Summary:

- Bank of America Corporation stock price may rise further on Q2 earnings.

- A strong balance sheet, robust interest income and diverse operations, position Bank of America Corporation for another strong quarter.

- The valuation is still quite attractive judging by the above-average dividend yields despite the large recent price rallies.

J. Michael Jones

BAC stock price can climb more on Q2 earnings

I last covered Bank of America (NYSE:BAC) about 3 months ago, shortly after it released its 2024 Q1 earnings. As illustrated by the screenshot below, In that article (see the next chart below), I rated the stock as BUY following the framework of the so-called Buffett’s rule of 10x EBT (earnings before taxes). More specifically, the article argued:

The bank’s strong balance sheet and capital ratios position it well for growth and potential regulatory changes. Other growth catalysts include high interest rates, increased wealth management fees, and diverse operations in various segments. The valuation is still cheap. Trading at about 10x FWD pretax earnings, it still fits Buffett’s 10xEBT rule well.

The stock price has advanced by more than 20% since my writing, far outpacing the broader market’s gain of ~11% (which is terrific already in its own right). Looking ahead, the bank is scheduled to report its 2024 Q2 financial results on Tuesday, July 16 before the market opens. Given the large stock price changes since my last writing and the upcoming Q2 earnings report, I feel an updated assessment is in order. In this article, I will organize my assessment in the form of a preview of its Q2 earnings, and I will argue why the stock remains a buy. In the remainder of this article, I will elaborate on the drivers that I anticipate for Q2 that could drive the stock price even higher.

BAC 2024 Q2 earnings preview: interest income

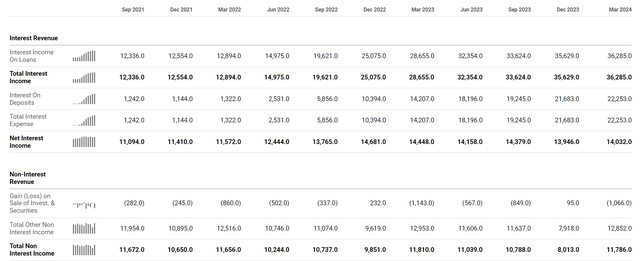

First and foremost, I expect the net interest income to improve from the previous quarter. Interest income is a major part of BAC’s revenues (although not a dominant part). As illustrated by the chart below (taken from its income statement), Q1’s net interest income dialed in at $14.03B, translating into a slight increase from the previous quarter ($13.95B) but a slight slip from Q1 2023 ($14.15B). To better contextualize the role of interest income, its total non-interest income during Q1 2024 was about $11.8B as shown and I will revisit this part of its income later.

The cause behind the interest income was the elevated funding costs, in my view. As seen, total interest expenses increased substantially YOY, from $14.2B in Q1 2023 to $22.2B in Q1 of 2024. For its Q2 2024 earnings, I expect the interest expenses to have stabilized and thus set the stage for an improved interest income.

Now, move on to non-interest income and expenses. In the noninterest income category, results were largely flat compared to a year ago ($11.78B vs. $11.8B as seen in the above). Although, digging a bit deeper, I can see the robust contributions from investment banking and trading activities. For Q2 earnings, I expect such contributions to further strength, given the good performance of the equity market over the past few months. Meanwhile, operating expenses are a key issue I will pay attention to in the Q2 release. When adjusted for FDIC assessments, BAC’s operating expenses were relatively well controlled in my view.

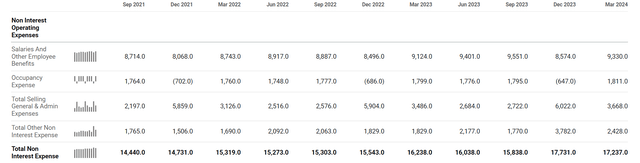

As seen in the chart below, total non-interest expenses were $17.2B in the March quarter, representing a sizable increase from a year ago ($16.2B) but a slight decline from Q4 2023’s $17.7B. Given the overall backdrop of elevated inflation and higher labor costs, I’d say that BAC has been doing a respectable job controlling costs. Furthermore, increases in expenses often were associated with commissions and fees directly linked to higher productivity. For Q2, I expect to see stable operating expenses, especially with the latest CPI data showing that inflation kept cooling.

