Summary:

- OPEN had naturally underperformed the wider market once the inflation rose and the Fed hiked interest rates in early 2022.

- With those headwinds behind us, OPEN now offers a compelling investment thesis for opportunistic investors looking to ride the great upside.

- The management has continued to report robust inventory metrics and expanding spreads, as observed in the promising FQ2’24 margin guidance.

- While OPEN remains highly shorted despite being a penny stock, we believe that the cooling inflation and the potential Fed pivot in September 2024 may bring forth great tailwinds.

- With 2025 likely to bring forth higher home transactions and improved top/ bottom-line performances, we believe that the stock remains a Buy for value and growth oriented investors.

Talaj

We previously covered Opendoor Technologies (NASDAQ:NASDAQ:OPEN) in March 2024, discussing why we had maintained our Buy rating, thanks to its improving profit margins, healthier inventory levels, and promising FQ1’24 guidance.

While the iBuying company was likely to remain unprofitable in the intermediate term, the recovery in resale home market was likely to boost its inherently discounted valuations while triggering the expansion in its financial performance and eventually, stock prices.

Since then, OPEN has unfortunately pulled back by -38.1%, well underperforming the wider market at +22.3%. Even so, we are reiterating our speculative Buy rating, with market sentiments likely to lift as the inflation cooled and the Fed potentially pivoting by September 2024.

With 2025 likely to bring forth higher home transactions and improved top/ bottom-line performances, we believe that the stock remains a Buy for value and growth oriented investors looking to buy a dip while riding the great upside potential.

OPEN’s Bottom May Be Here

OPEN 4Y Stock Price

OPEN had a volatile four years indeed, with its prospects tightly linked to the uncertain residential property markets in the US.

While the iBuying company had successful 2021 and 2022 years, with robust top line performance and the occasional profitability, it was apparent that market sentiments had soured drastically as the inflation rose and the Fed hiked interest rates.

However, it appears that things may finally be turning around indeed.

Here is why.

1. The Fed Pivot Is Near

One, the Fed’s recent tone is already dovish with the market pricing in a rate cut in the September 2024 FOMC meeting, potentially signaling that the worst may already be behind us.

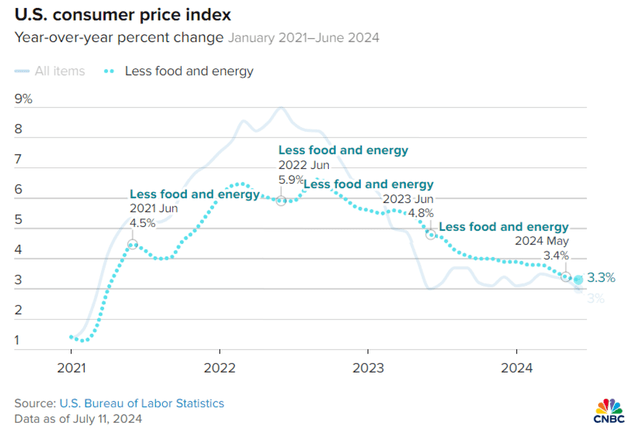

US Core CPI – June 2024

Much of the tailwinds are attributed to the consistent moderation in the US core CPI to 3.3% by June 2024 (-0.1 points MoM/ -1.5 YoY), with us nearer to the pre-pandemic averages of 2% than the September 2022 peak of 6.2%.

This development is highly beneficial for OPEN indeed, since the 30Y Fixed Rate Mortgage has also declined to 6.89% by July 11, 2024 (-0.06 points MoM/ -0.07 YoY/ +3.09 from 2019 averages of 3.8%), down by -0.9 points from the peak of 7.79% in October 26, 2023.

Assuming that mortgage rates continue to moderate, we may see the iBuying company report incremental volume growth and improved contribution margins moving forward, especially once we hit the “magic mortgage rate.”

Realtor.com has reported that a third of the surveyed Americans are more likely to buy homes once mortgage rates fall below 5%, drastically improved compared to the 22% reported at below 6%.

While it is uncertain when that may occur, we believe that the residential property market bottom may already be here, with it offering opportunistic investors with the chance of a great upside potential.

2. Spreads Appear To Be Improving

OPEN has been reporting lower inventory values over the past few quarters, at an average inventory price of $330K per home in FQ1’24 (-1% QoQ/ -2.3% YoY), compared to the peak average inventory price of $388K per home in FQ2’22.

The lower inventory prices are critical indeed, since it is representative of the management’s prudence during a housing market downturn while generating an improved profit spread to the US Existing Home Median Sales Prices of $385.1K (-0.4% QoQ/ +5% YoY).

This strategy has already allowed OPEN to report improved gross margins of 9.7% (+1.4 points QoQ/ +4.3 YoY) and contribution margin of 4.8% in FQ1’24 (+1.4 points QoQ/ +12.5 YoY).

