Summary:

- Snowflake shares continued to remain in the penalty box over recent months, thanks to a deteriorating short-term margin outlook and negative publicity from a data breach.

- Meanwhile, several company-specific growth drivers are lining up in the background that could visibly re-accelerate topline growth already this year.

- Combined with reasonable valuation levels, I continue to rate shares as a Strong Buy even if I’ve been fooled twice by the company recently.

inho Lee/iStock via Getty Images

Introduction and Investment thesis

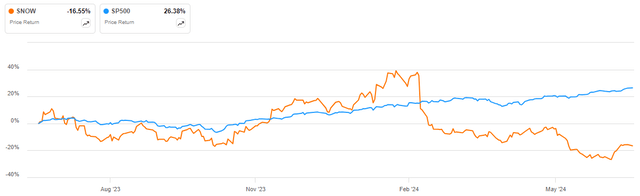

I’ve been bullish on Snowflake (NYSE:SNOW) shares since the middle of last year, when consumption trends started to stabilize, and the company began to position itself for the AI era. My thesis seemed to work out well until the company announced the replacement of former renowned CEO, Frank Slootman, and provided a disappointing guidance for FY25 at the end of February. Since then, shares underperformed the S&P500 by a very wide margin, namely 50%:

Seeking Alpha

In hindsight, I could’ve been more cautious before the company announced its guidance for FY25 and anticipated that management will potentially set a low bar for the upcoming year. Also, there have been some rumors that Frank Slootman is seeking retirement, but these haven’t been confirmed and even he seemed to deny these. After the news came out, I felt I’ve been fooled by Snowflake. This has been the first time.

After assessing that the new CEO, Sridhar Ramaswamy could be a strong leader over the upcoming years thanks to his experience in AI, I felt confident that a turnaround for shares is on the corner. This has been also supported by the facts that new products began to generate revenue (see Snowpark), customer bookings experienced significant growth, sales estimates have been anchored at conservative levels, and the valuation of shares became more reasonable.

I thought that the publication of Q1 FY25 results could be the catalyst for this turnaround, but I’ve been fooled again. After two months of stabilization the correction in shares continued after the release, which was a little surprising for me. Sales figures have been impressive in my opinion, although it turned out that margins will be weaker this year than expected due to heavy investments in GPUs, which power the company’s AI efforts. One other reason for disappointment could be a continued conservative guidance for FY25, but this isn’t really news in my opinion.

Following the Q1 FY25 earnings print bad sentiment around shares has been amplified by news of a massive data breach affecting ~165 Snowflake customers. Although it has been cleared that Snowflake’s security systems haven’t been compromised rather legitimate user identities were stolen through malware campaigns, negative publicity continued to pressure shares. The Snowflake Summit at the beginning of June couldn’t help this, so shares remained in the penalty box despite generally positive market sentiment.

After re-assessing recent developments, I decided not to change my Strong Buy recommendation for shares, even if this proved to be my worst call so far this year.

Fool me once. Shame on you. Fool me twice. Shame on me. Fool me three times. Shame on both of us. I believe this analysis won’t go down with Snowflake’s shares together, and I avoid being fooled for the third time in a row.

Q1 earnings: Encouraging growth figures combined with increasing investments

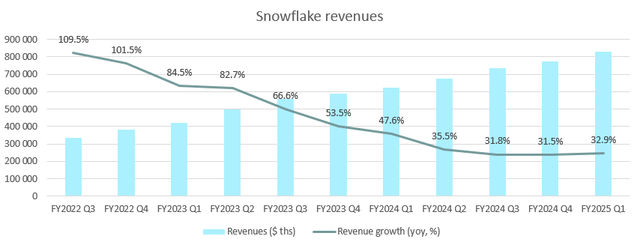

Not long ago, Snowflake has been standing out among SaaS companies with annual revenue growth figures above 100%. This has been followed by a strong cost optimization cycle in the IT space, which resulted in significant topline growth deceleration. At the end of FY24 it seemed that this negative trend could come to an end as topline growth figures began to flatten out. Now, the Q1 FY25 quarter finally marked the first sequential improvement in revenue growth, namely to 32.9% yoy from 31.5% a quarter ago:

Created by author based on company filings

At an annual revenue run rate easily exceeding $3 billion this is quite impressive in my opinion. It shows that Snowflake’s services are crucial for several companies worldwide, and there are not too many players in the space.

