Summary:

- Analysts are concerned about tax rate increases on sports gambling wins, but top operators have defenses in geography.

- DraftKings Inc. and FanDuel control 70% of the sports betting market share, with potential for consolidation of fringe sites.

- DraftKings expected to turn profitable by Q3 24, with potential for significant growth and profitability in the future.

States and leagues are ever hungry but platforms have weapons that can inhibit fast moves on tax and fee rises. Seth Love

- Analysts who worry about runaway raises in tax rates on sports gambling wins have driven up a dead end: Rises perhaps, but top operators have defensives in geography,

- New York’s confiscatory 51% gaming tax on sports bets can be raised of course, state greed is limitless. But DraftKings Inc. (NASDAQ:DKNG) and FanDuel (“FD”) of Flutter Entertainment (FLUT) have long had defenses in place that fundamentally only cost media advertising in across the border markets.

- In some ways, such raises by states and leagues will weigh in as the powerful wind that will trigger rapid consolidation of fringe sites barely existing.

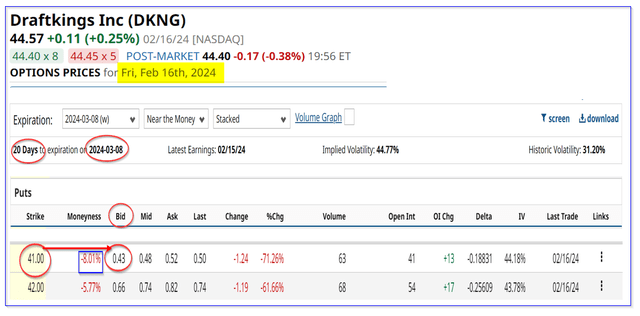

Premise: DKNG has taken a massive ride up and down the theme park roller coaster since 2021. From a dizzy high of $70, it had dived as low as $10 before it resumed its recovery. It now sits comfortably at $38, a bit skittish after a recent slide from the low forties. Analysts are beginning to question whether DKNG is beginning to look pricey–regardless of its excellent performance, delivering $1.175b in revenues in 1Q24. The latest consensus on full year 2024 is revenues reaching $4.5b to $5b. DKNG is near turning profitable, if not already there, by 3Q24’s earnings release.

google

As one of the two runaway market share rulers of the space (DKNG and FD control 70% of the entire sports betting market) with at least ten others scrambling for the crumbs, it is going up. There is no competitive thrust from any peer anywhere close to challenge the leaders for a seat in the market share leadership circle. Coming a bit close is BetMGM of MGM Resorts International (MGM), which now claims a double-digit share.

The ever-predatory states and leagues seeing this exponential double-digit percentage win gain every year can arbitrarily raise taxes. Among the greediest is New York, an early leader in the space which last year mulcted its taxes of 51% of $3.66b DKNG’s NY action, on all platforms totaling $1.697b. In neighboring New Jersey, just a fast hop over the George Washington bridge, did over $1b in win. The nationwide take for all sports betting in 2023 was $11b, with estimates for this year looking for at least another 22% increase.

As state checks get bigger, politicos see a fattening hog eating their meals. So it’s not difficult to see them upping the tax/admission fees for the operators, damaging FCF enough to kill off earnings gains that move the shares. At the same time, the sports leagues, among the greediest institutions on earth, might also follow suit and up their take. But they are still walking on eggs, as anti-gambling sentiment never really dies.

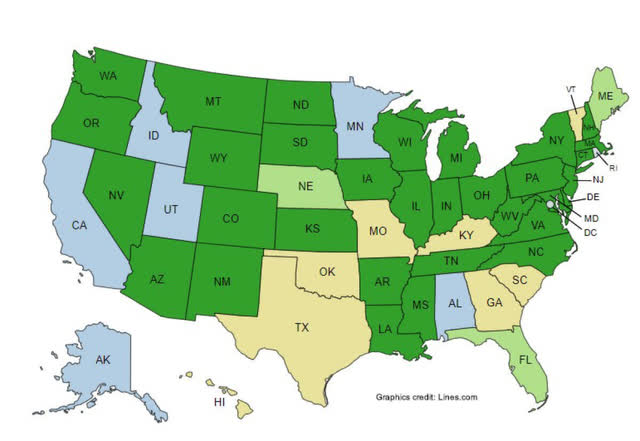

Above: FCF is presumably a victim of tax rises by states, but it can be defended by the simple facts of geography.

Such mass acts of raising their cuts can, of course, happen and wreak havoc on the sector’s earnings. The NFL is known to never leave a dime on any street they can sweep up.

The legal gambling business is not about borders, but it is about geography.

Above: Green designates current legal states. But notice the geography for both casinos and their out-of-state feeder markets. Same for sports betting.

The tax rise worriers forget one thing: People have cars and access to transportation. And because of the long-standing checkerboard of legal and illegal states in US geography, bettors can be expected to follow the odds. Raise the taxes and inevitably, you need to adjust betting odds down.

As an industry executive over decades, I think I can do a bit of player mind reading. Let’s do an experiment. It is all about geography.

It primarily involves DKNG as it is a US dominant operator.

