Summary:

- Pfizer Inc. announced today that it planned to continue development of its GLP-1 agonist weight loss drug danuglipron as a once-daily oral pill.

- The drug met efficacy endpoints in a Phase 2 study last year as a twice daily pill, but side effects caused a high level of patient withdrawals, undermining the results.

- The company says testing of the once-daily version reveals no evidence of liver damage – but it is a long way adrift in the GLP-1 space.

- Lilly and Novo Nordisk’s Zepbound and Wegovy are set to dominate a market potentially worth >$150bn, but there are several other contenders of note in clinical studies.

- Danuglipron feels like a back-marker in a crowded field – Pfizer may be better off focusing on the >$70bn worth of M&A deals it has made and the >$45bn of new revenue it has forecast from these sources.

MediaProduction/iStock via Getty Images

Investment Overview

Back in December last year, I shared a note on Pfizer Inc. (NYSE:PFE), the beleaguered “Big Pharma” company, entitled “Disastrous 2023 Hits New Low With Weight Loss Drug Failure.”

In that post, I discussed Pfizer and its business in some detail. I expressed disappointment – likely shared by Pfizer’s shareholders – that a company that realized a >$100bn uplift in revenues over three years thanks to the success of its Comirnaty COVID-19 vaccine, and Paxlovid COVID antiviral, achieving >$100bn revenues in 2022 alone – had experienced a ~30% drop in the value of its share price on a 3-year basis.

Pfizer used much of the additional income earned from its COVID franchise to fund a massive M&A spree (see my May note on the company for more detail). However, the revenue contribution from close to a ~$70bn outlay came to not much more than $1bn in Q1 2024, as many of the pipeline prospects purchased will take years to deliver a meaningful revenue impact.

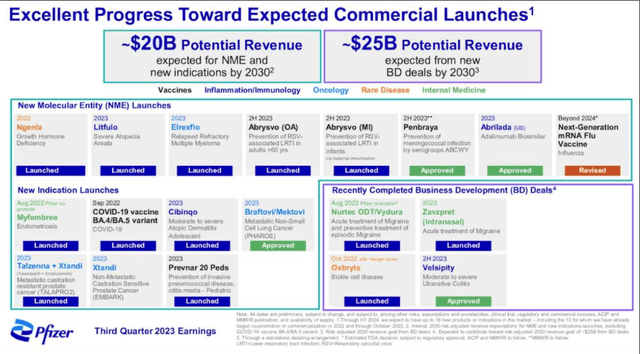

Pfizer has said that it expects to drive ~$20bn from newly launched products developed in house, and $25bn from drugs acquired from its respective M&A deals in time. However, the jury remains out on how realistic that target may be. Rather than be patient and work with what it has, Pfizer seems to have decided it needs to find a way to compete in markets such as weight loss, projected by Wall Street to be a >$150bn — $200bn market by 2030.

Dominating the weight loss landscape are Eli Lilly’s (LLY) tirzepatide, and Novo Nordisk’s (NVO) semaglutide. The former has secured approvals in Type 2 diabetes, under the brand name Mounjaro, and in weight loss, under the brand name Zepbound. The latter is approved to treat Type 2 diabetes under the brand name Ozempic, and in weight loss under the brand name Wegovy.

Tirzepatide and semaglutide are expected to dominate the weight loss landscape and potentially earn revenues of >$50bn per annum each, an outlook that has underpinned stellar gains in their share prices, which are up >285% and >225% respectively on a 3-year basis.

Pfizer’s “No-Brainer” Entry Into Weight Loss Market Underwhelms

As such, it makes sense that Pfizer would attempt to develop its own weight loss drug, which it has been doing — as I wrote back in December:

Under its CEO Albert Bourla, Pfizer cannot be accused of lacking the ability to innovate, and Pfizer has been developing its own GLP-1 agonist, which is known as Danuglipron. A major advantage of Danuglipron is that it can be taken orally, whereas semaglutide and tirzepatide are self-injectable therapies.

