Summary:

- Amazon is a core holding in my portfolio, but I’d like to further boost my weight in the coming months and years.

- The company topped the analyst consensus for both revenue and diluted EPS for the first quarter.

- Amazon’s swelling net cash position earns it an AA credit rating from S&P on a stable outlook.

- Shares of the stock are priced at a 32% discount to my fair value estimate.

- Amazon could realistically post nearly 30% annual total returns through 2026.

An Amazon truck drives on a freeway. Sundry Photography/iStock Editorial via Getty Images

As long-time readers know, the crux of my investing strategy revolves around buying and holding dividend growth stocks for the long haul.

For the most part, these tend to sport dividend yields between 0.5% and 4%. The weighted average dividend yield of my portfolio is currently 3.3%. This is an approach I largely don’t plan on changing.

I am 27 years old, though. Since I don’t plan on living off my dividends for quite a while longer, I do have time to let those dividends compound. So, I have been putting more emphasis on high-quality, hypergrowth stocks like Amazon (NASDAQ:AMZN) and Nvidia (NVDA) in recent years.

Despite just adding the latter in May, Nvidia has grown to 2% of my portfolio already. I plan on upping this substantially over time (to at least 6% to 7%).

Amazon is the focus of today’s article and comprises 3% of my portfolio. Like Nvidia, this one is under the S&P 500 index’s (SP500) weighting of almost 4%. So, I’d like to ideally get this one above a 4% weighting over time.

Since I last covered Amazon with a strong buy rating in February, shares have rallied 12%. That’s just above the 11% gains posted by the S&P in that time.

Today, I’m reiterating my strong buy rating on shares of Amazon. The company’s first-quarter results demonstrated that its growth prospects are intact. Amazon’s already vigorous balance sheet has markedly improved in the past 12 months. Even with its continued rally, the stock also arguably remains attractively valued.

Making Moves To Keep The Growth Needle Moving

Amazon Q1 2024 Earnings Presentation

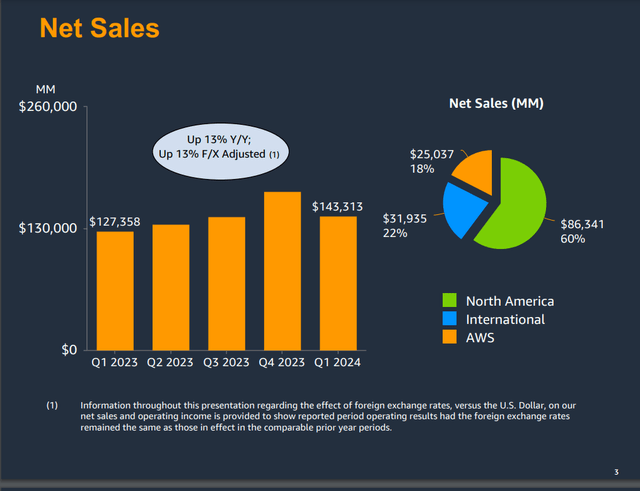

When Amazon shared its financial results for the first quarter on April 30, it extended its double-beat streak to five consecutive quarters. The company’s net sales jumped 12.5% over the year-ago period to $143.3 billion during the first quarter. Put into perspective, this was $750 million ahead of Seeking Alpha’s analyst consensus in the quarter.

Predictably, this topline growth was the result of all-around strength throughout the business. As has been the case in past quarters, the majority of this growth was led by its largest segment, North America.

The segment posted $86.3 billion in net sales for the first quarter, which was a 12.3% year-over-year growth rate. That was due to a mix of factors, including unit sales growth (driven by prioritizing price, selection, and customer convenience), subscription services growth, and growth in advertising sales.

The next biggest contributor to Amazon’s overall net sales growth rate was the AWS segment. The segment’s net sales spiked 17.2% higher over the year-ago period to $25 billion during the first quarter. This was fueled by increased customer usage, which was only partially countered by pricing changes on long-term customer contracts.

International segment sales grew by 9.7% year-over-year to $31.9 billion in the first quarter. As was the case with the North America segment, this topline growth was made possible by elements like unit sales growth and advertising sales growth.

