Summary:

- Wall Street is concerned that Salesforce may face headwinds in growth due to generative AI, but may be ignoring the company’s growing cash flow.

- Salesforce has balanced above-market top-line growth with expanding profit margins.

- I see at least 20% upside potential from multiple expansions alone.

- I see a clear path to market-beating returns given the net cash balance sheet and solid top-line growth.

Matt Winkelmeyer

Salesforce (NYSE:CRM) has long been able to adapt to the prevailing narratives in the market. The company was a pioneer of the software as a service model (‘SAAS’), and heading into this year appeared to be a beneficiary of artificial intelligence. But has the company finally lost its way? Wall Street appears concerned about the possibility that CRM may be a victim of generative AI, as its customers may show lower headcount growth moving forward on account of increased automation and generative AI benefits. I am of the view that the Street is ignoring the fact that CRM has become a real profitable compounder. I am upgrading the stock to strong buy.

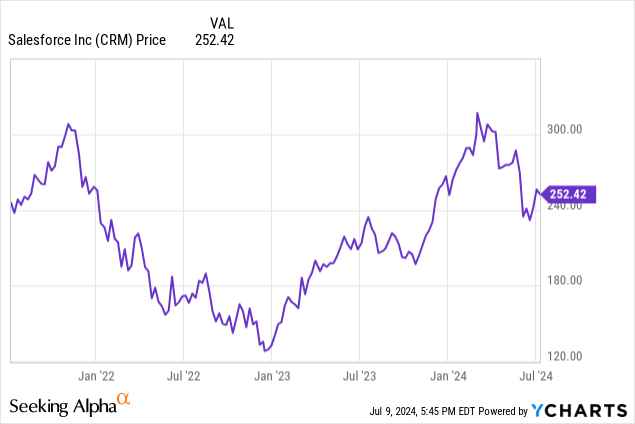

CRM Stock Price

I last covered CRM in April, where I reiterated my buy rating after the rumors circulated about a potential acquisition of Informatica (INFA), which have since been dispelled.

The market may be “missing the forest for the trees.” It is possible, if not likely, that CRM does indeed see long-lasting headwinds to growth due to generative AI. Over time, I expect the market to instead pay more attention to the rapidly growing cash flow picture.

