further expanding its AI chip production needs in Taiwan and probably globally. The company is aggressively expanding the capabilities of its Taiwanese fabs to accommodate as much as it can the demand for AI chips. Currently, the issue is not the demand but the supply. The company has said that it currently supports around 80% of the customers’ needs and with further investments in its Chiayi plants to increase the capacity, the company expects this shortage to be alleviated within a year and a half. The Chiayi Science Park expansion has just begun its construction, so at the earliest, TSMC expects to see this capacity improve operations sometime in 2026.

Last year, the company opened an Advanced Backend Packaging Fab 6 facility in Miaoli to improve the capacity of AI chips; however, it is still not quite enough. At around the same time, the company announced that they were looking to build another Advanced chip-packing facility worth $2.9B in Tongluo Science Park. There are still no confirmed dates on when this facility will be in full operation, but it is expected to begin construction sometime in the 2nd half of 2024, or now, and finish by 2027.

I also mentioned in one of my previous articles that the company is looking to add advanced packaging capabilities in its Arizona plants, and according to the most recent transcript, the company upgraded its 2nd fab to utilize 2nm tech to support the strong AI demand.

Another positive development concerning efficiency and capacity expansion regarding AI is that the company has been in the research phase of a completely new tech that, if it is going to be feasible, would triple the size of wafers. The company began exploring the notion of changing the shape of the wafer from the traditional circle to a rectangular shape, which will produce a lot less waste when cutting, thus lowering costs and increasing the volume by 300%. This will allow placing more chips on each wafer, with very little waste. This would be quite a massive technological shift, and it will come with many obstacles. As the study is still in its early stages, over time I believe the company may drop it because it found that it is not worth the effort and the change of machinery and other equipment to warrant such a shift, but who is better to pioneer this than the biggest player in the industry?

In short, the company is not standing still and is doing everything it can to increase capacity to meet the overwhelming demand for AI chips, and although it’s still a year or two away, I believe that once everything is operational, we will see outstanding growth of the top-line that may not be priced in yet.

Reason 2: Pricing Leverage Should Increase Top-line Potential

I think it was about time that TSMC began thinking of increasing pricing for the AI demand. Nvidia has been growing at a ridiculous pace over the last year or so, while the pick-and-shovel company that made it all happen has not seen such an explosion in its top line. I was glad to find out that TSMC is seriously looking into price hikes for NVDA’s explosive AI chip demand. The company has so much leverage right now, being the sole maker of these chips for NVDA. I think the company has so much leverage that it should seriously look into a much higher price hike than a measly 5% given how much NVDA enjoyed the explosion in earnings, but without TSMC’s technological expertise, none of this would have been possible. TSMC’s management needs to be a little greedier in my opinion. I don’t think NVDA is going to drop it as its manufacturer. It has a lot more to lose than TSMC, as NVDA accounts for around 10% of total revenues.

Reason 3: Geopolitical Tailwinds and Diversification

In the past, Geopolitics may have been the biggest risk of investing in TSMC given the proximity to China, and many people likely thought TSMC was doomed and would be taken over by force by China. I think this risk has been more or less mitigated because of all of the international investments that TSMC entered into in the last year or so. Now, I believe geopolitics is a positive for TSMC. Many governments, like the ones mentioned above, such as the US and Japan, have entered into multibillion-dollar agreements that help TSMC expand its global presence, which means a lot more countries will be affected by any sort of retaliation by China. Even before then, TSMC was too important globally, so now, with many subsidies granted to build new plants in many other regions, the company should be safe from being so close to a country that may invade it, which I don’t think they will, but crazier things have happened. With the new plant coming to Germany, 70% of it will be owned by TSMC, and the company is further solidifying its global footprint, while also paving the way for more plants to be opened in Europe under the European Chip Act.

Reason 4: Outstanding Financials

The last reason I would like to cover is the company’s outstanding financial health, which is what keeps me invested even after such a decent run it had in the last year. The latest quarter we have is a little outdated since the company is going to report again in the next couple of weeks (July 18th), but these numbers are still a good indication of the company’s financial health. The company’s total Cash and equivalents stood at an impressive $60B, which is not far behind companies that have a market capitalization over at least $1T. Companies like Amazon (AMZN) with a $2T market cap have around $85B in cash, Apple (AAPL) with $67B in cash at over $3T market cap, or Microsoft (MSFT) with around $80B in cash and similar market cap to AAPL. This stat may be of no use, but I like to see how well a company stacks up to the juggernauts. The company’s cash pile easily covers the company’s outstanding long-term debt, while interest expense is dwarfed by interest income, so there is no need to even pay back the debt outstanding, which stood at around $30B. The capital should be used to further the growth of the company, as I can see many more countries would love to have it set up shop and stimulate the economy.

