Summary:

- Airbnb’s financials are attractive with potential for value generation even with modest growth rates.

- Airbnb’s prospects include market share growth, core business improvement, and expansion into new ventures, but faces challenges like regulation and competition.

- The buy is based on Airbnb’s solid market position, potential for steady growth, robust free cash flow, and attractive valuation despite current market volatility and manageable risks.

aldomurillo

After Airbnb’s (NASDAQ:ABNB) Q1 earnings release, the stock returned to a level in the $150 range, very negatively impacted by the market’s lower-than-expected guidance. The market was estimating revenues of ~$2.74 bn for Q2, while management’s guidance was somewhere between $2.68 and $2.74bn and even though it was only slightly below, the stock fell by more than 8%.

The fact is that this level already shows an interesting level for the company’s financials, which together with its interesting prospects for generating value and an attractive multiple, don’t need to grow by 20% every quarter, and with only the ~9% indicated, should already be able to generate value for the shareholder.

Although the price-to-earnings ratio (LTM) is currently distorted by provisions, the company is trading at an attractive level and already generates substantial free cash flow, making good buybacks possible.

Bullish Prospects for Airbnb

Currently, Airbnb already has an estimated market share of more than 20% in the Vacation Rental segment (because it is estimated, it is possible to find different figures in other studies), and even with this relevant share, I believe that there is room for growth in its financials, which go through some main pillars, among them: 1. Improvement of the Core Business, together with market growth; 2. Market consolidation; 3. Expansion in new ventures.

There is significant room for Airbnb to improve its Core Business. Even though it is already a consolidated and well-known platform in the market, the company should unlock value and customer loyalty as its core business evolution initiatives mature further. One example is the use of algorithms to improve the user experience, more accurate suggestions of better rentals for new customers, and the like. In Q1, the company removed thousands of listings that failed to meet the guest’s expectations, showing that further refinement of the platform is still needed and that this is happening. This, together with data science, has the power to make the platform more mainstream and less commoditized, with loyal customers knowing that when they travel, they will find a high-quality option that matches their preferences on Airbnb.

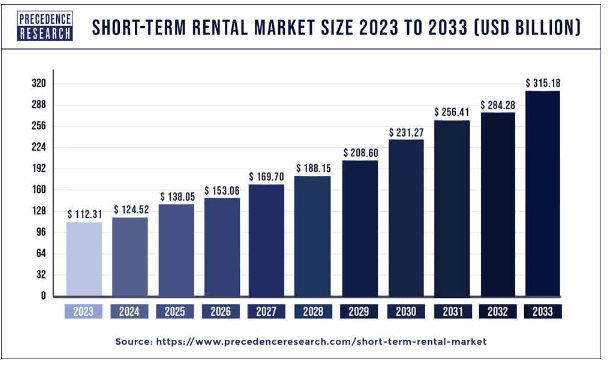

In addition, the Short-term Rental is becoming a secular trend. According to Precedence Research, it should have a CAGR of 10.87% between 2024 and 2033, driven by travelers prioritizing distinctive and genuine experiences. In other words, not only is there value to be unlocked internally, but even if the gain in market share is marginal, the company should be able to tap into this growing market.

Precedence Research

Consolidation of this market also seems to be a possible trend. With a number of less relevant players and a still fragmented market share, it is possible that we will see consolidation over the next few decades that will benefit the larger players (such as Airbnb and Booking), either through acquisition or by gaining market share due to the greater attractiveness and competitiveness of their platforms. As for acquisitions, the shareholder letter mentions that the robust Free Cash Flow enables investment in the operation and also growth through acquisitions. Combining this growth with acquisition but also enhancing the core business through data, Airbnb acquired Game Planner AI, which is able to analyze a range of data, historical sales, customer preferences, and the like.