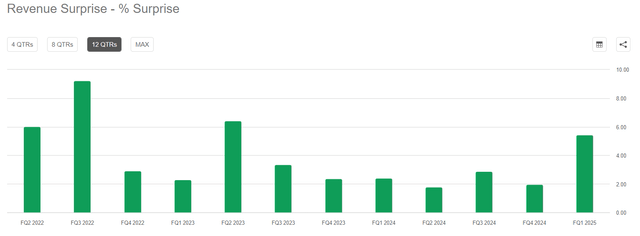

The 33% yoy growth rate resulted in revenues of $828.7 million for the quarter surpassing the average analyst estimate by more than 5%. This has been a refreshing beat compared to the preceding quarters:

Seeking Alpha

Based on the company’s ultraconservative guidance for FY25 this hasn’t been such a surprise, but it confirmed that there could be a growth turnaround indeed. Despite the strong sales figures for Q1 management decided to stay conservative and guided for 26-27% yoy growth for the Q2 quarter and only upped its FY25 guidance by a thin margin. On the top of management’s usual conservativism, the reasons for this are twofold: On the one hand, based on the company’s earnings call after a strong February and March, consumption on Snowflake’s platform has been somewhat softer in April. However, this can be partly linked to Easter holidays, especially in Europe where Snowflake generates somewhat less than 16% of its revenues.

On the other hand, the recently introduced tiered storage pricing concept could have some negative impact on revenues as well, as more and more customers explore this option. It provides a discount for storage payments to Snowflake based on the size of annual commitments. Based on the Q1 earnings call it had $6-8 million negative impact over the quarter, so it will be worth monitoring how this will evolve in the upcoming ones. Storage revenues make up 11% of Snowflake’s revenues, so I believe that this impact should be limited going forward and stay somewhere around 1% of revenues.

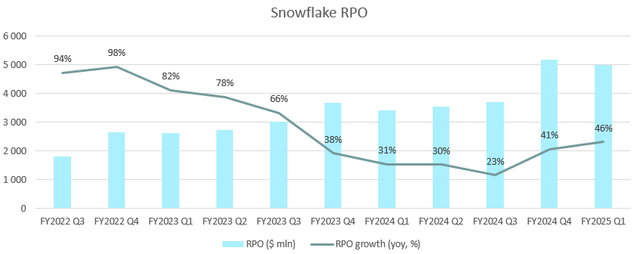

Besides encouraging topline growth figures business commitments to Snowflake continued to grow nicely as well, as remaining performance obligations (RPO) totaled $5 billion at the end of Q1. Although this has been a slight decline qoq resulting from the usual seasonality the yoy growth rate accelerated to 46%:

Created by author based on company filings

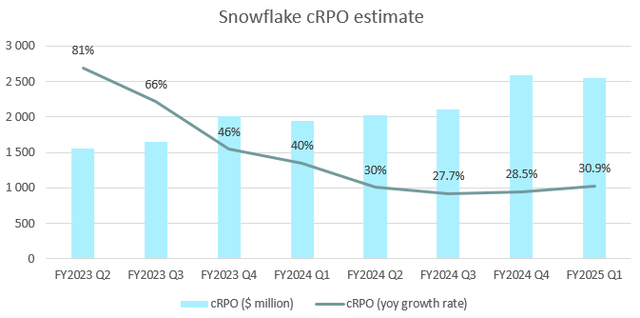

Although this has been partly the result of two large multi-year deals (one of them contracted in Q4 FY24 worth of $250 million, the other one in Q1 FY25 worth of $100), even if we strip out these the yoy growth rate would be still around 36%. I strongly believe that this is an encouraging sign for future growth, especially that the current portion of RPO (business to be realized over the next 12 months) shows also an accelerating tendency:

Created by author based on company filings

In the case of cRPO the company doesn’t provide exact dollar figures only their percentage proportion within total RPO, so there could be some variability in actual figures compared to my estimate. However, the tendency should be the same.

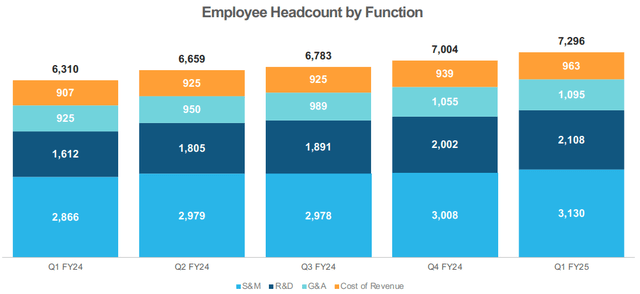

Another sign that revenue growth could continue to accelerate is that the number of employees in Sales and Marketing increased again in the Q1 quarter, after a few quarters of stagnation:

Snowflake Q1 FY25 Investor presentation

This, coupled with the recent reorganization of the company’s sales incentives (emphasizing consumption instead of bookings) and the strong focus on sales functions by the new CEO should bear fruit over the year.