BAC 2024 Q2 earnings preview: capital levels

The financial strength of the bank is in excellent shape and I expect it to remain this way. Asset quality is holding up well, despite slightly higher nonperforming loans and charge-offs (more on this later). The bank certainly has access to liquidity and capital levels exceed regulatory requirements. More specifically, according to the following results from the Federal Reserve’s 2024 Comprehensive Capital Analysis and Review (aka, the 2024 stress test and the emphasis were added by me),

Bank of America’s stress capital buffer (SCB) will be 3.2% and the CET1 minimum requirement will be 10.7% when finalized. This new SCB will be effective from October 1, 2024 to September 30, 2025. At March 31, 2024 Bank of America had $197 billion of regulatory CET1 capital and a CET1 ratio of 11.9% which exceeds our current regulatory minimum requirement of 10.0%.

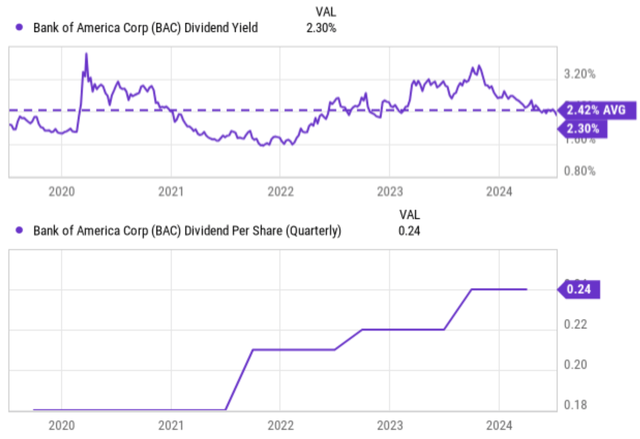

With 190 basis points of extra CET1 ratio above the minimum requirements, I expect the bank to have plenty of capital allocation flexibility to keep rewarding shareholders through stock buybacks and dividends. Speaking of dividends, the bank has recently increased its quarterly payouts to $0.26 per share beginning in the third quarter of 2024. Compared to the previous payout of $0.24 per share, this translates into an annual growth rate of 8.3%: a quite robust rate in my view.

With this increase, the stock is now yielding 2.5% on an FWD basis as of this writing, slightly above its historical average of 2.42% as seen in the chart below, indicating an attractive valuation.

Other risks and final thoughts

Other upside catalysts to watch for in Q2 include the performance of the Global Wealth and Investment Management unit (Merrill Lynch and Private Bank). I expect their business to be boosted by capital inflows and the higher asset levels we have experienced in the past quarter. Elsewhere, I also anticipate its Global Banking unit to benefit from the stronger investment banking business and better market outlook in recent quarters.

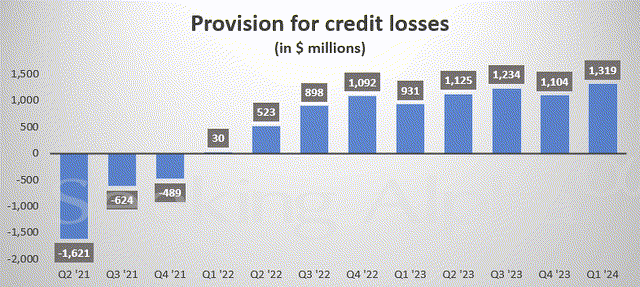

In terms of downside risks, as aforementioned, cost control will be a key issue that I will be tuning in during the Q2 earnings report. Another key issue at the top of my list is credit losses. In recent quarters, BAC has been increasing its provision for credit losses, as seen in the chart below. As of Q1 2024, the provision sat at $1.32B. In comparison, the provision was only $1.1B a quarter ago, about 20% lower than the current level. Compared to the level a year ago ($0.931B), the current figure is about 40% higher and is even more concerning.

Despite these issues, the overall picture is quite bright in my eyes. I see way more positives than negatives that can drive up its stock prices during/after the Q2 earnings report. To reiterate, the top 4 price drivers I expected to see in the Q2 report are robust interest income, strong financial position, shareholder reward programs, and very reasonable valuation despite recent price rallies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.