Summary:

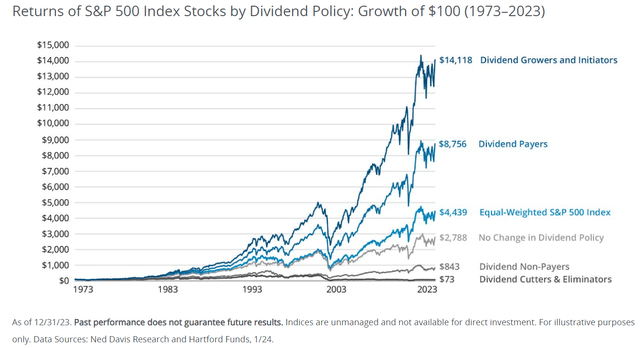

- Dividend growers and initiators have trounced all other investment classes by dividend policy in the last half-century.

- Earlier this year, Meta Platforms began paying dividends. This is exceptionally well-covered by earnings and further supported by an excellent balance sheet.

- The big tech giant enjoys a strong competitive position in an industry with secular growth trends on its side.

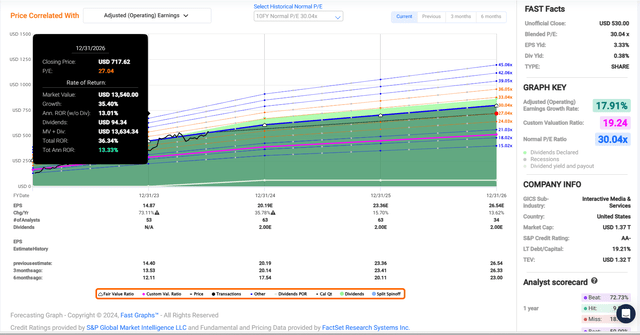

- Shares of META are priced at 10% under my fair value estimate.

- META could be positioned to post 35%+ cumulative total returns by the end of 2026.

A bride and her bridesmaids taking a selfie. LightFieldStudios/iStock via Getty Images

I have been interested in the concept of dividend growth investing since 2009 (age 12). Over the years, I have poured over more data that I believe backs up this investing strategy than refutes it. This is why when I began real-money investing in 2017, it was an easy choice to pick dividend growth investing as my strategy.

Hartford Funds – The Power of Dividends

Recent data from Hartford Funds is the most recent example of why I am standing by my dividend growth investing strategy. A $100 investment in the S&P 500’s (SP500) dividend growers and initiators in 1973 would have been worth over $14,000 with dividends reinvested to conclude 2023. This is 3x greater than the $4,400 the same investment amount put in an equal-weighted S&P 500 index would have grown to with reinvested dividends over that time.

Recently, I have increased my focus on the dividend initiator part of the equation. In the last couple of years, I have built up a 3% weighting in Google (GOOG)(GOOGL). Over time, I’m going to work to further boost this weighting.

Meta Platforms (NASDAQ:META) (NEOE:META:CA) is a stock I don’t yet own. Since META initiated its quarterly dividend in February, it has been firmly on my radar, though.

Today, I’m going to be discussing why I plan on opening a starter position in META in the coming weeks. The crux of my investment thesis centers around the company’s leadership status in the thriving digital advertising space. Another plus is META’s phenomenal balance sheet. As is the case for many dividend stocks that go on to be excellent dividend growers, the payout ratio has room to climb much higher in the years to come. Finally, shares could still offer decent value, despite its 53% gains so far this year.

Bright Growth Prospects And A Fortress-Like Balance Sheet

As one of just seven three-comma club companies, META and its ~$1.5 trillion market cap, probably doesn’t need an introduction. But here’s one anyway.

META is the parent company behind the world’s leading social media platforms, including Facebook, Instagram, Messenger, WhatsApp, and Threads.

The company reports its results in two operating segments:

- Family of Apps: This segment consists of the aforementioned social media businesses. These businesses sell advertisements to marketers to reach people with their marketing campaigns. As of March 31, the company had 3.2 billion daily active people across these platforms. Including monthly active people, META’s platforms reach four billion people – – half of the world’s entire population. This ability of META to reach the desired targeted audience of advertisers is an immense value proposition. For more context, 98.8% of the company’s $36.5 billion in total revenue during the first quarter was derived from FoA.

- Reality Labs: This segment offers Virtual Reality and Augmented Reality products to people. Meta Quest Virtual Reality devices and software through it Meta Quest Store are used by people for gaming, fitness, entertainment, and so on. Augmented Reality products include Ray-Ban Meta smart glasses, which include Meta artificial intelligence, as well as live streaming video and enabling hands-free interaction. RL made up the remaining 1.2% of META’s first-quarter revenue.