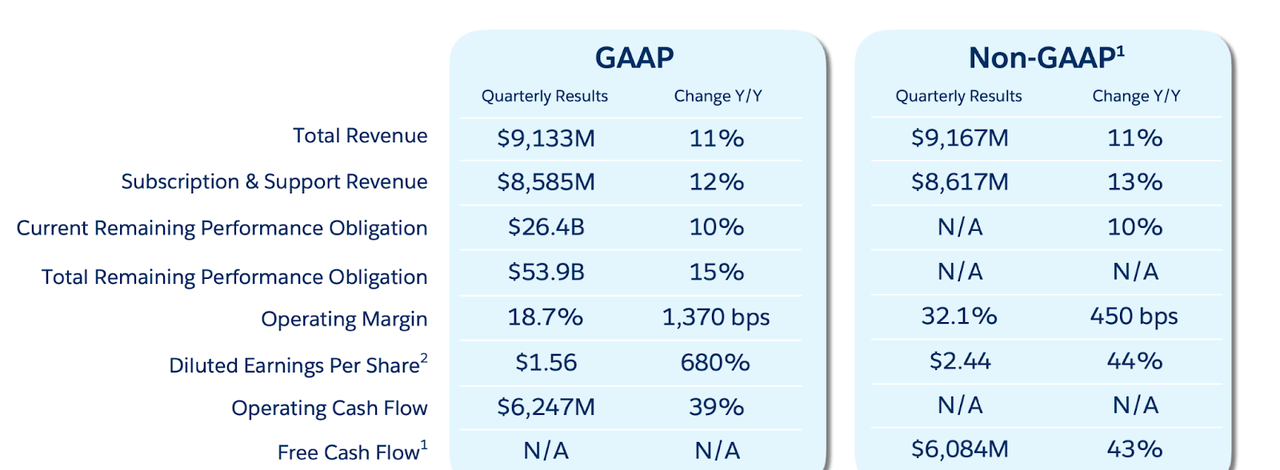

CRM Stock Key Metrics

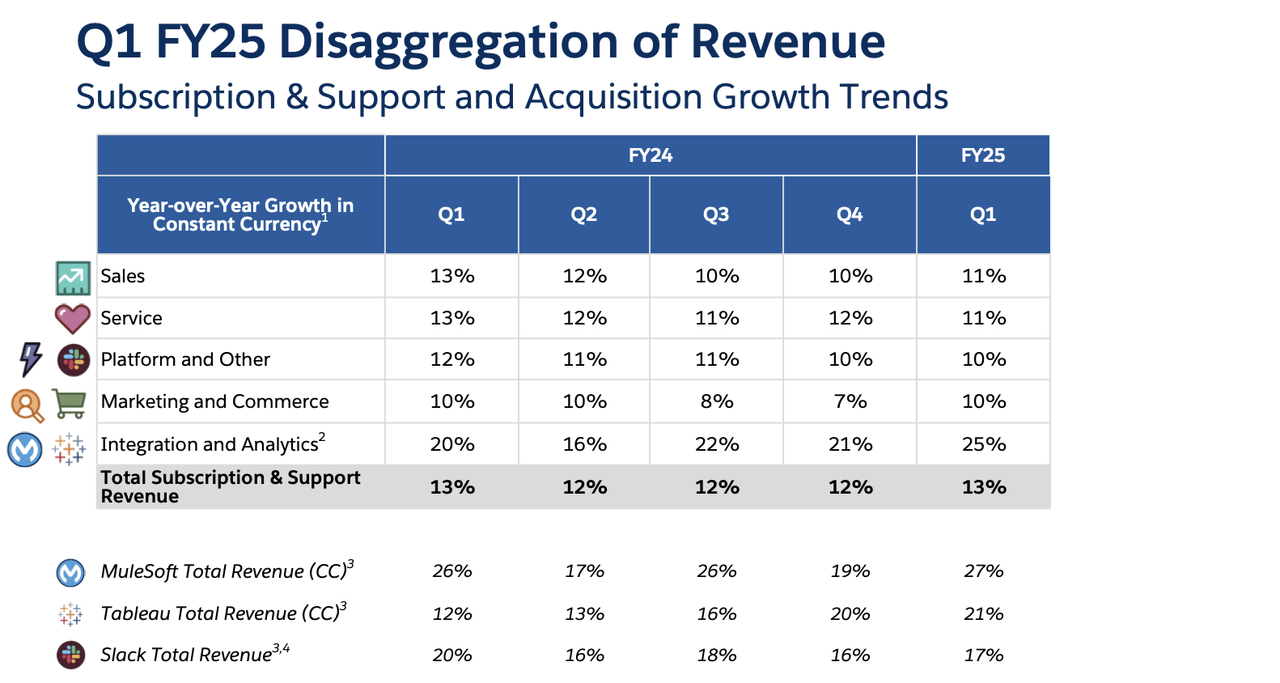

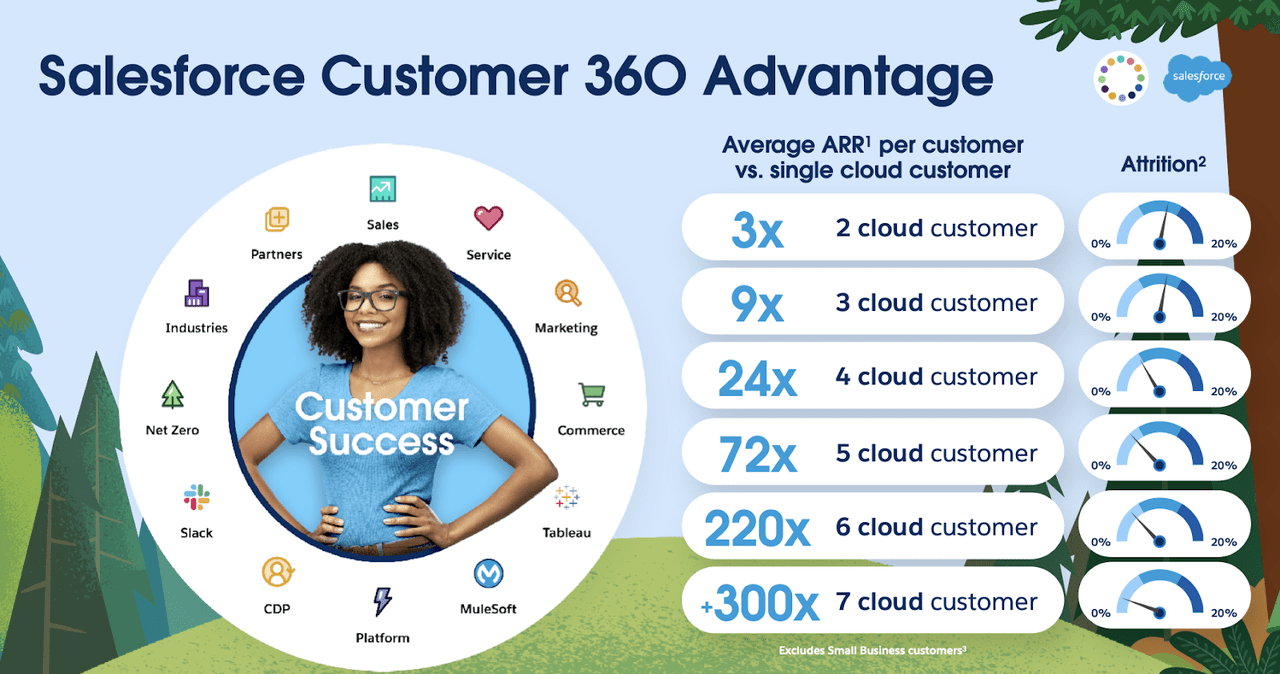

CRM is a dominant player in the enterprise tech space, led by its customer relationship management (‘CRM’) software. CRM has famously bolstered its product portfolio through an aggressive history of M&A. While one could quibble about the ROIs from some of the deals, it is undeniable that having a wide platform has helped CRM to sustain above-market top-line growth for many years.

2023 Investor Day Presentation

In the most recent quarter, CRM delivered 11% YoY revenue growth to $9.133 billion, coming in at the low end of its revenue guidance. This may already have been disappointing for many investors, given that CRM is typically a “beat and raise” kind of company. The company did at least beat on the profitability front, delivering $1.56 in GAAP EPS (versus guidance for up to $1.44) and $2.44 in non-GAAP EPS (versus guidance for up to $2.39). But many investors may still be invested in the name primarily for aggressive top-line growth, as it isn’t clear if the stock has yet proven itself worthy among those looking for profitable compounders.

The company sustained double-digit revenue growth in its core sales products, as well as seeing sequential acceleration in growth at some of its recent acquisitions in MuleSoft, Tableau, and Slack.

