Summary:

- Pfizer’s recent financial performance and Wall Street analysts’ expectations around the upcoming quarterly earnings release suggest that we are currently at an inflection point.

- The company’s current pipeline of new product developments looks promising, and two recent FDA approvals underscore its ability to deliver new products to the market.

- I expect more full-year EPS guidance upgrades soon, as it appears that the company is moving ahead of management’s initial cost-cutting plans.

- My valuation suggests there is a 30% upside potential even if no real dividend growth is incorporated into the DDM model.

Alexandros Michailidis

Investment thesis

My previous bullish thesis about Pfizer Inc. (NYSE:PFE) aged well because the stock returned 8.1% to investors since April, outperforming the broader U.S. market.

The recent quarter suggests that the company’s revenue and EPS have bottomed out and we are currently highly likely in the inflection point. The management is focused on boosting profitability and its aggressive cost-cutting adds a lot of optimism to me. Recent FDA approvals look promising as they will help in pursuing the company’s strategic goals and new products are aimed at serving large addressable markets. Pfizer’s reputation as a dividend machine and the current stellar 6% forward dividend yield will likely make the stock one of the first options for investors in case of a rotation of capital from growth to value. Moreover, the valuation is still extremely attractive. All in all, I reiterate my “Strong Buy” rating for PFE.

Recent developments

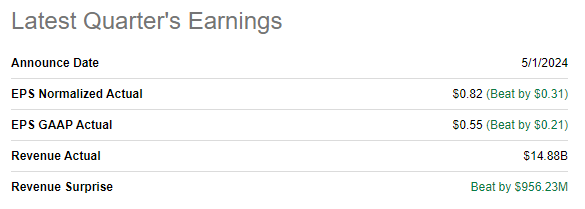

The latest quarterly earnings were released on May 1 when PFE surpassed consensus revenue and EPS estimates. There was still notable COVID-19 revenue in Q1 2023. Therefore, the latest quarter’s revenue still demonstrated a notable decline, of 18.6% YoY.

Seeking Alpha

On the other hand, Q1 revenue demonstrated another quarter of sequential growth, which is positive. Moreover, the bottom line recovers notably and there is a solid upward trend in profitability metrics after last year’s dip. The Q1 2024 adjusted EPS was lower on a YoY basis, but much higher compared to the previous three quarters.

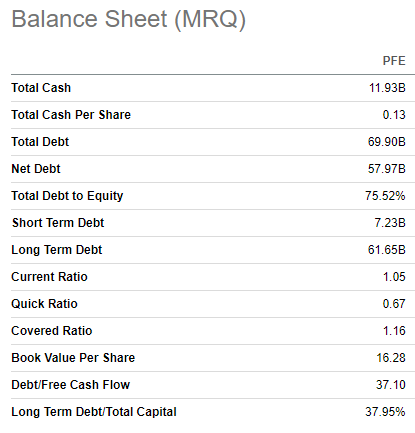

The free cash flow [FCF] was negative in Q1. However, it is mostly explained by aggressive deleveraging during the quarter with the net debt shrinking from $62.64 billion to $57.97 billion.

Seeking Alpha

Another positive sign to me is that despite reiterating full-year guidance at the same level, the adjusted EPS guidance was raised by $0.10. The improved expectations around the bottom line despite no revenue upgrades means that the company is moving ahead of the management’s endeavors in cost efficiencies.

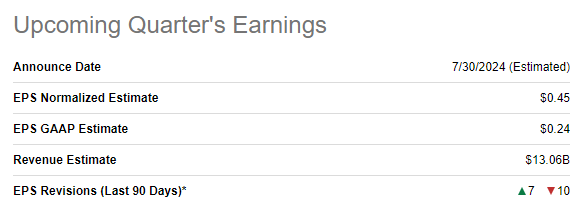

The upcoming earnings release is scheduled for July 30. Wall Street analysts expect Q2 revenue to be $13.06 billion, which will be 2.5% higher on a YoY basis. The growth will be marginal, but I think that showing revenue growth once again after several quarters of the top line decline will be an important psychological factor for the market. Expectations of analysts around the upcoming earnings release are mixed with 7 EPS upgrades and 10 downgrades over the last 90 days.

Seeking Alpha

I am optimistic about the upcoming earnings release not only because PFE will show quarterly revenue growth for the first time since 2022, but also because I think there is a notable probability that the management might boost full year EPS guidance once again. I think so because in late May the company announced expansion of its cost savings plan with another $1.5 billion to be saved by 2027.

