Summary:

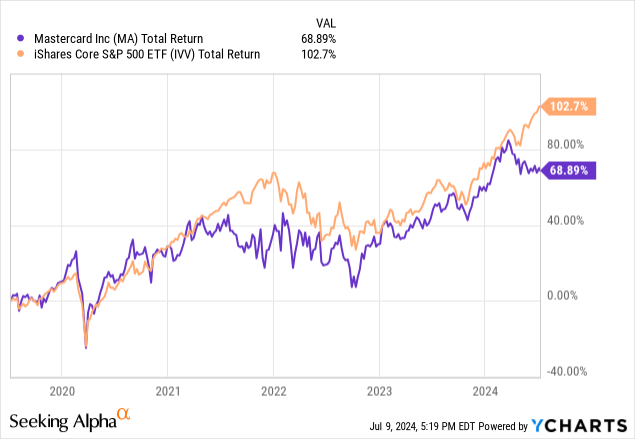

- Mastercard Incorporated has underperformed the broader market since the pandemic, despite holding on to all of its financial gains.

- The company has an unusually high profit margin, which, coupled with its strong balance sheet, helps insulate it from market down cycles.

- The stock is offering compelling value relative to its risk profile, and I see a clear case for market-beating returns.

- I rate Mastercard stock a buy.

LeventKonuk

Mastercard Incorporated (NYSE:MA) has proven to be a clear and sustained beneficiary of the pandemic, as that difficult period of time helped to increase credit card adoption. MA benefits both from the secular trend of cashless transactions, and taking market share within the sector from leader Visa (V). The company has a reasonably leveraged balance sheet and a generous shareholder return program. The stock is not exactly “dirt cheap” at current valuations, but its recent period of relative underperformance has offered a compelling entry point. I rate MA stock a buy.

MA Stock Price

MA was a huge winner heading into the pandemic, but the rich valuations that it traded at then may explain its relative underperformance since.

These periods of relative underperformance may be painful for existing shareholders, but the multiple compression is welcome for new investors.

MA Stock Key Metrics

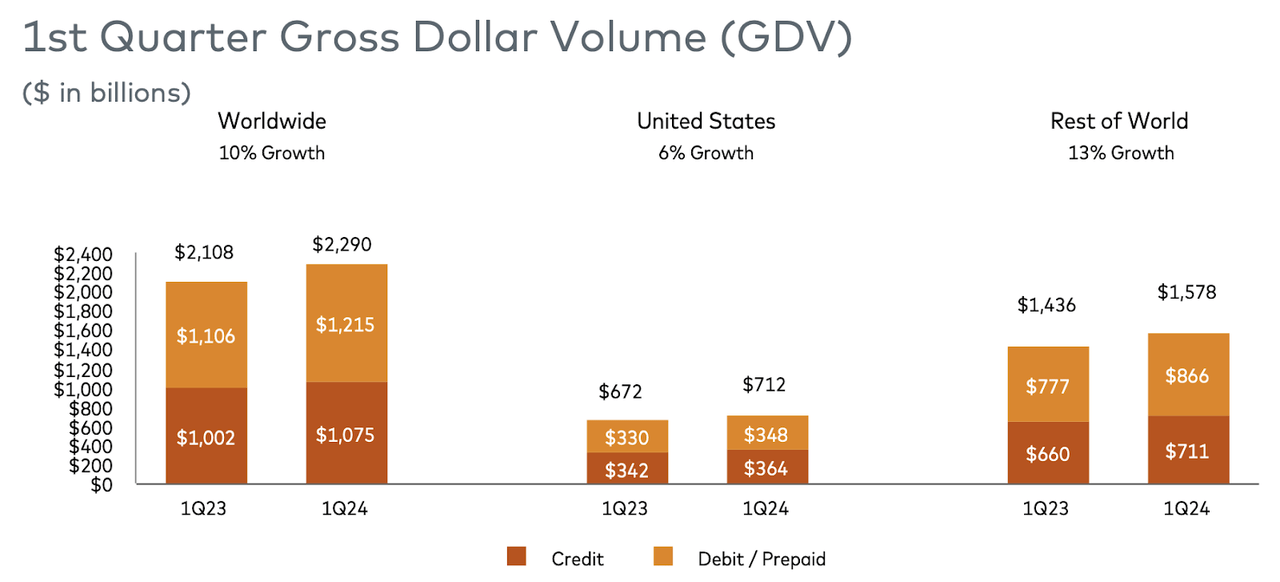

In its most recent quarter, MA saw continued growth, marked by 10% YoY growth in gross dollar volume (“GDV”), which was slightly boosted by the leap year.