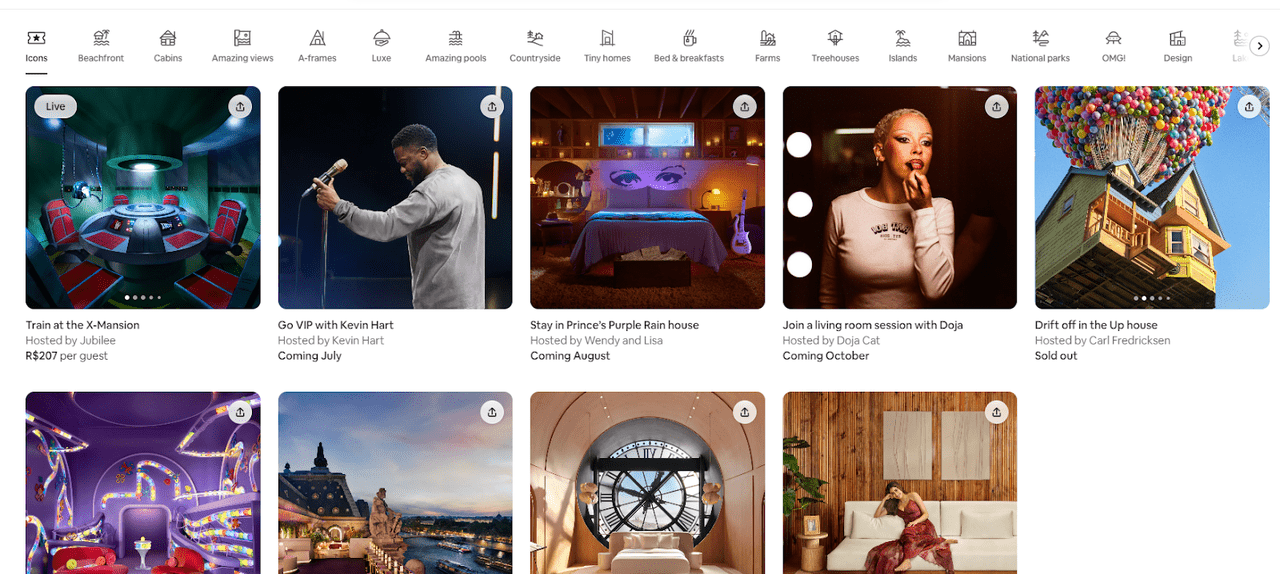

Finally, Airbnb is also expanding beyond its core business and becoming an even more unique platform. Icons, for example, although not yet relevant in terms of revenue and bookings, help to raise awareness and cross-sell the platform, with customers understanding that Airbnb can offer “more than accommodations”.

As I believe that these factors combined should make Airbnb stand out and outperform the industry, I see it as plausible that they can achieve a CAGR of just over 10% over the next few years. Even so, achieving this growth in a sustainable way will not be trivial, especially in view of a series of challenges that the company is facing and should continue to face over the coming years.

Challenges For Airbnb

The risks of the Airbnb thesis include the tourism market, greater sensitivity to the macroeconomic scenario, and other risks more specific to the thesis, such as regulation and reputational risks.

Regulation is certainly something that has to be monitored, when there are a number of important cities for the company’s operations, there is a cyclical threat to the thesis, leaving the stability of its operations in the medium and long term unclear. This is caused by a number of factors, where some cities see Airbnb as a problem due to its high turnover and threat to traditional hotels, which ends up changing the local economy through its modus operandi. In my opinion, the only way to mitigate this risk is for Airbnb to be more of a partner to cities and see them as stakeholders. Some progress has already been made, but I would stress that this is one of the characteristics that must be monitored and requires a little more care.

Another risk worth mentioning is the risk to reputation and security. There have already been a few cases of hidden cameras on Airbnb, and this, coupled with the fact that it is a platform where many individuals are able to make their homes available, increases the level of disbelief. The platform has already taken steps to improve this, banning cameras in rentals and, as mentioned in the section above, making efforts to improve the user experience.

But the most latent risk is that of competition. There is now a certain disbelief in the market that Airbnb will continue to capture market share in its segment, which is crucial to projecting growing financials. With the entry of Booking (BKNG) into this kind of rental, the cloudiness becomes even greater, raising doubts as to whether Airbnb will be disrupted and end up losing market share.

