Summary:

- Judging by Microsoft Corporation’s recent earnings, my earlier analyses have underestimated the pace of its AI deployment.

- Microsoft Corporation is at a point of applying AI at scale to drive revenue growth and profitability.

- As a result, I see good odds for market-beating returns despite its record stock prices and 40x P/E.

Kenneth Cheung/iStock Unreleased via Getty Images

MSFT is applying AI at scale

I last wrote on Microsoft Corporation (NASDAQ:MSFT) stock a little more than 3 months ago, as shown in the image below. In that article, entitled “Wonderful Business. Awful Price,” I analyzed the strength of its business model and expressed my reservations about the rich valuation and the uncertainty of its AI-fueled growth projection. Quote:

My goal was to scrutinize the key variables baked in the valuation of Microsoft Corporation: its growth rates (and the corresponding catalysts) and its discount rates. My conclusion is that Microsoft stock’s current price reflects too much valuation risk even under some quite aggressive growth assumptions – even with AI potential considered.

Since the publication of that article, MSFT has reported its fiscal third quarter earnings (for the fiscal quarter ending March 31). After analyzing the progress in the earnings report, I have to conclude that I underestimated the pace of its AI infusion. To wit, total revenue rose 17% year-over-year to $61.86B, and a key driver was the $26.7B pulled in by its Intelligent Cloud division (where the Azure cloud unit belongs). Azure’s revenue grew a whopping 31% YoY, and I think Copilot and the AI transformation are key catalysts here.

The company’s CEO, Satya Nadella, commented that:

“Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry”

Judging by the numbers reported, I totally share the management’s enthusiasm. I think the company is at a point where it can infuse AI at scale with its existing products and services and also create new frontiers. As Microsoft continues to infuse AI across all layers of the company’s technology, I expect it to gain new customers and advance efficiency.

With these new developments, the goal of this article is to provide an updated assessment of the stock. And I will explain how the stock can still deliver market-beating returns despite its high P/E (around 40x at the time of this writing) thanks to the growth from AI infusion ahead of its next earnings release expected on July 25th.

MSFT stock: AI infusion moved the profitability needle already

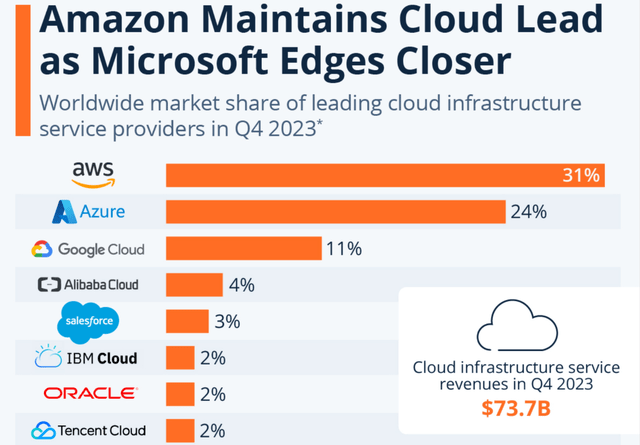

The top growth catalyst in my mind is the integration of AI and its cloud services. Admittedly, Amazon.com, Inc.’s (AMZN) cloud remains the market leader currently, as illustrated by the chart below. As of Q4 2023, MSFT’s Azure had a market share of 24%, lagging AWS by a sizable 7%. However, I anticipate Azure to grow at a faster pace due to its better AI integration potential (and also the synergies with other MSFT products). For example, MSFT has approximately 53,000 Azure AI customers and according to management, one-third are new to Azure over the past 12 months. Others seem to share this forecast. For example, the following Forbes report argued that MSFT’s cloud could take the lead from AWS as soon as 2026.

While Amazon has dominated the industry for more than a decade, AWS is growing far more slowly than Microsoft’s Azure cloud infrastructure unit. If current trends continue, Azure could be the industry leader by 2026. Underlying Azure’s rapid growth is the payoff from Microsoft’s estimated $13 billion investment in OpenAI.

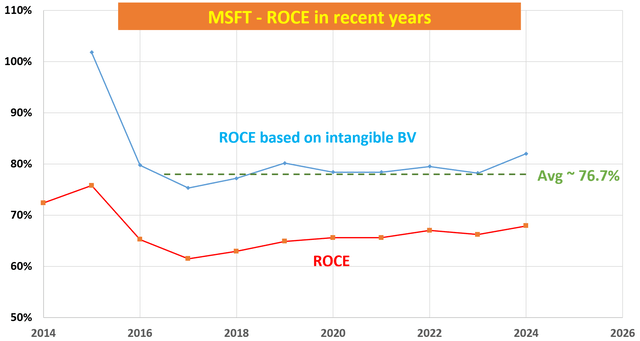

Putting aside futurist projections, recent financials also begin to show the profitability enhancement, as illustrated by the next chart below according to my analysis. As a long-term investor (thinking as a business owner), the most key profitability metric to me is the return on capital employed (“ROCE”). The chart shows MSFT’s ROCE in the past decade. As you can see, MSFT boasted ROCE on the order of 100%. The ROCE then began to decline sharply in 2016 and remained largely flat since then.

