Summary:

- Nike stock has cratered since June, presenting a buy-the-drop opportunity for value and growth investors alike.

- Despite recent challenges, Nike is refocusing on innovation, performance products, and its wholesale business for future growth.

- With a strong balance sheet and plenty of cash on the books for potential acquisitions, Nike offers potential for rewarding total returns to investors.

LSOphoto/iStock via Getty Images

In Major League Baseball, a fat pitch may come every now and then, giving the hitter an incentive to swing for the fences. While those opportunities are few and far in between, it pays to be patient, prepared, and to execute when the time is right for the big payoff.

The good thing for investors is that it’s a market for stocks rather than the stock market, as there are almost always something on sale, in both bull and bear markets alike.

While there is no such thing as a sure bet in investments, it’s hard to go wrong over the long run when one holds a basket of premium-branded businesses, especially if they’re acquired at substantial discounts from historical valuations.

Warren Buffett owns a strong portfolio of brand names in Berkshire Hathaway (BRK.A)(BRK.B) like Apple (AAPL) and Coca-Cola (KO), and has said that “your premium brand had better be delivering something special, or it’s not going to get the business”.

This brings me to Nike, which currently trades well off its recent high while fitting the mold of having a premium, globally recognized brand. Let’s explore why value and growth investors may find something to like in Nike stock at present for potentially rewarding total returns and some income on the side, so let’s get started!

Swing At This Fat Pitch

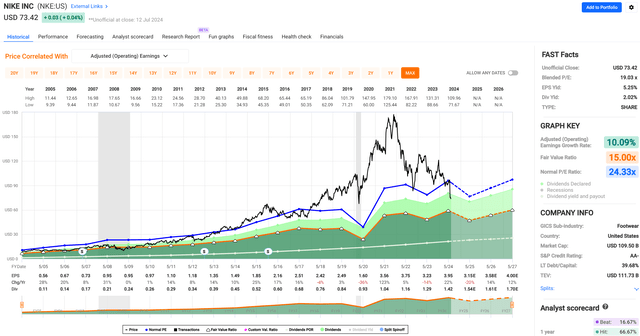

Nike (NYSE:NKE) has been a disappointment for shareholders, to say the least, over the past couple of years, leading up to its most recent fiscal Q4 2024 results released on June 27th. At the current price of $73.42, NKE is trading at just under half of its high of $150 reached in 2021.

NKE Stock 5-Yr Trend (Seeking Alpha)

NKE has faltered in recent years as consumer demand for apparel has waned since the early post-pandemic years. It’s also facing stiff competition from competitors such as UGG and Skechers (SKX) and new entrants like Hoka by Deckers Outdoor (DECK). Moreover, NKE’s strategy of relying less on retailers and more on its direct-to-consumer business was not a good idea, as retailing is in many ways different from branding and manufacturing, especially when it comes to handling to deal with consumer returns.

These challenges came to the forefront in Q4 2024, during which full-year revenue was up by just 1% YoY, and Q4 revenue was flat on an FX-neutral basis. This was driven by the direct-to-consumer side of the business seeing 7% drop in sales during Q4, offset by better results on the wholesale side (to retail partners) with sales up by 8% YoY on an FX-neutral basis. Management is guiding for revenue to decline by the mid-single digit for fiscal year 2025, with the first half of the year facing high-single digit declines.

It’s fairly clear that FY 2025 will be a rebuilding year for NKE as it refocuses on its innovation pipeline with emphasis on performance products, and speed to market with introduction of a ‘speed lane’ initiative to expedite the product creation process that includes better partnering with manufacturers.

Encouragingly, NKE recently rehired a former senior executive to mend relationships with retailers like Foot Locker (FL). This signals a shift toward higher reliance on the wholesale business over the lackluster direct-to-consumer side going forward.

Moreover, NKE aims to better resonate with consumers with bolder storytelling and plans to capture excitement around the WNBA as the fanbase has grown since the entry of rookie Caitlin Clark, who in April signed an 8-year deal with Nike. NKE could also see benefits from capturing market share away from Lululemon (LULU) as it prioritizes the fitness market with particular attention to its female customers, as noted during the recent conference call:

Fitness represents one of the largest market share opportunities we see as a company, particularly for our female consumer. We’ve made intentional decisions to make meaningful investments in fitness, and these actions are paying off. Over the past quarter, we saw broad-based growth for fitness led by double-digit growth in apparel. For example, statement leggings, which is a key focus for us, were up high double digits in Q4, led by innovations we’ve introduced over the past few quarters with Universa, Zenvy and Go.

Meanwhile, NKE maintains a stellar balance sheet with an AA- credit rating from S&P and $11.6 billion in cash on hand, which puts it in a favorable position to do acquisitions if it so chooses. It also carries a negligible net debt to TTM EBITDA ratio of 0.05x.

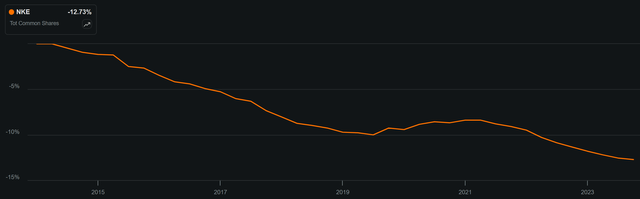

While the dividend yield of 2% isn’t high, it does come with a safe 37% payout ratio, a 5-year CAGR of 11% and 11 years of consecutive growth. NKE should also be considered a total return story as it also dedicates capital toward share buybacks. As shown below, its reduced share count by 13% over the past 10 years.

NKE Shares Outstanding (Seeking Alpha)

Lastly, I see now as being a good time to layer into NKE at the current price of $73.42 with a blended PE of 19.0 (which takes the average of TTM and Forward 12 months’ PE), sitting well below NKE’s historical PE of 24.3, as shown below.

The many sell side analysts who follow the company have an average price target of $93.19 and estimate 14-18% annual EPS growth in the fiscal 2026-2028 timeframe, which I believe is reasonable considering NKE’s benefits from scale, refocus on its wholesale retail channel, and aforementioned catalysts from partnerships and the fitness segment. As such, I see potential for NKE to return to a PE valuation of at least 20x to justify its turnaround and forward EPS outlook.

Investor Takeaway

Nike presents an attractive buy-the-drop opportunity for value and growth investors, with the stock trading at less than 50% of its high reached in 2021. Despite recent disappointments due to challenging consumer demand and strategic missteps, Nike is refocusing on innovation, performance products, and its wholesale business.

It boasts a strong balance sheet with an AA- credit rating and substantial cash reserves, supporting potential acquisitions and continued shareholder returns through dividends and share buybacks. With a current PE ratio of 19.0, below its historical average, and promising future growth prospects, Nike offers potential for rewarding total returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!