Suppose NY state kicks up its tax rate to 60%. That will impact operators in that state. Odds compared to neighboring New Jersey odds will become far less attractive in NY. As it was before NY legalized, tens of thousands of bettors simply walked across NJ state lines, or did a quick drive over bridges in Manhattan and Staten Island in lower traffic time frames, placed their bets, and drove home. Perhaps analysts warning of tax rises did not see the endless snaking lines around NJ retail stores of NY bettors. Seeing this outflow would result in lower handles, née wins, which in turn lower tax collections. Seeing this, NJ legislators might be disinclined to raise taxes on their end.

Those who remember will note that NJ legalized sports betting a month after the SCOTUS decision in 2018. As NY sat next door, not yet legal, the daily mass flow of bettors from there crowded into nearby NJ retail outlets. NJ became the number one state in US revenue. NY dawdled until mid-2021 to legalize sports betting. It did not take the first bet until January 2022.

New Jersey averaged (it was then #1 in the US) 12.6m transactions two weeks after NY went active in January 202. Those same two weeks saw NY jump to 13.1 transactions as the newbie. Predictions sprang up all over Wall Street as to the hit NJ would take when NY went active. There was something of a hit, yet today’s rankings still put NJ a tick ahead of NY. NJ is #1 and NY #2. NJ $3.8b in 2023 vs. NY$3.9b.

What tax worriers fail to recognize is the percentage of population of NY state residents who literally can walk to NJ betting locations and still do. If is a big gap in taxes ever came to NY, tens of thousands of NY bettors would, as they say, “Vote with their feet.” Add to that motorists, public transportation available of crossers. Then you can easily see a threat to NY revenues if taxes are raised to where they impede marketing goals.

And this probable migration would apply all over the US. The long history of gambling geography is this: location near the people is always nearby or across rivers. Casinos located near illegal state lines and depend on crossers as key customers. The only considerable exception is clearly Las Vegas, a true global destination resort.

Every casino in the US regional space is located near fast driving access or bridges to congruent states where bettors can gamble to their hearts content as close as thirty minutes away.

Secondly, new states may decide to keep sports bet taxes cheaper inside casino books because casinos employ so many citizens. Job creation has been a winning promise casino developers have used to win over populations in legalization campaigns.

Fear not: DKNG could be on a run here to the mid-forties again

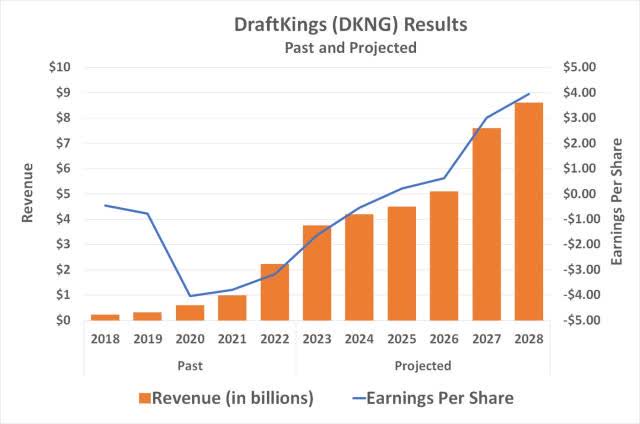

Revenue growth has been the leading catalyst for sports betting stocks since the PASPA ruling. In the near six years since legalization, sports betting stocks have enjoyed YOY sales growth, mostly in double digits. It is why sector stocks like DKNG have left their seats on the Wall Street roller coaster and now trade on elements beyond sales growth. First, investors now see a consistent pattern of DKNG results that show a continuing decline in marketing overspend.

It was one of the biggest bear takes on the stock (including us) that DKNG had spoiled bettors with so many promos and giveaways, that they’d never make as many laydowns once the wild deals were gone. Instead, during Q3 of 2023, for the first time in 12 quarters, DKNG reported a leveling to a small decline in marketing costs. From $327m to $313m. This trend is expected to accelerate. It is one of the reasons that Mr. Market expects the company to turn profitable at some point this year or early next. One telling forecast of management is negative EBITDA $721m in 2023 vs. Negative $151M for 2024, moving rapidly to positive results.

DNG Headed for its first profitable quarter this year or early next

We see DKNG headed for a first-ever profitability, possibly by latest early 2025 with an estimated $450/$500m in EBITDA. That number will be the entry gates to the breakthrough share price advance to the $45 to $50 range, where the high margin revenue will finally overcome excessive marketing and promo costs.

DKNG is always demonstrated its interest in transactions. It made two failed offers to Entain, and bought Jackpocket, Inc. for $750m last May. It’s a small move, but one we believe will not be the last. Our outlook, in general, includes a major deal upstream for either another platform, or perhaps a regional casino operator.

Although we could see some tax and fee rises ahead, we don’t see DKNG as vulnerable as some sentiment in the market believes.

We also see DKNG well on the way of continuing to reduce marketing and promo costs at the same time as enjoying double-digit sales growth. We have not included prospects for new states yet, though some are getting close.

Overall, we are setting a price target (“PT”) for DKNG that includes a spike we believe is probable once the news of a profitable EBITDA is confirmed.

For the period between now and Q3, we see DKNG recovering to a range of $42 to $44 and then a breakthrough, moving to the high 40s to low 50s.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.