The growing spread has also allowed the management to offer a promising FQ2’24 guidance at contribution profit margins of 5.5% (+0.7 points QoQ/ +10.1 YoY) and EBITDA margins of -2% (+2.2 points QoQ/ +6.5 YoY).

These numbers further underscore why the iBuying company has been oversold at current levels, attributed to its ability to incrementally generate improved margins.

3. OPEN Is Inherently Cheap Here

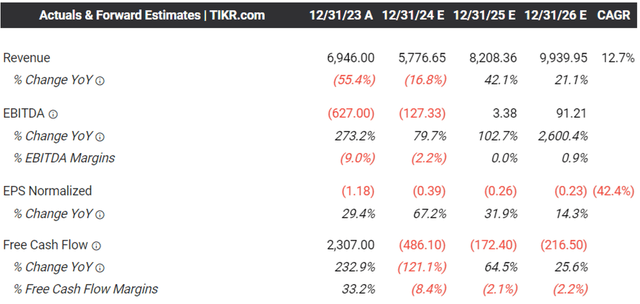

The Consensus Forward Estimates

This is the reason why the consensus forward estimates appear to be very promising from FY2025 onwards, with OPEN already expected to report improved adj EBITDA margins ahead.

While it is undeniable that it may remain adj EPS and Free Cash Flow unprofitable in the intermediate term, we believe that the management has demonstrated its iBuying proof of concept successfully, made particularly impressive given the extremely volatile and challenging market over the past few years.

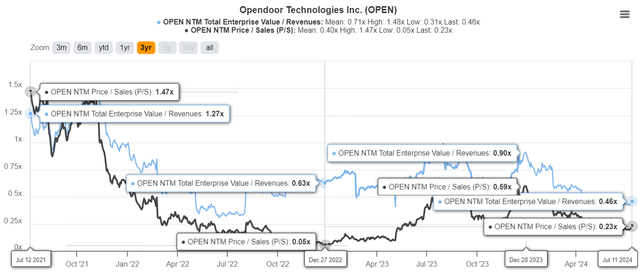

OPEN Valuations

And this is why we believe that OPEN looks highly attractive at FWD EV/ Revenues of 0.46x and FWD Price/ Sales of 0.23x compared to its historical valuations as observed in the chart above, based on the projected top line growth at a CAGR of +12.7% through FY2026.

Even when compared to its real estate peers, such as Redfin (RDFN) at FWD EV/ Revenues of 2.5x with the projected top line growth at a CAGR of +10.9% through FY2026, and Zillow (Z) at 4.74x at +12.6%, it is apparent that OPEN has been overly discounted – offering interested investors with an improved margin of safety.

So, Is OPEN Stock A Buy, Sell, or Hold?

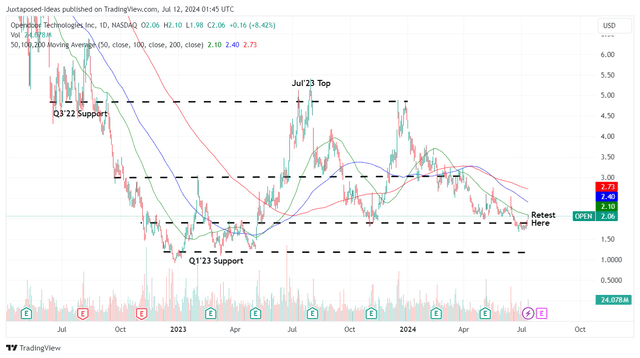

OPEN 2Y Stock Price

For now, OPEN has already bounced from the previous bottom of $1.70s in early June 2024 and showing signs of recovery as the US core CPI continues to cool on a QoQ and YoY basis.

Improving Market Sentiments

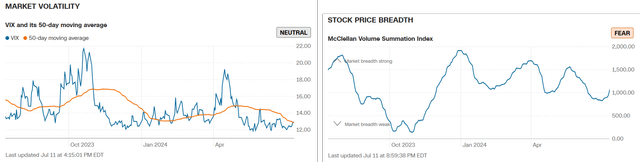

While it is uncertain when OPEN’s reversal may occur, we believe that market sentiments are already improving, as observed in the moderate CBOE Volatility Index and the rapidly reversing McClellan Volume Summation Index beyond its 1,000x neutral point.

While we are maintaining our Buy rating here, readers must note that the stock may remain volatile in the intermediate term, based on the elevated short interest of 15% at the time of writing despite its penny stock status (below $5 per share).

At the same time, the residential market is inherently cyclical in nature, implying that OPEN is likely to similarly fluctuate in stock prices depending on the rate of recovery and Federal Fund rate movement.

It goes without saying that the stock is only suitable for those with higher risk tolerance and long-term investing trajectory, with investors recommended to size their portfolios accordingly.

While OPEN appears to be achieving its “North Star remains rescaling our business and building towards a future of sustained profitable growth,” those whom buy in here must also temper their near and intermediate term expectations, since the normalization in macroeconomy likely to be prolonged through 2026, if not 2027.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.