Summary:

- Uncertainty surrounds the future of Southwest stock due to fundamental variables and its recent decline after a huge bounce in 2021.

- Elliott Wave Theory and sentiment analysis can provide insights and potential paths forward for trading Southwest stock.

- Emergent behavior in financial markets can help us understand crowd psychology and market dynamics when analyzing stock movements in tickers like LUV and others.

John M Lund Photography Inc

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

Articles have been written, opinions have been given. And frankly, no one seems to know how this is going to turn out. Why is that? Well, there are so many potential variables that are yet to be locked down on the fundamental side for Southwest Airlines (NYSE:LUV). It has taken some lumps in the near term. After a massive trampoline-like bounce up into 2021 from the 2020 washout panic lows, the stock has been in steady decline. What will it take for this to pull up from the nosedive?

We’re going to use Elliott Wave Theory to identify a specific setup with defined risk versus reward. Also, we’ll discuss what the term “emergent behavior” means and what it has to do with LUV stock. When the fundamental side is cloudy, the study of sentiment can shine a light into the fog, many times pointing a way forward.

The Fundamental Fog

With so much interest lately in LUV stock, we queried Lyn Alden, our lead fundamental analyst, regarding the current viewpoint from her vantage. Here is a brief comment that she shared with us:

“LUV as a highly cyclical airline stock with no economic moat is something I have no firm fundamental view on, and would defer almost entirely to sentiment and technicals for trading purposes.” – Lyn Alden

So if we find ourselves in thick soup, fundamentally speaking, how do we find a way out? Is there another way to analyze probabilities and determine a possible path through? The answer is “yes” and it is with Elliott Wave Theory. A specific aspect of this study is what has been denominated “emergent behavior”. Let’s briefly discuss this aspect of the methodology and then apply it to LUV.

What Is Emergent Behavior?

Avi Gilburt has shared multiple findings from across years of studying human behavioral patterns, i.e. sentiment. One of the research pieces entitled, “Large Financial Crashes,” published in 1997 in Physics A., a publication of the European Physical Society, shows where the authors, within their conclusions, present a nice summation for the overall herding phenomena within financial markets:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents.

In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.” – shared by Avi Gilburt

How Do We Apply This Theory In Practical Terms?

Let’s look at the current setup that we are able to identify in LUV. This post below was shared with our members a few weeks ago, and it outlines the bigger picture via sentiment, or crowd psychology.

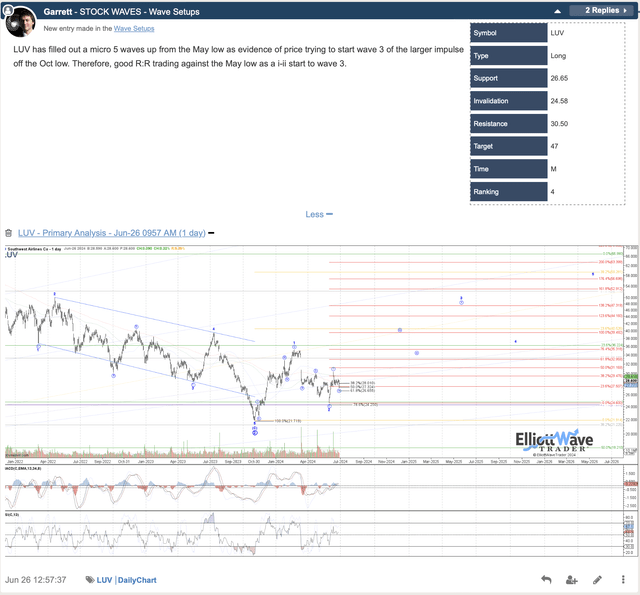

Wave Setup by Garrett Patten – StockWaves – Elliott Wave Trader

You will note from the chart shared by Garrett Patten that the daily time frame renders a bullish stance. As well, Zac Mannes posted this chart for our members on Friday of last week.

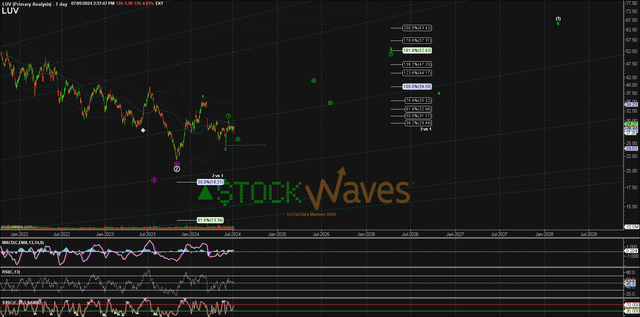

Chart by Zac Mannes – StockWaves – Elliott Wave Trader

If you zoom into the chart and graph posted with the Wave Setup by Garrett, you will note specific price levels that indicate either further confirmation of the setup or when it would actually invalidate for the moment.

Note also Zac’s chart that shows room for a minor pullback in the near term for circle wave ‘ii’ in the Green path.

Now, please recall from the above shared findings regarding “emergent behavior” that this is the market (LUV stock) as a whole that is manifesting “crowd think” as it were. Perhaps as an individual, you would personally reason that there is no way that LUV is investible at this moment. Or that it’s not a stock with which you wish to be involved given the fundamental uncertainties currently present. And, you know what? That’s OK.

However, from what we are able to identify, there is a bullish setup showing for as long as price holds at or above the last low struck at wave 2 at $24.60.

Do You Have A System In Place?

Those who have experience forged by time in the markets will tell you that it’s imperative to have a system of sorts in place. You need to be able to define how much you are willing to risk versus how much gain is likely. Those who survive across the decades in the greatest game on earth will also inform you that the preservation of capital is paramount.

While there are multiple manners of doing this, we have found Elliott Wave Theory with Fibonacci Pinball to be a tool of immense utility for traders and investors alike. It is the very methodology that we are using to identify the current setup in LUV. Will it work out as drawn up? That is for the market to determine.

There are many factors beyond one’s control. There are also market forces at work that an individual may not even perceive. Sentiment. Fear. Greed. It is all pushing and pulling the price of the stock across the chart. Our job as market observers is to identify the probable path or paths likely, and then determine our entry and exit points. That is the extent of our control. Everything else is just an illusion.

Conclusion

Many ways exist to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LUV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities! Get leading Elliott Wave analysis from our team, along with fundamental insights and macro analysis from top author Lyn Alden Schwartzer.

“Stockwaves is my bread and butter, and that’s only catching maybe 10% of the charts they throw out! I had 7-10x+ trades with SW last year, and dozens more that were “slackers” (LOL) with “only” 3-4-5x returns. Amazing!” (Nicole)

Click here for a FREE TRIAL.