Summary:

- Applied Materials is a global leader in semiconductor technology, benefiting from AI hype but with earnings growth below historical averages.

- Earnings beat expectations in May, with tepid EPS growth expected in the medium term despite AI enthusiasm.

- Valuation is historically high, driven by sentiment and hype around AI, with balance sheet strength and potential for increased dividends.

Sundry Photography

Introduction

Applied Materials (NASDAQ:AMAT) is a global leader in semiconductor wafer fab equipment, or WFE for short. The firm’s technology is pivotal in addressing the challenges of shrinking chip sizes and the challenges of increasing design complexity due to initiatives such as vertical stacking used in cutting-edge devices.

The firm has been a beneficiary of AI related hype and I will argue below that the firm merits a hold, despite boasting an excellent business which should continue to grow with time. Shares have appreciated close to 175% since October 2022 when the launch of ChatGPT shifted the narrative surrounding AI and the semiconductors requirements associated with it.

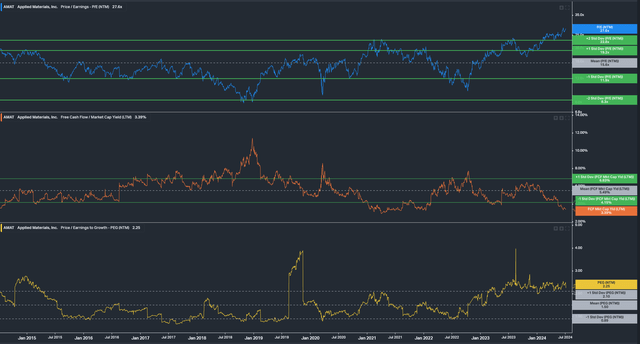

With shares now trading more than two standard deviations above historical averages, this clearly tells us as investors that the rapid price appreciation has not been properly supported by associated earnings growth. Even looking to the medium term, forecasts for earnings growth for the firm are below historical averages, in order to justify a two sigma PE, I would expect to see meaningfully higher expected earnings growth. With this in mind, I think it prudent to recommend a hold at given prices. Applied Materials is a name I think investors should look to buy when valuations revert back to historical norms.

Earnings

AMAT last reported earnings in May, with both EPS and revenue coming in ahead of expectations. The firm has a consistent track record of earnings beats. Over the past 20 quarters, they have beaten on earnings 17 times, and they have achieved the same ratio of revenue beats.

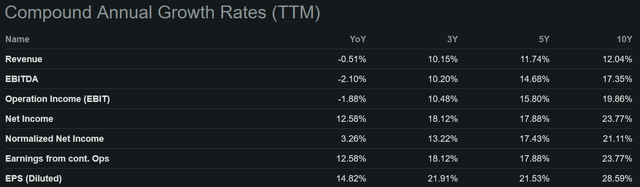

Looking ahead to fiscal Q3, consensus is expecting 6.3% EPS growth. Earnings growth is expected to begin ramping more substantially from Q2 2025 as EPS growth returns to a double-digit pace. Despite all of the AI hype, EPS growth is tepid versus the firm’s recent history. Consensus is looking for medium term EPS growth of 12.3%. This is a solid rate of growth, but it is relatively unimpressive when compared to the firm’s three, five and ten-year CAGRs.

Given all of the noise around AI and the boost it is providing to demand for companies such as Nvidia (NVDA), we would expect to see higher than historical growth for a firm like Applied Materials, but this is not the case.

Valuation

This is the part of the stock I am not so keen on. Simply put, I see AMAT as too expensive at current levels to justify an entry into the stock. On a forward P/E basis, the stock is greater than two standard deviations above its ten-year average. Essentially, the stock is the most expensive it has been in the last ten years, this is understandable given the AI enthusiasm.

A high valuation does not by itself signal a bad entry point in a stock. We need to consider other variables to get a broader understanding. When we bring expected growth into the equation via the PEG ratio, we once again see valuation significantly above the mean. Hence, we can determine that the higher P/E ratio is not a function of a higher expected growth rate for the stock. Lastly, we look at the FCF yield, which indicates a value close to ten-year lows. Once again, we can see the higher valuation of the stock is not being driven by higher cash generation in the business.

Taking these factors together, I think it is reasonable to conclude that the historically expensive P/E valuation of the stock is being purely driven by sentiment and hype surrounding AI. It is not being driven by a higher expected future earnings growth or superior cash generation capabilities.

Looking at the balance sheet, we see a business in robust health. The firm boasts net cash on the balance sheet of close to $1.6B. Balance sheet strength is highly desirable for investors, as it means the company is not burdened with interest payments on debt. Additionally, balance sheet strength gives the firm financial firepower with which to pursue strategic M&A if it is opportune.

Historically, the firm has not pursued large scale M&A, with the largest deal executed back in 2011 for Varian Semiconductor a mere $4.9B. In the absence of M&A the firm has been effectively deploying capital to reduce its own outstanding shares through buybacks. Over the last ten years, the firm has reduced shares outstanding at a rate of 3.75% CAGR. All else equal, this reduction in shares leads to a corresponding boost to EPS.

The firm at present has a relatively unimpressive dividend yield of less than 0.7%. However, given the payout ratio is just 16.5% I see scope for AMAT to be a more significant dividend option in future. Over the past ten years, they have grown the dividend at a 13% CAGR, so there is plenty of reason for optimism regarding future cash returns to shareholders.

Risks

One of the key risks to my thesis is a sharp slowdown in AI-driven sentiment. A shift in sentiment would likely drive a reversal in valuations for most stocks involved in the semiconductor food chain. Given the strength of the Applied Materials business, I think a pullback in valuation could present investors with a nice entry point into the stock, so it would be a risk for current holders of the stock but an opportunity for those waiting in the wings looking to pick up shares.

Conclusion

In Conclusion, I see AMAT as a high-quality leader in the semiconductor wafer fab equipment space. However, the stock has gone parabolic since October 2022 when the launch of ChatGPT brought AI into the mainstream. Importantly, the share price appreciation does not look to be backed up by a corresponding increase in forecast earnings or an improvement in cash generation.

As a result, I am recommending a hold, as I do not think an entry at current prices represents good value for investors. Given the increase in P/E multiple looks to have been driven mostly by a change in sentiment, I expect we will see some mean reversion as sentiment retraced from current peak levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.