Summary:

- Bank of America Corporation and other large bank stocks are trading at multi-year highs despite economic concerns and potential rate cuts.

- The large bank is expected to report a decrease in EPS for Q2, with challenges in NII and asset quality making for a cloudy position.

- The stock is overbought and trading at multi-year highs, decreasing the interest of being in Bank of America here.

filo/iStock via Getty Images

Despite the economy floundering and market experts starting to push rate cuts, Bank of America (NYSE:BAC) and other large bank stocks trade at multi-year highs. The sector has gotten a boost due to dips in capital requirements, but the sector faces an environment of lower rates and potentially higher loan risks. My investment thesis is more Neutral on the large banking stock of above $40 after pushing investors to repeatedly buy the stock down closer to $30 and below in the last year or so.

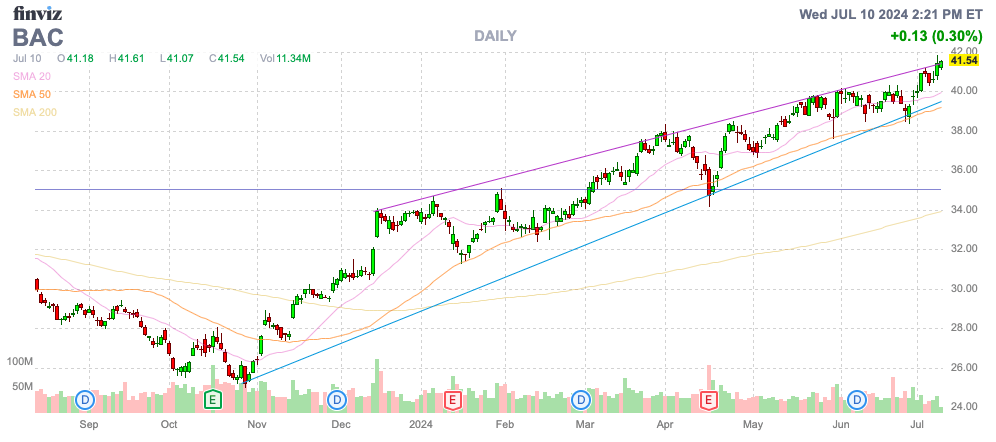

Source: Finviz

Q2 ’24 Earnings Preview

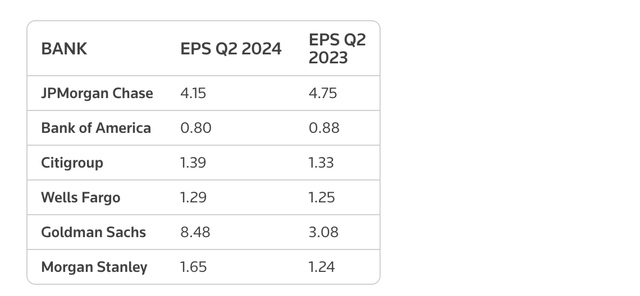

BoA heads into Q2 earnings on July 16 before the market opens on Tuesday with limited expectations. The consensus analysts’ estimates have the large bank watching EPS slip in the just ended June quarter.

The forecast is for BoA to report an EPS of $0.80 after reporting $0.88 last Q2. The results appear in line with the expectations for JPMorgan Chase (JPM), whose analysts forecast EPS to dip by double-digits from last year, as shown below.

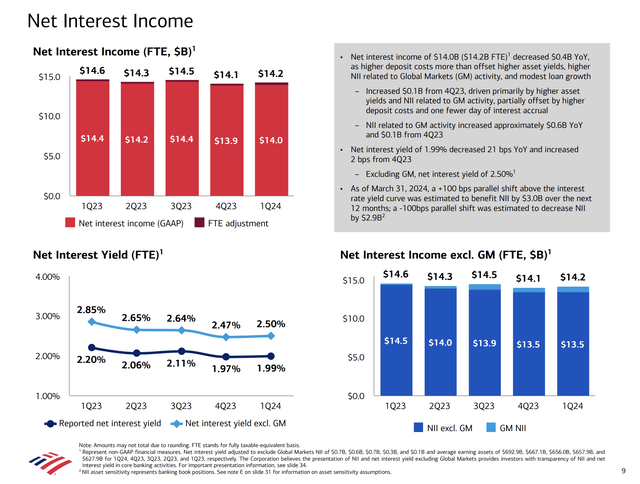

Due to high interest rates, BoA faces major NII headwinds and a tepid lending environment. NII was down $0.4 billion YoY in Q1, and Q2 is forecast to slip even further, with net interest yield of just 1.99% in the last quarter.