In fact, back in January 2023, at the JP Morgan Healthcare conference, CEO Bourla confidently predicted that Danuglipron “could be $10 billion product for us in a market that could be $90 billion,” adding:

we think there will be very few players that will play in the oral GLP-1, us and Lilly, clearly, we are going to be one of them. We think the data should show which one has a better profile. We believe and we hope that we will have. But no matter what, it’s going to be so big a market that it’s going to be a very big product for both of us, I think.

Like tirzepatide and semaglutide, Danuglipron is a glucagon-like peptide 1 (“GLP-1”) receptor agonist. However, it is also a small molecule, enabling it to be administered orally, potentially handing it a crucial advantage over Lilly and Novo’s drugs, and making it a serious contender for a slice of a historically large market.

Back in December, Pfizer shared data from a Phase 2 clinical study in ~600 obese adults. The study met its primary endpoint, as per a press release:

Twice-daily dosing of danuglipron showed statistically significant reductions from baseline in body weight for all doses, with mean reductions ranging from -6.9% to -11.7%, compared to +1.4% for placebo at 32 weeks, and -4.8% to -9.4%, compared to +0.17% for placebo at 26 weeks. Placebo-adjusted reductions in mean body weight ranged from -8% to -13% at 32 weeks and -5% to -9.5% at 26 weeks.

There was an issue, however, in that study discontinuation rates were high, as were instances of adverse treatment effects, as follows:

While the most common adverse events were mild and gastrointestinal in nature consistent with the mechanism, high rates were observed (up to 73% nausea; up to 47% vomiting; up to 25% diarrhea). High discontinuation rates, greater than 50%, were seen across all doses compared to approximately 40% with placebo.

After sharing the results, Pfizer stock took another nose-dive, falling from ~$30 per share, to ~$26 per share, as the drug did not seem to represent a genuine rival to tirzepatide or semaglutide, if patients were unable to tolerate its side effects.

Pfizer Goes For Broke With Once-Daily Formulation Of Danuglipron

Earlier today, Pfizer issued a press release in which it stated its intention to advance development of a once-daily version of danuglipron. The company said that it had:

selected its preferred once-daily modified release formulation for danuglipron, an oral glucagon-like peptide-1 (GLP-1) receptor agonist. Pfizer plans to conduct dose optimization studies in the second half of 2024 evaluating multiple doses of the preferred modified release formulation to inform the registration enabling studies.

Pfizer’s Chief Scientific Officer (“CSO”) commented as follows:

Following a thorough analysis of our previous Phase 2b data and trial design, we believe that with the preferred modified release formulation and future trial design optimization, we can advance a competitive oral GLP-1 molecule into registration enabling studies, with the goal of addressing the present and persistent medical needs of people living with obesity.

The company added that:

To date, study results have demonstrated a pharmacokinetic profile supportive of once-daily dosing. with a safety profile consistent with prior danuglipron studies including no liver enzyme elevations observed in more than 1,400 study participants.

Analysis — Encouraging Signs, Or “A Day Late & A Dollar Short”

Pfizer’s unexpected success winning the COVID vaccine development race with Comirnaty, and developing the best-selling COVID antiviral, ought to have reinforced its reputation as a pharmaceutical innovator. However, unlike with COVID, when the company was able to enlist the help of a trailblazing messenger-RNA specialist, in BioNTech (BNTX), the company can hardly be considered a front-runner in the weight-loss drug / GLP-1 agonist space.

On one hand, it is encouraging that the Pharma has been able to report no liver issues with its once-daily version of danuglipron. But on the other, that data has not been made public, and the drug must first succeed in a pivotal Phase 3 study before it can even be considered as a candidate for commercial markets.

Naturally, tirzepatide and semaglutide have already aced pivotal studies in Type 2 diabetes (“T2D”) and weight loss — studies indicated that Wegovy reduced weight loss in patients by a mean of ~15%, and Zepbound by ~21%, with apparently tolerable side effect profiles.