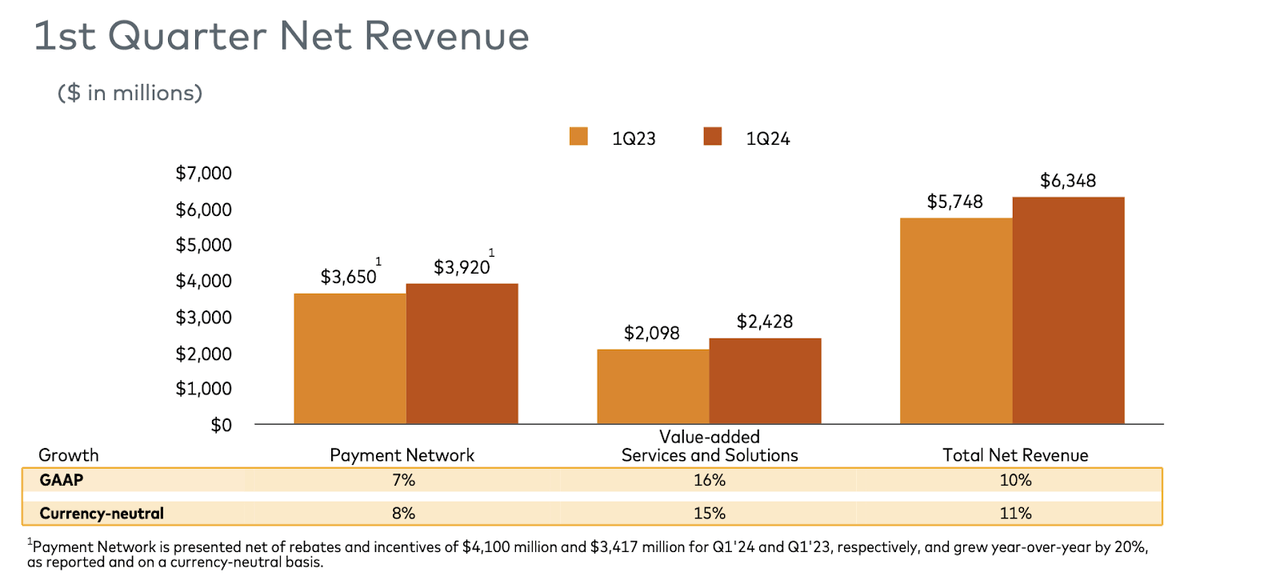

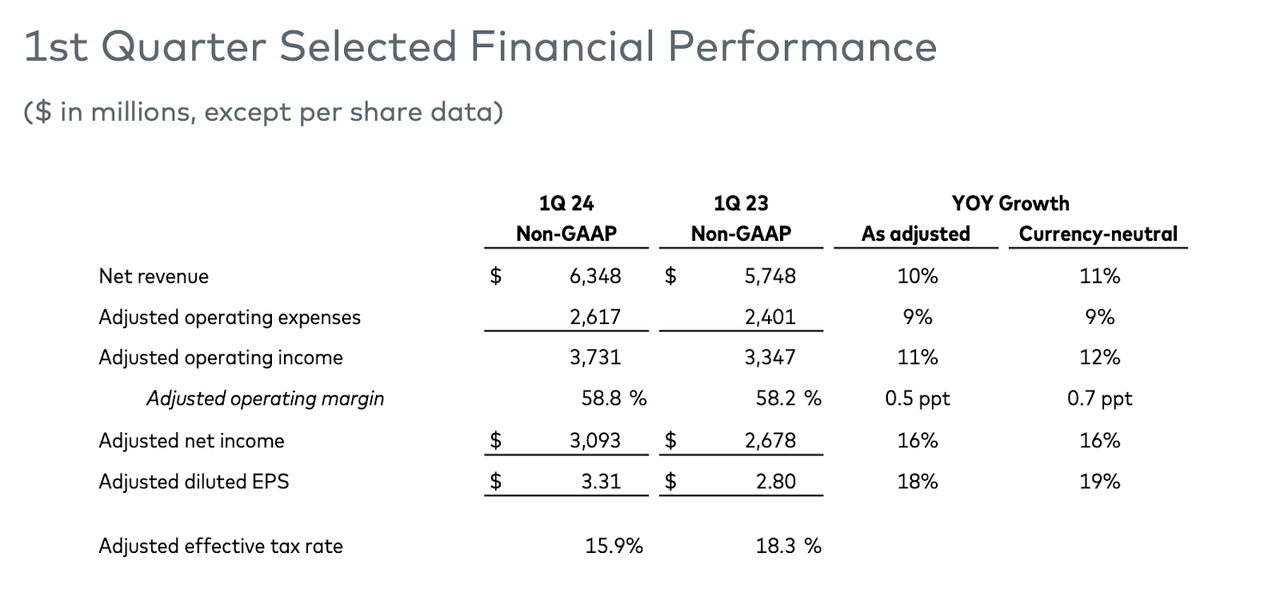

That helped lead to 10% YoY growth in net revenue (or 11% on a currency-neutral basis). Management had guided for the “low end of low-double-digits.”

The company saw operating income grow slightly faster at 11% YoY due to operating leverage, and earnings per share grew even faster at 18% YoY due to both a lower tax rate and share repurchases.

MA ended the quarter with $7.3 billion of cash versus $13.5 billion of debt. That represents a reasonable leverage ratio as compared to the $15.8 billion in trailing twelve months EBITDA. Over time, I can see MA supporting at least 2x net debt to EBITDA (for reference, Global Payments (GPN) is at around 4x). The company spent $2 billion of share repurchases and $616 million of dividends versus $1.7 billion of cash flow from operations, indicating that management is actively using its balance sheet.

