Summary:

- Previously, I have argued for a buy rating on Amazon.com, Inc. stock considering its improved free cash flow.

- Here, I want to provide a broader view by analyzing the various catalysts afoot.

- The top 3 in my mind are the regionalization of Amazon’s fulfillment centers, AWS, and its vast and sticky member base.

- Besides growing EPS, these catalysts, especially the resonance among them, can augment Amazon’s competitive moat to a formidable extent.

imagedepotpro

AMZN stock: buy rating reiterated despite near all-time-high prices

I last wrote on Amazon.com, Inc. (NASDAQ:AMZN) about little more than 3 months ago (see the screenshot below). As the title of the article (FCF Turnaround Makes It A Buy) suggests, I rated the stock as a buy based on the improvement in its free cash flow in recent quarters. More specifically, the article argued:

Amazon.com, Inc.’s free cash flow has significantly improved, suggesting increased profitability and sustainable growth. Analysts expect double-digit earnings growth for Amazon in the next decade. I share the optimism thanks to key growth drivers like the recovery of its e-commerce operations and AWS. The discounted free cash flow model indicates a fair share price of ~$195, signaling the stock is currently close to fair valuation.

Since then, the stock price has advanced by more than 7% and currently hovers around an all-time high. Meanwhile, the company has also released its 2024 Q1 earnings report (“ER”). Given the stock price change and the new developments mentioned in its Q1 ER, I think an updated assessment is in order. And in the remainder of this article, you will see why my updated assessment also concludes with a buy rating.

My last article was more narrowly focused on its FCF intentionally given the intricacies caused by its extensive leasing obligations. In this article, I will switch to a different style by analyzing several of its ongoing catalysts with broader strokes, intending to provide a more holistic view of the business. And the view is basic in my mind: I see the company swimming in catalysts.

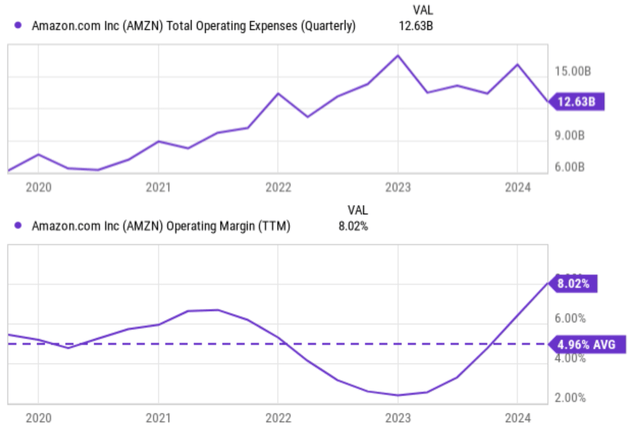

AMZN’s regionalization of fulfillment networks

The top catalyst with the most direct benefits in my view is the recent regionalization of its fulfillment networks. This catalyst has lowered expenses substantially, actually much more than what I had anticipated earlier. To better appreciate the effect, the chart below shows AMZN’s operating expenses in recent quarters (top panel) and its operating margin (bottom panel). As seen, Amazon’s operating expenses (“OPEX”) have been increasing rapidly over the past few years and peaked at almost $16B in 2023. The company has implemented various measures to control costs, but the costs only began to come down decisively in Q1 of 2024 as seen. In the past quarter, OPEX was reported to be $12.6B, about 20% below the peak levels. Thanks to such a large reduction in OPEX, the operating margin has improved drastically in tandem. As seen, the current operating margin of 8.02% is not only far above the historical average of 4.96% but also at the peak level in at least five years.

Looking ahead, I anticipate more benefits from its enhanced fulfillment networks. I expect these improvements to help with its fulfillment of same-day and next-day deliveries. I also expect the cost-to-serve metric to further drop going forward (last quarter was the first time this key metric showed a decrease in the past five years).

AMZN stock: Amazon Web Services (AWS)

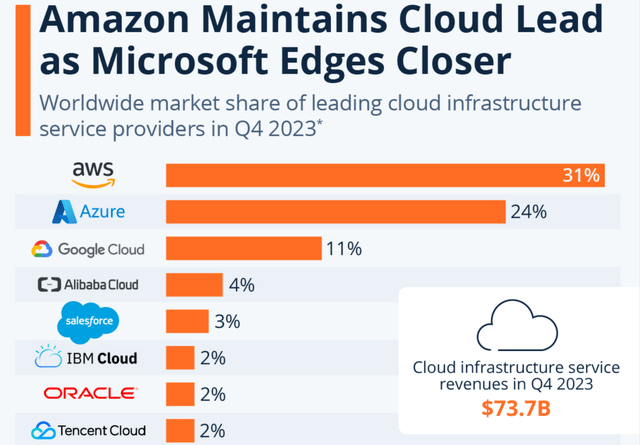

I did not start with Amazon Web Services (“AWS”) not because it is not significant, but because the issue has been thoroughly discussed by so many other SA authors already. Thus, I will be brief here so that I can move on to other less-discussed issues.

AWS has demonstrated its resilience to hold market share and maintain its lead position (see the next chart below) despite the competition, especially with the recent rise of AI as a potential disruption force. Not only was it able to hold its position, but AWS has also been able to grow its revenues consistently in the past three quarters by a robust ~12% rate. In addition, I also have a positive view toward its ongoing initiatives to integrate AI into its AWS and other various services, given the incredible user base as discussed next.