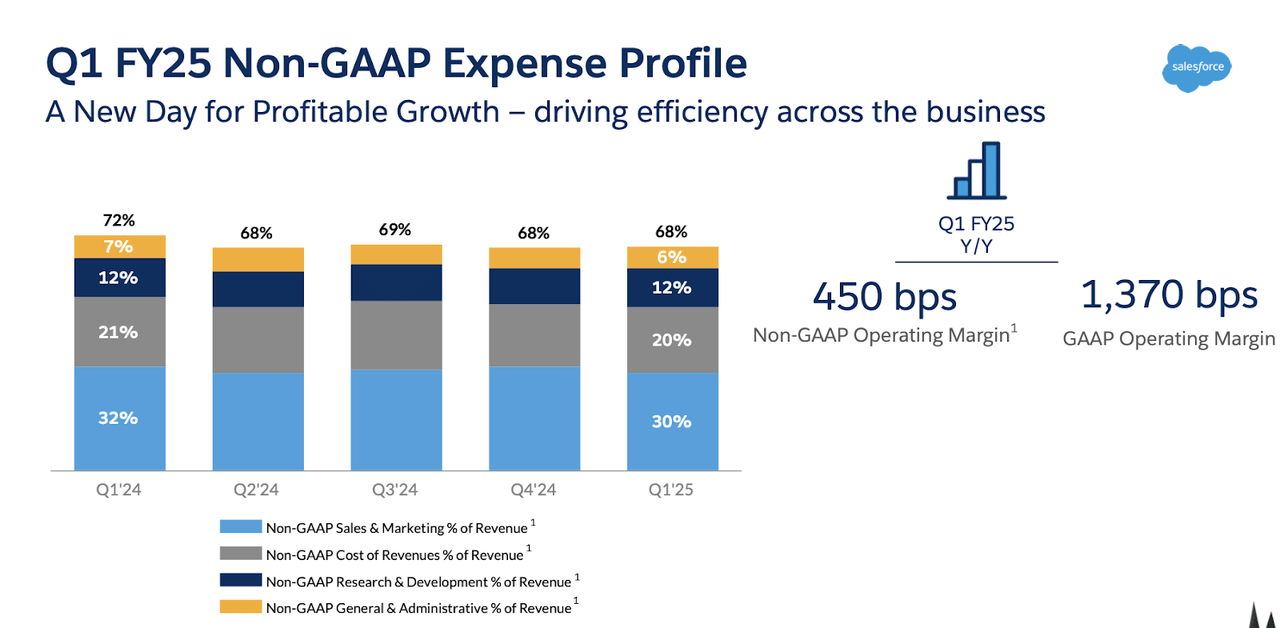

CRM continued to show expense discipline, with non-GAAP operating margins expanding to 450 bps YoY. That sent non-GAAP margins to 32.1% for the quarter – for reference, the first quarter margin two years ago was just 17.6%. But again, Wall Street might not yet have calibrated to appreciating the progress made on the profitability fronts, as it appeared much more focused on top-line growth.