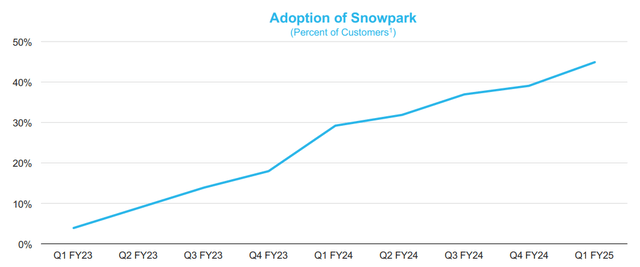

Finally, new product launches and the ramping of newer products that are already generally available should be also an important driver of growth going forward. The best example for this is Snowpark, Snowflake’s own developer framework, which lets developers interact with data residing in Snowflake (for more details see my deep-dive analysis on Snowflake products). Management guided for 3% product revenue contribution for FY25, but knowing their conservativism I think it could be much higher.

Looking at Snowpark’s penetration among customers it could probably reach 50% already in the Q2 quarter:

Snowflake Investor Day presentation

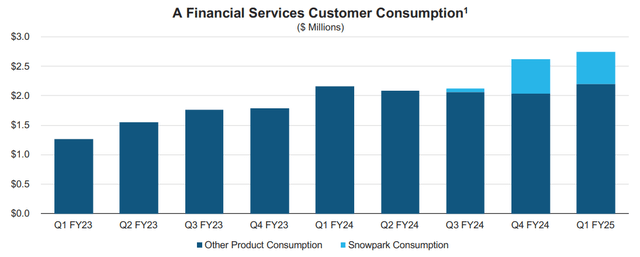

Meanwhile, one example of a large financial services customer shows that it can have significant revenue generating ability going forward:

Snowflake Investor Day presentation

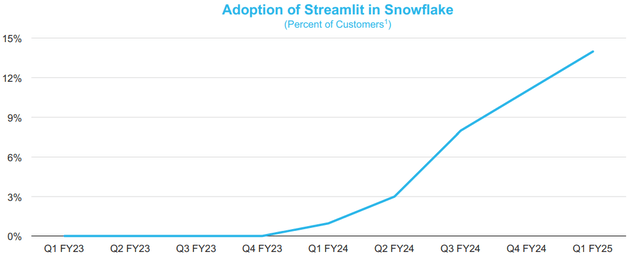

Snowpark is just one example out of many. As another one there is Streamlit, Snowflake’s 2022 acquisition, which has been integrated into the platform. It enables creating and sharing web applications for ML and data science. Looking at customer adoption trends they’re also encouraging:

Snowflake Investor Day presentation

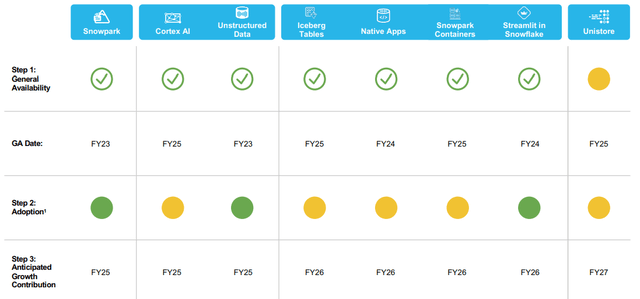

I don’t want to elaborate on every new product at this point, but for more details see my previous articles on the company. Thankfully, Snowflake created a well-summarized product roadmap for its Investor Day presentation, which gives a good overview of what to expect of recent and upcoming product launches:

Snowflake Investor Day presentation

Snowpark, Cortex AI (managed service which enables building AI apps for everyone), and the support for unstructured data will already contribute to revenues this year, while there are several other ones lining up for FY26. This roadmap shows that the company excels in rapid product innovation and in bringing these to market as soon as possible. A good example for this is Arctic, Snowflake’s recently introduced large language model, which has been developed by the company in less than three months with surprisingly high training efficiency.

Finally, beside ongoing product development efforts Snowflake continues to make strategic acquisitions, which is enabled by the $4.5 billion cash pile the company has built up over the years. The most recent acquisition has been TruEra, an AI observability platform, which could open new dimensions for the company. Leaders in the observability space like Datadog (DDOG) or Dynatrace (DT) emphasize that the observability of LLM and ML workloads could be an important growth driver of this space over the upcoming years. Snowflake joining this market is great news in my opinion.

Based on the above I believe that Snowflake’s topline growth could visibly accelerate over the upcoming quarters as the general improvement in the IT spending environment is met with several company specific growth drivers.