My optimism is also backed by the two FDA approvals PFE obtained in late April. Pfizer obtained full approval for its TIVDAK product which will be used to treat recurrent or metastatic cervical cancer. Expanding its footprint in the oncology market is one of Pfizer’s strategic priorities, which is apparent after a massive $43 billion Seagen acquisition. Therefore, getting a new product in its oncology portfolio will likely help PFE in achieving its strategic goal of expanding its reach within this market.

Another vital FDA approval which Pfizer obtained relatively recently is its BEQVEZ product, which is a one-time gene therapy for adults with hemophilia B. The development is crucial for investors because the hemophilia treatment market is growing with a solid 7.5% CAGR and is expected to reach $26.9 billion by 2031. Pfizer is also currently working on a solution to treat hemophilia A, which is in trials of Phase 3.

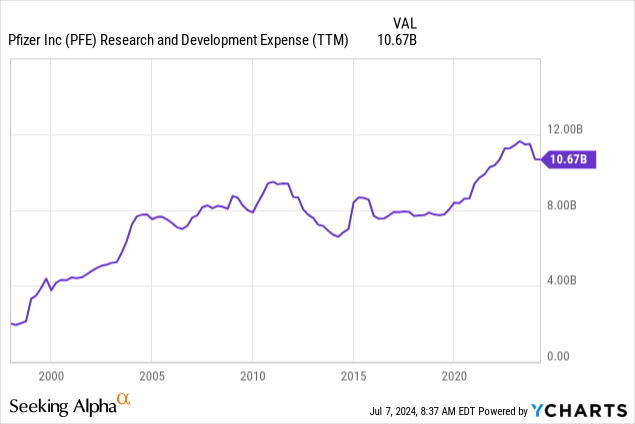

Obtaining these two approvals indicates Pfizer’s ability to consistently deliver new products to the market, which is crucial for an innovative biopharmaceutical company like PFE. The R&D budget is above $10 billion even after last year’s dip in revenue, which is positive from the perspective of creating long-term value for shareholders. As of May 1, PFE had 113 products in its pipeline. Out of them, 37 are at Phase 3 trials. According to the source, about 25-30% of Phase 3 drugs eventually obtain FDA approvals. That said, PFE’s current pipeline suggests that it is likely that the company will obtain around ten new approvals in the next few years. This will likely contribute well to the company’s long-term financial performance.

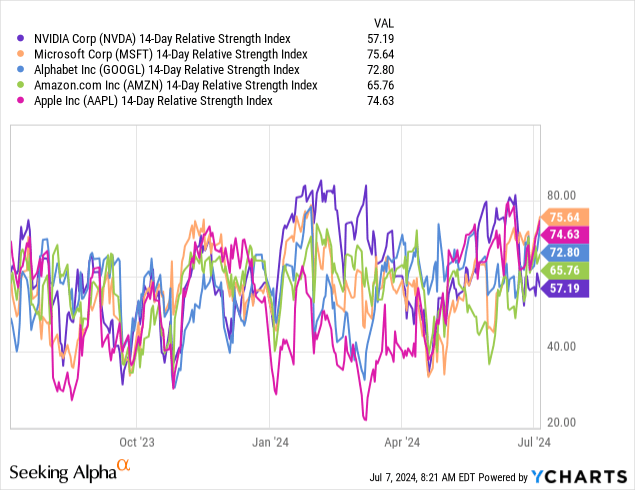

The situation in the stock market might become more beneficial for PFE soon as well. With a 6% forward dividend yield and exceptional dividend consistency, the stock is an apparent safe haven in case the broader market experiences turbulence. While I do not think that we are in an AI bubble, the RSI indicator of the largest tech companies is mostly elevated and there might be a correction in growth stocks. As a high-yielding dividend stock with a healthy balance sheet, PFE will likely be a no-brainer for investors seeking a safe haven.