In Q1 2024, Mounjaro earned $1.8bn of revenues, Zepbound — only approved in November 2023 — $517m, Wegovy, $1.34bn, and Ozempic $4.3bn. These numbers are a fraction of what the market sees these drugs earning long term, as discussed above. Crucially, though, they will enjoy years of market exclusivity before Pfizer would even be in a position to launch Danuglipron — provided, of course, the drug also aces its pivotal study.

In fact, Pfizer needs to worry not only about tirzepatide and semaglutide, but also several other contenders. Swiss Pharma Roche (OTCQX:RHHBY) and California based Amgen (AMGN) both believe they are developing “best-in-class” GLP-1 agonists, both of which are in the Phase 2 study stage, with compelling data promised. Altimmune (ALT), Viking Therapeutics (VKTX), Zealand Pharma and Bohringer Ingelheim, and Structure Therapeutics (GPCR) all have contenders in the race to be the next “blockbuster” (>$1bn per annum) selling GLP-1 agonist drug.

For good measure, Lilly has its oral GLP-agonist in development, orforglipron, plus a next-generation version of tirzepatide, retatrutide, both of which are delivering some outstanding clinical data. Plus, not to be left out, Novo is developing amycretin, and studies have shown it has reduced weight loss by 13% in just 12 weeks (for more detail on these candidates see my recent note on Altimmune).

In short, while Pfizer was in pole position throughout the race to develop a successful COVID vaccine, and reaped the considerable rewards, in the GLP-1 agonist space, the company should probably be considered a back marker that it may be unwise to place bets on.

Concluding Thoughts — Pfizer Needs To Stop The Bleeding, But Fresh Weight Loss News Unlikely To Rouse Wall Street

In May, I covered Pfizer’s Q1 2024 earnings in a note for Seeking Alpha, and frankly, there was not a lot wrong with Pfizer’s overall performance. I summarized the numbers as follows:

Pfizer generated $14.9bn of revenues in Q1 2024, down 19% year-on-year including comirnaty and paxlovid, but up 11% otherwise. With adjusted cost of sales decreasing 34% year-on-year, to $3bn, adjusted SG&A up 3% to $3.5bn, and adjusted R&D flat at $2.5bn, Pfizer announced reported EPS of $0.55 for the quarter, and adjusted EPS of $0.82 – respectively down by 44%, and 32% year-on-year. A gain of $0.11 of EPS was attributed to the “favorable impact of final adjustment to Paxlovid revenue reversal recorded in Q4 2023”.

Inevitably, revenues fell after governments stopped mass purchases of Comirnaty and Paxlovid post-pandemic. However, the 11% uplift in revenues was encouraging at least, and there is no question there is a great deal more to come from its product portfolio and pipeline, as illustrated in the chart below.

Pfizer promise (earnings presentation)

When you have invested $43bn acquiring Seagen, the antibody drug conjugate (“ADC”) specialist leading the way in a field of drug development expected to become one of the more lucrative oncology markets, and >$10bn in Biohaven and its migraine franchise, >$5bn in a sickle cell disease franchise, and >$7bn in an autoimmune drug, recently approved under the brand name velsipity, it seems logical that this needs to be management’s main area of focus.

Pfizer does not necessarily need to admit defeat in the GLP-1 agonist field. However, just as Eli Lilly and Novo failed to produce a COVID vaccine, preferring to maintain focus on their weight loss drugs, there seems little point in Pfizer busting a gut (so to speak) trying to win the weight loss race. As I wrote last December:

It may be wrong to believe that Pfizer has lost its knack for innovation overnight. With amongst the lowest forward price-to-sales and price-to-earnings ratios in the Big Pharma sector, and with a dividend yielding 6%, compared to Eli Lilly’s <0.8%, there may be no harm in holding Pfizer Inc. stock long-term, even if the company made itself a laughing stock in 2023.

In trading so far today, post its danuglipron announcement, Pfizer stock is +1.5% at the time of writing. There is absolutely no harm in Pfizer maintaining development of danuglipron, and experimenting with a once-daily oral pill, so long as it does not neglect a pipeline that is arguably as strong as any in the Big Pharma industry — even if weight loss does not feature prominently in that pipeline, and may not do so over the long run, either.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.