Searching the Internet, you can find dozens of different articles comparing Airbnb, Booking, and Vrbo, both from the point of view of hosts and travelers. My take is that although they are competitors, it’s still not a very direct competition. Airbnb has a greater focus on experiences, group travel, stand-alone vacation homes, and shared spaces (and for this reason, I believe it has a certain moat), while Booking, although it also has this type of property, is more focused on hotels, with less diversity of other types compared to Airbnb. For the host, there are also some advantages to listing on Airbnb, such as a more user-friendly platform, and better fees and processes, and this is even more true for those owners who only want to rent out a property and don’t have a robust structure. For these reasons, as much as I believe that Booking can continue to advance in this initiative and threaten Airbnb’s share, I understand that there is a competitive advantage and a focus on the Airbnb experience that mitigates this risk, especially taking into account that this must be improved gradually.

In any case, these risks weigh on the thesis and should not be ignored. Due to the sensitivity of forecasts to these nuances, it is possible to consider Airbnb shares more risky, requiring closer monitoring and a more precise dosage in the portfolio.

The Price Makes It a Little Bit Better

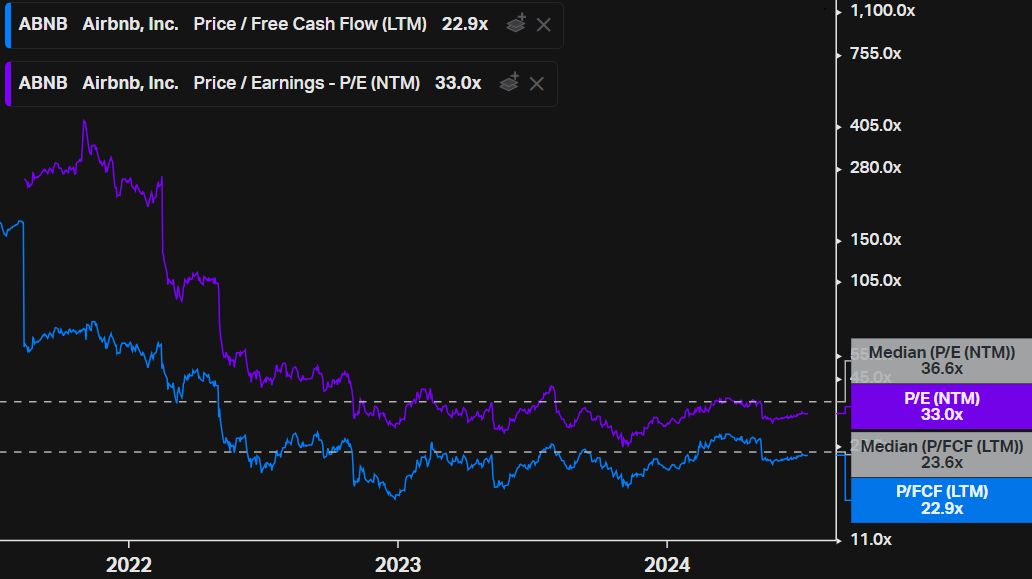

At current prices (close to $150), Airbnb stocks are trading at a price-to-earnings ratio of 20x, which sounds very attractive considering the potential. However, this figure may not accurately reflect earnings potential, since in 2023 there was a significant amount of income tax benefits that inflated this figure. It is therefore much more reasonable to look at the future multiple, which for the next 12 months is around 33x.

