Summary:

- China is on par with US technology, thus is able to manufacture high quality aircraft.

- China’s emergence as a major player in the commercial aircraft market poses a threat to Boeing’s dominance, especially in Asia.

- New aircraft that will challenge Boeing’s dominance are in the pipeline.

Sky_Blue/iStock Unreleased via Getty Images

Preamble

From my research, the notion that Chinese technology lags far behind that of the US is nothing more than a common-or-garden trope. Little wonder many have this idea since recent news reports highlight the US government’s escalating efforts to restrict the export of advanced technologies to China. These restrictions encompass everything from cutting-edge manufacturing equipment by ASML to purposely downgraded chips from Nvidia, which I have covered in a previous article. Such news reports certainly lend support to the notion that China has quite a bit of catching up to do.

I challenge anyone to saunter into any bar in the US and casually ask a tippler supping their beverage of choice; “Who do you think manufactures the technology that goes into the fearsome Tomahawk missile?” I guarantee that you will be assured that this product is knocked-out by teams of highly educated boffins in white overalls located in the secretive labs of Raytheon or General Dynamics. However, the reverse is true, as a hot-off-the presses report from Govini vividly illustrates. For those unfamiliar with Govini, the organisation “applies AI to solve public sector defence acquisition pain points.”

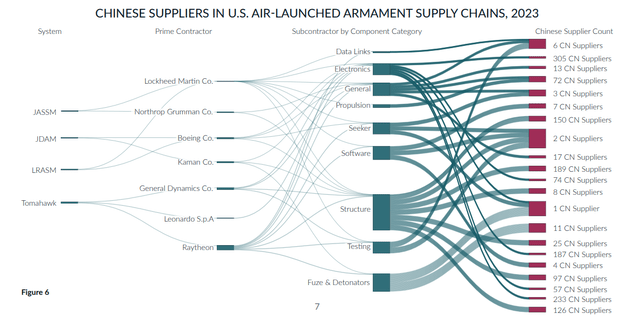

Below is a graphic produced by Govini that shows just how many of the key parts of the current array of US air launched weaponry is produced by the Chinese.

Source of components for US missiles (Govini)

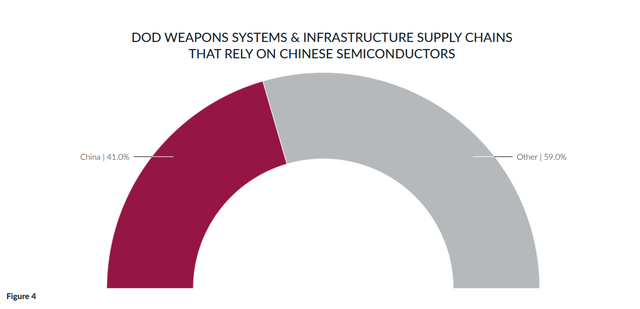

The study by Govini revealed a significant reliance on Chinese suppliers for semiconductors crucial to the Department of Defence (“DoD”). From the graphic below, you can see that over 41% of these essential components originate from China. This dependence extends to critical weapons systems that include the B-2 Bomber and Patriot missile system. This not only highlights the deep interconnectedness between Chinese suppliers and vital US defence capabilities, but also that Chinese technology is at least on a par with the US.

Percentage of components that originate from China (Govini)

Given the above, it can hardly be beyond anyone’s imagination that the skies could soon be filled with a new challenger to Boeing (NYSE:BA) dominance in the shape of new commercial aircraft manufactured in China. Indeed, the focus of this article is that we can certainly expect to see China emerge as a major player in the commercial aircraft market in the very near future. Therefore, as something approaching 50% of Boeing’s revenue comes from Asia, investors can anticipate a big hit to Boeing’s already depressed stock price once market share is lost to COMAC, China’s manufacturer of commercial aircraft.

The increasing level of competition together with Boeings poor financial performance does not bode well for the stock price in the medium to long term.

Boeing’s Financials

The company’s last quarterly report must have made depressing reading for investors. For instance:

- Net Loss and Lower Revenue: Boeing reported a net loss of $355 million for Q1 2024, although, this was a decrease from the same period in 2023. Revenues also fell by $1.352 billion, primarily due to lower 737 deliveries and customer considerations related to the 737-9.

- Production Issues and Grounding: The Alaska Airlines 737-9 accident led to grounding and inspections, impacting production and deliveries. The FAA also identified quality control issues, further slowing production and delaying certifications.

- Financial Impact of Production Issues: The production slowdown and certification delays significantly affected Boeing’s financial results, particularly in the Commercial Airplanes segment.

- Supply Chain Disruptions: Boeing continues to face challenges due to global supply chain constraints and labour instability, impacting productivity and financial performance.

- Reach-Forward Losses on Fixed-Price Contracts: Several fixed-price development programs, including the KC-46A Tanker and T-7A Red Hawk, have reach-forward losses, indicating potential future financial risks.

Positives

To be fair, there were a few positives to hearten investors:

- Increased Backlog: Boeing’s total backlog increased to $528.749 billion, driven by new orders for commercial airplanes and defence products. To put this in perspective, this is an increase of around 1.5%; hardly earth shattering.

- Improved Performance in Defence, Space & Security: This segment saw increased earnings due to lower charges on fixed-price development programs, revenue growth, and improved performance on various programs.