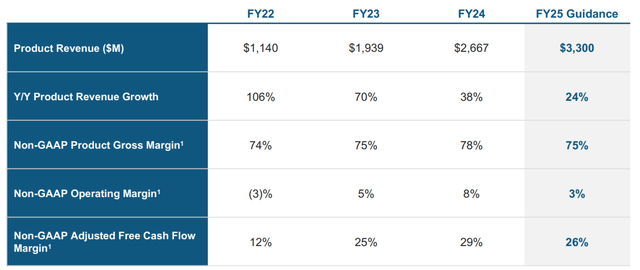

However, at the same time the company decided to increase its investments into technology (mostly GPU related costs) and human resources, which will have a negative impact on margins over the upcoming quarters. In the Q1 earnings release management decided to cut its full-year margin outlook by a few percentage points, which resulted in the following guide for FY25:

Snowflake Q1 FY25 Investor presentation

On the one hand, this can be interpreted as negative news because material improvement in bottom line profitability seems to have shifted more into the future (non-GAAP operating margin guide of 3% for FY25 after 8% in FY24). However, in times of rapid shifts in technology I believe it’s necessary to invest heavily to stay competitive. From this point of view increasing investments should be regarded as a positive until they meaningfully contribute to topline growth in the future.

Risk factors

Data breaches are always an important risk factor in the case of SaaS companies, where their customers heavily rely on their IT security environment. We could’ve witnessed in the case of Okta (OKTA) that such incidents can negatively impact the share price for months. Snowflake received negative publicity recently as it turned out that personal data of ~165 of its larger customers (e.g.: Ticketmaster, Santander Bank) has been compromised in a well-organized cyber security attack.

Luckily, Mandiant, a Google subsidiary cybersecurity firm proved that this wasn’t the fault of Snowflake, it rather resulted from the inadequate level of security on the side of its customers regarding user logins. The cybersecurity gang managed to steal customer credentials via malware attacks over the past years, which have been used to login into Snowflake’s platform and extract valuable data. A simple multi-factor authentication could have prevented this, so Snowflake is currently working on a plan how to enforce it for all of its customers.

Another important company specific risk factor in the case of Snowflake is represented by those solutions of the company, which enable customers to decrease their spending on the platform. One of these is tiered storage pricing that I’ve already covered in the article. I don’t find it particularly risky.

Another one is Iceberg tables, which will be generally available soon. It will enable customers to store their data in an external cloud storage and not within the Snowflake platform. This will obviously decrease storage revenues, if customers opt to move out their data to these tables from the platform. However, at the same time it can generate new business as well, because Snowflake will have access to a significantly larger data pool. The net effect of this remains to be seen, but it should be positive, otherwise Snowflake hadn’t put so much effort into creating it. On the short run negative effects should outweigh positive ones, but this should change over time.

Finally, there is the risk of competition, especially in the form of hyperscalers, who have their own cloud-based data services (Amazon Redshift, Google BigQuery, Azure Synapse). And there is Databricks, providing strong competition in data science workloads. If they go public this year it could provide headwind for Snowflake’s share price on the short run as investors could reallocate their funds between the two companies. However, on the long run this shouldn’t have a material impact as the share price is mostly determined by underlying company fundamentals.

Valuation

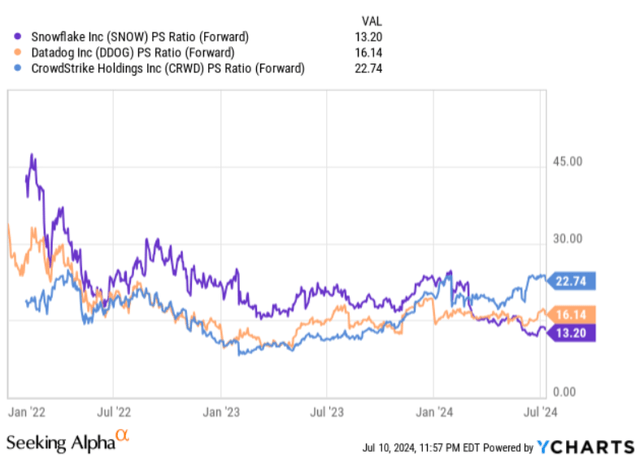

Thanks to the significant correction in Snowflake shares they became more investable over recent months. In my previous article on the company, I have pointed out that top SaaS companies trade at significantly higher valuation multiples than Snowflake even as there aren’t such great differences in fundamentals when measured by the Rule of 40 metric (revenue growth + FCF margin). CrowdStrike (CRWD) closed the previous year as a Rule of 67 company meanwhile Snowflake reached Rule of 66. However, CrowdStrike’s shares trade at a 72% premium based on the forward P/S ratio, which is a significant difference. Of course, this could mean that the shares of CrowdStrike are valued too aggressively, and the shares of Snowflake are fairly valued, but I think the truth lies somewhere between the two.

Looking at Datadog, another leading SaaS company who closed the previous year with a Rule of 55 metric, Snowflake shares are still valued conservatively at an 18% discount:

YCharts

I believe this discrepancy won’t hold for long and Snowflake shares will get out of the penalty box rather sooner than later. The fact that the company repurchased shares worth of more than $500 million in Q1 is also good evidence in my opinion that current valuation levels are compelling.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.