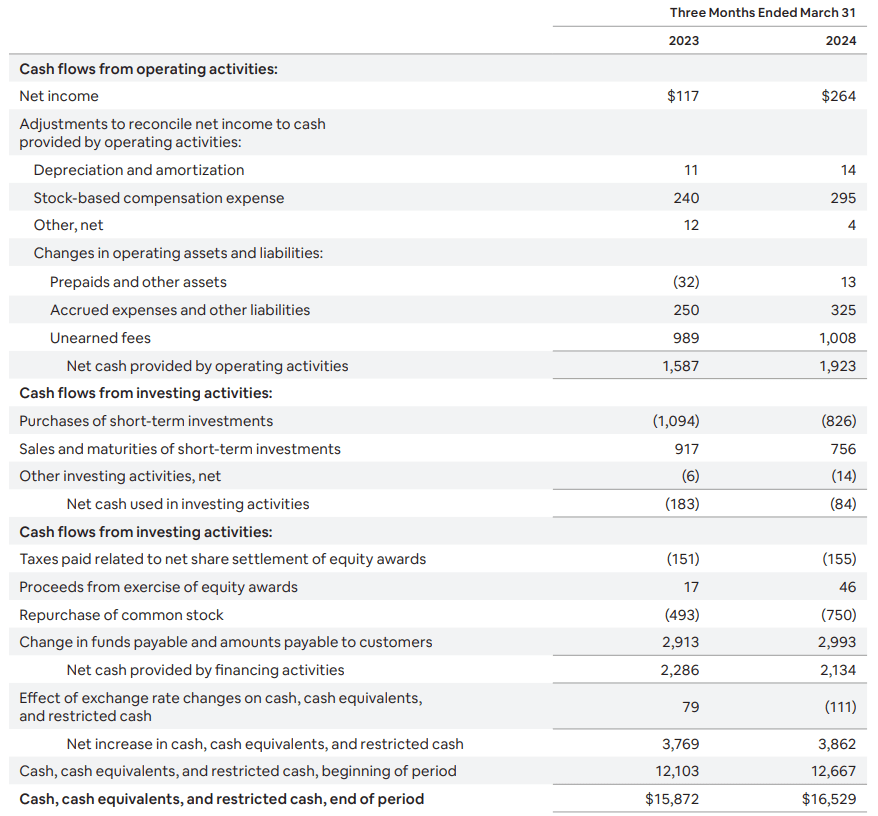

Another catch is that Airbnb’s Free Cash Flow benefits from its business model. As the company collects service fees at the time of the booking, but only passes them on to the host a few weeks later, this amount ends up being higher than net income and often higher than adjusted EBITDA. This isn’t a bad thing, in fact, it’s a leverage that I think is interesting for the business model, allowing greater flexibility for capital allocation, but you have to keep this dynamic in mind and understand that these “Unearned Fees” can add volatility to cash flow as the company grows less and also due to the effect of seasonality.

I consider the price-to-FCF of around 23x, slightly below its historical median of the last 3 years, to be an attractive level for the company, given its great prospects and very high-quality financials.

Koyfin

Note that this asset-light business model and unearned fees, allow the company to realize a large generation of shareholder value even with a substantially lower net income. While net income was $264 million in Q1, the buyback was $750 million (although the SBC was almost $300 million). In addition, I would draw attention to the high cash and equivalents that the company has in the period, adding greater robustness to its capital structure, given that its cash exceeds $16bn and its total Debt is ~$2.3bn. At current prices, Free Cash Flow in relation to EV (which ends up increasing given the amount of cash), gives us a yield of 4.8%.

Shareholder Letter – Airbnb

I don’t see the current prices as a huge bargain, but this yield provided by very reasonable multiples seems to make sense for a company with potential, which should benefit from interesting growth, made possible both by the trends in the travel market and by its internal initiatives.

If we think that today’s multiple is fair and there will be no expansion in the future, a CAGR in Free Cash Flow of just over 10% (for the next decade) seems feasible and enough for a quality company, not to mention the possible positive surprises that may come along the way, such as a greater conquest of market share or the maturing of new growth avenues.

Final Thoughts

If we consider all the above sections, we have a company that, despite having an already high-quality business model and a robust capital structure, still has room for growth by improving its core business, but also with possible positive surprises in the coming decades that can be considered optionalities. All this at very reasonable prices, making the rating a buy.

Despite all this quality, it is necessary to reinforce the risks here. There are some negative scenarios where it is possible to see reasonable downsides, such as in a case where the global macroeconomics continues to be pressured (causing customers to prefer price to quality and experiences) together with greater competition from platforms such as Booking, which could lead to a price war and compression of margins and growth for Airbnb. And so, if the base case turns out to be one where Airbnb is not one of the leading platforms in its segment and the medium and long-term prospects are growth in the mid-single digit and worse margins, a compression in multiples would be reasonable.

In any case, giving the benefit of the doubt to good management, which has an interesting track record and has been demonstrating initiatives to leverage the platform’s potential, makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.