Summary:

- Amazon continues to see strong growth and success, particularly in its cloud operation, AWS, which is a key driver of profits.

- Despite past challenges, the company’s international business is showing signs of improvement, contributing to overall margin expansion.

- With promising growth potential in the e-commerce market and strong financial performance, Amazon remains a solid investment with further upside expected.

Daria Nipot

For better or worse, the history of capitalism will be defined, in part, by the success of e-commerce giant Amazon (NASDAQ:AMZN). In addition to being one of the largest publicly traded companies on the planet, it is a business that continues to grow at a rapid pace. Over its lifetime, it has made many investors wealthy. And in the long run, it’s likely this trend will continue. It has been this mindset, combined with how shares have been priced, that has led me to be generally bullish about the firm.

The last article that I wrote about the company was published in the middle of March of this year. At that time, I ended up reaffirming my ‘buy’ rating on the stock. Since then, shares have seen upside of 5.8%. Unfortunately, this does trail, ever so slightly, the 6.1% increase seen by the S&P 500 over the same window of time. But from the first time that I upgraded the company to a ‘buy’ from a ‘hold’ back in October of 2023, shares are up a whopping 49.8% compared to the 27.4% rise seen by the broader market. Despite this move higher, the firm continues to show drastic signs of improvement. And that is enough to justify further upside from here.

Some great momentum

Even though Amazon is, at its core, an e-commerce business, one of the most important parts of the firm is actually its cloud operation. This is known as AWS. In an article that I wrote not long ago regarding Google parent Alphabet (GOOG) (GOOGL), I talked more about this industry and the potential that it has. Even though this is a large market, rapid growth moving forward should result in excellent potential for the top few businesses in this space. And the fact of the matter is that, right now, Amazon and rival firm Microsoft (MSFT) are the industry leaders.

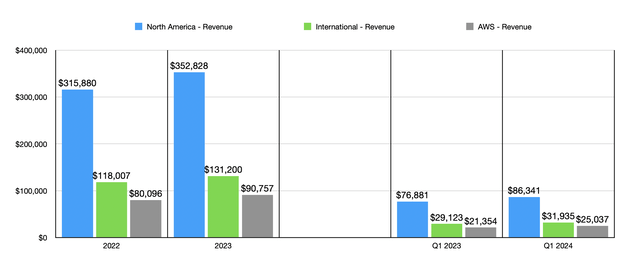

Despite fierce competition, Amazon continues to see strong upside. Since I last wrote about the firm, we have only had one additional quarter worth of information come out. That covers the first quarter of 2024. For that time, revenue generated by AWS came in at $25.04 billion. That’s 17.2% above the $21.35 billion the segment generated one year earlier. This increase in revenue was driven largely by a rise in customer usage. In fact, things are going so well that this growth was in spite of the fact that pricing changes, driven by a shift to long-term customer contracts, had a negative impact on operations.

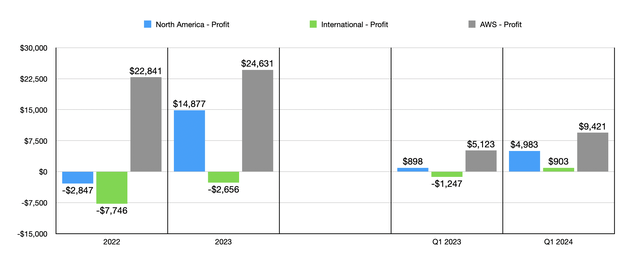

As impressive as this revenue growth is, it’s actually the growth in segment profits that investors should be paying attention to. Profits jumped from $5.12 billion in the first quarter of last year to $9.42 billion the same time this year. This improvement was driven not only by the higher revenue, but also because of decreased payroll and related expenses. The picture would have been even better had it not been for increased spending on technology infrastructure that the company is making an order to improve operations and to drive further growth.

