Summary:

- Merck’s price rise might have stalled in the past quarter, but at least for now, there’s potential for some upswing again.

- Keytruda continues to drive revenue growth, and expansion in its usage along with positive news on other treatments and an acquisition related bump up too, the sales outlook is healthy.

- Concerns arise, however, regarding the earnings outlook due to the acquisition of Eyebiotech, which can impact non-GAAP EPS and potentially reduce guidance.

- So far, the acquisition costs aren’t enough to materially affect the forward P/E relative to the stock’s five-year average, though.

JHVEPhoto/iStock Editorial via Getty Images

Since I last wrote about the pharmaceuticals stock Merck & Co., Inc. (NYSE:MRK) in April, its share price has seen a small decline, after a 20% rise in the first quarter of 2024 (Q1 2024). While the developments for the company have been broadly positive since, there are some emerging risk as well. Here, I assess how the balance of the supporting factors and the potential drags sits and what it means for the price going forward.

Keytruda stays the highlight

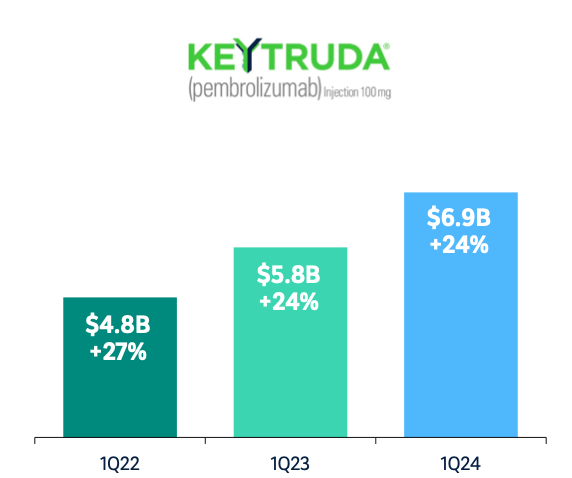

First, the positives. Keytruda, the immunotherapy treatment for cancer, Merck’s big revenue generator that accounted for 44% of the total in Q1 2024, continued to be the highlight of the past quarter.

The treatment’s revenues grew by 20% year-on-year (YoY) at market exchange rates and showed even more robust growth in constant currency terms (see chart below). This increase was driven primarily by its use in lung cancer treatment, but also urothelial cancer in the US and use in early-stage cancer treatment in other markets.

Keytruda’s performance also pulled up Merck’s total sales growth to 9% YoY, the fastest increase in one and a half years. The company’s second biggest treatment, the HPV vaccine Gardasil, also contributed to improved growth, but to a lesser extent, since it’s a far smaller contributor to revenues in any case and also because its growth was a slower 14% YoY at market exchange rates.

Keytruda Sales (in constant currency) (Source: Merck)

In Q2 2024, further developments indicated the Keytruda will continue to perform well. These developments pertain to the expansion in its scope. Here’s how:

- It received an FDA approval for use in treating endometrial cancer, following data that it can reduce the risk of worsening in the disease or death by 40-70% in some patients.

- The FDA also granted a priority review for it to be a first-line treatment, along with chemotherapy, for specific lung cancers as it could reduce mortality risk by 21%.

Healthy revenue growth to continue…

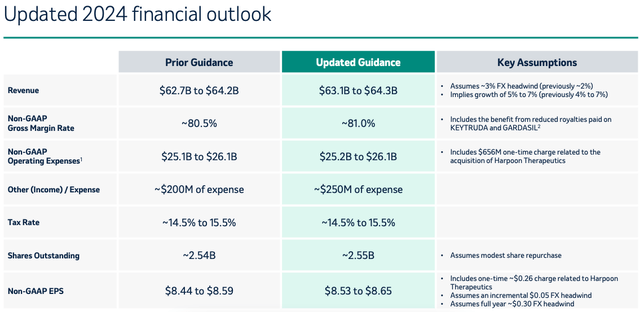

With robust sales performance in Q1 2024, the company has marginally upgraded its guidance for the year (see table below). It now expects 6% revenue growth compared to the 5.6% seen earlier.

This forecast is backed not just by the healthy growth seen already and Keytruda’s prospects, but is also supported by two other recent developments:

- After winning an FDA approval in Q1 2024, its hypertension treatment Winrevair has been recommended for approval by the European Medicines Agency, the EU’s evaluation body for pharmaceuticals. It will now be considered by the European Commission for marketing authorisation. The decision on the same is expected in Q3 2024.

- Merck Animal Health completed the acquisition of Elano Animal Health’s (ELAN) aqua business, which can marginally bump up the segment’s revenues as early as Q3 2024. For context, the animal health segment contributed 9.6% to the company’s Q1 2024 revenues. The share would have been 200 basis points higher with the inclusion of Elano’s aqua revenues during the quarter.

… but earnings outlook at risk

I am concerned about the earnings outlook however, after the company decided to acquire Eyebiotech, the ophthalmology biotech company. Merck could pay up to USD 3 billion for it, which includes a USD 1.3 billion cash payment. The transaction is expected to close in Q3 2024. During the quarter, the cash payout will represent a drag of USD 0.5 on the non-GAAP EPS.

This news followed after a month of Merck upgrading its non-GAAP EPS guidance by ~1% at the midpoint of the ranges provided. It’s possible that discussion on the acquisition were already underway when the outlook was revised, and its impact on the figure is already baked in. But we can’t be sure. If it’s not, then the guidance can be expected to reduce by 5% instead.

The market multiples look alright

However, even if the EPS is affected by the latest acquisition, the forward non-GAAP price-to-earnings (P/E) ratio doesn’t rise enough to change the stance on Merck. First, at 15.94x, it’s not significantly higher than the 15.3x the last I checked. Second, it’s still lower than the stock’s five-year average ratio of 18.62x. Third, if the earnings guidance were to remain unchanged, the P/E ratio is actually at 15x, which is actually slightly below the number even the last I checked, in a small measure also as the stock’s price has seen a slight softening since.

Also, the EPS figure would still be a big jump over last year’s earnings. This in turn means that there’s still hope for a dividend increase later in the year. With little change in the price and no change in dividends since I last wrote, the trailing twelve months [TTM] dividend yield hasn’t changed much. It’s at 2.4% compared to 2.3% then. But it continues to be better than that for the healthcare sector at 1.49%, which too has stayed static over the past quarter.

What next?

With the fundamentals looking healthy, the forward P/E still indicating price upside and dividends to consider as well, Merck remains a Buy. Specifically, after the company’s encouraging Q1 2024 results, the next earnings update, due later this month, can be positive as well. The expansion in Keytruda’s usage bodes well for revenue growth and is also supported by positive developments for Winrevair.

However, its acquisition of Eyebiotech needs to be watched more carefully, in my view. It’s expected to be a drag on Merck’s earnings in Q3 2024 in any case. While so far, that’s not enough to change the outlook on the stock, but I would look out for further developments for any other escalation in costs related to it and their impact on earnings.

Last year’s profits disappointed partly due to the Prometheus Biosciences acquisition. Admittedly, it wasn’t the only drag on earnings, and foregoing today’s earnings for tomorrow’s growth isn’t a bad strategy either. But it does impact the stock price negatively. For long-term investors, fluctuations in earnings matter less, but those with a short-to-medium-term time horizon in mind, they can affect returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—