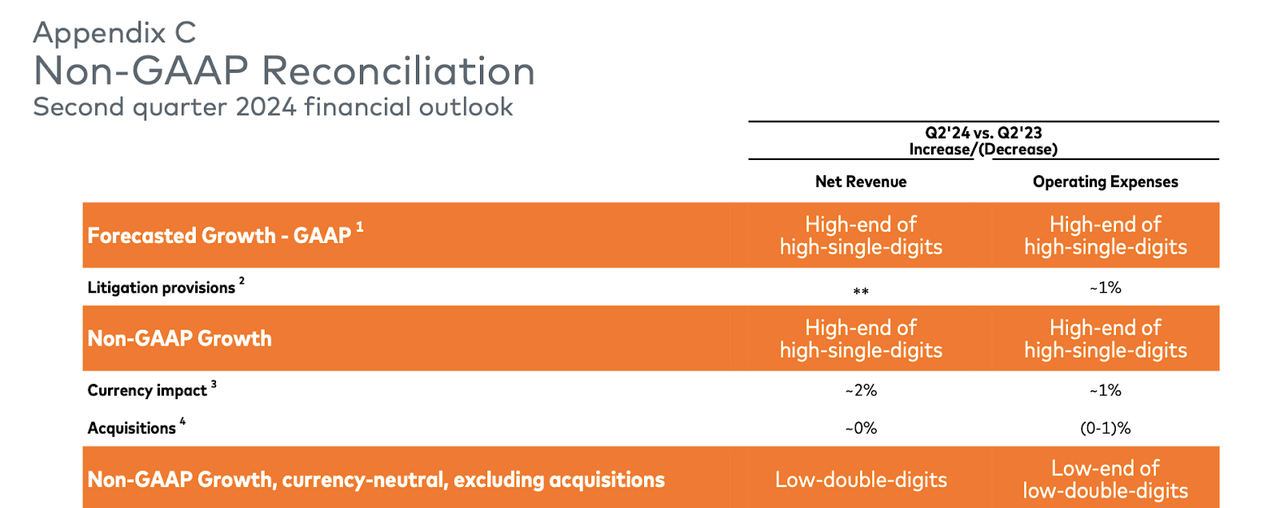

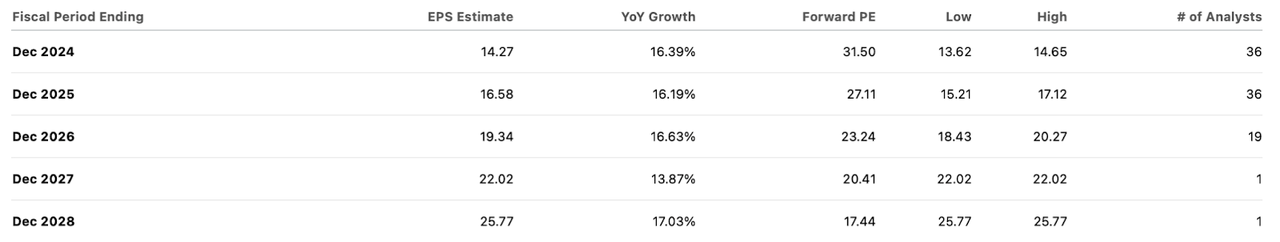

Looking ahead, management has guided for the second quarter to see high-single-digit revenue growth (versus consensus estimates for 9.3% growth), or low-double-digit on a currency neutral basis. Consensus estimates call