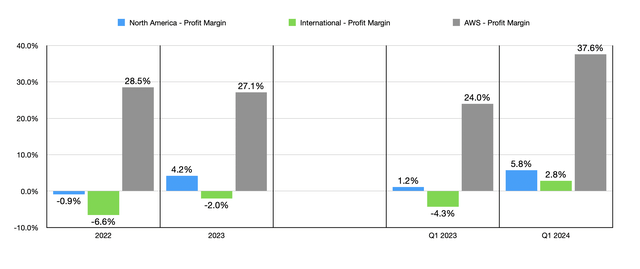

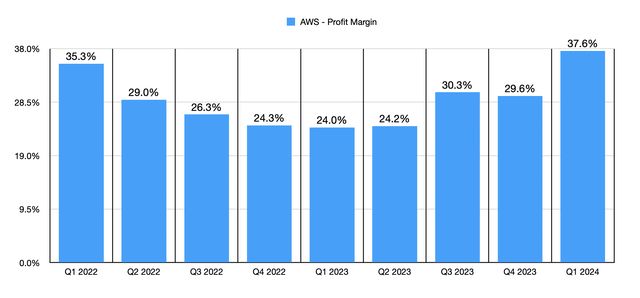

This growth on the bottom line for AWS is clearly not a one-time blip on the radar. The fact of the matter is that management has been successful in growing margins for some time now. In the first quarter of 2022, profit margins for the segment came in at 24.3%. Since then, we have seen growth to a profit margin of 37.6%. There was a time, back in the first quarter of 2022, when margins were nearly as high. But that seems to have been a temporary thing. The cost-cutting initiatives that management has been focused on make it seem as though we will not see a repeat of the decline that was seen back then.

I would make the case that AWS is the gem in the crown that is Amazon. But it’s not the only reason I am bullish about the business. The fact of the matter is that other parts of the company are expanding nicely also. Its North American business, for instance, continues to expand. Revenue in the first quarter of 2024 came in at $86.34 billion. That’s 12.3% above the $76.88 billion generated one year earlier. According to management, this was largely because of increased unit sales, including sales by third-party sellers, as well as stronger advertising sales and increased subscription services. Management’s continued emphasis on fast shipping options also helps considerably.

In the not-too-distant past, the e-commerce part of the company was a true money loser. But that has since ceased to be the case. In the first quarter of 2023, the North American operations generated segment profits of $898 million. That number has ballooned to $4.98 billion as of the end of the most recent quarter. This growth is in spite of continued investments in shipping and fulfillment costs, as well as greater technology and infrastructure spending. The fact of the matter is that, as the company continues to grow, its cost structure becomes more efficient. This is the famous flywheel that Jeff Bezos envisioned many years ago. And after all this time, it is finally bearing fruit.

The biggest weak spot for the company has always been its international business. The fact that this part of the company is considerably smaller than its North American operations explains all of this. A smaller operation means weaker economies of scale. But the good news is that even on this front we are seeing some improvements. In the most recent quarter, revenue internationally came in at $31.94 billion. That’s a hair above the $29.12 billion generated one year earlier. This growth, and the economies of scale that comes with it, has been helpful in pushing the firm from generating a segment loss of $1.25 billion to generating a segment profit of $903 million. What we are seeing across the company is margin expansion. And that is an excellent catalyst for upside for investors.

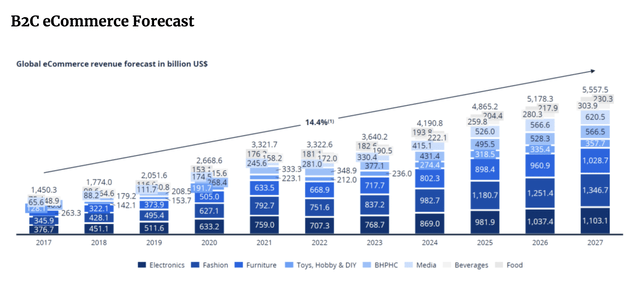

At some point in time, the growth prospects for Amazon will dwindle. But I don’t think this will occur anytime soon. We live in a growing world where goods and services continue to be purchased in increasing quantities online. This is driven in part by globalization, but also by domestic changes. The data that’s available right now suggests that this growth trend is nowhere near done. On the B2C (business to consumer) front, global e-commerce revenue is expected to expand by roughly 11.2% per annum, climbing from $3.64 trillion last year to $5.56 trillion in 2027.