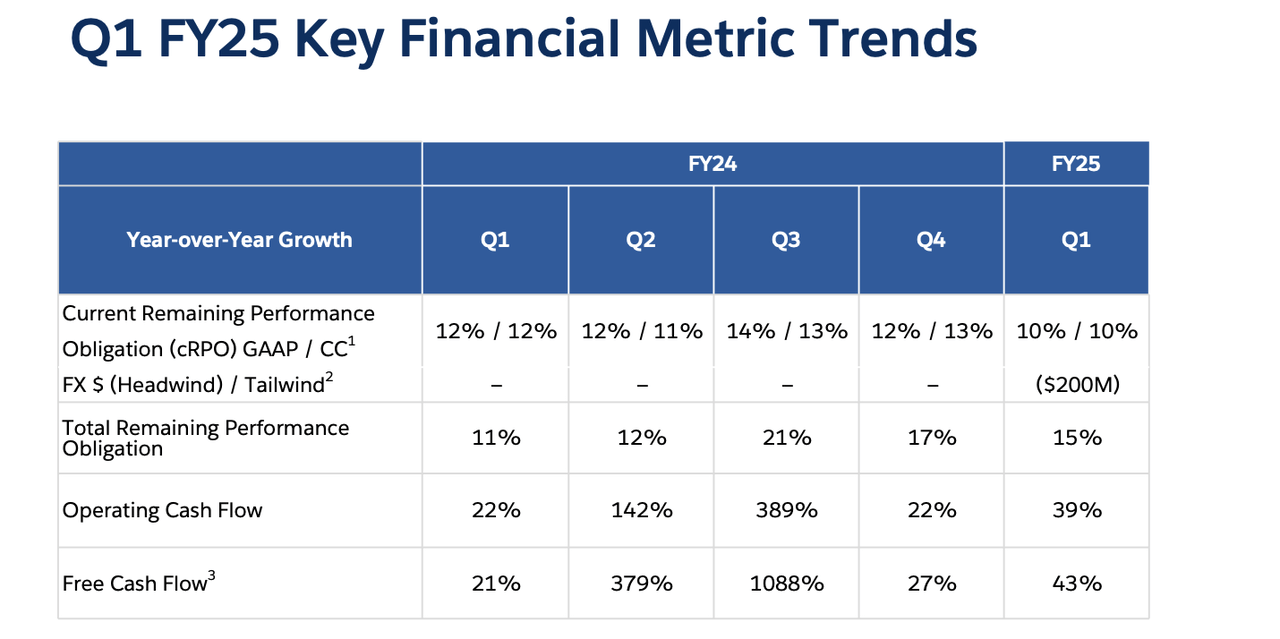

The company missed on guidance for 11% YoY growth in current remaining performance obligations (‘cRPOs’), with cRPO growth coming in at 10%. I view cRPO growth as a leading indicator for future revenue growth, and the deceleration might be a warning that top-line growth is set to decelerate moving forward. That likely disappointed many investors, who were instead hoping for an eventual acceleration in top-line growth.

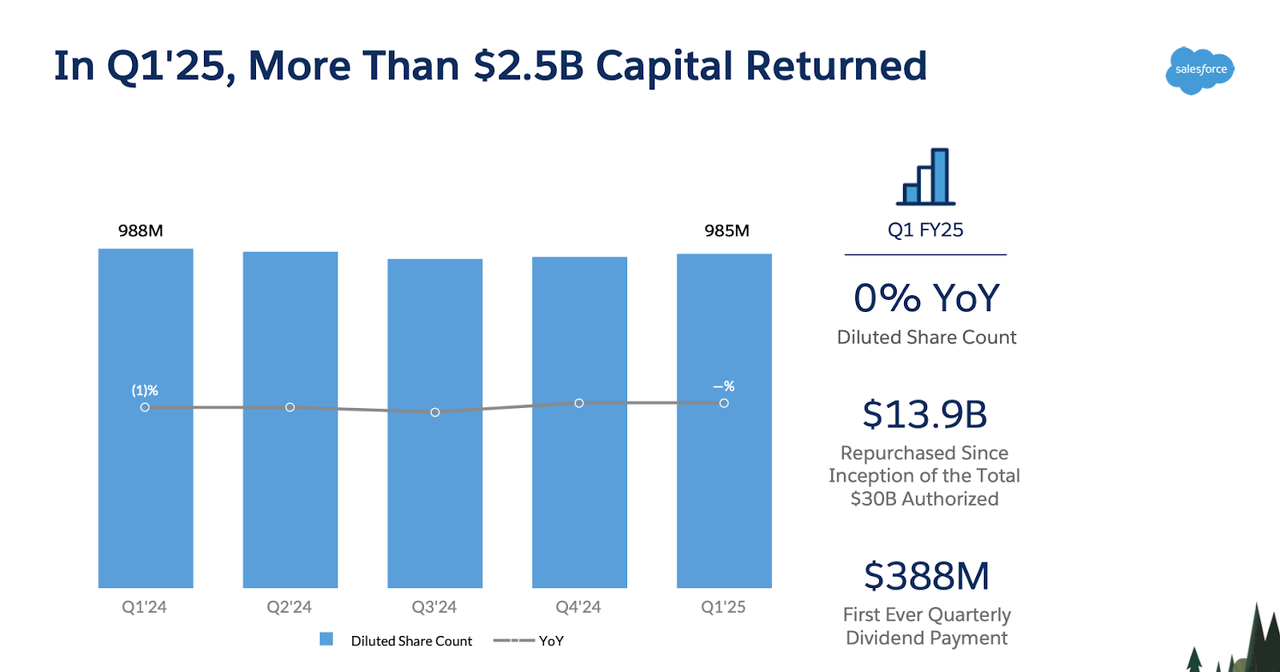

CRM ended the quarter with $17.7 billion of cash, $5 billion of strategic investments versus $8.4 billion of debt, representing a bulletproof net cash balance sheet. The company repurchased $2.2 billion of stock, allowing it to offset dilution from stock-based compensation.