Amazon’s diluted EPS more than tripled to $0.98 for the first quarter. For more color, that was $0.15 beyond the Seeking Alpha analyst consensus.

Cost cuts in sales and marketing, general and administrative, and technology infrastructure helped to keep higher fulfillment and cost of sales expenses in check. This is how total operating expenses increased by just 4.4% during the first quarter to $128 billion. That resulted in a 480 basis point expansion in the net profit margin to 7.3% in the quarter. This is what led Amazon’s diluted EPS growth to far exceed net sales growth for the quarter.

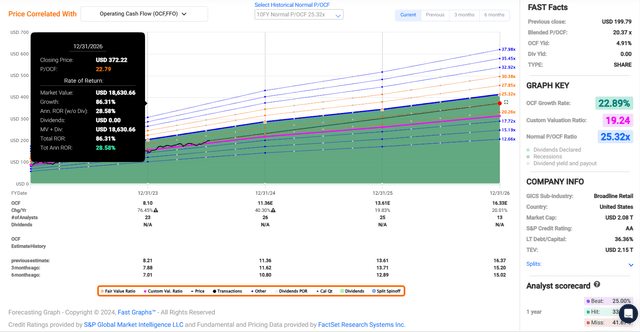

Looking forward, the FAST Graphs analyst growth consensus for the company’s operating cash flow per share (arguably the most relevant performance metric for the company) is very encouraging.

Thanks to its capex investments made in recent years, the consensus is that OCF per share will soar 40.3% to $11.36 in 2024. For 2025, another 19.8% growth in OCF per share to $13.61 is anticipated. In 2026, it’s projected that OCF per share will rise another 20% to $16.33.

Amazon’s catalysts arguably support these analyst forecasts as well.

The company already has hundreds of millions of items and the broadest selection of items available on its e-commerce platform. The company hasn’t forgotten the core tenets that have made Amazon the planet’s most dominant retailer, either.

CEO Andy Jassy indicated in his opening remarks during the Q1 2024 Earnings Call that the company is intensely focused on adding even more selections. Recently, Amazon added Gen Z fashion favorites, Parade and Cider. The company also announced a collaboration with Hardly Ever Worn It in Europe for customers to buy pre-owned items from luxury brands.

Another way Amazon is widening selection is by streamlining the process for third-party sellers. The company recently launched a new generative AI tool to enable sellers to provide a URL to their website, and a high-quality product detail page is automatically created on Amazon. This tool has already been used by more than 100,000 of Amazon’s selling partners.

Amazon’s regionalization efforts to keep cost growth contained are helping the company continue to win on the pricing side of the equation. All the while, delivery speeds to Prime Members were the fastest in the company’s history in the first quarter. This should continue to drive double-digit annual retail net sales growth for Amazon in the years to come.

Jassy also pointed out that 85%+ of global IT spending remains on-premises. As more of this continues to move into the cloud, that will bode well for AWS as the global industry leader. On top of that, Jassy noted the generative AI opportunity as potentially the biggest opportunity for growth since the cloud or even the Internet (unless otherwise sourced or hyperlinked, all details in this subhead were according to Amazon’s Q1 2024 Earnings Presentation and Amazon’s Q1 2024 10-Q Filing, and Amazon’s Q1 2024 Earnings Press Release).