- Higher Revenue in Global Services: This segment experienced revenue growth, primarily due to higher commercial services revenue.

- Available Liquidity and Financing Options: Boeing had $6.9 billion in cash, $0.6 billion in short-term investments, and $10.0 billion in unused credit lines, suggesting available liquidity to address financial needs.

- Potential Acquisition of Spirit AeroSystems: Preliminary discussions to acquire Spirit AeroSystems could potentially strengthen Boeing’s manufacturing operations and improve quality if a deal is reached on reasonable terms.

Recent News

There has been some news that will negatively affect the company’s balance sheet. In a major blow, it has been reported that Boeing faces a significant financial penalty. The company agreed to plead guilty to criminal charges for misleading the U.S. government, stemming from the deadly 737 MAX crashes of 2018 and 2019, which comes with a hefty price tag.

Boeing will be fined $243.6 million, on top of the $243.6 million they already paid as part of an earlier settlement. But the financial repercussions don’t stop there. Boeing is also required to invest an additional $455 million to bolster their safety and compliance programs. This court-mandated investment brings the total financial hit to nearly $700 million for the aerospace giant.

Whilst Boeing has a significant cash cushion of $6.9 billion to cover this penalty, potentially, ongoing losses threaten to quickly deplete these reserves.

On top of the penalties, there is the unquantifiable impact on Boeing’s reputation to consider, given that the company now has a felony conviction.

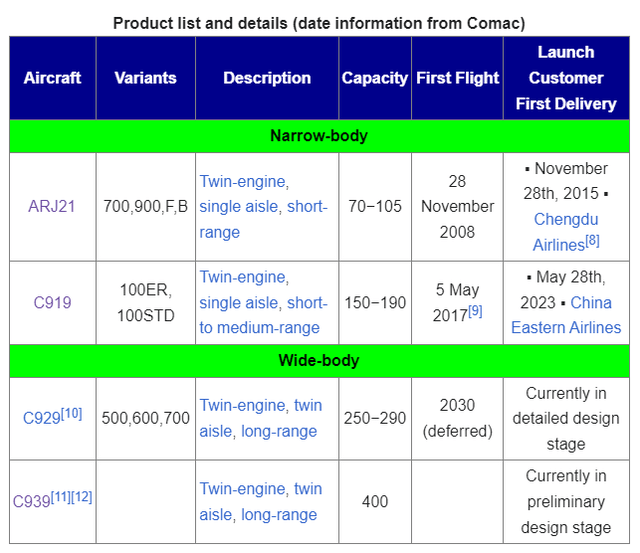

China’s Commercial Airline Aspirations

The country’s foray into commercial aircraft came with the establishment of Commercial Aircraft Corporation of China, Ltd. (“COMAC”) in 2008. Since then, the company has introduced the ARJ21 and the C919. In addition, there are wide body aircraft in design phase, as the graphic below shows.

COMAC’s aircraft (Wikipedia)

If we consider China’s homegrown C919 passenger jet, which took off not just figuratively, but literally, with its first commercial delivery to China Eastern Airlines in May 2023. This delivery marked a significant milestone, and the pace of deliveries has picked up. Five more C919s found their way to China Eastern throughout 2023 and early 2024, completing their initial order.

The C919’s appeal hasn’t been limited to the initial launch customer. The aircraft has garnered significant interest and has attracted orders and options from major Chinese airlines and leasing companies. HNA Group placed a hefty order for 200 C919s in 2018, and Brunei Gallop Air became the first non-Chinese client in September 2023 with an order for 15 jets.

Future Developments

The South China Morning Post reported in May that following the successful launch of the C919, which is comparable in size to Boeing’s 737, COMAC has unveiled plans for the C929 and C939, both of which are widebody aircraft designed for international routes.

With sizeable orders for the C919 from major Chinese airlines, COMAC is in the process of expanding production capacity to meet demand. Alternatives to Boeing are gaining momentum in China, which is bad news for Boeing investors.

Markets For Chinese Aircraft

The potential market for Chinese-manufactured aircraft extends far beyond China’s borders. The Shanghai Cooperation Organisation (“SCO”), the Eurasian political, economic, and security alliance, presents a significant opportunity for COMAC, especially given its likely competitive pricing.

The expanded BRICS alliance further amplifies this potential. These emerging economies have burgeoning aviation sectors and a growing demand for air travel.

Furthermore, South America and other non-Western-aligned nations offer additional markets. Many of these countries are seeking to reduce their reliance on Western manufacturers such as Boeing (See previous article).

The lower cost of Chinese aircraft, stemming from lower labour and production costs, could be a decisive factor in these markets. While Boeing has traditionally dominated the commercial aviation industry, the emergence of a more affordable and technologically comparable option from China could disrupt the status quo.

Summary

In conclusion, China’s rapid technological advancement in aviation, poses a significant challenge to Boeing’s dominance. The successful commercial operation of the C919 and plans for wide-body aircraft like the C929 and C939 could lead to Boeing losing a substantial market share in Asia and beyond.

This, coupled with Boeing’s recent financial struggles, including a $700 million fine for misleading the US government regarding the 737 MAX crashes, paints an uncertain future for the American aerospace giant.

As China continues to strengthen its domestic capabilities and expand its presence in the global aviation market, Boeing will need to adapt and innovate to remain competitive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.