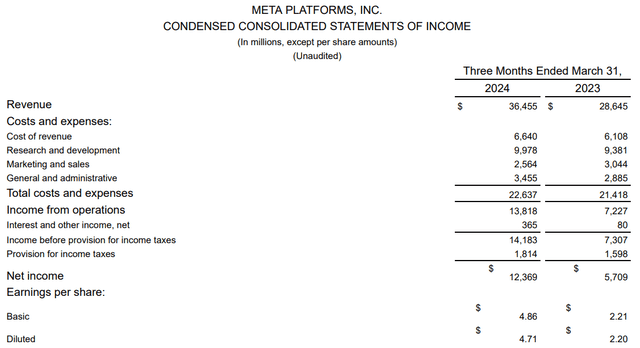

META Q1 2024 Earnings Press Release

META’s first-quarter results shared on April 24 were impressive. The company’s revenue surged 27.3% higher year-over-year to $36.5 billion in the first quarter. For perspective, this was $240 million greater than Seeking Alpha’s analyst consensus.

There were a few factors that played into these fantastic operating results. For one, META’s virtuous cycle of daily active people growth continued. As more people join a social media platform, this provides other people with more of an incentive to join it themselves.

That is why the daily active people count was up 7% over the year-ago period and topped 3.2 billion during the first quarter. This bigger user base coupled with greater engagement yielded 20% year-over-year growth in ad impressions for the quarter.

Another element that buoyed META’s results was the overall state of the digital advertising industry. Growth in advertiser spending was one variable that led to a 6% growth in the company’s average price per ad. Improvements in ad targeting and measurement tools were also key drivers.

META’s diluted EPS soared 114.1% over the year-ago period to $4.71 in the first quarter. That came in $0.39 better than the analyst consensus from Seeking Alpha.

Disciplined cost management made a world of difference for META’s profitability. Thanks to prudent cost management, the company’s total costs grew by just 5.7% year-over-year to $22.6 billion during the first quarter. That caused META’s net profit margin to expand by 1,400 basis points to 33.9% for the quarter. This is how the company’s diluted EPS growth far outpaced revenue growth in the quarter.

Moving forward, META has notable growth catalysts.

For one, the company operates as a leading player in the digital advertising industry. Oberlo anticipates that the global digital advertising market will compound by 9.3% annually from $667.6 billion in 2024 to $870.9 billion by 2027.

This is based on a couple of assumptions. For one, overall global economic growth should drive advertising growth in the years to come. Not to mention that the overall share of digital advertising to total advertising will expand by almost 200 basis points from 2024 to nearly 71% by 2027. This is because digital advertising can provide more targeted advertising versus traditional advertising mediums like newspaper or television ads.

I believe META also is in a great position to at least maintain this market share or even grow it in the years ahead. Per Chairman and CEO Mark Zuckerberg’s opening remarks during the Q1 2024 Earnings Call, 30% of the posts on Facebook feeds are delivered by its AI recommendation system. For perspective, that’s 2x more than a couple of years ago. Instagram’s AI recommendation system now accounts for more than 50% of the content that people see on the platform.

As META further deploys its AI recommendation system across its platforms and refines it to become more efficient, this should power future growth. That’s why I believe the FAST Graphs analyst consensus forecasts for the next few years are realistic.

For 2024, diluted EPS is predicted to climb by 35.8% to $20.19. In 2025, another 15.7% growth in diluted EPS to $23.36 is being projected. For 2026, the analyst consensus is that diluted EPS will rise by 13.6% to $26.54.