Valuation update

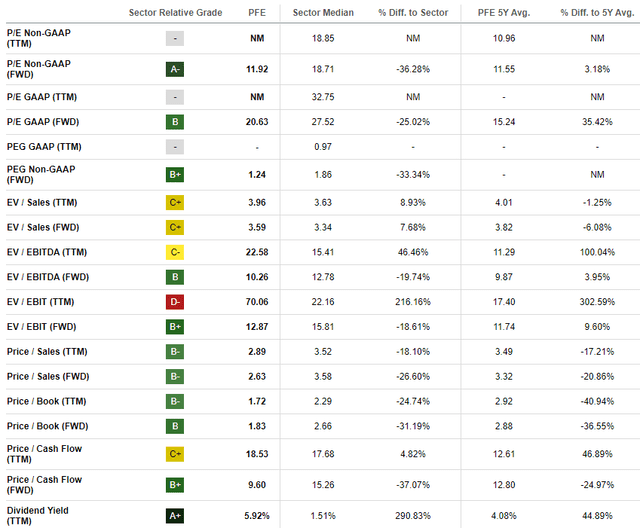

The stock lost 23% of its value over the last twelve months, lagging behind the broader U.S. market. YTD performance is also weak with a -2.5% share price change. Valuation ratios look very attractive as most of them are significantly lower than the sector median. That said, PFE is attractively valued based on ratios analysis.

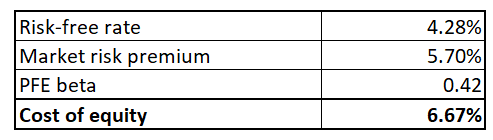

High dividend yield is one of the stock’s primary strengths. Therefore, implementing the dividend discount model [DDM] here looks like a sound option. The DDM discount rate is PFE’s cost of equity, which I figure out below using the CAPM approach. Pfizer’s cost of equity is 6.67%, and all the variables for CAPM are easily available on the Internet.

Author’s calculations

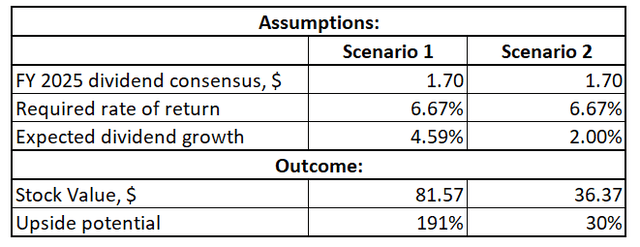

FY 2025 dividend estimate from consensus is $1.70, which I incorporate into my DDM analysis. In the below table, I simulate two DDM scenarios. The first one incorporates a 4.59% dividend growth, which is in line with the last five years’ dividend CAGR. The second scenario assumes a very conservative 2% dividend growth, which aligns with long-term historical trends in U.S. inflation.

PFE is substantially undervalued under both scenarios. Even with a 2% dividend CAGR assumption, the stock’s fair value is 30% higher than the last close. This is a very attractive upside potential, especially if we consider a 6% forward dividend yield.

Risks update

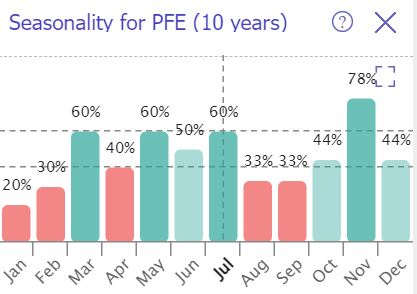

Despite being a long-term investor, I also look at stock seasonality. This increases the chances of selecting better entry points, and PFE’s seasonality analysis over the last decade suggests that investors might have better buying opportunities in August and September because these are some of the stock’s historically weakest months. Therefore, investors might consider adding up to their positions not in July but wait a little bit because there might be a pullback in August or September.

TrendSpider

From the fundamental perspective, I believe that the major risk remains around the expiration of patents of major products by 2027. Patents of some of the company’s most successful products of recent years are expected to expire within the next couple of years, which means losing exclusivity rights. In FY 2023, PFE generated more than $20 billion from products with patent expiration years approaching. I think that is the major reason why investors are still very cautious about PFE. And expiring patents are indeed quite a risk for any company. On the other hand, as I mentioned in “Recent Developments” PFE continues investing billions in R&D, which increases the chances of successfully substituting products with patents expiring.

Bottom line

To conclude, PFE is still a “Strong Buy”. Financial performance of the latest quarter and Wall Street analysts’ expectations around the upcoming earnings release suggest that the worst for Pfizer is highly likely in the rearview mirror. Recent FDA approvals look promising for the company’s top line future prospects, and the management’s stringent cost discipline means that more value for shareholders will be created. Moreover, the valuation is still compelling.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.