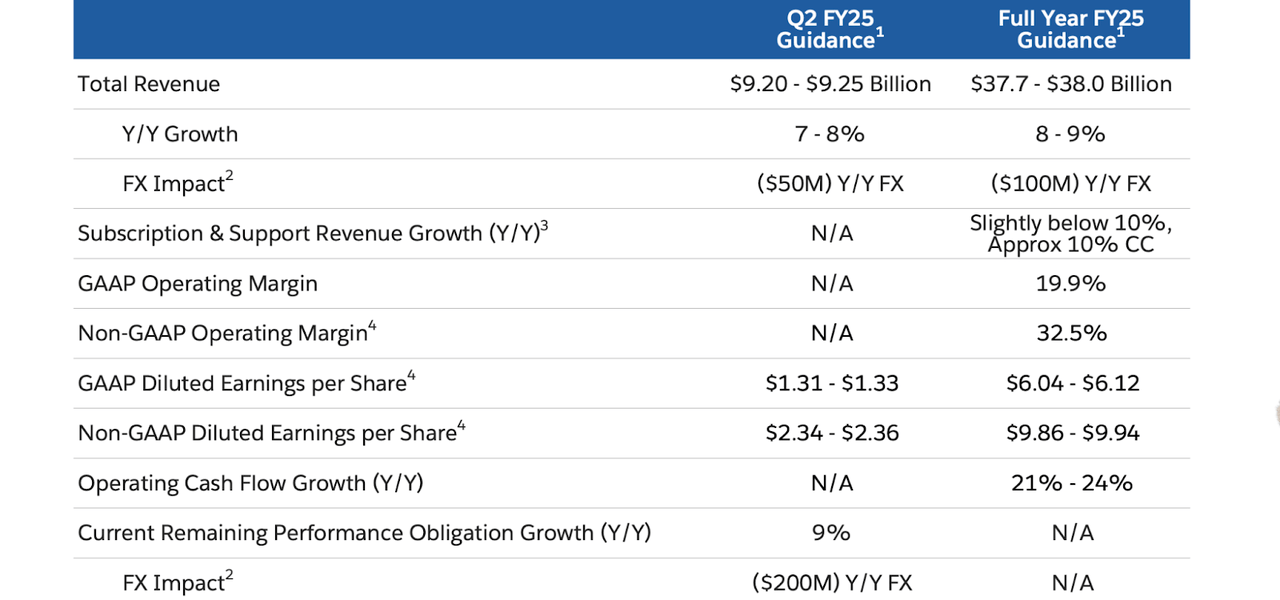

Looking ahead, management guided for the second quarter to see just 8% YoY revenue growth to $9.25 billion, and 9% growth in cRPOs. Management did not lower the full-year revenue guidance but did slightly increase guidance for non-GAAP EPS to up to $9.94.

On the conference call, management appeared to be surprised by the negative reaction by Wall Street, as they repeatedly called their results “incredible.” I view this as understandable given that management had been repeatedly emphasizing their focus on cash flows in recent quarters (though it isn’t clear if investors understood the desired shift in narrative). Some analysts were still concerned about management’s decision to not lower full-year revenue guidance, noting that a more conservative guide might better enable the “beat and raise” cadence that investors have grown accustomed to. Management’s reply, that they have confidence that they “will be within the range” likely only added fuel to those concerns.

Management blamed “measured buying behavior” for the decelerating top-line growth, which might imply the potential for a macro-related recovery at some point in the future. However, it might also reflect a new reality, as its customers might be trying to determine exactly how much human resources can be saved from the rise of generative AI. Yet management tried to frame their company as being critical for a generative AI future, stating that it manages “250 petabytes” of front office enterprise data that is integral to training AI models. From my perspective, it does not look like management is suggesting any potential new revenue streams from generative AI related to the data, but may be instead trying to get the market to appreciate the company’s important and sticky business model.