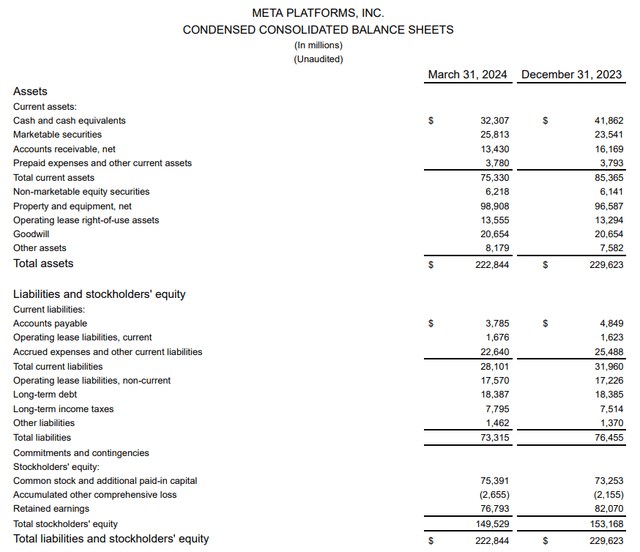

META Q1 2024 Earnings Press Release

If META’s growth potential isn’t enough, the pristine balance sheet could put it over the top. As of March 31, the company carried a net cash/marketable securities balance of $39.7 billion. At a time when many businesses are struggling with higher interest expenses, this huge net cash/marketable securities balance led META’s interest income to more than quadruple to $365 million during the first quarter. As a result of its enviable financial health, the company possesses an AA- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to META’s 10-K Filing, META’s Q1 10-Q Filing, and META’s Q1 2024 Earnings Press Release).

Fair Value Is Closing In On $600 A Share

After rallying 50%+ thus far in 2024, conventional wisdom would have it seem like shares are fully priced by now. When dealing with the most dominant businesses on the planet like META, conventional wisdom doesn’t always apply, though.

The stock’s current-year P/E ratio of 26.3 is moderately below the 10-year normal P/E ratio of 30 per FAST Graphs. Even with all it has going for it, the law of large numbers means that META’s growth story likely won’t be as strong as in the past.

The days of high-double-digit or low-triple-digit diluted EPS growth are probably in the rearview mirror. The three-year forward outlook of ~18% annual diluted EPS growth is still very vigorous, however. This is why I believe that a valuation multiple of one standard deviation below the 10-year normal P/E ratio is reasonable. That would be a fair value P/E ratio of 27.

The calendar year 2024 will be 54% complete in just a few days. This means that another 46% of 2024 and 54% of 2025 are yet to come in the next 12 months. That is how I’m weighing the 2024 and 2025 FAST Graphs diluted EPS consensus estimates to get a forward 12-month diluted EPS input of $21.92.

Using my fair value multiple of 27, I get a fair value of $593 a share. This works out to a 10% discount to fair value from the current $531 share price (as of July 10, 2024). If META matches the growth consensus and reverts to my fair value estimate, it could deliver 36% cumulative total returns through 2026.

Future Dividend Growth Has A Lengthy Runway

The Dividend Kings’ Zen Research Terminal

As expected for a new dividend payer, META’s 0.4% forward dividend yield is modest. It is a fraction of the communication services sector median of 3.2%. That is why META’s grade for forward dividend yield from Seeking Alpha’s Quant System is an F.

As an emerging dividend growth stock, I contend that it would be wise for me to focus on future income rather than immediate income.

This is because META is on pace to pay $2 in dividends per share in 2024. Against the $20.19 analyst consensus for diluted EPS, this is an EPS payout ratio of just below 10%. That’s comfortably lower than the 60% EPS payout ratio that rating agencies prefer from META’s industry, per The Dividend Kings’ Zen Research Terminal.

Teens annual diluted EPS growth potential aside, this gives the company flexibility to hand out generous dividend hikes for the foreseeable future. In the next several years, I anticipate dividend growth will be in line with earnings growth.

As META grows further, and growth opportunities eventually settle down, I expect dividend growth to outpace diluted EPS growth, though. As the years progress, this will result in dividends becoming an increasingly important part of the total return picture.

Risks To Consider

META is arguably one of the best businesses to ever grace this planet. However, it still has risks that must be discerned before making any investment decisions.

The biggest risk to META is the aforementioned network effect of which it has been a beneficiary since its founding in 2004. If this trend reversed and daily active people began to decline, its advertising revenue could be adversely impacted. This could weigh on the company’s future growth.

Another risk to the company is on the regulatory front. If more major markets follow the path of the European Union regarding data privacy laws, this could hinder the effectiveness of META’s digital ads. That could also harm the company’s growth story.

Finally, a bet on META is a bet on its brilliant leader, Mark Zuckerberg, in my view. The company’s dual-class structure of its common stock means that META’s future will continue to be guided by him. The potential for Zuckerberg to make key strategic errors is there, but not likely in my view.

The greater risk here is the potential for him to be injured or incapacitated by his participation in high-risk activities, such as combat sports and surfing. This would leave a gaping hole that META may not be able to fill, which could cause its business to suffer.

Summary: A Compounder That I Can’t Afford Not To Own

META is a business that’s too good for me not to own. Growth remains admirable. The vigor of the balance sheet is incredible. Shares are also a decent value here in my opinion. So, it’s high time that I open a position and build that to an overweight position in my portfolio over time (3%). This is why I’m starting coverage with a buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.