The company’s free cash flow, although very strong even today, has a lot more opportunity to improve in the later years after the aggressive capex spending tapers off. In my previous article, I mentioned the company is looking to spend around $30B on Capex to meet the growing demand for many technologies like AI, HPC, and 5G megatrends, These all require a massive upfront investment, after that once the factories and other facilities are up and running, the company’s free cash flow should see a massive spike, until it decides to expand its presence further and continue to spend a lot of capital.

Update on Valuation

I’ll keep it short in this section, as I recently did a model; however, I am a bit more optimistic this time around.

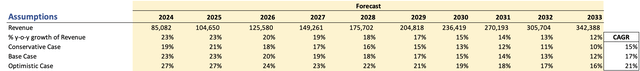

For revenues, with all the expansions and other fabs coming online over the next few years to catch up with the demand, I believe the company can grow at around 17% CAGR over the next decade, which I still think may be on the more conservative end. The company has a lot of leverage to raise the prices of the AI players since those guys are raking in all the earnings. It’s time for the company that helps make their product to get a good piece of it.

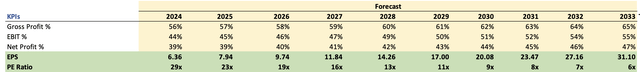

For margins and EPS, I believe once all the fabs come online and the company reduces its expenditures, we should be able to see decent improvements all around. The company’s fabs should return to working at close to the maximum utilization rate, which should equal higher economies of scale.

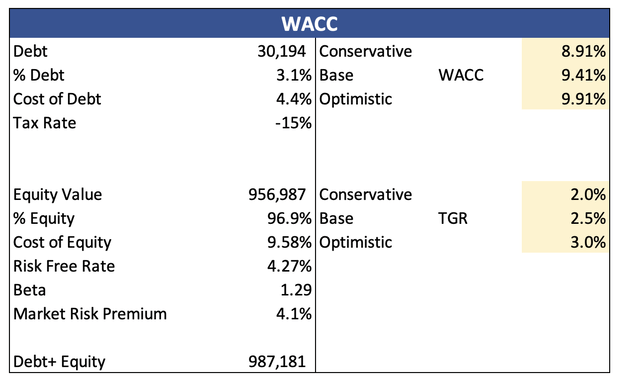

For the DCF model, I went with the company’s WACC of 9.4% and 2.5% terminal growth rate.

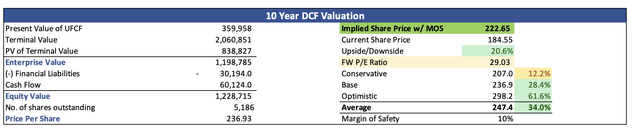

I will also keep the 10% discount rate to the final fair value calculation to give myself some room for error in estimates. With that said, I believe the company’s fair value is around $222 a share, meaning TSMC is still trading at a discount to its fair value.

Risks and Closing Comments

Of course, this is not a surefire way of making lots of money. There are still some risks involved.

I think if the AI demand is going to wane quicker than anyone anticipates, then all those aggressive expansions may be for nothing and end up idling without any production capacity being used because, for some reason, the AI hype dies down relatively quickly. The company predicts that AI-related revenues will make up around 20% over the next couple of years, so it will be quite a decent chunk, and if we see any weakness there, that is going to affect the company’s operations significantly.

I know I mentioned that proximity to China is not a bad thing anymore, in my opinion, but as I said, crazier things have happened in the recent past, so I still have to mention it here as a caution and a worst-case scenario.

No company is immune to economic downturns, especially the company’s share price. Even if a company does a stellar job of operating, the company’s share price could still suffer because of overall broad market jitters and uncertainty.

The calculations above depend on the overall vast improvement of the semiconductor sector, and the company’s plans to increase efficiency and utilization of its capacity and fabs, which will take a while and may not be as robust as I have estimated above there, but not out of the realm of possibility for sure.

Nevertheless, I do think even right now at the current share price, it still has a lot of potential to outperform in the future. I am still kind of surprised that this company is not at least a $1.5T company. The company is at the center of advanced technology, and I believe many people are overlooking it due to that one geopolitical risk. I may be wrong, but I believe the company deserves a lot more love because there are many positives in its long-term growth story. They will just take time to bear fruit. However, with such a run-up, I am not as confident as I was previously when giving it a strong buy, and I will be downgrading it to a buy, meaning, it’s still possible to nibble at these prices for the long run, but also the company may see a little pullback after the run it had recently. I am going to increase my position relatively soon, but I may wait until it reports its earnings and see how it is looking in terms of the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.