for $3.52 in non-GAAP EPS, representing 21.8% YoY growth.

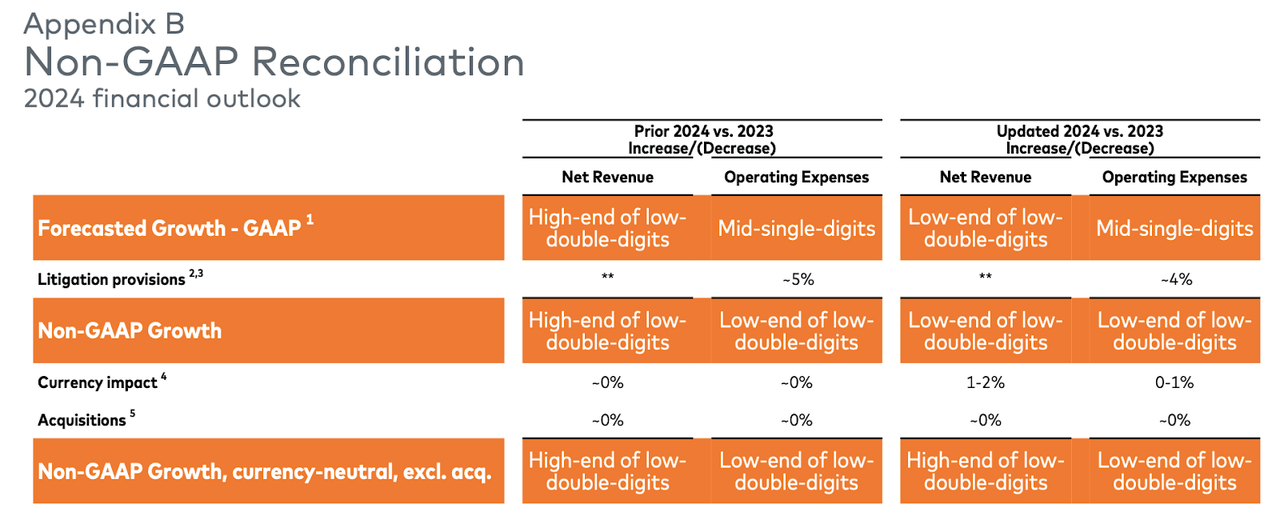

For the full-year, management guided for the “low-end” of low-double-digits revenue growth, but maintained expectations for the “high-end” of low-double-digits revenue growth on a currency-neutral basis.

