Summary:

- Shares of ailing zero-emission transportation start-up Nikola Corporation have rallied by more than 50% from last week’s all-time low after the company announced higher-than-expected FCEV truck sales.

- Unfortunately, recent changes in the company’s go-to-market strategy are likely to result in increased cash burn.

- But even at the current rate of cash usage, Nikola would be required to raise additional capital in the second half of the year.

- Last month, the company gained shareholder approval for increasing the number of authorized shares by more than 1,500%, thus paving the way for additional shareholder dilution.

- Consequently, investors should consider using the recent rally for disposing of existing positions ahead of what I expect to be another dismal quarterly report in early August.

Tramino

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

Shares of ailing zero-emission transportation start-up Nikola Corporation (“Nikola”) have rallied by more than 50% from last week’s all-time low of $7.25:

The main reason behind the bounce has been a short press release which celebrated higher-than-projected Q2 FCEV truck deliveries:

(…) For Q2 2024, Nikola Corporation (…) wholesaled 72 Class 8 Nikola hydrogen fuel cell trucks, above the high end of truck sales guidance of 60 units.

For the first half of 2024, Nikola wholesaled 112 hydrogen fuel cell trucks.

“We have maintained our 2024 momentum with solid wholesale numbers, new customers such as Walmart Canada, and repeat customers like 4GEN and IMC, purchasing vehicles through our dealer network,” said Nikola CEO Steve Girsky. “We are firmly on the field and are continuing to secure our first-mover advantage in zero-emissions Class 8 trucks in North America, as well as with our HYLA hydrogen refueling solutions.”

All Nikola trucks are assembled in Coolidge, Ariz.

But at least in my opinion, investors would be well-served to curb their enthusiasm as the company will be required to raise additional funds sooner rather than later.

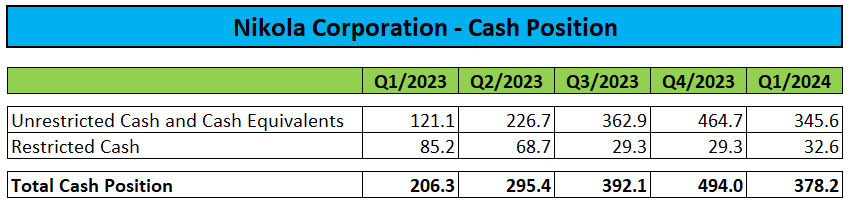

At the end of Q1, unrestricted cash was down by approximately $120 million quarter-over-quarter to $345.6 million:

Company Press Releases

However, with estimated cash losses of approximately $425,000 per FCEV truck, higher sales volumes are likely to result in increased cash burn as production numbers remain insufficient to achieve economies of scale as also admitted by management on the Q1 conference call:

There is a market for our trucks and we’ve begun to demonstrate that. That said, profitability will not be where we want it to be until we can build scale. Simply put, it is not practical to optimize our cost structure without a meaningful level of volume. (…)

To address the issue, Nikola has altered its go-to-market approach and is now focusing on winning large North American customers by the means of discounted offers:

First, we are putting a greater focus on selling to national accounts, which we define as fleets greater than a thousand trucks. Second, we are being more forgiving on the economics of the initial deal to build confidence with our end fleet users. (…) Finally, we are expanding our geographical focus beyond California and Canada.

With many of these potential customers located outside of states with generous subsidy regimes, the company will be required to step in thus likely increasing cash usage even further.

For my part, I wouldn’t be surprised to see average cash losses per truck approaching $600,000 over the next couple of quarters.

Assuming quarterly FCEV truck production increasing to 125 units in the second half of the year, negative cash contribution would calculate to $75 million, and this number does neither include cash operating expenses nor capital expenditures.

Given the unfavorable combination of higher production levels and deteriorating unit economics, I would expect quarterly cash burn to increase substantially in the second half of the year.

But even assuming stable cash usage going forward, Nikola would have to raise additional capital in Q4 at the latest point, but I really do not expect the company to wait that long.

Last month, Nikola gained shareholder approval for increasing the number of authorized shares from 53.3 million to a whopping 1,000 million (or almost 1,800%) on a reverse stock split adjusted basis, thus paving the way for additional shareholder dilution.

However, the company will be required to file a new registration statement with the SEC as Nikola is approaching the maximum amount of $1.2 billion permitted under its existing shelf registration.

In early May, the company had approximately $95 million left under its existing shelf registration, but I would expect this number to be lower today as a result of additional open market sales over the past two months.

With the company facing increased cash usage and the stock price showing signs of life, I would expect Nikola to file an automated shelf registration statement on form S-3 at any time now.

Subsequently, the company would be free to increase the pace of open market sales, conduct another public offering or issue additional convertible notes in the very near future and with another dismal quarterly report likely just weeks away, I would expect management to take action very soon.

Generously, assuming Nikola being able to raise $300 million in the second half of the year at an average selling price of $10 per share would result in approximately 40% additional dilution for existing equity holders.

Bottom Line

Nikola Corporation’s shares have rallied more than 50% from recent all-time lows after the company reported higher-than-projected Q2 FCEV truck sales.

However, recent changes in the company’s go-to-market strategy are likely to increase cash losses per truck substantially over the next couple of quarters. In combination with higher production volumes, quarterly cash usage is likely to increase materially in the near term.

As a result, Nikola will be required to raise a substantial amount of new capital in the second half of the year.

After shareholders approved a massive increase in authorized shares last month, I would expect the company to file an automated shelf registration statement with the SEC at any time now, thus paving the way for increased open market sales or an outright public offering.

Consequently, investors should consider using the recent rally for disposing of existing positions ahead of what I expect to be another dismal quarterly report in early August.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.