Note that to analyze the ROCE of MSFT, I consider the standard items of capital actually employed such as payables, receivables, inventory, and also PPE (net Property, Plant, and Equipment). The results from these considerations are shown in the orange line. However, given the unique nature of high-tech companies, I also considered an alternative approach by amortizing its intangible book value (mainly intellectual property and patents). The result from this approach is shown in the blue line, which displays a similar trend but is higher in magnitude.

By either approach, you can see a noticeable uptick in the past 1 year or so. For example, by the second approach, its ROCE now hovers around 82.3% from my analysis, above the figure a year ago and also its 5-year average of 76.7% by a good margin as seen.

MSFT stock: valuation and return projections

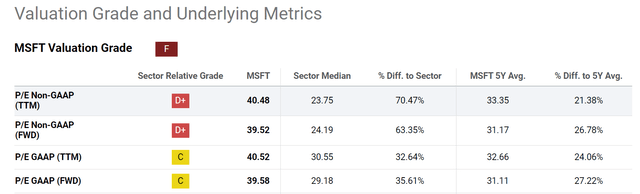

No matter how wonderful the business is, the stock price is off-putting. Trading at close to 40x P/E (as illustrated by the chart below), it’s expensive in both absolute and relative terms (e.g., when compared to peers or its own historical averages).

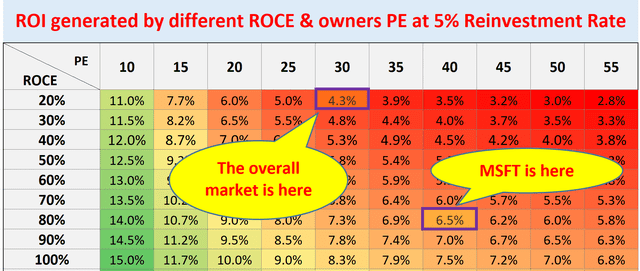

However, thinking as a long-term business owner, I am still seeing respectable return potential thanks to the growth and profitability outlook. Actually, I am seeing better return potential than the overall market, as shown in the next chart below. The method used in this projection is detailed in my earlier article. So, I will only quote the gist here for ease of reference:

- The long-term ROI for a business owner is determined by two things: A) the price paid to buy the business and B) the quality of the business. A is determined by the owner’s earning yield (“OEY”) when we purchased the business. And that is why P/E is the first dimension in the table. B is determined by the quality of the business and I rely on ROCE for the reasons aforementioned.

- The long-term growth rate is governed by the product of ROCE and the Reinvestment Rate. So in the end:

- Longer-Term ROI = Valuation + Quality = OEY + Growth Rate = OEY + ROCE*Reinvestment Rate.

At MSFT’s current P/E of ~40x, the accounting earning yield is about 2.5%. With its current ROCE of around 80% and 5% reinvestment rate, a growth long-term growth rate of 4% can be expected (ROCE * reinvestment rate = 80% * 5% = 4% growth rate). Thus, the total expected return is about 6.5%, far more attractive than the overall market as seen. Furthermore, note that:

- The OEY (owner’s earning yield) is a bit higher than its accounting earnings yield. The OEY is around 3% by my analysis because MSFT’s economic earnings are more than its accounting earnings.

- The growth rate analyzed above is the real growth rate before inflation.

Considering these factors, I expect the notional return to be close to 10% per annum (assuming an inflation factor of 2.5%) despite the current elevated P/E.

Other risks and final thoughts

There are a few other risks worth mentioning before closing. On the positive side, Microsoft also completed its acquisition of Activision Blizzard. The financials from the past quarter were the MSFT’s first quarter with Activision Blizzard’s earnings included (and its Personal Computing revenue came in at $15.6B last quarter).

Looking ahead, I anticipate Activision Blizzard’s popular franchises like Call of Duty and Candy Crush to boost Microsoft’s game pass subscription service. Also, Activision Blizzard is a powerhouse in mobile gaming with a huge mobile user base (think Candy Crush). This is a sector where MSFT has an especially weak presence in my view. The acquisition should substantially strengthen MSFT’s position in this fast-growing market.

On the downside, like many high-tech companies, Microsoft faces the challenge of keeping pace with competition and navigating a complex regulatory landscape (e.g., antitrust and privacy concerns). Besides these common risks, MSFT also entails some unique challenges. The top one on my mind is its heavy reliance on PC-related products, with the expansion of alternative computing devices like tablets and smartphones.

All told, my verdict is that MSFT is still a solid hold for current shareholders. The giant still boasts strong growth potential, especially considering the synergies between Artificial Intelligence and its Azure cloud. Judging by its latest earning report, my assessment is that the Microsoft Corporation’s AI initiatives are already enhancing its profitability and the company is already at a point to deploy AI at an even larger scale. Due to the growth potential and enhanced profitability, I am seeing good odds for market-beating total returns in the long term despite the record stock prices and 40x P/E.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.