Summary:

- Broadcom Inc.’s footprint in AI is expanding ahead of a largely anticipated 10-for-1 stock split.

- Broadcom’s 80% market share in the AI Ethernet switching and routing chipset industry positions it to capitalize on accelerated data center spending.

- Valuation ratios and the discounted cash flow analysis indicate that the stock is fairly valued, making the price compelling for such a strong company, especially ahead of the stock split.

Sundry Photography

Introduction

I gave a “Strong buy” recommendation for Broadcom Inc. (NASDAQ:AVGO) in April. I can say that the recommendation aged well because the share price rose by around 36% since April 18.

My updates to fundamental and valuation analyses suggest that there are no reasons to become less bullish about AVGO, and it still deserves its “Strong Buy” rating.

The company continues executing its strategy around incorporating VMWare into its portfolio of assets, with recent notable upgrades to the VMWare Cloud Foundation. Rumors around the AI chip development in cooperation with ByteDance suggest that the company is seeking new ways to expand its AI exposure. Broadcom’s dominance in data center networking and accelerated R&D investments highly likely mean that the company will be able to capitalize on aggressive data center spending from cloud giants.

I remain very bullish despite my DCF analysis suggesting limited upside potential because Broadcom is a wonderful company traded at a fair price. Furthermore, Nvidia’s (NVDA) recent successful stock-split example adds to my bullish stance, as AVGO will start trading with a post-split price next week.

Fundamental analysis

Broadcom continues to prioritize expansion of its exposure to the booming AI industry. Recent news suggests that the company cooperates with ByteDance to develop AI chips. This cooperation looks promising given the strong record of success of both partners. The information looks quite bullish for investors, as the AI chip market is expected to compound with a 30% CAGR by 2032.

While the level of uncertainty around this cooperation’s potential success is elevated, there are a few more developments which represent more reliable evidence of Broadcom’s expanding AI footprint.

Two weeks ago, Broadcom announced upgrades to the VMWare Cloud Foundation. New features are aimed to enhance infrastructure through the seamless integration of existing environments. This will support advanced AI workloads and simplify application deployment and management. Given Broadcom’s strong track record of successfully integrating acquired assets into its business, I think that the company will create strong synergies from VMWare.

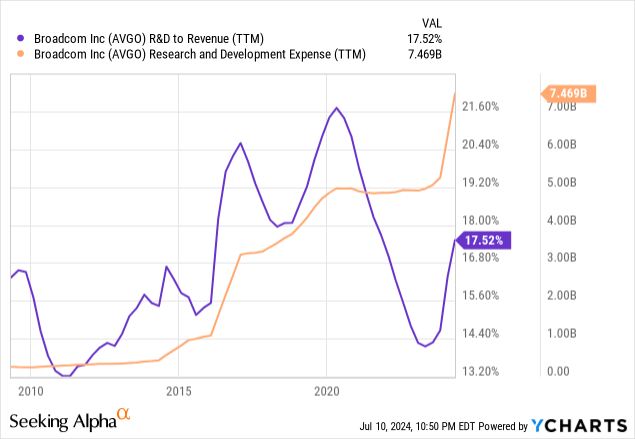

A high probability of creating synergies with VMWare is backed by the fact that AVGO has been ramping up R&D spending in recent quarters. Aggressive R&D spending will highly likely help AVGO to maintain its dominance in the data center networking industry. According to Harlan Sur of JPMorgan (JPM), Broadcom commands a staggering 80% market share in datacenter/AI Ethernet switching and routing chipset market. Having such a vital importance for data centers means that Broadcom will remain one of the major winners of the secular AI trend.

And this trend continues to gain momentum. It appears that tech giants like Microsoft (MSFT), Google (GOOGL), and Amazon (AMZN) announce new investments in data centers almost every day. For example, yesterday it was announced that Microsoft will invest 1.8 billion euros in Spanish data centers. Two days ago, there was information that Google plans to invest another $1 billion in Iowa data centers. Last week’s news suggested that Amazon will build a data center worth around $1.3 billion in Australia. That said, the show goes on in data centers, and Broadcom will highly likely capitalize on these favorable developments.

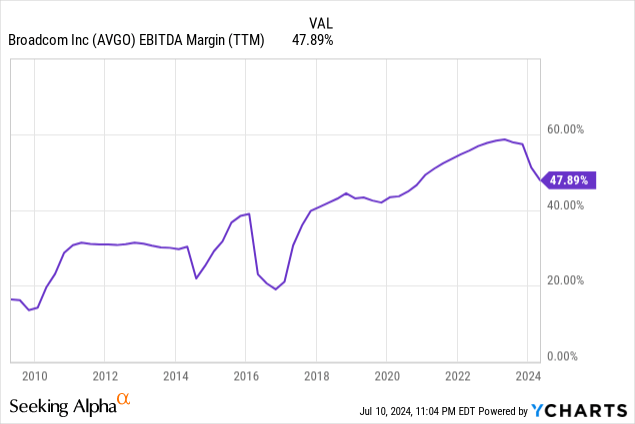

Broadcom is extremely efficient in converting revenue growth to value for shareholders. Its EBITDA margin is exceptional and the recent pullback in the metric is primarily caused by the accelerated R&D spending, which I mentioned earlier. Since AVGO has a stellar profitability record and historically strong return on capital employed performance, I tend to consider AVGO’s accelerated R&D spending as a bullish signal.