Amazon Is Being Flooded With Free Cash Flow

Amazon Q1 2024 Earnings Presentation

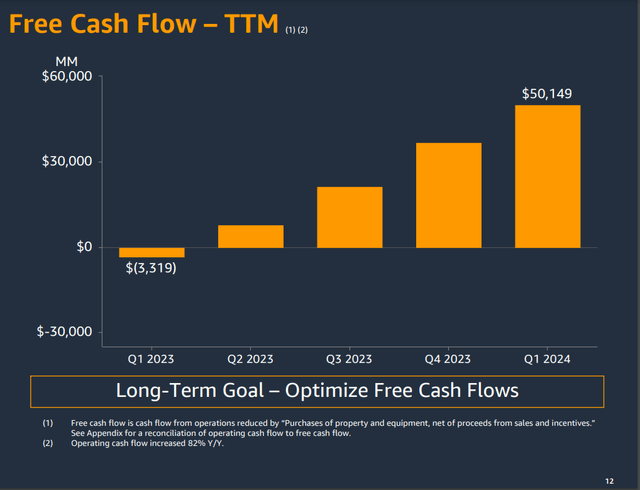

As I alluded to earlier, investments made earlier in Amazon’s capex cycle are beginning to pay dividends. This is how the company’s operating cash flow in the past twelve months has nearly doubled to $99.1 billion as of Q1, 2024. Combined with reduced capex in that time, this is what moved TTM free cash flow from -$3.3 billion in Q1 2023 to top $50 billion in Q1 2024.

That shift from a free cash flow deficit to a free cash flow surplus has helped Amazon’s net cash/marketable securities balance improve from -$2.7 billion to end Q1 2023 to $27.4 billion to close out Q1 2024 (info in this subhead was sourced from Amazon’s Q1 2024 Earnings Press Release and Amazon’s Q1 2023 Earnings Press Release).

The Dividend Kings’ Zen Research Terminal

Amazon’s finances are being buoyed by its sizable net cash/marketable securities position and expanding free cash flow capabilities. Thus, it possesses an AA credit rating from S&P on a stable outlook per The Dividend Kings’ Zen Research Terminal. For context, this credit rating is bested only by Microsoft (MSFT), Johnson & Johnson (JNJ), Apple (AAPL), and Google (GOOGL)(GOOG).

Nearly 50% Upside To My Fair Value Estimate

In my view, Amazon’s shares remain a compelling value proposition. They trade at a current-year P/OCF ratio of 17.1. This is well below the 10-year normal P/OCF ratio of 25.3 per FAST Graphs.

In the past decade, Amazon’s OCF per share has compounded by 29.2% annually. The three-year forward annual OCF per share consensus is 22.9%. Accounting for the company’s much greater size, this means its growth prospects are about as strong as ever.

This is why I’m assuming a fair value P/OCF multiple of just one standard deviation below the 10-year norm of 25.3. That equates to a P/OCF ratio of 22.8.

After this week concludes, the calendar year 2024 will be around 54% complete. That means another 46% of this year is left and 54% of 2025 is ahead in the next 12 months. This is how I get a 12-month forward OCF per share input of $12.57.

Applying my fair value multiple to this OCF per share input, I arrive at a fair value of $287 a share. This would be a 32% discount to fair value from the current $195 share price (as of July 11, 2024).

In other words, if Amazon were to rally almost 50% overnight, that would be almost entirely justified by the fundamentals. If the company returns to my fair value multiple and grows as expected, it could post 86% cumulative total returns by the end of 2026.

Risks To Consider

Amazon is a remarkably qualitative business but faces risks to its investment thesis just like any other company.

The massive amounts of data that the company processes, stores, and transmits make it a treasure trove for potential hackers. If Amazon’s IT network experienced a major cyber breach, this could compromise the sensitive data of countless millions of customers, employees, and third-party sellers. That could lead to substantial lawsuits being brought forth against the company. It could also unfavorably impact Amazon’s brand image.

Another risk to Amazon is the evolving regulatory environments within the key markets in which it does business. If data privacy laws are passed, this could interfere with the company’s ability to create value for its advertising customers.

Finally, Amazon’s success wouldn’t be possible without its approximately 1.5 million employees (page 4 of 94 of Amazon’s 10-K Filing). If the company can’t maintain positive relationships with these employees and retain them, operations could be disrupted. Retaining these employees could also result in meaningfully higher labor costs for Amazon.

Summary: Amazon Is A No-Brainer Holding For Me

Amazon provides my portfolio with an unmatched combination of size and growth potential. Its balance sheet is also bested by very few other companies. Best of all, Amazon’s shares are a bargain. That’s why I’m happy to hold my position and plan on also adding to it soon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, NVDA, MSFT, JNJ, AAPL, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.