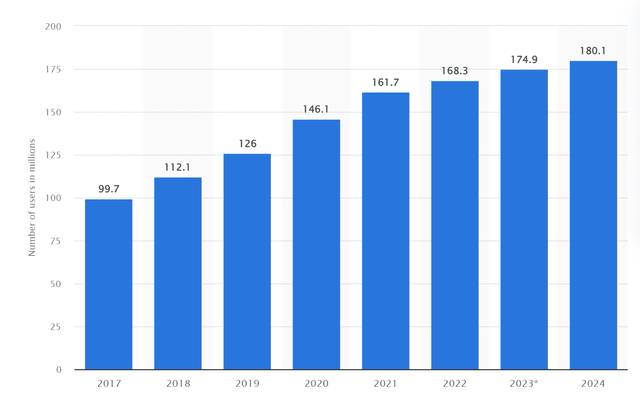

AMZN stock: vast user base

AMZN’s prime subscription service surpassed a mind-boggling 180 million in March (see the next chart below). This translates into an increase of 8% from a year earlier, according to the data provided by Consumer Intelligence Research Partners. The convenience and attractive pricing of Amazon’s membership are now well-established, deep-rooted, and very sticky in my mind. Speaking out of my personal experiences, my family does so many things on Amazon (i.e., besides shopping) that it is difficult to imagine living without it now.

Yet, there are still new frontiers that the company can create to make this vast member base even stickier. The top possibility in my mind is its One Medical service. Members can now add One Medical primary health services for a small fee. Plus, online vehicle sales will be available now with Hyundai. It is both very tempting and scary at the same time that all these services and conveniences are offered in one membership. I begin to see the company approaching a lock-in point with its members.

Other risks and final thoughts

Other catalysts include its entertainment segment and advertising initiatives. The entertainment segment is emphasizing more international content, as well as sports programming: both are likely to boost revenue growth. Advertising is another high-growth area in my view. It is a relatively new business segment, but it has been growing rapidly. For example, its revenues grew by 27% in the most recent quarter. Combined with the vast user base mentioned earlier, I anticipate this new segment to be a source of tremendous growth for the years to come.

In terms of downside risks, just like other tech companies, AMZN faces the challenge of keeping up with the rapidly evolving tech landscape, the risk of a potential economic slowdown, and the possibility of increased government scrutiny and regulation. Besides these generic risks, here I want to point out two risks that are more particular to AMZN in my view.

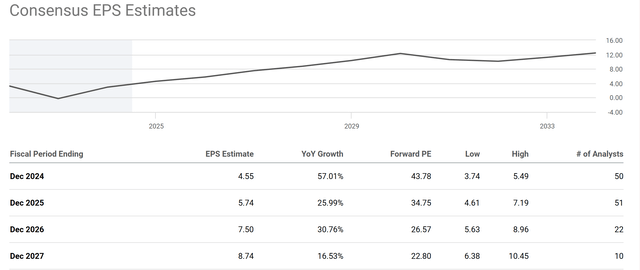

First, the stock is currently trading at an expensive P/E. As illustrated by the chart below, Amazon’s current forward P/E ratio is 43.78x. This is clearly expensive, either by absolute or relative standards. However, the P/E ratio is expected to decline rapidly over the coming years thanks to EPS growth driven by the catalysts mentioned above. For example, the consensus estimate implies a forward P/E ratio of 22.80x only by the end of fiscal 2027.

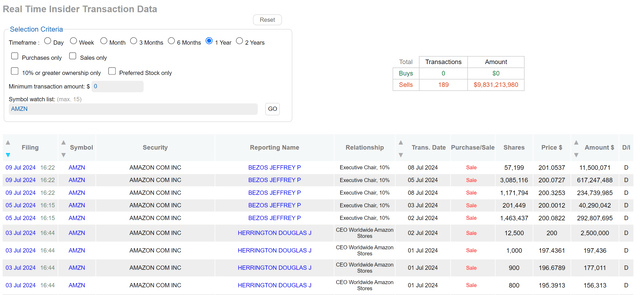

Another potential downside involves insider selling. As seen in the next chart, insiders at Amazon have sold a significant amount of stock in the past 12 months. According to the data, a total of 189 insider transactions have been reported in the past year and there has been no insider buying at all. Recent activities include sales by former CEO and founder Jeff Bezos. As noted in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. Insider buying activities usually have only one explanation – the insiders think the stock is undervalued. In contrast, selling activities can be triggered by a range of factors irrelevant to business fundamentals (e.g., to diversify their portfolios, pay for a major expense, exercise stock options, etc.)

However, in the case of AMZN here, I consider insider selling as a downside risk given A) the insider activities are completely dominated by selling, and B) the large number of shares held by Bezos.

All told, my conclusion is that the positives easily outweigh the negatives. I see a multitude of catalysts that can drive the company’s earnings. To recap, the top 3 catalysts in my mind are the improvements of its fulfillment centers, AWS, and its vast and sticky user base. Besides driving EPS, these catalysts, especially the synergies among them, can further solidify its competitive moat in the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.