I find such a strategy to be highly appropriate – if not necessary. With the company operating at a near $40 billion revenue base, the law of large numbers suggests that top-line growth must slow down eventually. That might make the stock look unattractive relative to faster-growing peers of a similar price to sales multiple, but CRM’s GAAP profitability and growing profit margins are an important differentiating factor that I find unlikely to be ignored indefinitely. In particular, I expect the market to eventually focus less on the actual top-line growth rate but instead on the quality of the revenue and earnings base.

CRM is arguably the de-facto standard for enterprise tech across many of the products it offers, and this is evidenced by its impressive customer lineup, including the leading cybersecurity company CrowdStrike (CRWD), which management noted as having added 5 different products in the quarter. I note that Apple (AAPL) is the most famous example of having “educated” Wall Street on this transition, as the stock has, in general, enjoyed premium valuations in spite of lower top-line growth rates relative to peers. The company’s $0.40 per share dividend, announced prior to the quarter, is one consistent step in that direction. Management also appeared to suggest a more disciplined approach to M&A, noting that any deals must work both its customers as well as company accretion.

If CRM is to go down the quality thesis path that AAPL appears to have successfully embarked on, then investors arguably should be hoping for a strong commitment to expanding profit margins coupled with an expanding return of capital to shareholders (largely driven by share repurchases). The $2.5 billion returned to shareholders through dividends and share repurchases was markedly lower than the $6 billion in free cash flow, and I am hopeful that management moves to increase the aggressiveness of its share repurchase program moving forward.

Is CRM Stock A Buy, Sell, or Hold?

After the selloff, CRM found itself trading at just around 26x this year’s earnings estimates.

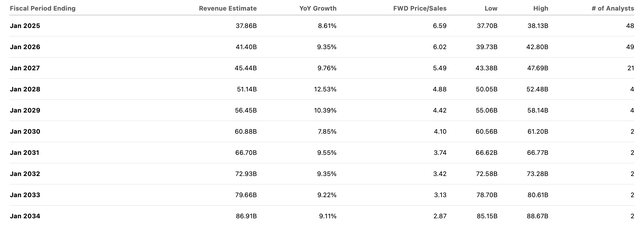

That valuation looks “about right” when compared against consensus estimates for high single-digit topline growth moving forward.

Bears might point out that consensus estimates might prove a tad optimistic, and revenue growth might be more around the 7% to 8% range. That might prove accurate, but I’d contend that long-term margins for the company are likely far higher than the 26% rate implied by the Street (based on 2033 estimates) – I instead expect the company to reach 33% net margins, if not much higher. Between the net cash balance sheet and highly recurring revenue base, I can see the stock warranting a 30x earnings multiple upon maturity. For conservatism, I instead employ a 25x earnings multiple, equating to a roughly 8x sales multiple. With the stock trading at around 6.6x sales, that implies around 21% potential upside from multiple expansion alone. In the meantime, I can see the stock delivering double-digit annual returns from the roughly 8% top-line growth and 3% GAAP earnings yield, giving it the potential to outperform the market even without assuming multiple expansion. My 12-month price target for the stock is $300 per share, reflecting that 8x multiple assumption.

CRM Stock Risks

My quality investing thesis notably lacks explicit catalysts. Sure, an ongoing commitment to profitability and share repurchases is the typical playbook, but investors might be able to only wait for the broader investor base to catch on. It is possible that CRM eventually faces competitive risks that slow down top-line growth and pressure the valuation multiple, due to lower perceived business model quality. I find the largest risk to be a large M&A deal, not too dissimilar with management’s appetite over the past decade. Such a deal might leverage the balance sheet and dilute margins, two items which would go against the quality investment thesis.

CRM Stock Conclusion

Growth investors might be fleeing CRM due to prospects for decelerating top-line growth, but the stock is looking as investable as ever for profitability-minded investors. I see a clear path to market-beating returns between the GAAP profitability and persistent top-line growth, and a reasonable path to stellar returns if my anticipated multiple expansion scenario takes place. I expect increased aggressiveness in the share repurchase program to be an important theme over the coming quarters, though it’s unclear if that’ll be enough to drive a re-rating. I am upgrading CRM stock to “strong buy” due to the attractive risk-reward proposition.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.