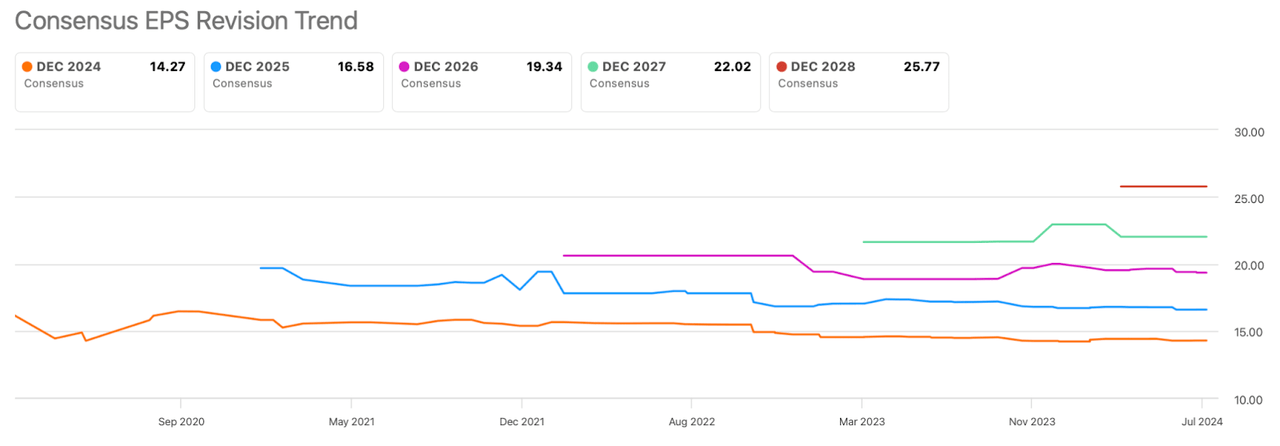

Unlike the soaring estimates of high-flying artificial intelligence stocks, earnings estimates for MA have seen a steady and slight downtrend. This might suggest that current estimates are conservative, at least relative to historical levels. Given the company’s mature revenue base (and lack of exposure to AI markets), I am not counting on material beats to consensus estimates, but that is not crucial to the thesis.

On the conference call, management reiterated their optimism in the cashless transition growth opportunity, noting that Italy is still “45% cash” and Indonesia is “over 70% cash.” I suspect most readers are very familiar with Mastercard and may be of the belief that Mastercard and Visa operate in a fairly equal duopoly. In reality, MA remains a clear underdog relative to Visa and continues to take market share. While MA and V have similar projected growth rates moving forward, I have greater confidence in MA’s ability to sustain double-digit growth. This is because it benefits not only from the ongoing transition to cashless transactions, but also from increasing market share.

Is MA Stock A Buy, Sell, or Hold?

MA stock may be held back from a regulatory overhang, as their prior $30 billion swipe fee settlement has been rejected by a federal judge. One of the drawbacks of selling exclusive technology is the ever-present risk of regulatory intervention.

As of recent prices, MA traded hands at around 15x sales, well below its 5-year average of nearly 17x sales.

That might seem like a lofty sales multiple even among tech investors, but we must remember that MA has no official “cost of sales” and its operating margin stood at an astounding 57% in the latest quarter. Given that MA is very much a “toll road” kind of business, I expect operating margins to continue to move higher over time.

On an earnings basis, the stock traded just above 31x earnings and below its 41x 5-year average. Consensus estimates call for healthy double-digit earnings growth, outpacing top-line growth due to the aforementioned operating leverage (and share repurchases)

I am doubtful that MA trades up to its 41x 5-year average earnings multiple, let alone the 49x multiple that it had traded at for many years before the pandemic. However, I can see the stock sustaining a 30x earnings multiple given both the stickiness of its revenue base and the economic safety provided by the high profit margins. That implies that the stock might deliver forward annual returns equal to the earnings growth rate, which consensus estimates peg at around 15%. Given the business model quality and conservative leverage ratio, that kind of return proposition is highly attractive. Over the next 12 months, I can see MA trade up to around 35x earnings to price in the elevated growth rates over the medium term, implying around 29% upside to 2025 estimates.

MA Stock Risks

MA has sustained double-digit growth for so long that investors may be taking it for granted. It is possible, if not likely, that growth rates slow down as credit card adoption increases. MA and V may eventually engage in a price war, which might not only negatively impact growth rates but may also pressure the valuation multiples as it may raise questions about the business model quality. MA may have exposure to general market spending and may see some financial volatility in a tough market, though I would expect it to remain highly profitable even under difficult conditions given its high margins.

Mastercard Stock Conclusion

There aren’t many growth stories that are more solid than the transition to cashless transactions, and due to an extended period of underperformance, MA stock offers a way to invest in this trend at a reasonable price. The company continues to show aggressive top-line growth as it also benefits from increasing market share, and earnings growth should remain even faster due to both operating leverage and increasing use of the balance sheet. I can see the stock delivering strong market-beating returns from here, even without assuming multiple expansion. I rate Mastercard Incorporated stock a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!