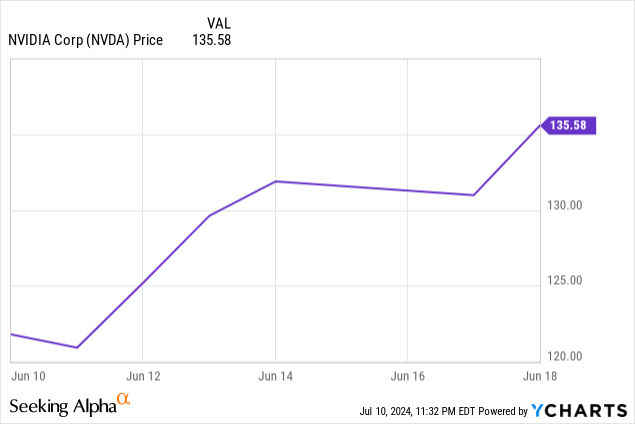

Finally, the anticipated 10-for-1 stock split is coming, which will likely be a strong positive catalyst for the stock. The stock will start trading at a post-split price on July 15 as of market open. The latest example of a stock split from the mega cap is Nvidia, which occurred exactly a month ago, on June 10. After the split, NVDA rallied by around 15% between June 10 and June 18, which makes me optimistic about AVGO’s split as well.

Valuation analysis

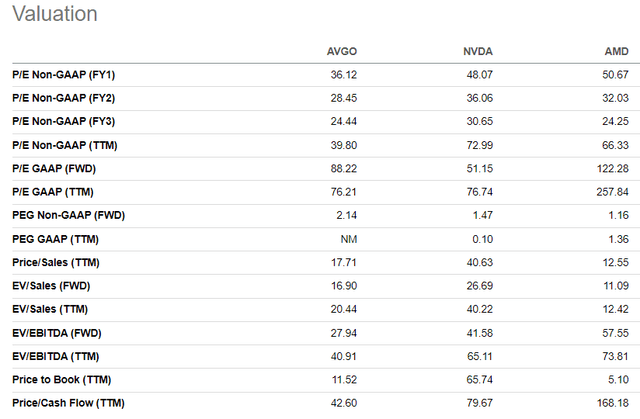

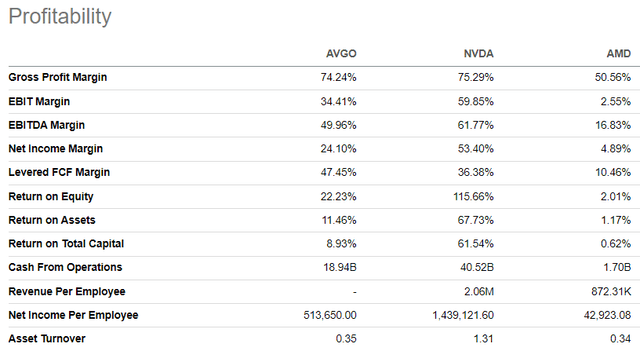

Since my fundamental analysis suggests that AVGO’s exposure to the AI revolution is massive, I think it is fair to compare its valuation ratios to players like Nvidia and Advanced Micro Devices (AMD). While NVDA’s high multiples appear to be fair considering this company’s spike in revenue and EPS in fiscal years 2024-2025, AVGO seems unfairly cheaper than AMD.

I think that much higher AMD’s multiples are unjustified because its YoY and forward revenue and EBITDA growth is not even close to Broadcom’s. Furthermore, Broadcom’s profitability is also substantially higher compared to AMD and is much closer to NVDA. Therefore, based on peer valuation ratios analysis, I can conclude that AVGO’s valuation is fair and attractive.

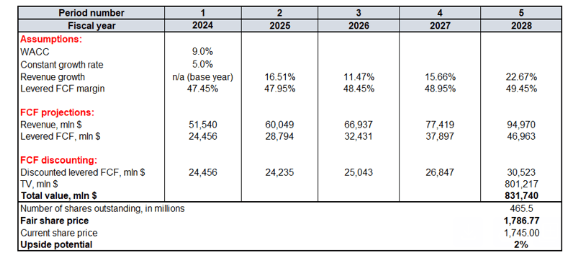

To determine my target price for AVGO I need to run a discounted cash flow (“DCF”) model. I use a 9% WACC, which is lower compared to the previous 9.3% assumption due to the expected one interest rates cut in 2024. A $51.54 billion FY 2024 revenue is based on consensus estimates, and I also rely on consensus for prospective years as well. A 5% revenue constant growth rate for the terminal value (‘TV’) estimation is in line with my previous analysis, which aged well. A 47.45% levered FCF margin is the current TTM level. Since revenue is projected to grow at a notable pace, I expect the FCF margin to follow and expand by 50 basis points yearly. According to Seeking Alpha, there are currently 465.5 million AVGO shares outstanding.

Calculated by the author

The upside potential is limited, but this does not mean that I am less bullish about AVGO. Having a fair valuation for one of the apparent AI winners is compelling, in my opinion, as it is always better to buy a wonderful stock at a fair price, as one of the greats said. Moreover, the stock is highly likely to rally further after the stock split.

Mitigating factors

The rally of the last 12 months in the most prominent semiconductor names has been staggering. Therefore, expectations of investors on positive earnings surprises and guidance upgrades are high. That being said, it appears to me that large players like AVGO, NVDA, and AMD share the same market sentiment and if one of them delivers disappointing earnings or guidance it might drag shares of all three players down.

Broadcom’s concentration in China is notable. According to the 10-K, net revenue from China (including Hong Kong) for fiscal years 2023, 2022, and 2021 was $11.5 billion, $11.6 billion, and $9.7 billion, respectively. These are substantial portions of AVGO’s sales, and I see risks in it. It is widely known that relationships between the U.S. and China are complicated, and AVGO already experienced adverse consequences on its financial performance in 2019 due to the Huawei export ban.

Conclusion

Broadcom Inc.’s strong data center exposure makes it one of the apparent winners from the powerful secular transition to AI. The upcoming stock split will likely fuel a robust near-term rally as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.