Source: BoA Q1’24 presentation

The environment isn’t expected to improve until the Fed cuts interest rates later this year with 1 or 2 rate cuts. The large bank forecasts a $3 billion impact to NII over the next 12 months based on a 100 bps shift in interest rates with a benefit from a parallel shift above the interest rate yield curve.

Piper Sandler analyst R. Scott Siefers forecast the NII bottoming at ~$13.9 billion in Q2 ’24 and reaching a level of up to $14.6 billion by Q4. The prediction is for the net interest yield to bounce back to 2.3% to 2.4% over the coming years, providing a tailwind to the business.

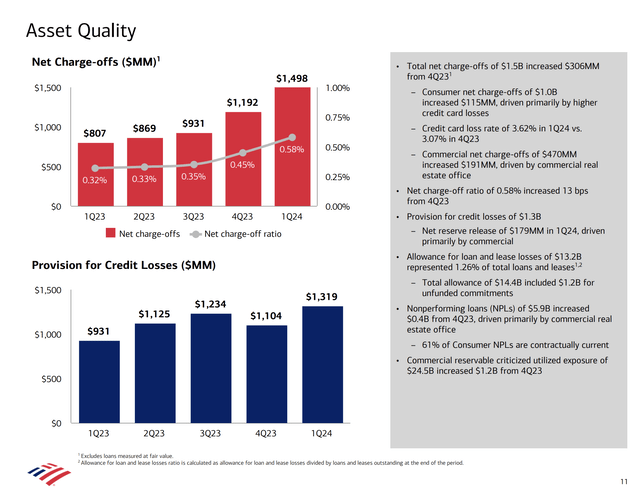

Asset Quality Focus

On the flip side of the NII benefit ahead, a big focus of the Q2 earnings report is the ongoing issues in asset quality. BoA posted a jump in net charge-offs to $1.5 billion in the March quarter, nearly double YoY.

Source: BoA Q1’24 presentation

The large bank still has very minimal net charge-off rates of 0.58%. BoA actually reported a net release of reserves ending with an allowance for loan loss of just $13.2 billion.

BoA has total loans and leases of $1.05 trillion at the end of Q1. The biggest risk to the investment story is larger charge-offs from weaker credit cards and commercial loans during a potential recession in the year ahead.

The large bank is reporting quarterly pretax income in the $7 to $8 billion range, so any increase in the provision for credit results would have a substantial impact on financials. A big reason for the lower EPS this year is the nearly doubling of the net charge-offs leading to much higher loan provisions.

BoA recently announced an 8% hike to the dividend after passing the stress test. The company will start paying a quarterly dividend of $0.26 for a dividend yield of 2.5%.

The bank had a CETI ratio of 11.9% after Q1 earnings, and the new requirement for the CET1 ratio following the stress test is 10.7% on October 1. The Fed is apparently looking at reducing the GSIB requirement, as the large banks have pushed back on the excess capital requirements layered onto the large banks over the last decade.

The stock trades at ~12x 2025 EPS targets of $3.55, requiring ~10% growth from the 2024 EPS targets. BoA would be far more appealing, if the stock wasn’t trading at multi-year highs and nearly 1.7x tangible book value.

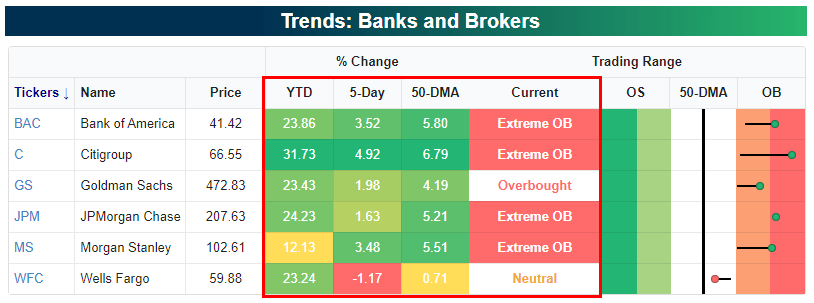

BoA has a solid dividend yield of 2.5% going forward, but the stock price is clearly overbought after the big rally over the last year. According to Bespoke, the whole banking sector is overbought, with stocks like BAC and JPM in the extremely overbought area being ~6% above the 50-dma.

Source: Bespoke

Takeaway

The key investor takeaway is that Bank of America Corporation stock is less appealing now, trading near multi-year highs, and likely facing more loan provisions due to a weakening economy. The stock offers a solid dividend for long-term investors, but the capital returns are likely tapped out here above $40. Investors should wait before a pullback to buy more shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start July, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.