International Trade Administration

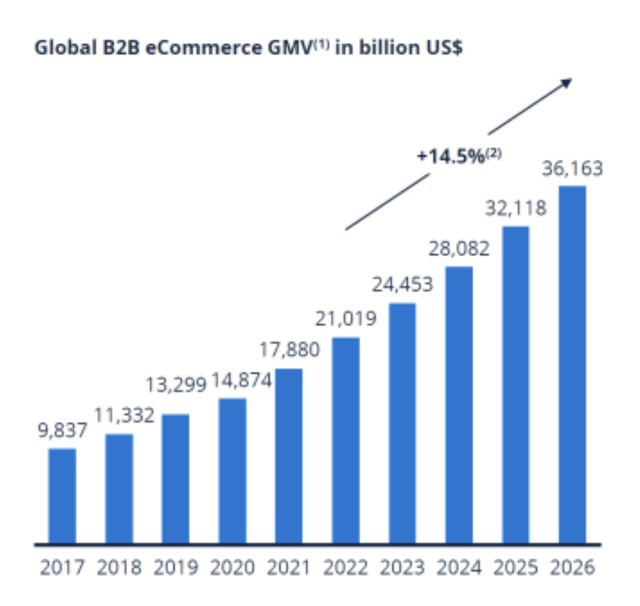

This does indicate a slower growth rate than the 14.4% annualized growth anticipated from 2017 through 2027 as a whole. But you can’t expect rapid growth to occur forever. On the B2B (business to business) side of things, growth is expected to be quite robust as well. In 2023, it was estimated to be worth $24.45 trillion. And by 2026, it should expand to $36.16 trillion. That’s an annualized increase of 13.9%. It’s unclear exactly how much of this Amazon we’ll be able to capture, considering that about 80% of this market will be in the Asia Pacific region of the world. However, Latin America will also be a major growth area, as will the Middle East. Obviously, none of this factors in the growth associated with its cloud operations, which is a topic I have covered before. In short, growth potential for the business as a whole looks promising.

International Trade Administration

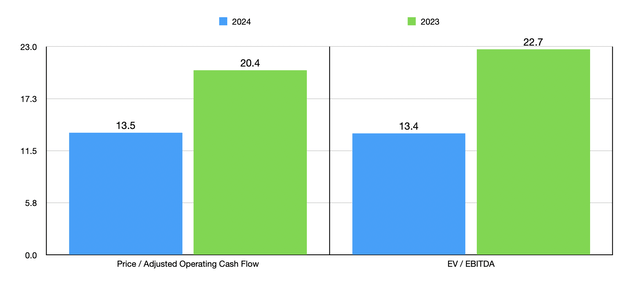

If we annualized the results that we have seen so far for Amazon, then we would expect adjusted operating cash flow this year of about $145.81 billion. Meanwhile, EBITDA would come in at about $145.19 billion. For those worried that recent growth was a one-time thing, management did say that they expect operating income in the second quarter of this year to be between $10 billion and $14 billion. That’s well above the $7.7 billion reported at the same time last year. This will be based on revenue growth of between 7% and 11% on a year-over-year basis. With numbers like these, I don’t worry about my estimates for this year as a whole being off by all that much.

With these figures, I was able to value the company on a forward basis, as shown in the chart above. You can also see how the company is valued relative to figures from 2023. On a forward basis, specifically, shares look quite attractively priced. This is especially true when you factor in the growth the company is seeing and the fact that it has net cash as opposed to net debt in the amount of $27.44 billion on its books.

Takeaway

The way I see things, the future for Amazon and its investors is almost certainly going to be bright. Absent something significantly negative coming out of the woodwork, I suspect further upside moving forward. This will be based on growing revenue, profits, and cash flows. Due to these factors, I have no problem keeping the company rated a ‘buy’ at this time, even after seeing such rapid upside since I first rated it a ‘buy’ back in October of last year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!